Injective Asia Growth Manager Justin Wu delves into the project highlights and recent development plans.

Interview: Giovanni Chen, Meta Era

With Bitcoin's resounding breakthrough of the historic $40,000 mark, this historic event has once again ignited the entire Web 3.0 community. Looking back at Bitcoin's breakthrough of $40,000 in January 2021, its strong momentum has led the bull market frenzy throughout 2021.

Now, two years later, the hot scene of the Web 3.0 community has reappeared, and many people are pondering a question: Is a new round of the crypto bull market reopening?

At the same time, just before the recovery of Bitcoin prices, a project has quietly returned to the previous bull market's peak, with a market value reaching a historic $2 billion. With the expectation of Bitcoin halving again next year, how high can this project surge to its all-time high?

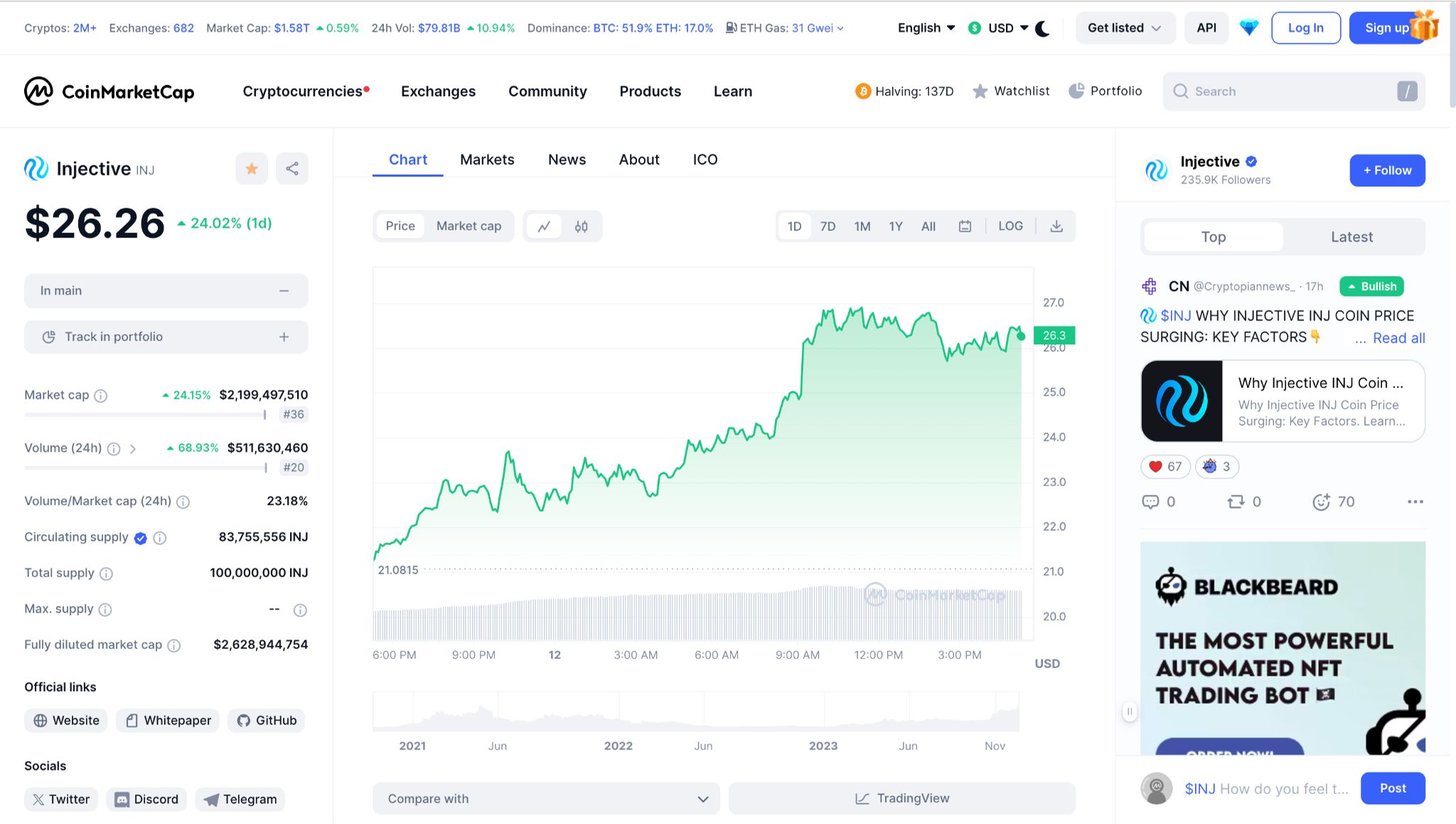

This indeed sparks endless imagination. It is none other than the star project ranked 36th in Coinmarketcap's market value (screenshot and ranking taken from December 12, 2023) — Injective.

