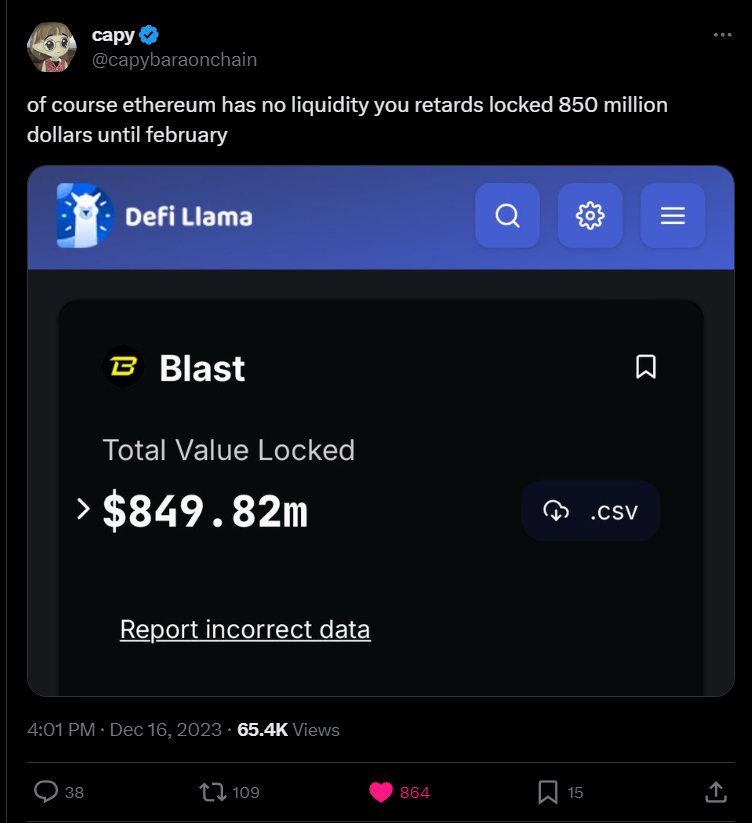

Imagine locking up $850m in the multisig instead of farming the two most promising airdrops while being liquid and earning yield.

As you may know, EigenLayer is raising its caps on 18th Dec, including not only stETH, cbETH, and rETH, but 6 other LSTs too, including ETHx.

EigenLayer restakers will likely receive a massive airdrop. To get into the queue and farm additional airdrop, you can deposit $stETH or $ETHx into @KelpDAO.

Kelp is a liquid restaking protocol (LRT) launched by @staderlabs founders (Stader is a top 10 LST project with $250M TVL).

The thesis here is:

- Kelp is well positioned to be the Lido of EigenLayer / the dominant LRT of EigenLayer;

- No other LRT at the moment is ready for deposits and audited (Kelp is double audited by Sigma Prime and Code4rena);

- Kelp has been working on the design since Q1 2023 and was the first to publish LRT intentions and coined the term LRT (this is the first reference to Liquid Restaking ever published anywhere);

- Flashforward to today, there are 5 or 6 other teams building LRTs. But none have the track record of Stader (2.5y building LSTs, 40+ DeFi integrations, 85k+ stakers, etc);

In the case of Stader ETHx, it was launched on 10th July and already has decent traction with more than 200+ Node operators, and $100M+ TVL;

To estimate what can be the potential of EigenLayer let's look at $TIA:

Celestia is now valued at $14b with little to nothing to show.

@EigenLayer has a very flourishing ecosystem and EigenDA has already nailed very good partnerships.

If $EIGEN were to drop right now, how much would it be valued?

Is there a place for a whole restaking market to appear?

I think the answer is yes.

Restaking has the potential to be 2-4x higher than the staking market (300-500 bn).

TLDR of the above:

1. Kelp is the first LRT with audits and ready for deposits.

2. By depositing in Kelp, you will be earning BOTH Kelp and EigenLayer points for their airdrops.

3. By depositing in Kelp you will jump in the EigenLayer queue, ensure you get in, and save the horrendous fees that are likely to happen on the 18th (the global cap for LSTs will fill fast since in this round they are whitelisting 6 new LSTs).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。