Preview of the Week (12.11-12.17), Super Central Bank Week is Coming, Was the Monday Plunge Due to Whale Selling? Inflow Data Can Reveal the Truth

○/Author: DC Research Institute

Lao Li Mortar

Table of Contents for This Week's Research Report:

- Key Events Forecast for Macro-Economic Data and the Cryptocurrency Market This Week

- Review of Key News in the Cryptocurrency Industry

- Community Interaction and Sharing

- Interpretation of Important Events, Data, and Deepcoin Research Institute

- Institutional Perspectives and Overseas Views

- Top Gainers in the Cryptocurrency Market Last Week and Selection of Hot Community Coins

- Attention to Project Token Unlocking and Negative Data

- Top Gainers in Cryptocurrency Market Concept Sectors

- Overview of Global Market Macro Analysis

- Future Market Analysis by DC Research Institute

1. Key Events Forecast for Macro-Economic Data and the Cryptocurrency Market This Week:

December 11th (Monday): Adjustment of the Northbound 50 Sample Stocks; Binance delists 8 BUSD trading pairs.

December 12th (Tuesday): US 10-year Treasury bond auction until December 11th; ZEW Economic Sentiment Index for December in the Eurozone; US CPI for November (monthly and annual rates), Core CPI (monthly and annual rates).

December 13th (Wednesday): Industrial Production for October in the Eurozone (monthly rate); US PPI for November. Binance delists 9 BUSD trading pairs; OKX Jumpstart launches ACE new coin mining.

December 14th (Thursday): Federal Reserve interest rate decision; Main refinancing rate of the European Central Bank; US Retail Sales for November (monthly rate), Import Price Index for October (monthly rate), Business Inventories for October (monthly rate); Federal Reserve announces interest rate decision, Federal Reserve Chairman Powell holds a monetary policy press conference; European Central Bank President Lagarde holds a monetary policy press conference.

December 15th (Friday): Seasonally Adjusted Trade Balance for October in the Eurozone; New York Fed Manufacturing Index for December, Industrial Production for November (monthly rate), Markit Manufacturing PMI Flash for December, Services PMI Flash for December. Binance stops supporting BUSD products and delists 17 BUSD-priced trading pairs; WLD market makers need to return 75 million WLD to the Worldcoin project party.

December 16th (Saturday): FTX submits a related revised restructuring plan.

From December 11th to 17th, APT, APE, CYBE, and other tokens worth approximately $230 million will be unlocked.

2. Review of Key News in the Cryptocurrency Industry (Exclusive Compilation):

Data:

Bitcoin volatility has increased from its low point in August, with a 30-day annualized volatility increasing by 7% in the past week.

In the past 7 days, 15,170.12 BTC have flowed into exchange wallets.

An address started selling BTC after it returned to $44,000, with total profits exceeding $9 million.

Tether froze 161 addresses, with only 11 addresses holding a total of over 3.5 million USDT.

The total market value of cryptocurrencies has exceeded $1.7 trillion, reaching a new high for the year.

Bitcoin options open interest has reached a historical high of $20.7 billion.

In filings submitted to the SEC in November, there were 1,074 mentions of Bitcoin, reaching a historical high.

Projects and Platforms:

Tether advisor: Disagrees with VanEck's prediction, USDT will continue to lead and gain market share.

In the past 7 days, the NFT sales volume on the Bitcoin network exceeded $122 million, with a growth rate of over 140%.

Fidelity's spot Bitcoin ETF is coded as FBTC and is listed on the DTCC.

LayerZero: Expects to launch a token in the first half of 2024.

a16z released a list of trends that excite the cryptocurrency industry for 2024, including modular technology stacks.

MicroStrategy's Bitcoin holdings' unrealized gains have exceeded $2.3 billion.

Four whale addresses deposited a total of $18.5 million UNFI into Binance in the past two days.

Solana DEX's weekly trading volume exceeded $5 billion, reaching a historical high.

Macro Policies and Regulatory Aspects:

The Financial Services Commission of South Korea issued a legislative notice on the formulation of the "Virtual Asset User Protection Act" and other implementation regulations.

The US Internal Revenue Service is intensifying efforts to combat tax evasion related to cryptocurrencies.

The US Congress's National Defense Authorization Act did not include any cryptocurrency or blockchain provisions.

The Bank of England: Asset tokenization on the blockchain may increase systemic risks.

The Securities and Futures Commission of Hong Kong released its third-quarter report: losses narrowed to $120 million, and 9 suspicious virtual asset trading platforms were disclosed.

CFTC Commissioner: Enforcement actions against cryptocurrency companies may have peaked.

The US Internal Revenue Service stated that about half of all investigations into digital assets in the past year involved tax issues.

