Produced by | Odaily Planet Daily Editorial Department

2023 was a year of rapid change and intensified differentiation.

The old smoke of war had not yet dissipated, and new conflicts arose. Technological blockades and economic suppression intensified.

AI represented by ChatGPT began large-scale commercial use, and the debate between accelerationism and technological pessimism continued on the eve of what may be the most significant innovation change for humanity. The showdown between the two social media giants, Musk and Zuckerberg, stopped at the online stage. Meanwhile, globally, cultural, entertainment, popular, and consumer products were lackluster. All of these seemed to be the inevitable result of the deep development of diverse values.

Under the reversal of population structure and macroeconomic adjustment, industries such as real estate, (mobile) internet, which once supported high-speed GDP growth, lost their luster, while industries such as intelligent manufacturing, AI, materials, and energy saw an upswing. People on this land finally returned to "normal" offline life, trying to regain the lost years, but had to bear the impact of large-scale layoffs and cost reductions by enterprises.

Focusing on the Web3 field, in the context of differentiation and transformation, small actions to bridge the gap and survive continued.

In terms of external linkage, the progress of BTC spot ETF accelerated, and the favorable entry of large funds continued to be digested; the adoption rate of Crypto as a payment method steadily increased; Worldcoin collected over 2.53 million iris information in more than 130 days; well-performing US Treasury bonds coupled with RWA through DeFi; CZ stepped down, and other compliant participants will have to navigate the turbulent regulatory waters behind Binance; while facing off against US regulation, Hong Kong continued to release positive news; SBF was convicted, and the mess left in 2022 is gradually being cleaned up; and Silicon Valley Bank went bankrupt, causing stablecoins like USDC to decouple, prompting us to re-examine the risk distance between traditional finance and crypto finance.

The Bitcoin ecosystem experienced a renaissance in art and literature, and there was a resurgence of asset issuance methods and protocol standard changes, with the new narrative returning to the oldest and most consensus-based public chains; the wind of inscriptions and memes blew across multiple chains, with "innovators" holding a pass called "fairness," attempting to redistribute benefits. Ethereum, which completed the Shapella upgrade, bid farewell to mining, and opened staking withdrawals, while the leading Lido of LSD leaped to the king of DeFi TVL; EVM maintained its orthodox foundational nature, and new and old L2s entered the underlying competition.

In terms of applications, in 2023, there was no peak summer, and DeFi, NFT, GameFi saw low-frequency micro-innovations, with the landscape remaining stable. The only family that barely stirred up the spring water was Blur+Blend+Blast; fortunately, AI+Crypto took over, landing integrated applications in social, Q&A, data, and trading directions.

Also this year, people questioned narratives, understood narratives, and became narratives. Critics, observers, and builders vied for the baton, weaving the variations of the three melodies into a 2023 version of the Web3 symphony.

This report is a long read. Odaily Planet Daily will review 2023 from the perspectives of major events, data interpretation, and industry analysis, from the macro market to the micro track, and look back at 2023 and predict 2024 together with you.

Click here to download the PDF version.

Regulatory Policies: Heavy-handed Regulation in the United States, Hong Kong Forging Ahead

In 2023, the U.S. Securities and Exchange Commission (SEC) and other regulatory agencies took stricter regulatory measures overall towards the cryptocurrency industry.

From the cryptocurrency lending programs of Genesis Global Capital and Gemini Trust Company, to actions against Kraken and SushiSwap, to the lawsuit against Tron founder Justin Sun, and legal actions against Coinbase and Binance, these events highlighted the strict attitude of U.S. regulatory agencies towards the "wild west" state of the cryptocurrency market, aiming to make the entire industry more standardized.

In particular, large exchanges like Coinbase and Binance, which embrace regulation, were not spared, showing that regulatory agencies are not only focusing on small or fringe companies, but conducting a comprehensive review of the entire industry.

During the bull market of cryptocurrencies, pressures from large company legal teams, legislative bodies, and public opinion prevented regulatory pressure from being completely released, as everyone benefited from it; during the bear market, regulatory agencies could use events like FTX as a reason to loosen their grip on regulation.

However, from another perspective, these legal actions and rulings in 2023 also brought a certain degree of clarity and certainty to the cryptocurrency industry.

For example, the ruling in the Ripple case provided a clearer legal status for digital assets like XRP, and the lawsuits won by Grayscale showed some successful legal challenges. In addition, the agreement reached between Binance and its CEO CZ with the U.S. Department of Justice indicates that when cryptocurrency companies cooperate with regulatory agencies, they can find ways to resolve disputes. This gradual clarification of the regulatory environment is a positive signal for cryptocurrency companies, indicating that they no longer need to operate with trepidation, but can develop their businesses within a clearer and more stable legal framework.

Although facing challenges, the cryptocurrency industry seems to be moving towards a more mature and stable direction after experiencing this series of legal and regulatory events.

On the other side of the ocean, Hong Kong, the former important financial hub of the East and West, is embracing Web3.

Chief Executive Carrie Lam, Financial Secretary Paul Chan, and other representatives of the Hong Kong government frequently voiced their strong support for Web3 to land in Hong Kong, attracting cryptocurrency companies and talents from all over to build. In terms of policy support, Hong Kong has introduced a licensing system for virtual asset service providers, allowing retail investors to trade cryptocurrencies, launched a Web3Hub ecological fund of over tens of millions of dollars, and plans to invest over 700 million Hong Kong dollars to accelerate the development of the digital economy, promote the development of the virtual asset industry, and has also established a dedicated working group for Web3.0 development.

In terms of financial institutions, the first batch of 800 million Hong Kong dollars of tokenized green bonds were successfully issued, compliant representative Hashkey Exchange steadily promoted the opening of product services, and plans to issue platform coin HSK, the cryptocurrency group BGX invested in another licensed exchange OSL, which partnered with Victory Securities to provide BTC and ETH trading services to retail clients in Hong Kong, and virtual banks, insurance companies, and other institutions have also reached cooperation with trading platforms.

While making great strides, risk events also followed suit. Unlicensed cryptocurrency exchange JPEX was involved in cases involving over 1 billion Hong Kong dollars, the HOUNAX fraud case involved over 100 million yuan, and HongKongDAO and BitCuped were suspected of virtual asset fraud… These malicious events have attracted high attention from the Hong Kong Securities and Futures Commission and the police. The Securities and Futures Commission of Hong Kong stated that it will formulate risk assessment guidelines for virtual asset cases with the police and exchange information weekly.

Outside the United States and Hong Kong: In January, South Korea allowed the issuance of security-type tokens; in August, the first spot Bitcoin ETF in Europe (Jacobi FT Wilshire Bitcoin ETF) went online; in September, the Japanese government allowed startups to raise funds with cryptocurrencies; in October, the G20 leaders issued a joint statement, unanimously passing a roadmap for cryptocurrency regulation; and Singapore plans to ban cryptocurrency margin or leverage trading by mid-2024 to curb retail speculation.

Secondary Market: Repair, Accumulation, Internal Structural Transformation

In 2023, the market gradually emerged from a deep bear market and gradually welcomed a small spring after the FTX explosion event, marking the beginning of a crypto winter.

Overall, according to Coingecko data, the total market value of the crypto market was approximately $831.7 billion at the beginning of the year. Since then, it has risen steadily, and as of December 12th, the total market value has exceeded $1.62 trillion, nearly doubling from the beginning of the year, approaching the market value of the fourth largest company in the world, Alphabet ($1.67 trillion).

During the critical period of the bull and bear market transition, the total market value of BTC and ETH also underwent significant changes: Bitcoin's market dominance increased from 38.31% at the beginning of the year to the current 49.5%; ETH, on the other hand, rose from 17.45% at the beginning of the year to over 18%, then fell back to the current 16.2%, failing to keep up with BTC's fundraising pace.

In terms of prices, Bitcoin gradually rose from $16,615 at the beginning of the year, breaking through $20,000 on January 14th, $30,000 on April 11th, experiencing a six-month adjustment, and breaking through $30,000 again on October 22nd, and officially breaking through the $40,000 mark on December 3rd, reaching $41,890 on December 12th, 2.5 times the price at the beginning of the year. ETH also gradually rose from $1,200 at the beginning of the year, breaking through $2,000 on April 13th, and has been fluctuating in the range of $1,500 to $2,000, maintaining a price above $2,000 in December, reaching $2,232 on December 12th, an 86% increase from the beginning of the year.

At the end of the year, most of the top 100 tokens benefited from the small spring, experiencing significant increases; only a few tokens such as SUI, BLUR, APE, CAKE, ALGO, among others, declined.

Among the top 20 tokens by market value, the following three tokens saw significant increases:

- Solana (SOL), mainly benefiting from the FTX relaunch and other news, rose from $9.97 at the beginning of the year to the current $66, an increase of 579.57%, currently ranking 6th in market value;

- Chainlink (LINK), benefited from the recovery of the crypto market, rose from $5.62 at the beginning of the year to the current $14.17, an increase of 154.46%, currently ranking 14th in market value;

- Bitcoin Cash (BCH), influenced by the popularity of Bitcoin, rose from $95.96 at the beginning of the year to the current $227.48, an increase of 134.33%, currently ranking 19th in market value.

In addition, the concept related to L2 was hot this year. According to Coingecko's statistics, the total market value of L2 tokens has reached $16.78 billion, with the top five being Polygon ($7.89 billion), Immutable ($2.6 billion), Optimism ($1.95 billion), Mantle ($1.786 billion), and Arbitrum ($1.45 billion), with IMX and OP tokens showing an increase of over 80% in market value.

In terms of modular blockchains, the leading project Celestia launched its mainnet at the end of October, and the token TIA rose by 188% within a month.

In terms of AI, with the release of ChatGPT at the end of last year, 2023 can be called the first year of large-scale AI model applications. AI-related concept tokens benefited from this and saw high increases this year. The high market value representatives for this concept are Bittensor ($17.85 billion) and Render ($14.98 billion), with increases of 178% and 734% respectively. In July, Worldcoin, a crypto startup project by OpenAI CEO Sam Altman, officially launched its coin at around $2, bottomed out at around $1 in September, and then slowly rose, currently priced at $2.38.

In terms of platform tokens, according to Coingecko's statistics, as of December 12th, the total market value of platform tokens was $65.321 billion, with the top five being: BNB ($37.962 billion), UNI ($4.58 billion), OKB ($3.605 billion), LEO ($3.449 billion), and CRO ($2.584 billion). The platform tokens with significant increases this year are: RUNE (297.61%), BGB (168.79%), and OKB (117.03%). It is worth mentioning that FTT, which collapsed last year, saw a significant increase this year due to the news of FTX relaunch, with an increase of 246.49% from the beginning of the year to the present.

In terms of stablecoins, as of December 12th, the total market value of stablecoins reached $129.8 billion, accounting for 8.0% of the total crypto market value. In terms of market size, USDT ($90.5 billion), USDC ($24 billion), DAI ($5.28 billion), TUSD ($2.6 billion), and BUSD ($1.47 billion) have basically divided most of the stablecoin market share. Compared to Tether, USDC, and BUSD last year, this year, USDC and BUSD saw significant declines in market share.