In 2018, Injective Labs was founded by Eric Chen, who was studying at New York University at the time, and Albert Chon from Stanford University. Injective Labs is the main contributor to Injective. As early as the end of 2018, Injective was already the first star project incubated and invested by Binance Labs. Its mainnet was launched in November 2021. Injective is a Layer 1 blockchain built specifically for finance, providing support for the next generation of DeFi applications. Investments from prominent VCs such as Binance, Pantera, Jump Crypto, Hashed, and Mark Cuban have also made Injective famous.

In the cozy atmosphere, Meta Era specially invited Justin Wu, Injective's Asia Growth Manager currently based in Taipei, to delve into Injective's project highlights and recent development plans.

Meta Era: Can you briefly introduce the background, mission, and vision of the Injective project?

Justin: It's a pleasure to accept the interview from Meta Era, a Web 3.0 media outlet in Hong Kong. This month is truly extraordinary because November happens to be the two-year anniversary of Injective's mainnet launch. Injective has always been a blockchain built for finance. The vision of Injective is to build the best infrastructure to help developers in the Web 3.0 space collectively build the future of finance. Injective is an open and highly interoperable Layer 1 blockchain, with the main goal of powering the next generation of decentralized finance. Over the past two years, we have seen some successful DeFi applications on Injective, such as decentralized spot and derivative exchanges, prediction markets, lending protocols, and asset management protocols.

Meta Era: Why has Injective's growth been so rapid?

Justin: The financial infrastructure modules provided by Injective allow any developer to build a fully decentralized on-chain application from scratch, such as a MEV-resistant, almost zero gas fee on-chain order book DEX, which is one of Injective's flagship applications.

Compared to traditional DeFi's AMM, on-chain order books have transparent and queryable prices, which align with the usage habits of traditional traders. Injective allows third parties to build new platforms, and all on-chain trading platforms can share the same order book and liquidity, greatly improving the efficiency of capital utilization and attracting the participation of numerous traders.

From a development perspective, Injective has also launched two sidechains, inEVM and inSVM, this year. This means that Injective can not only integrate with the Cosmos ecosystem but also gain support from Ethereum and Solana developers, who can join the Injective ecosystem with just one-click RPC setup from Ethereum and Solana wallets. Mature projects built on other ecosystems can seamlessly migrate to Injective, so various types of projects such as derivatives and exchanges are welcome to bridge and deploy on Injective.

Meta Era: So, from a technical perspective, what innovations has Injective used to achieve such L1 DeFi infrastructure?

Justin: From a fundamental technical perspective, the Injective chain itself uses the Cosmos SDK framework to build an interoperable decentralized financial infrastructure layer. This architecture ensures on-chain security and fast block times to handle a large volume of transaction demands.

Technically:

First, the CLOB I just mentioned is the on-chain order book, which includes mature technologies for spot or perpetual contract futures, as well as options market matching engines.

Second, Injective uses a Frequent Batch Auction matching mechanism, where all orders in the memory pool are executed at the end of each block, which lasts about 1 second, with this delay until the bidding process is completed before entering the order book, thus preventing MEV frontrunning. The gas fees required by users are also close to zero.

Third, Injective's interoperability with other L1s through different cross-chain bridges such as Wormhole, including Polygon, Solana, etc., will significantly enhance liquidity on Injective.

Fourth, Injective uses decentralized ERC-20 cross-chain bridges to support interoperability with the Ethereum network. Therefore, users can use Ethereum network assets when using Injective.

Meta Era: This is really interesting. Can Metamask be used on Injective?

Justin: Indeed! Early on, when the team decided to use the Cosmos SDK framework for development, it was decided that a certain level of compatibility with Ethereum cross-chain bridges and wallets must be achieved. This strategy is very forward-thinking. Even in 2023, we can still see that many users are still using the MetaMask wallet.

Meta Era: So, Injective's technical advantages are tailored for finance, fast, low-cost, and bridging with mainstream ecosystems and assets. Does Injective have a unique competitive strategy for acquiring users?