CoinGecko's report states that cryptocurrency is currently legal in 119 countries and 4 British overseas territories, meaning that over half of the world's countries have legalized cryptocurrency. 64.7% of cryptocurrency legalization countries come from emerging and developing countries in Asia and Africa.

Institutional Research Reports and Perspectives:

Fidelity Global Macro Director: Bitcoin is an asset with exponential growth.

VanEck: Bitcoin will reach a historical high in the fourth quarter of 2024.

AP_Abacus: It is unlikely that the approval of spot Bitcoin ETFs will be delayed until after January.

Report: Short sellers of cryptocurrency stocks lost $2.656 billion in the past three months.

Cathie Wood: The biggest boost to the appreciation of Bitcoin in the next five to ten years will come from institutions.

Deribit's Chief Business Officer: Optimistically believes that the Bitcoin futures market will maintain its current upward trend in 2024.

Bloomberg: In the recent Bitcoin rally, the influence of Korean cryptocurrency traders has greatly increased.

CoinDesk released the most influential annual list for 2023, with the founder of the Bitcoin protocol Ordinals topping the list.

3. Community Interaction and Sharing:

Regarding some data and indicator access methods, both TV and Aicoin have adopted some indicator payment models. Previously, QKL123 had many free and practical big data and indicators, but unfortunately, it ceased operations in 2021. TV is more suitable for people who like algorithmic trading, and some important data indicators are charged on Aicoin, such as large single orders/trades, volume-price distribution charts, on-chain data, intelligent candlestick charts, and more.

Regarding selling in batches, there is actually no unified terminology for this. Selling in batches to take profit, staged closing, pyramid-style opening and closing, and so on are all forms of selling in batches.

Regarding trading volume, there are too many cryptocurrency trading platforms, and a single platform cannot reflect the complete trading volume. Representative leading platforms can be selected for viewing, all of which have volume indicators. In addition, third-party data platforms will aggregate the trading volume of major platforms, such as Aicoin and Feixiaohao.

4. Interpretation of Important Events and Data by Deepcoin Research Institute:

Regarding large amounts of BTC flowing into exchanges. Data shows that in the past 24 hours, 2,745.99 BTC flowed into exchange wallets, 12,176.22 BTC flowed into exchange wallets in the past 7 days, and 11,797.64 BTC flowed out of exchange wallets in the past 30 days.

The Deepcoin Research Institute believes that the data mentioned in the DC community yesterday is worth paying attention to. Approximately 2,746 BTC flowed in over the past 24 hours, and about 12,176 BTC flowed into exchange wallets over the past week. If this large-scale net inflow still needs to be treated cautiously, generally speaking, the transfer of BTC to exchanges by main funds is a potential selling behavior, indicating the possibility of some selling pressure. Of course, this is not necessarily the peak or turning point, and it still needs to be comprehensively judged based on future data changes, as well as other data and market news.

The morning market fell as expected today, largely due to selling by main funds, which can also be verified by data. There is news mentioning: According to on-chain data monitoring, an address bought WBTC multiple times at the beginning of 2022. During the bear market, this address did not sell BTC at a loss but accumulated 401 WBTC (worth about $8.7 million) during the bear market. The average purchase cost of this address has dropped to $28,223. After the recent price of WBTC returned to $44,000, this address began selling WBTC to make a profit, with total profits exceeding $9 million.

Additionally, there have been reports recently that over 1,000 bitcoins from an early miner have been transferred to exchanges and custody platforms, leading analysts to speculate that the miner has sold these bitcoins. These bitcoins were transferred once between August and November 2010, when they were obtained through mining, with an estimated total cost of about $100.

Of course, this is just the tip of the iceberg. The real cause of the market downturn is the large inflow of bitcoins into exchanges mentioned above. Upon verification, the latest data shows a net inflow of 3,130.66 bitcoins in the past 24 hours and a net inflow of 18,398.57 bitcoins in the past week. Considering that Binance's BTC balance is only a little over 500,000 bitcoins, the proportion of this inflow is about 3.6%. When compared to the unlocking magnitude of project tokens, this is still quite significant, leading to a significant drop in the market from $44,700 to around $40,400.

Regarding the Super Central Bank Week.

The Deepcoin Research Institute believes it is important to pay attention to the impact of central bank policies on the market. This year, the market has been significantly influenced by the decisions of the Federal Reserve. This week, the "Super Central Bank Week" is coming, with the Federal Reserve, European Central Bank, Bank of England, and Reserve Bank of Australia all holding interest rate meetings and announcing their latest interest rate decisions. Of these, the December interest rate decision of the Federal Reserve is of particular market interest. It has become a consensus that the Federal Reserve will not raise interest rates in December, and the market is more concerned about the impact of a potential rate cut. The market is also focused on the outlook for the policy path. The latest CPI data in the US and Europe will also be released, sparking attention due to the recovery process. The US Treasury will conduct a $37 billion 10-year bond auction and a $13 billion 20-year bond auction, which will also impact US bond yields and the US dollar index, thereby affecting the cryptocurrency market.