In March 2023, a major event occurred involving the issuer of USDC, Circle, and Silicon Valley Bank (SVB). Due to a liquidity crisis and customer fund run on SVB, Circle's $3.3 billion held at the bank was at risk. This caused fluctuations in the stablecoin USDC price and decoupled it from its peg. The bankruptcy of SVB severely affected its reputation, leading to a significant reduction in the circulation of USDC. Circle and its competitor Tether both invested their stablecoin reserves (amounting to $24 billion and $87 billion respectively) in U.S. Treasury bonds and other assets to earn returns, but the decline in USDC market share posed a more severe challenge for Circle's IPO. As a result, the market value of USDC decreased significantly, gradually decreasing from $44 billion in January to around $24.5 billion at the end of November, a decrease of approximately 44.32%.

In February, the U.S. Securities and Exchange Commission (SEC) issued a Wells notice to the stablecoin company Paxos, indicating a possible lawsuit against it, as the BinanceUSD (BUSD) issued and listed by Paxos was considered an unregistered security. On the same day, the New York State Department of Financial Services (NYDFS) instructed Paxos to stop minting new BUSD. Paxos announced that it would stop issuing new BUSD tokens from February 21st, but would continue to support the product, ensuring redemption until at least February 2024. CZ believes that the SEC's consideration of BUSD as an unregistered security could have far-reaching implications for the crypto industry, and expects users to gradually shift to other stablecoins. There is also speculation that the SEC's crackdown on BUSD may be related to its interest-bearing products or the broader category of "securities." After that, the market value of BUSD saw a significant decline, dropping from $16 billion at the beginning of the year to around $1.69 billion now. In November, Binance announced the removal of BUSD and the conversion of BUSD to FDUSD.

Unlike the above, the market value of USDT saw a significant increase due to users abandoning other stablecoins and turning to Tether, rising from $66 billion at the beginning of the year to $90.5 billion at the end of November, an increase of 37.12%. At the same time, stablecoins such as PYUSD released by PayPal and GHO released by Aave also appeared during the year, making the stablecoin ecosystem more diverse.

Primary Market: Total Financing Amount Exceeds $7.4 Billion, Anticipating Rebound in the Doldrums

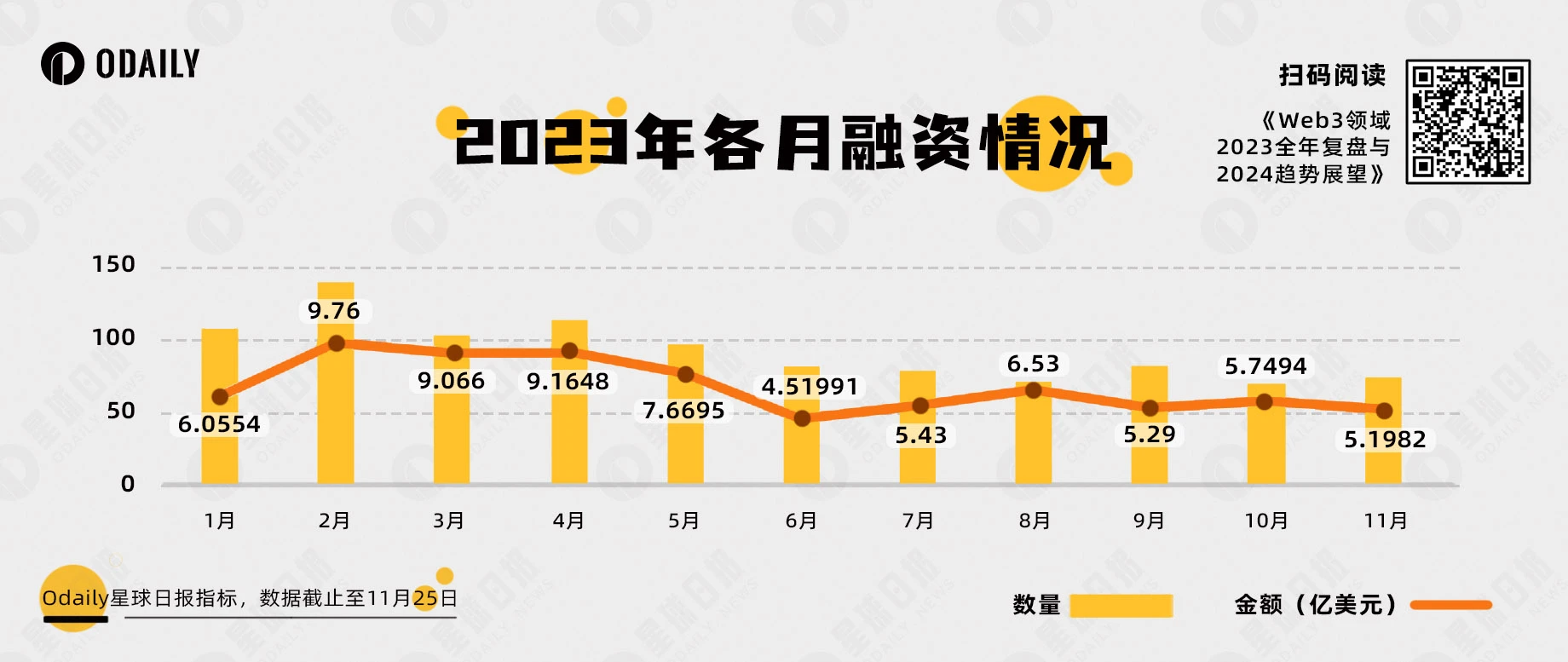

According to incomplete statistics from Odaily Planet Daily, as of November 25th, 2023, the crypto industry publicly disclosed 1,023 investment and financing events, a year-on-year decrease of 38.3%, with a total disclosed financing amount of approximately $7.44 billion, a year-on-year decrease of 78.74%.

January-November 2023 Financing Volume and Amount

2023 Web3 Primary Market Financing: In terms of quantity, the monthly average is close to 100 cases, showing a trend towards balance but a decrease overall; from the perspective of financing amount, the first 5 months were higher than the last 6 months.

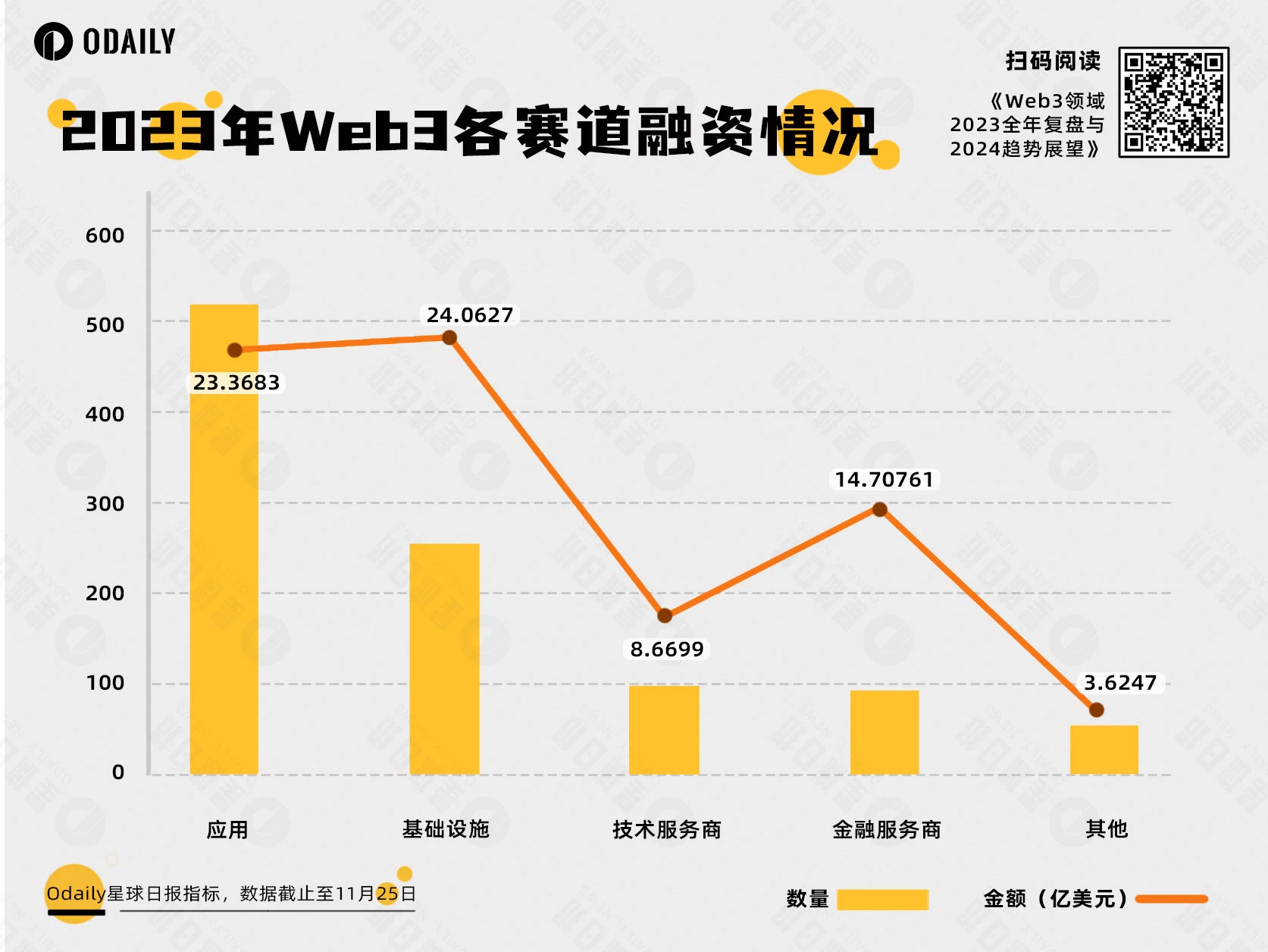

Looking at the primary market financing projects in 2023, Odaily Planet Daily has categorized all disclosed financing projects into 5 major tracks based on the business type, target audience, business model, etc. These tracks are infrastructure, applications, technology service providers, financial service providers, and other service providers. They further categorized them into sub-sectors such as DeFi, underlying infrastructure, GameFi, CeFi, tools, NFT, and Layer1.

The chart above shows that the hot financing track in 2023 is in applications, with the number of financings exceeding 500 for the whole year. This also indicates that the development of Web3 infrastructure is slowing down, and the industry urgently needs "fat applications" with large-scale adoption potential.