Justin: You're absolutely right. Once a certain technological advantage is achieved, a product strategy that meets market demand must be formulated.

In terms of products, let's take the flagship DEX Helix on Injective as an example. Helix has launched some innovative and unique market products, including Celestia (TIA) Pre-Launch Futures, which was launched in November. This product allows users to trade futures before the token is issued. Before the token is issued, there is already discussion about the price of this hot asset, naturally attracting a large number of new users and trading volume. This user and market demand-oriented product is a successful case.

Helix's performance in the past two months has been remarkable. The total trading volume of all DEXs on Injective has exceeded $15 billion, and Helix alone has reached a trading volume of $1 billion in the past month.

Last month, Helix also launched a Trading Bot, a more advanced feature that is usually only found on centralized exchanges like Binance. It has already started to be integrated into Helix, so in the near future, advanced features of Helix are expected to surpass existing decentralized exchanges and even compete with centralized exchanges.

Another outstanding highlight is that Injective has established liquidity partnerships with over twenty market makers to provide ample liquidity for Injective's on-chain order book. In this Open Liquidity Program, INJ rewards are settled and distributed monthly based on the contributions and rankings of market makers. With good liquidity, users' trading experience will be very smooth. When combined with user-friendly and functional products that meet market demand, user growth is achieved in this way.

Meta Era: Very interesting. I noticed that Injective has been focusing on ecosystem development recently and integrating with many well-known projects. What kind of ecosystem does Injective want to build? What kind of ecosystem partnerships can we expect in the next 6 months?

Justin: This year has been a year of great development for the Injective ecosystem, with applications deployed on-chain in many areas such as NFTs, DeFi, and AI, expanding the user base of the entire ecosystem. For example, partnerships with Binance Web3 Wallet can attract users from the largest exchanges. Collaboration with public chains like Klaytn and Kava will also bring new cross-chain environments and asset interoperability for users.

In the next 6 months, the focus will be on RWA, including collaborations with projects like Ondo Finance and Maple Finance. Injective's DeFi ecosystem will also be expanded to include a wider variety of protocols.

Additionally, in January next year, the EVM-compatible inEVM will be officially launched, so we can expect to see more projects deployed from Ethereum to Injective.

Another point worth mentioning is that the CosmWasm smart contract platform used by Injective is based on Rust, which is very similar to the Move language used by Aptos and Sui ecosystems. Therefore, in the future, we can also expect collaborations between Injective and the Move language ecosystem, such as Aptos and Sui.

Meta Era: Now let's talk about the star projects in the Injective ecosystem. Can you introduce a few star projects on the Injective chain?

Justin: I just mentioned the decentralized exchange Helix, which has very fast trading speeds and very low trading fees. Helix will continue to list new trading pairs and provide long-term trading rewards to traders.

Mito consists of many strategy pools and a Launchpad that supports asset issuance. Over the past few months, a total of 50,000 people have been testing on the testnet, and the next step is to move to the mainnet.

Talis Protocol is the first NFT marketplace built on Injective, listing many NFT projects. The NFT sector of the Injective ecosystem is also very worth paying attention to.

Black Panther is an on-chain asset management platform incubated by Injective's hackathon and officially launched on the mainnet in the past few months. Users are welcome to try it out!

Meta Era: Next, let's discuss the auction burn of the Injective token. Starting from this point, could you introduce the INJ token to the audience?

Justin: Of course. INJ is the native token of Injective. INJ's use cases include capturing the value of DApps, proof of stake, ensuring security, developer incentives and staking, and protocol governance. The INJ token can participate in every component of Injective, including on-chain upgrades, voting, proposals, and staking in POS.

Regarding the auction burn, 60% of all on-chain transaction fees generated are burned every week. When users participate in the auction, they must use INJ to bid, creating periodic use cases for INJ. In the INJ 2.0 upgrade launched this year, each on-chain protocol can even allocate 100% of its transaction fee income for auction burn, contributing to the ecosystem.

Meta Era: Now let's talk about the challenges Injective is facing. Although Bitcoin has recently risen to $40,000 and market sentiment has improved, Injective's TVL has decreased from $19 million to $12 million. Can you explain the reasons behind this? Are there more plans to increase TVL?