This week faces the last interest rate decision of the year. After frequent rate hikes in the previous period, the market's expectation is still for no rate hike. However, Federal Reserve Chairman Powell has expressed a hawkish attitude multiple times before, emphasizing the need to curb inflation, raise interest rates, and delay rate cuts. It is important to pay attention to Powell's speech at the press conference after the Federal Reserve meeting, as this is more likely to influence the market and future expectations.

5. Institutional Perspectives and Overseas Views:

Regarding the circulation volume of BTC, the cryptocurrency data research institution CryptoQuant recently released a report indicating that the supply of Bitcoin on centralized exchanges is at its lowest level in six years, similar to the data from 2017, which may signal a bullish trend for Bitcoin. The report states that the reduced supply has entered its 45th month, and based on the Metcalfe Price Valuation Indicator, it predicts that Bitcoin will soar to $50,000 to $53,000 by early 2024.

Regarding the dominance of spot demand in the market, the on-chain data analysis company Glassnode's analysis report states that the demand for spot Bitcoin (BTC) is still strong. The spot supply of Bitcoin accounts for 23.8% of the total circulating supply, reaching a historical low. The ratio of futures leverage to market capitalization remains flat, indicating that spot demand still dominates. Compared to the market conditions from 2019 to 2021, the current Bitcoin market is more similar to the market conditions in 2016.

Grayscale released a statement indicating that Bitcoin is a digital substitute for physical gold. The price of Bitcoin benefits from factors that drive up the price of gold, such as declining real interest rates. Grayscale analysts believe that a rate hike by the Federal Reserve may suppress the price of Bitcoin, while a rate cut may help the valuation rebound. The Federal Reserve interest rate meeting is expected to be held next Wednesday (December 13th), and if there are signs indicating that rate cuts may begin early next year, it will support the price of Bitcoin.

Coinbase's stock price has surged nearly 300% this year, far exceeding the increase in BTC. According to the analyst team at Fairlead Strategies, because COIN is on track to confirm a breakout of a long-term base pattern, further gains may be imminent.

CoinDesk released the most influential annual list for 2023, aiming to recognize those who defined the year in the field of digital assets and Web3. The list includes 50 award-winning individuals and entities, with the top 10 having a significant impact. They are: Casey Rodarmor, founder of the Bitcoin protocol Ordinals; Ryan Selkis, founder of Messari; Jenny Johnson, CEO of Franklin Templeton; Lido DAO; Paolo Ardoino, CTO of Tether; Jose Fernandezda Ponte, Senior Vice President of PayPal; Gary Gensler, Chairman of the SEC; Brian Armstrong, co-founder of Coinbase; Sam Altman, CEO of OpenAI; Brad Garlinghouse, CEO of Ripple.

Former SEC official John Reed Stark stated that the rise in cryptocurrency prices is due to two reasons: the first involves regulation of the cryptocurrency industry, and the second revolves around the concept of the "greater fool theory." For cryptocurrencies, there is no intrinsic value, no cash flow, no harvest, no employees, no management, no balance sheet, no products, no services, no operational history, no analysis valuation, no profit reports, and no confirmed adoption or reliance records, except for analyses related to cryptocurrency speculation, there is no data of any kind, which is inherently suspicious. This former SEC official also refuted reports claiming a 90% likelihood of the SEC approving a Bitcoin spot ETF, calling it absolutely absurd.

Overall, in terms of celebrity and institutional perspectives, there are 4 bullish views, 1 moderate neutral view, and 1 view that heavily criticizes BTC and is bearish.