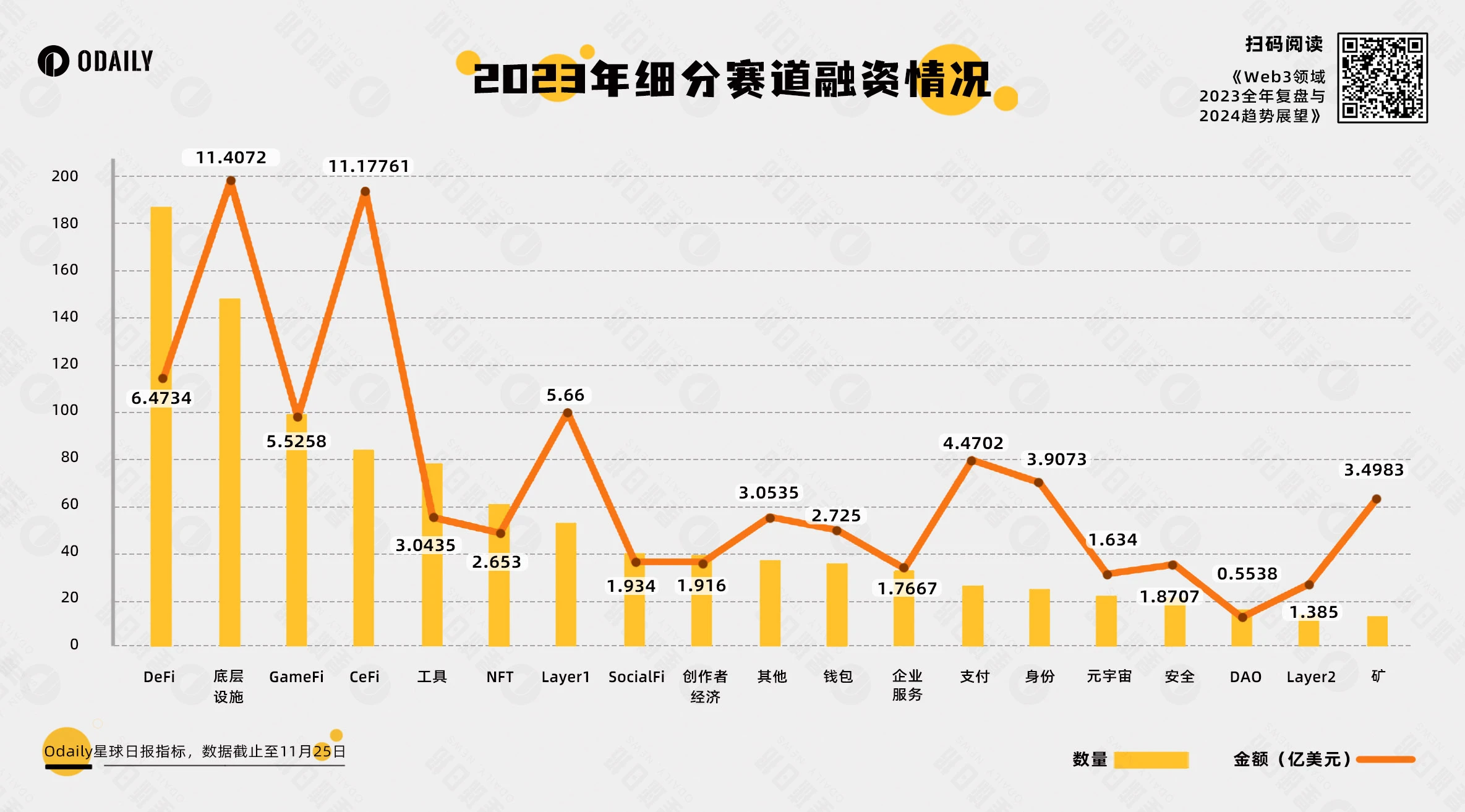

Looking at the financing quantity of sub-sectors, the DeFi sector ranks first with 187 financings. This includes emerging institutional trading platforms and order book DEXs based on high-performance blockchains.

Next, the underlying infrastructure, a sector that has always been favored by capital, also received 148 financings. More underlying infrastructure projects are actively serving traditional fields, with more diverse revenue channels.

GameFi and CeFi sectors followed closely, receiving 99 and 84 financings, respectively. GameFi, with its playability and return on investment, has always been at the forefront of Web3 newcomers. In the past two years, GameFi projects have consistently ranked high in terms of financing quantity, perhaps indicating that GameFi has a shorter return cycle for capital.

Some new models have emerged in the sub-sectors, such as TelegramBot, portal-level platforms, and AI+. The rise of TelegramBot and application portal platforms provides a simple and easy-to-use Web3 entry for new users. The rise of AI+ projects benefits from the rapid development of the AI field.

During the bear market phase, capital became more cautious, and the number of projects with financing amounts exceeding $10 million decreased by about 58.68% year-on-year. However, there were still projects with financing amounts exceeding $100 million.

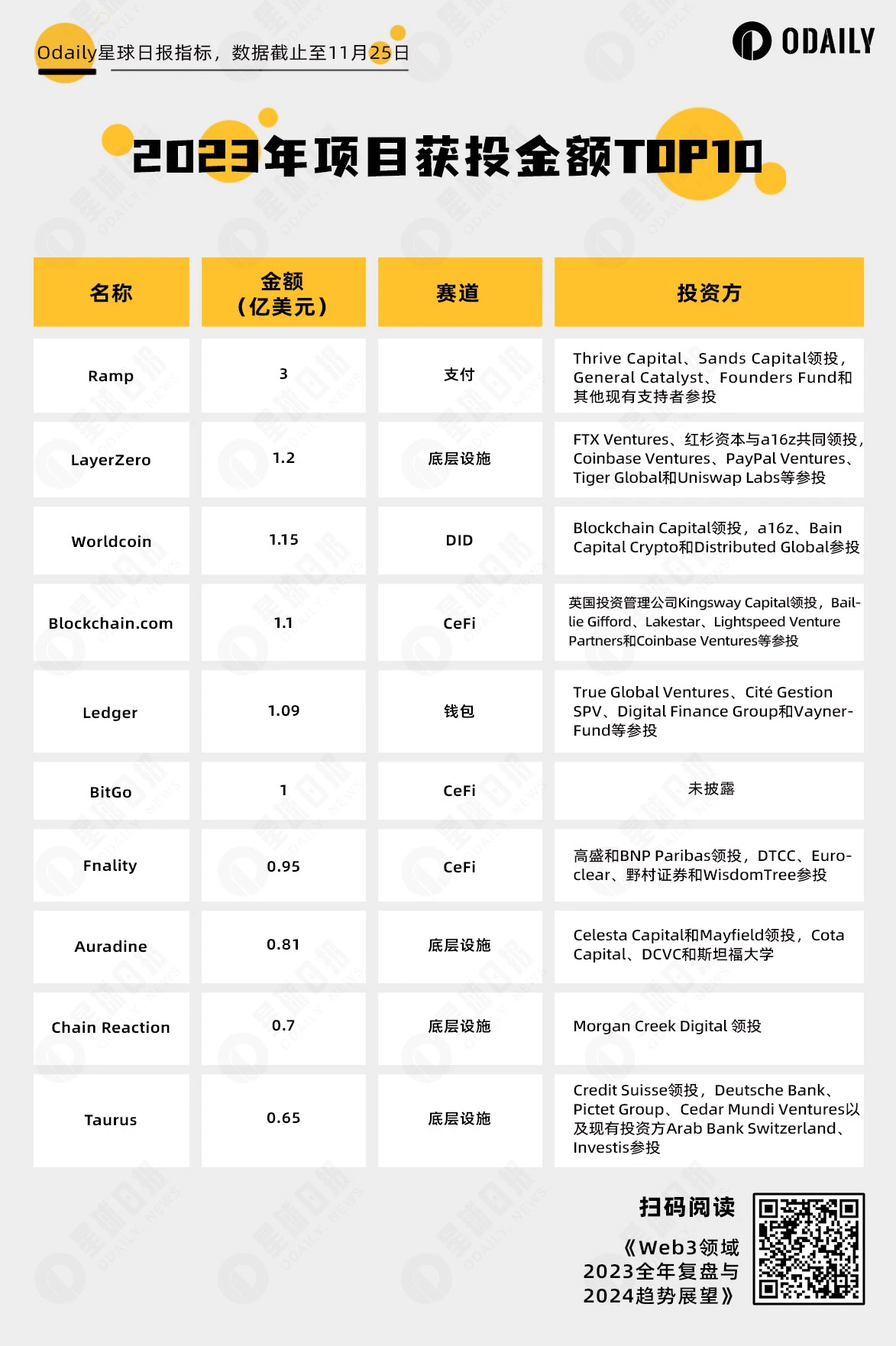

Top 10 Investment Amounts in 2023

Ramp, LayerZero, and Worldcoin are the top three in terms of investment amounts for the year:

Ramp mainly serves as a fiat payment channel between the crypto market and traditional financial markets, providing infrastructure for the introduction of funds into Web3.

LayerZero, as an underlying infrastructure, has gained favor from Web3 well-known institutions such as a16z, Coinbase Ventures, and traditional institutions such as Sequoia Capital and PayPal Ventures.

Worldcoin, with its team background and unique future technological value, has attracted attention and pursuit in the crypto market. As a new leader in the DID track, it has raised public expectations for the integration of identity systems and Web3 in the AI era.

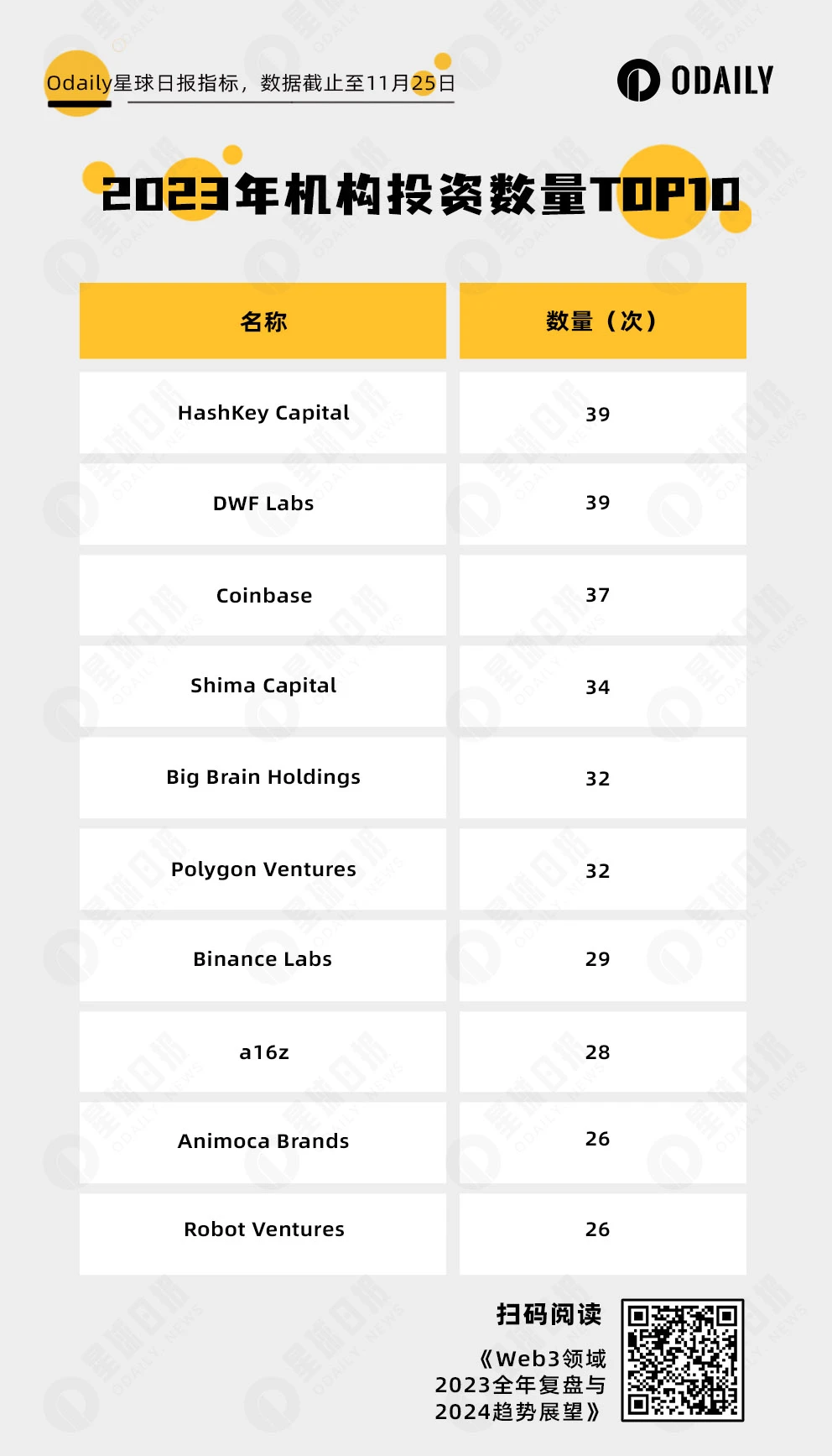

The chart above shows that HashKey Capital and DWFLabs tied for first place in the number of investments made this year. In terms of preferences, infrastructure and DeFi accounted for nearly two-thirds of HashKey Capital's investments this year. DWFLabs, which focuses on market-making style and vertical business models, has focused on Layer1 and GameFi tracks (a total of 17 investments).