Justin: TVL itself is determined by many factors, and some protocols are more likely to attract TVL, such as applications like liquidity staking or lending, which can increase TVL quickly. Injective currently has many such applications on the testnet, including Hydro Protocol in the liquidity staking part and the recently launched Gryphon, as well as Neptune in the lending field. So I believe that after these four or five projects are officially launched on the mainnet, Injective's ecosystem TVL will take a step forward.

Meta Era: Next, let's talk about a more relaxed topic! The founders of Injective Labs are from New York University and have a strong technical background, and you yourself also have a background from New York University. What is the atmosphere like in the team? Are you all a group of tech geeks?

Justin: The atmosphere in the Injective Labs team is very harmonious. Most of the team members have a strong technical background, with a total of over thirty engineers, making the team very strong. Because we are a relatively small team, communication within the team is very fast and flexible. Information doesn't wait for days to be conveyed to other team members; usually, it is synchronized on the same day. The internal collaboration is very pleasant and efficient. After joining the team, I found that the atmosphere is very hardworking, and while everyone does their own work well, there is also active discussion on how to help the ecosystem projects grow.

Meta Era: In terms of community and ecosystem, Injective has established a $150 million ecosystem development fund to support developers. Besides participating in ecosystem project interactions, as far as I know, ordinary users can also participate in the Ninja Ambassador Program. Can you please introduce the content and goals of this program?

Justin: Let's start with the ecosystem fund. Developing projects requires a lot of time and cost, and as the size of the development team increases, the amount of funding required also increases. Therefore, Injective has established a $150 million ecosystem fund to provide project subsidies using this fund. In terms of grant distribution, Injective uses milestone achievements as the basis and issues grants in stages.

Additionally, if project teams or developers are interested in contacting VCs or investors, Injective also provides channel referrals. However, project teams need to demonstrate their achievements or strength, such as achieving a certain trading volume six months after launching on the mainnet, to have a greater chance.

In the community, the Ninja Ambassador Program is a community activity plan of Injective, encouraging users to be active in the community and interact deeply with the project. Ambassadors are divided into five levels, and the more they contribute, the higher their level. Every month, Injective distributes a certain amount of INJ to ambassadors as an incentive, promoting interaction between ambassadors and projects in the Injective ecosystem, and through their contributions to the ecosystem, allowing more users to understand the Injective ecosystem in depth.

Meta Era: Today, we have learned a lot of details about the project. Finally, do you have anything special to express or share with our Chinese-speaking audience in the Greater China region?

Justin: Of course! In addition to the development of the English-speaking community, Injective has actually put a lot of effort into the Chinese-speaking community in recent years. Injective has a Chinese Twitter and Telegram, and there is also a Chinese channel on the official Discord, where all Injective ecosystem news is synchronized. Basically, all announcements and articles are translated and organized in a timely manner by the Injective Chinese team, so the Chinese-speaking community in Hong Kong and the Greater China region can quickly get first-hand information. For development-related matters, developers can also ask questions directly on Injective Discord or the official Telegram group, and team members will generally respond promptly.

Finally, I would like to mention that in mid-December, Injective will send multiple team members to participate in the Taipei Blockchain Week and will also hold events around Taipei. Interested friends are welcome to sign up and meet offline for exchanges!

Meta Era: Thank you very much for your time today! We sincerely wish for the continued success of the Injective ecosystem.

Summary

Injective has a hardcore and efficient global team that has built the infrastructure public chain Injective for the future of decentralized finance. They have developed innovative financial modules using strong technical capabilities and innovation, providing developers with a diverse toolkit for developing upper-layer applications and integrating multiple cross-chain bridges with different public chains. At the same time, Injective has designed powerful liquidity integration capabilities, built an excellent public chain ecosystem, and provided users with a diverse selection of DeFi applications.

In terms of token economics, $INJ is designed with multiple empowerment use cases, including but not limited to protocol governance, dApp value capture, proof of stake (PoS) security, and developer incentives. The weekly auction burn of the INJ token adds a periodic use case for INJ.

In addition to an excellent development and operations team, Injective has also received endorsements from a host of star investors, including Pantera, Jump Crypto, and Mark Cuban, among others. To support Injective ecosystem projects and development teams, Injective has partnered with well-known industry institutions such as Kraken Ventures and Jump Crypto to establish a $150 million ecosystem fund to support the overall development of the Injective ecosystem.

We are very much looking forward to Injective's future breakthroughs in RWA, leading the world of blockchain in linking real assets and providing comprehensive and rich DeFi solutions for crypto users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。