At the same time, we also see many institutions that were on the list last year, such as a16z, Animoca Brands, Shima Capital, and Coinbase. Although the number of investments has decreased significantly compared to last year, the projects they invested in continue to attract attention, such as Worldcoin, LayerZero, and YGG.

Finally, although some institutions did not make the list, they still achieved impressive results, such as Paradigm, which made only 6 public investments throughout the year, but projects like Friend.tech, Blast, and Flashbots received high attention.

Overall, compared to last year, the primary market financing in 2023 has seen a significant decline in both quantity and amount, which is somewhat related to the bear market phase in the secondary market. However, the trough has been formed, and next year may see a rebound. The institutions that have planted the seeds will also witness the young seedlings grow into trees.

Bitcoin: Two Forces of Ecosystem from Bottom-up and Funds from External to Internal

On January 30th, the "Ordinals" protocol created by Casey Rodarmor was officially launched on the Bitcoin mainnet, opening the way for the grand wave of innovation in the Bitcoin ecosystem in 2023.

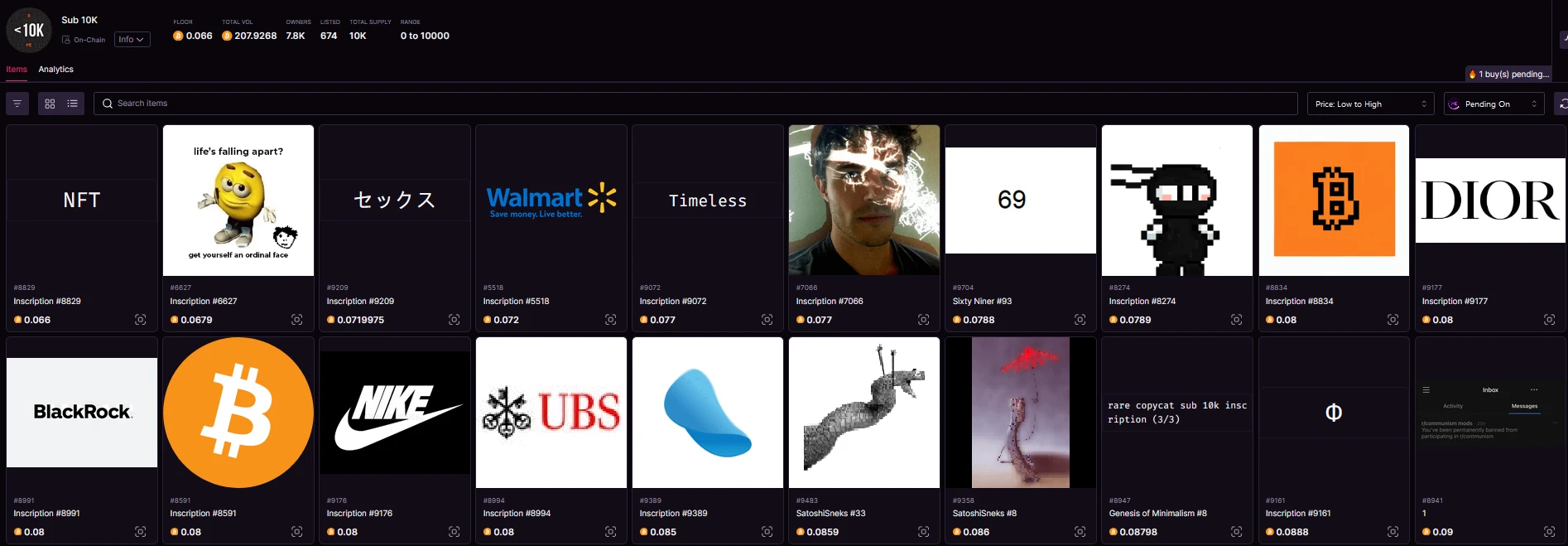

Initially, Ordinals focused on NFT projects, giving rise to the concept of sub10K (inscriptions before the first ten thousand), and the projects at this time were quite diverse, mostly created by community members themselves.

Subsequently, YugaLabs, as an early regular army, released the TwelveFold series, "YugaLabs explores the relationship between time, mathematics, and variability for the TwelveFold series." Unlike PFPs such as BAYC, the works that make up the TwelveFold series are created internally by YugaLabs' art team using 3D modeling, algorithm construction, and high-end rendering tools, as a tribute to the currently manually completed inscriptions.

The series of Bitcoin NFTs initially focused on porting NFT series from other chains, such as OrdinalPunks and BitcoinPunks, which used images from Ethereum's CryptoPunks. The NFTs of this era were very simple, and the validity check for BitcoinPunks was based on image comparison and hash verification by the development team one by one.

During this time, a wave of BRC-20 tokens emerged.

Domo proposed a token standard on March 9th, engraving a specific text onto Bitcoin and "treating it as" a token, giving birth to the first BRC-20 token, ORDI, followed by ecosystem participants deploying meme, punk, pepe, and other ownerless community tokens, with sats also born on March 9th.

In March, BRC-20 tokens did not attract much attention and were mainly traded through OTC. By the end of April, the price of ORDI reached 1U, triggering a series of BRC-20 increases. The mainstream trading varieties at this time were still spontaneously established and spread by the community, such as the aforementioned meme, punk, etc., as well as concepts introduced by the founder of Ordinals, Domo, and the complete combination concept, nals.

Subsequently, ORDI's rise broke through 4U, and the popularity of BRC-20 increased. Various tokens with project parties began to emerge, such as the IDO platform TURT and the game concept ORDZ.

At the same time, some influential figures from the X platform also began to participate. XEN founder Jack Levin's related tokens included PUSY, EPIC, DRAC, and finally, the public release of VMPX, causing Bitcoin network transaction fees to soar to over 400 sats/byte. Similarly, a user named BitGod gained popularity through a series of operations, and the token OXBT promoted by them also became one of the most popular BRC-20 tokens for a time.

The extreme FOMO also indicated the arrival of a turning point. On May 8th, Gate.io announced the listing of ORDI, with the highest increase to 29.5 USDT, closing at 17.8 USDT on the same day. Due to network congestion, users had difficulty placing orders, and after existing orders were cleared, ORDI on Unisat exceeded 30 USDT for a time. On May 20th, OKX announced the listing of ORDI, with ORDI reaching a high of 17.1 USDT and closing at 12.5 USDT.

The second spring of BRC-20 began on September 25th, with the completion of the sats token minting, with a total of 21,107,258 mintings and 36,061 holders. The minting started on March 9, 2023, and lasted for 6 months, with a minting cost exceeding $20 million. On this day, a monster from Corsica landed in the port of Juan, and ORDI closed at 3.6 USDT.

On October 30th, the Bitcoin inscription wallet UniSatWallet announced the decision to include 14 inscription assets in the first batch of supported assets on the BRC20-swap mainnet, including sats, ordi, oxbt, meme, vmpx, pepe, and others.

In early November, sats rose again, sparking renewed interest in BRC-20. The zoo concept began to rise, with a series of animal tokens such as rats, cats, bears, etc., occupying the top positions in the trading rankings.

The supreme emperor arrived in his faithful Paris on November 7th: with Binance listing ORDI, ORDI began to regain lost ground, reaching a high of 27.8 USDT on November 24th, once again becoming the top BRC-20 token by market value. On December 7th, ORDI reached a historic high of 69.7 USDT, with a market value exceeding $1 billion.

On November 16th, the regular transaction fees on the Bitcoin network rose to 186 sats/byte. The minting cost of BRC-20 tokens continued to rise, but it did not dampen the enthusiasm of users. Several high-volume BRC-20 tokens, including MMSS, Bear, etc., quickly completed all minting.

With the vigorous development of BRC-20, various competing protocols gradually entered people's field of vision. The following are the top protocols:

TaprootAssets (formerly Taro) is a protocol supported by Taproot for issuing assets on the Bitcoin blockchain, creating assets that can be transmitted on the Lightning Network, enabling instant, high-capacity, and low-cost transactions.

AtomicalsProtocol is a simple and flexible protocol for creating, transmitting, and updating digital objects (traditionally known as NFTs) on UTXO blockchains such as the Bitcoin network. Unlike Ordinals, which was originally designed for NFTs, it rethinks from the ground up how to issue tokens on BTC in a decentralized, immutable, and fair manner.

BRC-420 introduces a digital asset management method in the metaverse, providing creators with a comprehensive system to manage, share, and profit from their creations through recursion, licensing, and royalties.

While the native Bitcoin ecosystem was developing, the external environment also underwent drastic changes. The application for a Bitcoin spot ETF opened the path to compliance for Bitcoin, and top whales were aggressively increasing their holdings, further raising their holdings and corresponding influence.

As early as June 29, 2021, ARKInvest, under Cathie Wood, submitted a Bitcoin ETF application, which was officially rejected by the SEC in April 2022 after multiple delays. Later, ARK's application was rejected for the second time at the beginning of 2023, and in May, they applied for a third Bitcoin spot ETF. Some asset management companies did not hold much hope for the appearance of a Bitcoin spot ETF during this period.

It wasn't until June 15th that insiders indicated that BlackRock, the largest asset manager, was about to submit a Bitcoin ETF application, igniting market enthusiasm. BTC bottomed out at 24,800 USDT, becoming the lowest point in the market after June. Subsequently, Fidelity, the third-largest asset manager, also joined the application queue. After the news of Franklin Templeton's application on September 12th, the market reached its final bottom, and the expected funds from these asset management giants made the spot ETF an important factor in the short-term and long-term fluctuations of Bitcoin.

In September and November, the SEC repeatedly postponed the decision on the Bitcoin spot ETF. On October 16th, there were even rumors of the SEC approving the iShares Bitcoin spot ETF under BlackRock, but many believed that the approval of the Bitcoin spot ETF was inevitable, it was just a matter of when.

As a traditional financial participant in the United States, CME's open interest in Bitcoin contracts has been rising all the way, surpassing Binance to rank first, and is close to the historical high point of 2021.

As a representative of whales, MicroStrategy had accumulated 174,530 bitcoins as of December 7th, with a total cost of $5.28 billion, resulting in an average holding price of 30,252 USDT. Based on the current price of 44,000 USDT, the unrealized profit is estimated to be $2.4 billion.

MicroStrategy was once considered a contrarian due to significant unrealized losses, but through continuous accumulation, it waited for the market to turn around. The company remains very optimistic about the future of Bitcoin. MicroStrategy co-founder Michael Saylor participated in an interview with CNBC, and his main points included:

They may continue to buy, and you can never have "too much Bitcoin";

The approval of a Bitcoin spot ETF by the SEC will not threaten MicroStrategy, as it offers a differentiated product;

The selling pressure after the halving will decrease from $12 billion to $6 billion annually, making them quite optimistic for the next twelve months;

The SEC is expected to approve a Bitcoin spot ETF in the first quarter of next year, or at some point in the next twelve months.

Ethereum: Growing More Mature, Facing Old Rivals and New Challenges Bravely

As one of the most important forces in the crypto ecosystem, Ethereum's performance in 2023 was not as expected. Especially after the completion of the Shapella upgrade (Shanghai+Capella), the Cancun upgrade was repeatedly delayed, with no significant progress on the technical front and a lack of speculative hotspots in the news. The price remained lackluster until the end of the year, when it began to rebound along with the overall market, but it remained weaker than Bitcoin.

1. Data: Lackluster Price, Declining ETH/BTC Exchange Rate

Throughout 2023, ETH's price performance can only be described as "flat." It did not experience the heroic rise from $750 to $4,860 in 2021, nor the thrilling drop from the peak to below $900 in 2022.

At the beginning of 2023, ETH made a move from $1,200, following the overall market trend, but it fluctuated around $1,500. It seemed that external positive and negative factors had little impact on it. It was not until the completion of the Shanghai upgrade in April that the ETH price briefly broke through $2,000, reaching a high of around $2,150, but it lacked follow-through and slowly fell back, remaining in the range below $2,000. It wasn't until the confirmation of the bull market signal at the end of the year that ETH seemed to "make up its mind" and re-entered the divine realm of $2,000, reaching a high of $2,400, with a total annual increase of 83%.

ETH's "flatness" was not only reflected in its price but also in its stable market share. Throughout the year, ETH's market share remained at around 17%-18%, while BTC's market share continued to rise and exceeded 50% by the end of the year. The difference between the two was even more pronounced in the ETH/BTC exchange rate, which declined from 0.072 at the beginning of the year and fell below 0.05 in December, currently hovering around 0.052. Although the ETH/BTC exchange rate has rebounded from the bottom when viewed from a larger perspective, whether it can "stand firm" and continue to rise is still worth watching.

Ethereum's total value locked (TVL) in DeFi increased almost in sync with the price, from $3.4 billion at the beginning of the year to $6.4 billion at the end of the year, an increase of less than 100%. Due to the industry-wide crypto winter in 2023, the DEX, lending, and other sectors based on Ethereum generally cooled down, causing the once proud DeFi ecosystem of Ethereum to lose its strong momentum.

Another noteworthy development is that the Ethereum Liquidity Staking Derivatives (LSD) sector became a market hotspot in the first quarter of this year, receiving much attention. The reason behind this was that with the transition of the Ethereum mainnet from PoW to PoS, users could stake 32 ETH as a staking node. As staking ETH reduced the liquidity of assets for users, there was a strong demand for liquidity for staked assets, leading to the emergence of LSD services.

However, after the Shanghai upgrade, ETH withdrawals were opened, and the LSD sector quickly cooled down. Apart from a few leading projects, other latecomers found it difficult to gain market share again. Currently, the liquidity staking solution provider Lido is leading the pack with a 31.8% share, followed by Coinbase with an 8.84% share, and Stakefish with a 7.3% share.

2. Technology: Two Major Upgrades, High Expectations

On the technological front, the two most significant events for Ethereum this year were related to upgrades: the Shapella upgrade and the Cancun upgrade.

On April 12th, after 7 months of the "merge" upgrade, Ethereum simultaneously underwent the Shanghai upgrade and the Capella upgrade, collectively known as the "Shapella upgrade." The ultimate change was that the upgrade allowed stakers who did not provide withdrawal credentials at the time of deposit to have the ability to provide credentials, enabling withdrawals. This brought the staking withdrawal function to the execution layer, allowing stakers to withdraw nearly 20 million ETH locked since 2020 from the beacon chain to the execution layer, enabling full withdrawals or staking rewards withdrawals, releasing the liquidity of staked tokens.

Although the Shanghai upgrade did not reduce gas fees, the implementation of EIP-3651, EIP-3855, and EIP-3869 reduced gas fees for Ethereum developers and block creators. More importantly, this was the final important step for Ethereum's transition from proof of work (PoW) to proof of stake (PoS).

After the implementation of the Shanghai upgrade, although some early stakers made withdrawals, the situation reversed in the following two weeks, with a net inflow of staking increasing, and the amount of staking and the number of validators showing an accelerating upward trend.

Another highly anticipated upgrade is the Cancun upgrade Dencun (Dencun+Cancun), another milestone upgrade for Ethereum, with Cancun focusing on the Ethereum execution layer and Deneb focusing on the consensus layer.

The Cancun upgrade is expected to bring substantial benefits to the Ethereum network, including enhanced scalability, reduced gas fees, improved security, efficient data storage, and enhanced cross-chain connections. After the upgrade, it is expected to stimulate a major outbreak of applications in both Ethereum L1 and L2 ecosystems, as well as in cross-chain bridges, storage, and GameFi sectors.

Originally scheduled for November, the Cancun upgrade continued Ethereum's consistent trend of being repeatedly delayed. Currently, at the Ethereum core developer meeting, the official statement indicated that the Cancun upgrade may be postponed until early 2024. With multiple factors such as the Bitcoin halving and the continued push for a spot ETF, Ethereum may receive even greater positive returns if the upgrade is completed next year.

3. Other Aspects: Vitalik Buterin Begins to Feel Anxious, Spot ETF Awaits Approval

This year, Ethereum seems to be truly "cultivating internal strength," fully absorbing and digesting past achievements. At the same time, Ethereum has not stopped exploring new technologies.

For example, among the 30 personal opinions expressed by Vitalik recorded by Odaily this year, 8 are related to wallets, especially abstract account wallets. In the mid to late 2023, it even sparked an industry debate about which is better, abstract account wallets or EOA wallets. Compared to EOA wallets, abstract accounts certainly have advantages. However, Vitalik's statement at an Ethereum community meeting that "abstract account upgrades can attract billions of people to use Ethereum" may be the reason why Vitalik is particularly fond of it.

Vitalik is also anxious. This anxiety is multifaceted. Firstly, the recent rise of the Bitcoin ecosystem and the emergence of various consensus protocols have made Bitcoin faster and cheaper to deploy applications, while also starting to divert attention from Ethereum in the market. Additionally, high-performance new public chains represented by Aptos, Sui, and Ton are maturing, and some Layer2 solutions have also diverted users and funds that originally belonged to Ethereum.

At the end of this year, another major news is that an Ethereum spot ETF is also about to be launched. Along with the application for a Bitcoin spot ETF, companies such as BlackRock and ARK have also started applying for an Ethereum spot ETF. Once the former is approved, the possibility of an Ethereum spot ETF coming to market will greatly increase, ultimately bringing in more incremental funds and perhaps causing the price of Ethereum to soar.

As an ecosystem with the most complete Web3 industry system and the representative that most clearly showcases Web3 product forms to the traditional world, Ethereum, which has accumulated for a year, will truly flourish when the real world fully embraces it. At the same time, it will also face its old rivals and new challenges in a new way.

Layer2: Diverse Development, a Surge is Coming

In 2023, Layer2 has gradually become the mainstream choice for scaling the execution layer.

In the past year, we have seen a group of Layer2 solutions gradually catching up with the established Layer1 solutions in terms of TVL. We have also seen centralized institutions such as Coinbase and ConsenSys experimenting with Layer2, and even Layer1 projects like Celo transitioning to Layer2.

Looking closely at the internal competition within the Layer2 race, the two representative projects of the Optimistic-Rollup series, Arbitrum and Optimism, continue to lead the race in terms of TVL, but they have shown distinct differences in their development strategies.

Arbitrum launched its governance token, ARB, in March of this year and subsequently conducted the largest airdrop activity in the entire crypto industry. Today, Arbitrum continues to stimulate the activity of the main chain through frequent ARB incentives. It is also exploring vertical scaling through ArbitrumOrbit. Additionally, Arbitrum is actively building a new development environment, Stylus, in an attempt to achieve scaling of the EVM through support for more programming languages.

On the other hand, Optimism continues to advance its horizontal expansion based on the OPStack architecture and has received support from strong allies such as Base and Zora. In August, Optimism signed a governance and revenue-sharing agreement with Base, unveiling the future collaborative operation of the "super chain" ecosystem. Based on the LawofChain framework, OP will govern the entire ecosystem; the main chain Optimism will expand the ecosystem and promote decentralization by distributing OP; and the Base and other ecosystem chains will continuously contribute revenue back to the main chain.

It is also worth mentioning Blast, a project that initially only had smart contracts but claimed to build an automatic interest-bearing Layer2 based on Optimistic-Rollup. It suddenly disrupted the entire Layer2 market at the end of the year and successfully attracted hundreds of millions of dollars in real money, becoming the third-largest "Layer2" in terms of TVL, following only Arbitrum and Optimism.

As for ZK-Rollup, the mythical zkEVM is no longer just a phantom in narratives. zkSyncEra, Polygon-zkEVM, Linea, and Scroll have all launched their mainnets this year and achieved a certain scale in their ecosystems. Starknet has also completed the "quantum leap" upgrade, significantly improving network execution efficiency.

Today, these major networks have become the main battlegrounds for airdrop hunters, with countless airdrop enthusiasts and bots accumulating interaction data day and night, trying to get a piece of the pie from the still uncertain future airdrops.

Another focus of Layer2 in 2023 is that the development of projects such as Celestia and Eigenlayer has driven discussions about modularity. As some Rollup solutions have turned to third-party networks rather than Ethereum as the data availability layer (DA), it has sparked intense discussions in the market about what constitutes "pure" Layer2.

In response, Vitalik's recent articles seem to be quite directive. He redefined various types of Layer2 and then proposed exploring the potential feasibility of ZK+Plasma in the market, seemingly deliberately guiding the market away from third-party DA solutions.

Looking back at the entire year of 2023, it is regrettable that the long-awaited Cancun upgrade has encountered delays, but this has also become our greatest expectation for the development of the Layer2 race in 2024.

Looking ahead to next year, the Cancun upgrade is expected to drive large-scale cost reductions and speed increases for Layer2, which may lead to a new peak of growth for Layer2.

In addition, the decentralization process of Layer2 itself next year is also worth looking forward to. This includes whether ZK-Rollup will universally launch tokens and improve governance systems, as well as the development and implementation process of decentralized sequencers.

A surge is coming. Will 2024 be the year of Layer2? Let's witness it with a slightly positive attitude.

Layer1: Reduced Market Diversity, the Glory of "Ethereum Killers" is Fading

With the gradual improvement of Layer2, there are now multiple Layer2 solutions competing in the market. According to DeFiLlama data, among the top 10 chains in terms of TVL, Layer2 has secured 3 positions, and in the future, Layer2 may still be able to occupy more positions previously held by Layer1.

In this context, how are the once shining "Ethereum killers" doing?

In the past year, most emerging Layer1 solutions have already moved further away from their moments of glory. However, this does not mean that the Layer1 market is silent. Currently, it seems that the "emerging" Layer1 solutions from the past year have still seen many changes and innovations.

Looking at the Layer1 race, the most noteworthy event is the surge of Solana. After experiencing the FTX crash, Solana, despite a long period of silence, is still steadily rebuilding amidst the ruins.

At the beginning of the year, Solana's situation was not excellent. In February, the Solana network experienced a forking event. This event began with a node failure on the network, leading to a "fork" that essentially created two independent versions of the Solana blockchain. As a result, nodes in the network could not reach a consensus, leading to a consensus failure. Under this major fault, Solana's processing capacity per second temporarily dropped to less than 100 transactions.

The network outage lasted for several hours, causing significant disruption to users and developers. Although developers were able to quickly identify and resolve the issue, the event still had a negative impact. After the downtime, panic triggered doubts about the platform's scalability and reliability. The community's confidence and trust were put to the test, and the event also caused a significant drop in the price of the SOL token.

Since then, the Solana Foundation and developers have been working tirelessly to improve the network's stability and resilience. By Q4 of this year, the Solana network has experienced a significant recovery and has shown strong growth momentum.

For example, DeFiLlama data shows that in the first three quarters of 2023, Solana's TVL remained relatively stable, hovering around $300 million. However, after entering Q4, Solana's TVL grew rapidly and has now surpassed $800 million, an increase of about 200% from the previous round.

Solana's DEX trading volume has also been rapidly increasing. In mid-December, the weekly trading volume reached a historic high, surpassing $3.7 billion.

In the crypto market, achieving a temporary increase in value is not difficult, and most tokens have had their moments of glory. However, what sets Solana apart is that the project has experienced a "second" resurgence, which is rare for a crypto project.

In the scattered non-EVM network market, the "Move series" has also been a rising star in the new public chain space this year.

In April, Aptos announced the launch of staking delegation, allowing users to delegate their staking rights to trusted network validators and receive rewards.

In May, the Sui mainnet went live. Although it lagged behind Aptos, which had already launched the previous year, Sui's launch also achieved good results. With Layer2 gradually becoming the market focus and the weakening narrative of Layer1, what makes these two highly anticipated Move series public chains unique?

Looking back at the story of the "Move series," it is worth mentioning Facebook's involvement. As a social media giant, Facebook once intended to enter the crypto space and developed the innovative Diem blockchain. However, with setbacks in regulation, Diem did not achieve the expected results. The developers realized that to avoid regulatory constraints, they needed to move away from their original domain, leading to the birth of networks more closely related to the crypto "native" world—Sui and Aptos.

Because these two networks are more or less related to Facebook's original Diem, they both inherited the Move language as their smart contract language.

Move is significantly different from Solidity, and while we won't make judgments about which is better, this significant difference has made Sui and Aptos a unique pair of similar products in the market.

DeFiLlama data shows that Sui's current TVL is approximately $150 million, while Aptos is around $78 million. According to on-chain data, the current total number of accounts on the Sui network exceeds 9.11 million, and on the Aptos network, it exceeds 9.9 million.

Overall, the Sui blockchain had a good start in 2023. The platform made progress in both technology and the ecosystem and gained support from investors and developers.

Additionally, some "old-fashioned" Layer1 networks have also shown impressive performance.

Filecoin made a significant move this year as a non-EVM network. In March of this year, the Filecoin Virtual Machine (FVM) was successfully launched. Since then, the Filecoin blockchain has been able to support smart contracts and user programmability through FVM.

Similarly, in April, the EOS EVM mainnet Beta version was officially launched. This launch also marked the achievement of interoperability between the Ethereum and EOS ecosystems.

Looking back at the non-EVM Layer1 networks in 2023, we have observed an interesting phenomenon.

The strong momentum of Layer2 not only continues to drive Ethereum forward but also has a subtle but long-term impact on the Layer1 market. The vast developer ecosystem of Solidity has led more non-EVM-compatible networks to actively embrace the EVM ecosystem. Some niche, non-mainstream networks that cannot be compatible with EVM seem to be struggling to survive in the market.

The gravitational pull of Ethereum is so strong that it actively or passively influences other public chains. In November of this year, the EVM Layer1 Celo made a regrettable move. The main developer of the blockchain, cLabs, posted a topic on its forum about "choosing the L2 protocol stack framework," inviting the community to provide feedback and participate in the discussion.

Celo is trying to redefine itself. The network is attempting to inherit existing assets while developing a Layer2 network using a mature stack and migrating the ecosystem. In the planned framework, the priority is to handle "simple migration, minimal downtime, low gas fees, and Ethereum compatibility."

This also means that once the migration is complete, one less network will compete in the Layer1 world, and users will have a new Layer2.

With the change in the Celo brand ecosystem, it is easy to predict that more Layer1 projects will face a countdown to their existence. For more niche networks, they either risk being swallowed by Ethereum or take a completely independent path, just like Solana, Aptos, and Sui.

The survival space for Ethereum-like Layer1 networks has become increasingly narrow.

In that case, how have the "Ethereum killers" that emerged in the past developed?

Taking Fantom as an example, Fantom shone brightly during the previous bull market. Fantom used Multichain as the main cross-chain bridge in its ecosystem. In July of this year, due to the Multichain incident, Fantom found itself in a precarious situation. Approximately $1.18 billion in assets were transferred from the Multichain-Fantom bridge contract, and the stablecoin issued by the Multichain bridge contract on Fantom experienced a significant deviation from its peg.

This event dealt a heavy blow to Fantom, and its TVL has not recovered to this day.

On the other hand, the fate of another "Ethereum killer," Avalanche, has been quite different. Despite being in a bear market, Avalanche's TVL has not significantly decreased this year. Interestingly, at the end of this year, the AVAX token surged in value, and the TVL also increased significantly.

In mid-December, the price of AVAX briefly surpassed $40. Although it still lags far behind the previous bull market high, it has achieved a monthly increase of about 100%. The quarterly increase has been even more impressive. In Q3 of this year, the AVAX token lingered around slightly over $10 for an extended period.

Finally, BNBChain remains the most noteworthy EVM network. Despite being an established public chain, BNBChain has not stopped innovating. With the launch of BNBGreenfield and opBNB, BNBChain now includes multiple domains such as computing, storage, Layer, and zk.

Of course, the BNBChain brand is not just one chain, but a huge family of 5 chains. This unique positioning in the Layer1 space sets it apart from other players in the field.

There are many players in the Layer1 space, and it's difficult to list them all in this article. In addition to the main ones mentioned above, other public chains have also made significant progress.

For example, in November, the new CEO of Polkadot's development organization, Web3 Foundation, stated that Polkadot is about to undergo a major transformation. The previously market-hot "parachain auctions" will become history, and Polkadot will abandon the parachain auctions for parallel chains, instead adopting a new mechanism that allows application developers to rent block space as needed. In November, NEAR also announced the launch of the NEAR Data Availability (NEARDA) layer, which provides strong, cost-effective data availability for ETH rollups and Ethereum developers. NEARDA can reduce costs, improve rollup reliability, and maintain Ethereum's security. TON Network is also quite different from other networks. In July, the popularity of the BOT race made Telegram an alternative crypto application that combines wallets and trading. Although the tokens traded are not on the TON network, they still spark people's imagination about the TON network. In September, Telegram officially announced a collaboration with the TON Foundation, and the huge user base brought great potential for user growth to the TON network.

Looking ahead, it's difficult to predict the specific direction of the Layer1 market in the future. However, it's clear that the strong rise of Ethereum Layer2 will further compress the survival space of other Layer1 networks.

For public chains, in the future, "being like Ethereum" may increasingly become a constraint for development—either integrating into the Ethereum ecosystem or being completely different from it.

As the bull market approaches, will the narrative of Layer1 be completely surpassed by Layer2 in this cycle? In the upcoming year of 2024, we will witness the answer to this question together.

DeFi: Crossing the Winter, Heading for Recovery

In the year-end summary of 2022, we described the DeFi track as not having the best year.

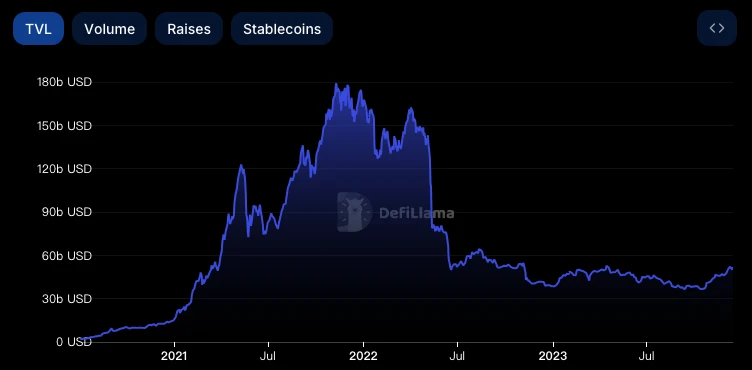

The same statement still applies to 2023. According to DeFiLlama data, as of early December, the total value locked (TVL) in all DeFi protocols on major networks is approximately $50.8 billion, still more than three times lower than the peak of $178.54 billion during the DeFi Summer in 2021.

Odaily Daily Planet Note: The total TVL is still significantly below the historical peak.

However, 2023 is clearly not the worst year for DeFi. After crossing the winter of 2022, DeFi has shown signs of a strong recovery this year. This is evident not only in the relative recovery of the overall TVL and individual token prices but also in the small-scale outbreaks in multiple sub-sectors and the breakthrough iterations and innovations of multiple projects compared to the overall silence in 2022.

In April, Ethereum successfully completed the Shanghai upgrade and officially activated the staking redemption feature, which directly boosted the launch of the LSDFi sector. Lido, taking advantage of this momentum, surpassed many leading players in multiple sectors such as trading and lending, and took the top spot on the TVL leaderboard. At the same time, with the continuous expansion of the "pool" size of LST, more different types of upper-layer applications have emerged around the LSD scene, many of which have had outstanding performances in the secondary market, such as Lybra, which hopes to break through the stablecoin market with native staking rewards, and Pendle, which focuses on yield optimization.

In addition to LSDFi, RWA is also the hottest sector in the DeFi track this year. Maker, as a pioneering representative, capitalized on the high-yield cycle through the DSR and the new window Spark Protocol, thereby amplifying the market demand for DAI and boosting the market value of MKR, making it one of the most eye-catching DeFi projects for a long period this year.

While DAI was strong in high-yield, a group of projects began to "dig into the corner." The stablecoin sector welcomed several heavyweight new players this year, with Curve and Aave's long-awaited crvUSD and GHO both going live. Although they still cannot compete with DAI in terms of scale, the inherent advantages of being backed by leading protocols have ensured that their potential should not be underestimated. For the sake of healthy competition, we are pleased to see more diverse stablecoins emerge, as the market has long realized that having more options is the best solution, especially after the large-scale stablecoin deviation caused by the Silicon Valley Bank incident at the beginning of the year.

The perennial topic of derivatives is another eye-catching sector in the DeFi track this year. From dYdX, which completed the transition from a self-application to a network, to dYdX, which is about to launch its v3 version, to GMX, which dominates on Arbitrum, we are witnessing the power of DeFi gradually encroaching on a sector that was almost monopolized by CeFi.

The "Intent" promoted by Paradigm is a new narrative in the DeFi track, and a small number of projects involved in this sector have received early investments from VCs.

Looking at the micro level, many projects have also delivered commendable results in 2023. Uniswap, which continues to lead the trading track, has stunningly released the blueprint for v4, aiming to achieve more flexible and comprehensive functionality using hooks. The all-rounder Frax has performed well in multiple sectors such as stablecoins, lending, LSD, and RWA, and demonstrated excellent resilience during the CRV liquidation turmoil in the middle of the year. Aevo, through its "early bird" contract for pre-TGE tokens, has become a major venue for value discovery before the launch of many popular tokens… There are many similar outstanding representatives.

Of course, in addition to these positive signs of recovery, there are still many hidden concerns in the DeFi world in 2023, such as the stablecoin deviation turmoil caused by the Silicon Valley Bank incident mentioned earlier, the vulnerability of the lending system highlighted by the "malicious borrowing" of Curve founder Michael Egorov, the centralization issues repeatedly criticized by Uniswap Labs, and the escalating hacker threats represented by the "Kyber takeover threat" incident…

This is the first bear market experience for DeFi as a complete narrative, but completeness does not necessarily mean maturity. Clearly, DeFi still faces many unresolved challenges. However, overall, after passing through 2023, we have seen that DeFi has not been defeated by the winter, but is instead stepping towards recovery.

Looking ahead to 2024, although we cannot yet know what will ignite the next big explosion of DeFi, the overall trend indicates that as different types of Dapps emerge collectively in the on-chain ecosystem, such as games and social apps, DeFi as infrastructure will undoubtedly attract more users and greater traffic.

Projects that dare to cross the winter are destined to receive the rewards of time.

NFT: Limited Innovation, Few Takers, Can it Shine in the Dark Next Year?

Compared to the brilliant runes, NFTs have been in a sustained downturn this year. Apart from a few individual projects with occasional highlights, the top blue-chip NFTs have been in a predicament of rebound rather than reversal throughout the year. For example, Bored Ape Yacht Club (BAYC) had an average price of around 71 ETH at the beginning of the year, but by the end of the year, the floor price had dropped to less than 30 ETH.

In contrast, "small penguin" PudgyPenguins has made a steady progress from the brink of community dissolution to the physical toys being sold out on Amazon, and the new team is steadily advancing its layout. Its floor price has also broken through the 10 ETH mark in the bear market, and recently even exceeded it.

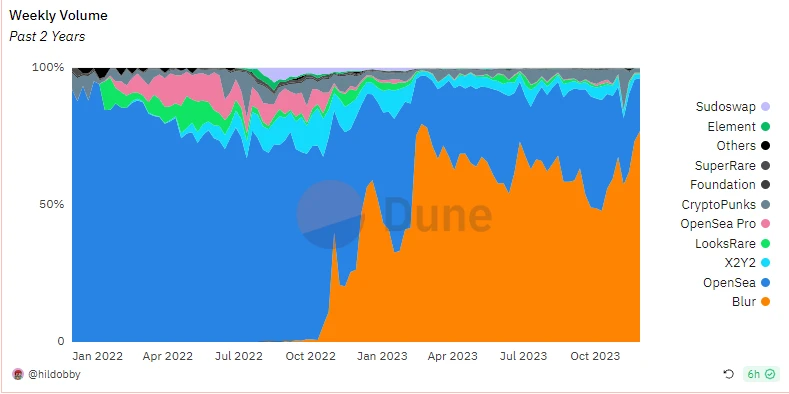

The landscape of the NFT market has also undergone significant changes, with Blur going from competing head-to-head with Opensea at the beginning of the year to almost completely capturing the majority of the market share by the end of the year. Meanwhile, Opensea, which once enjoyed unparalleled glory, only accounted for 20% of the market's weekly trading volume in December. Despite making some product responses and community feedback to counter Blur's impact, it has been to no avail. The debate over zero royalties has also come to an end with Blur's dominance—few will discuss whether "creators should receive royalties" anymore.

X2Y2 and LooksRare, which focus on mining trading, did not become market surprises due to their models. In late September of this year, LooksRare took the lead in adjusting its token economics, ending the trading mining model that had lasted for more than a year, and introducing gaming as the platform's new selling point. While X2Y2 retained the mining trading model, it also announced a reduction in token emissions and the launch of a cross-chain aggregator in November. However, both of them saw their trading volume in the market decrease, ultimately becoming just one of many denominators.

Behind Blur's rise is the exodus of whales. On February 15th of this year, Blur announced the second season airdrop plan, encouraging users to bid and place orders. The first season's myth of getting rich quick attracted a large number of users, who bid more crazily to get a piece of the action. As BAYC whales, Franklin and "Brother Ma Ji" Huang Licheng started a fierce battle, with their trading volume at one point accounting for 8% of the market. However, due to excessive liquidity, the whales also took on a large number of sell orders during the scoring process. Huang Licheng lost over 500 ETH in this scoring game. Franklin, who had made a bold move in the BendDAO collective liquidation event, found himself deeply mired in the quagmire of on-chain gambling, eventually liquidating all NFTs and deleting his Twitter account.

Even the blue-chip projects that were supposed to earn royalties couldn't hold on. At midnight on June 28th, the new series of works, AzukiElementalBeans, from the leading NFT project Azuki, officially went on sale. The starting price of 2 ETH brought the project a total income of 20,000 ETH, showing the community's enthusiasm. However, the AzukiElementalBeans released after the sale almost completely replicated the original Azuki artwork, and the project's perfunctory response angered its supporters. Although the Azuki official proposed an airdrop plan to try to make amends after the incident, holders still exchanged their small pictures for real money and then left the community forever without looking back.

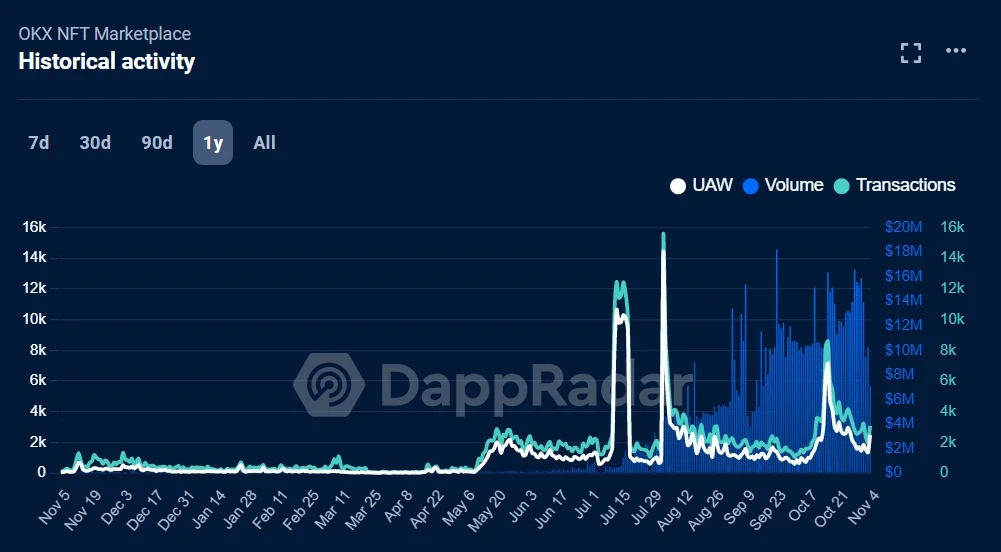

The only ones who have gained something are probably the platforms that have taken the multi-chain aggregation route. Platforms like OKXNFTMarketplace and MagicEden have risen against the tide, especially the former, which has leveraged the power of its built-in Web3 wallet to the fullest and has solidified its position by taking advantage of the rise of the BTC ecosystem, becoming an undeniable presence in the market. However, looking ahead, NFTFi, which was once buzzing with activity, has become a dispensable chicken rib due to the gradual decline in market heat and the abundant liquidity of Blur. The aggregator is likely to become the endgame of innovation in the NFT market.

GameFi: Ponzi to the left, full chain to the right

If the blockchain games of 2021 and 2022 were colorful, then the blockchain games of 2023 are endless shades of gray—from "PlaytoEarn" to "XtoEarn," countless projects are using various token models and crude game graphics to attract a wave of speculators eager to replicate the dream of getting rich. However, in the end, all that's left is a mess after the death spiral of the projects.

In June, the official Twitter account of Bored Ape Yacht Club released a promotional video for the new game "HV-MTLForge" and revealed that the game would officially launch on June 29th. This space construction game centered around Yuga Labs' latest mecha NFT series, HV-MTL, allows players holding HV-MTL to build or customize a unique space in the game and upgrade their HV-MTL to a new form through the game. However, Yuga's new game did not receive the same high attention as in previous bull markets—people began to tire of NFTs and their derivative games.

In July, the development company ATMTA of the 3A blockchain game StarAtlas in the Solana ecosystem announced a significant layoff, reducing the team from 167 people to 45, a staggering 73% reduction, including full-time employees and contracted studios invited to develop the game. This project, which was severely affected by the FTX collapse, barely managed to support itself with the meager income from the NFT trading market, which was not enough to cover the salaries of all team members. Illuvium co-founder Kieran Warwick even directly stated on Twitter, "The warning a year ago was to protect Web3 investors from potential pitfalls," and openly dug up the dirt.

How about another highly anticipated 3A blockchain game?

As a product of the previous bull market, Bigtime, which officially launched in 2021, was highly anticipated, and its NFTs were quickly sold out. Now, the game officially opened the preseason version on October 10th of this year, after nearly 3 years of development, Bigtime's launch was highly anticipated.

However, under the official's continuous rule changes, many new studios, after weighing the pros and cons, chose to leave, and there were even cases of "setting up the machine on Monday, starting to grind gold on Tuesday, and withdrawing completely on Wednesday." The studios that had already laid out for this blockbuster chose to stay, but their earnings showed a declining trend. While the project's self-regulation can maintain token output and prices at a relatively reasonable level, the overly centralized regulation makes it hopeless for players to recoup their investment—after all, no one is really here to play the game.

Amidst the sea of gray, there is a glimmer of hope. FOCG (Fully-on-chain Games) has received much attention this year. Different from GameFi 1.0, which focuses on on-chain assets, FOCG completes all interaction and status on the chain, achieving true decentralized gaming. A series of excellent works such as LootSurvivor, Darkforest, Ryo, and Skystrife quickly became favorites of supporters, and the community is never far from the "bible" and "halal" of the full-chain.

"Why do people want to put games on the blockchain?" Full-chain games attempt to combine the characteristics of the blockchain with the playability of the game itself, intending to provide a perfect answer to this question.

AICoin is a proper noun. The English translation of "派网" is "Pionex".

A capable wife cannot cook without rice. Whether it's the performance-testing FOCG or the traditional Ponzi-Game, they all need to rely on infrastructure to achieve great success, and Ronin and Starknet each hold one end: the former has reached agreements with various game studios, attracting various blockchain game developers, and even contacted Sandbox; the latter, due to its performance advantages and the emergence of the full-chain game engine Dojo, has been labeled as the "most popular development platform for full-chain games," attracting various Degen to showcase their skills. Let's not forget Sui—Sui8192, a small game based on the blockchain, is simple and light, with gameplay identical to the once-popular 2048. It only requires using the arrow keys to move the blocks and combine two identical numbers to form a larger number. This simple and easy-to-understand game once helped SuiNetwork's daily transaction volume exceed 20 million transactions and surpass Solana.

For practitioners and ordinary users alike, the CryptoGame track no longer offers a middle ground: turn left towards traditional blockchain games, floating and sinking in wave after wave of token flywheels and Ponzi schemes, enduring frequent bugs but still able to reap wealth; turn right towards full-chain games, experiencing the true joy of gaming in novel experiences, but with a high probability of not making money.

Where do you stand?

SocialFi: Dark horses emerge, the track is no longer a chicken rib

The Web3Social track, originally seen as a chicken rib, has seen a sudden rise this year.

On February 1st, Twitter founder Jack Dorsey tweeted that the social products Damus and Amethyst, based on the distributed social media protocol Nostr, had been launched on the Apple App Store and Google Play Store, respectively. Subsequently, Damus announced that it would randomly distribute small amounts of Bitcoin to users via the Bitcoin Lightning Network and introduce a feature for Bitcoin tipping on posts in the next version.

For a time, WeChat Moments and Twitter timelines were flooded with a long string of letters, as people crazily shared their public keys, re-establishing their relationships in the encrypted world.

Farcaster, based on the Ethereum architecture, is more niche, with an invitation-only entry that has attracted VCs, project founders, Ethereum community users, and even Vitalik Buterin. This protocol, established by Dan Romero, former executive at Coinbase, is completely decentralized, making it easy for developers to build decentralized social network applications. Creating a profile on Farcaster generates a mnemonic and an identity on the Ethereum Goerli test network.

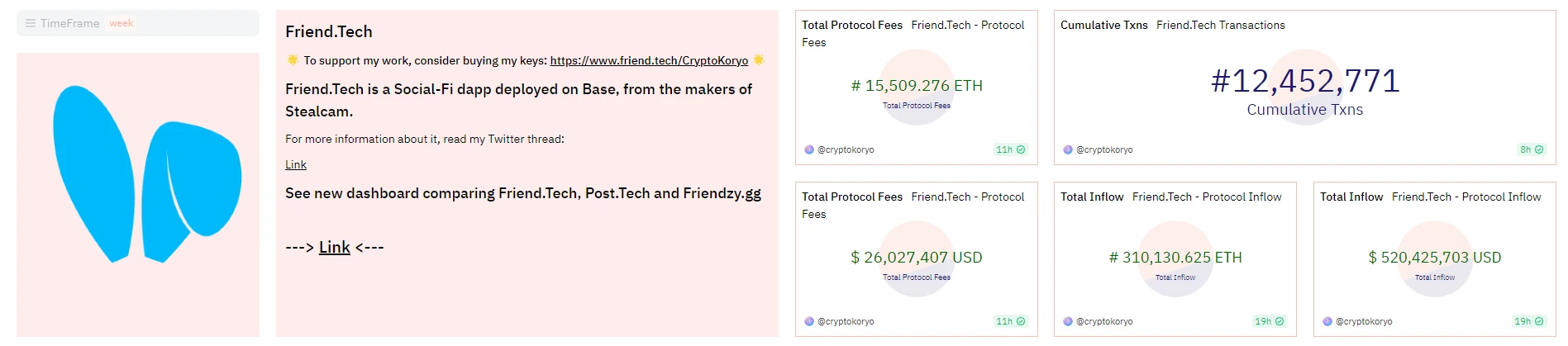

If the first two are only a small circle of people self-indulging, the emergence of Friend.tech (referred to as FT below) has completely ignited the track.

This social protocol, built on the Base chain, combines the gameplay of pricing relationships with Key based on dynamic games and the expression of social value. It also adopts a "royalty" model similar to NFTs, with the project charging a 10% fee on each Key transaction, with 5% distributed to the buyer and seller of the Key, and the remaining 5% going to the treasury. The high royalties and the official introduction of a point airdrop mechanism have made holding high-value KEY (3,3) the optimal choice for many.

In just a few days, FT has attracted a large number of new users, and its protocol revenue and transaction volume have also increased significantly. As of the time of writing, the total revenue of the FT protocol has reached 15,509.276 ETH, with a total of 12,452,771 transactions.

FT's explosive growth has directly driven the flow of the entire track, with competitors such as StarsArena, Tomo, and NewbitcoinCity joining the fray. StarsArena, with the founder of AVAX personally taking the stage, took the position of the market's second place, but the protocol was hacked and the slow response of the development team allowed Tomo, which was subsequently more complete and had more projects taking the stage, to take away market share, ultimately fading away quietly.

However, founder withdrawals, a large number of robot accounts rushing to profit, and frequent changes in point rules gradually drained FT of its vitality, and a large number of real users being misjudged as robots added fuel to the fire for the project in trouble. The founder Racer's "Family, who understands?" left on the platform has completely escalated the matter to an unprecedented level.

At this point, a large number of users selling off has become a foregone conclusion. On November 19th, FTTVL fell to $36.04 million, an 18.13% decrease from $42.25 million on November 18th.

Was FT's attempt on the SocialFi track correct?

From a mechanism design perspective, FT has indeed pioneered an unprecedented model, and its daily activity and protocol revenue prove the feasibility of this (3,3) flywheel. This model provides users with an opportunity to participate and share value, thereby attracting a large number of users in the early stages. However, despite the attractiveness of FT's mechanism design, it is still a product with strong financial attributes, rather than a social product that can truly have long-term sticky users. The long-term stickiness of social products is usually built on real social relationships, common interests, and value sharing among users. The KOLs participating in this "making friends" game are more motivated by economic interests, and the social relationships built by Key are being destroyed as TVL declines.

However, this track still has its significance—In Web2, social networking is a piece of fat that the giants are unwilling to let go of, and in Web3, the still-immature wild west also needs a group of protocols native to the blockchain world to strengthen the connections between the entire network, and narratives such as "decentralization," "breaking data monopolies," and "self-owned assets" have always been the goals pursued by idealists.

The new year is approaching, what surprises will the SocialFi track bring us?

The security situation is becoming more complex, and the introduction of risks is far more than just technical vulnerabilities

2023 was a year of multiple innovations in the crypto world, but behind the innovations, there were also many astonishing security incidents. A series of security incidents not only highlighted the current system vulnerabilities but also left important lessons for future security strategies and technological developments.

Looking back at 2023, the Web3 industry experienced numerous major security incidents during the bear market, involving various aspects such as smart contract vulnerabilities, wallet security, cross-chain transaction issues, and attacks on decentralized finance platforms.

As in previous years, as an intermediary for asset cross-ecosystem, the large amount of locked assets in cross-chain bridges is undoubtedly the best target for hackers. In 2023, the single-loss amounts from multiple cross-chain bridge attacks still ranked at the top, with various reasons for the damage.

In July, the cross-chain interoperability protocol PolyNetwork was attacked. The hacker minted assets on several chains through Poly, including nearly 100 million BNB and nearly 10 billion BUSD on the Metis network. The hacker also minted various assets on Ethereum, HECO, Polygon, Avalanche, BSC, and other chains.

In addition, there has been significant progress in the BNB whale attack case from 2022. Previously, the attacker who stole about 2 million BNB (worth nearly $600 million) using the BinanceBridge vulnerability deposited 924,821 BNB, worth $249 million, on VenusProtocol. Whether the deposited position will be liquidated, leading to further chain reactions in the market, has been a concern for the entire BNB ecosystem users.

The proposal approved by the Venus team shows that Binance and other participants in the BNB chain ecosystem will cooperate to take over the position when it reaches the liquidation line and jointly repay the debt. Therefore, the BNBChain core team is actually the sole liquidator of this position, ensuring the safe control of this large supply of BNB to avoid direct chain liquidation. This position has been liquidated several times this year (relative to the total amount), and BNB has continued to develop steadily. Neither the on-chain ecosystem nor the price of BNB has experienced the worst-case scenario as expected—stampede, chain liquidation, or a spiral decline in the coin price.

In terms of ecological impact, the Multichain incident may be the most serious accident in the past year. This incident is also the most bizarre among the losses in cross-chain bridges.

In May 2023, users of the cross-chain bridge Multichain suddenly found that their transfers were not being received. As time passed, the native token of Multichain, MULTI, also experienced a rapid decline, with the token price plummeting by 35% in a single day. A series of issues led to the inability to use some cross-chain routes. This event quickly sparked widespread community attention and concern, leading to panic in the crypto community.

On July 6th, over $126 million in assets was artificially transferred out of the MPC custody address. According to the contract audit team Beosin's analysis, the fund transfer was entirely manipulated, and the private key of Multichain's MPC custody address was under external control.

However, what was even more surprising was that, according to the official statement, we learned that Zhaojun alone controlled the private keys of all 24 MPC nodes of Multichain, and all node services were running entirely on his personal server.

Although this event was not purely due to technical vulnerabilities or attacks, the project's risk management capabilities and high level of centralization still leave people feeling regretful. This further emphasizes the importance of project governance—non-technical "vulnerabilities" have far more destructive potential than code vulnerabilities.

This risk event not only threatened the project itself but also dealt a heavy blow to the Fantom ecosystem. Fantom used Multichain as the primary cross-chain bridge in its ecosystem. Unfortunately, in October of this year, the Fantom Foundation's wallets on Ethereum and Fantom were attacked, with confirmed losses exceeding $657,000. Fantom found itself in a more precarious situation than before.

The "bankruptcy" of JPEX exchange further highlights the artificial risks of centralized operations. This is another risk event unrelated to technology but causing significant losses to many users.

In September, during the token2049 conference, JPEX exchange restricted withdrawals. The withdrawal limit was restricted to 1000 USDT, with a staggering fee of 999 USDT. The JPEX booth at the conference was also deserted. More than 2,000 people reported being victims in this case, involving an amount of 1.3 billion Hong Kong dollars. Some Hong Kong media even called this case the "largest financial fraud in history." Many individuals associated with the exchange, including exchange personnel and KOLs promoting it, were implicated.

While the Hong Kong government encourages support for Web3, the occurrence of the JPEX case undoubtedly dealt a heavy blow to the Hong Kong Web3 industry and further eroded the trust of the general public. This event has put a small footnote on the recently promoted regulatory compliance in the Hong Kong Web3 industry.

Other established exchanges are also facing challenges in security management.

In November of this year, Poloniex, owned by Justin Sun, was attacked. On-chain data shows that the hacker stole approximately $114 million in assets. Tron Foundation promptly froze some of the hacker's on-chain assets, but the effect was not significant.

Justin Sun urged the hacker to "refund" as soon as possible and offered to provide 5% of the assets as a white hat reward. Dramatically, the hacker converted the majority of the stolen assets into TRX tokens, causing a short-term surge in the TRX token price.

Another stroke of misfortune befell another exchange under Sun's ownership—Heco and HTX were attacked in the same month.

In November, a withdrawal operation of 10,145 ETH occurred on HecoBridge, followed by continuous transfers of other assets, including 42 million USDT, 489 HBTC, and a series of other assets. Outside of the HECO bridge, HTX also experienced a suspicious transfer of $23.4 million.

Both exchanges have since recovered from the crisis, and their operations have not been severely affected, with user funds gradually being restored.

For those well-known DeFi projects, their large liquidity pools make them a feast for hackers. In mid-March, EulerFinance was attacked by hackers, resulting in a loss of nearly $200 million. The attacker later returned all the stolen funds. The return of stolen assets is extremely rare in the cryptocurrency field.

The security of emerging projects is also worth noting. Rapid development, lack of experience, and a large amount of locked funds have made emerging star projects a security vulnerability. During the peak of the SocialFi craze this year, StarsArena was in the spotlight. However, in early October of this year, the platform suffered a serious exploit, resulting in the theft of nearly $3 million worth of AVAX tokens, raising concerns about the existing security measures.