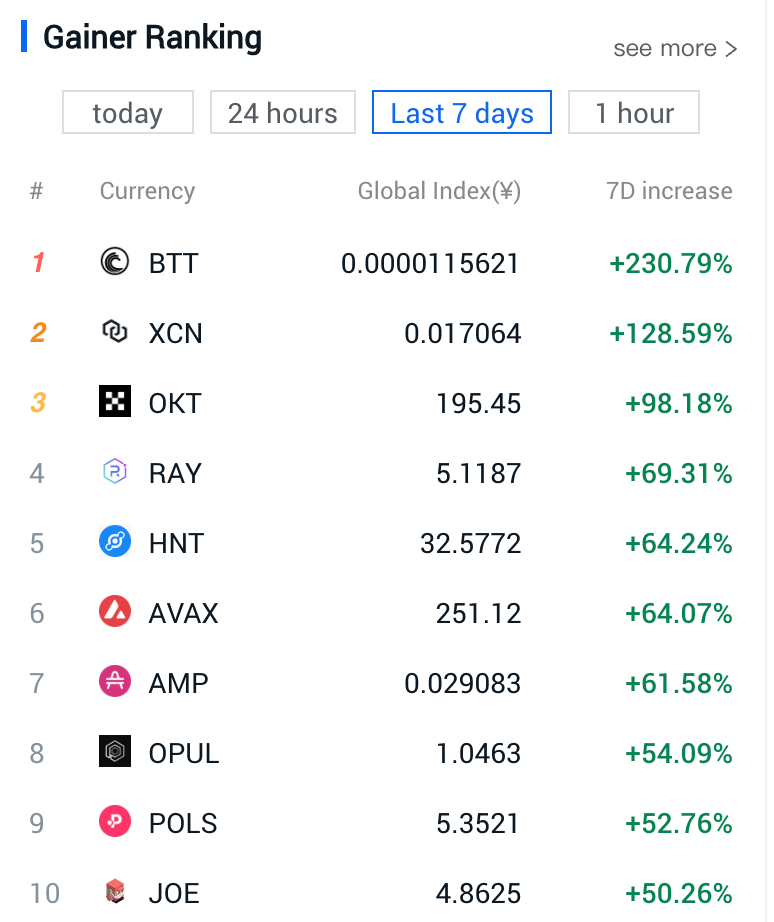

6. Top Gainers in the Cryptocurrency Market Last Week and Selection of Hot Community Coins:

In the past week, the top gainers in the altcoin market are as follows: BTT saw a significant increase, approximately doubling in value; XCN saw an increase of about 130%; OKT nearly doubled in value; RAY, HNT, AVAX, and APM saw increases of about 60%-70%; and other coins also saw significant gains. These coins should continue to be monitored for potential trading opportunities this week, as the market hotspots shift and it is important to seize the right timing.

The following are the hot community coins discussed in the DC community, with the views provided for reference only and not constituting trading advice:

ETH showed strong gains last week, representing a catch-up market. The market entered the second phase, and as predicted, apart from ETH, altcoins had the opportunity for a catch-up rally. The market then saw a rotation of gains for established mainstream coins, followed by a rally in altcoins, leading to a new high in cryptocurrency market capitalization, and finally, a market downturn led by BTC.

The current rally was driven by speculation around the BRC20 concept and Bitcoin ETF. However, it was accompanied by regulatory scrutiny of trading platforms, resulting in poor performance for platform coins, but strong performance for BTC.

Sol has short-term resistance near $79-82, with medium-term resistance near $122 and $143.5. The current upward trend line is around $63, and as long as it is not broken, the bullish outlook is maintained. If the upward trend line is broken, it will turn into a pullback, testing support near $51-54.

For Ordi, the support levels are around $40.7, $36.7, and $31.

For ETC, the resistance levels are around $23.3 and $25.

Doge has been relatively strong recently due to the satellite launch news and has broken the downtrend line since December last year. The current support is around $0.087, and after a short-term adjustment, a second rally is expected.

Many altcoins do not meet the target for equal amplitude due to the volatility, and generally, BTC's form is used to judge the amplitude.

CHZ has a potential bottoming pattern on the daily chart. If it can surpass the previous high near $0.08623, it can establish a pattern similar to a head and shoulders bottom, with resistance near $0.098-0.1. If it continues to be pressured near $0.08623, it will return to a range-bound pattern.

For strong coins, a pullback is a good buying opportunity, but Ordi has a relatively large fluctuation range, so it is easier to manage risk by buying spot or reducing leverage and position. Additionally, there was a significant drop last week, indicating loose chips, and there may be a further pullback in the future. Ordi reached a new high last week, but Nals did not, and other inscription concept coins also performed relatively flat. The support levels for Ordi are around $37.8 and $31.

This round of Ordi is indeed a true tenfold coin, and Nals has seen an increase of over tenfold as well. However, the short-term decline has been quite significant, and the current market heat is partly due to the inscription concept, so a decrease in inscription heat will also affect the cryptocurrency market.

Seven, Project Token Unlocking and Bearish Data Focus:

Token Unlocks data shows that this week (December 11th to December 17th), GLMR, APT, CYBER, FLOW, and APE will see significant unlocking:

- On December 11th at 8:00, Moonbeam token GLMR will unlock 12.72 million tokens (approximately $4.31 million), accounting for 1.6% of the circulating supply.

- On December 12th at 8:00, Aptos token APT will unlock 24.84 million tokens (approximately $209 million), accounting for 8.9% of the circulating supply.

- On December 15th at 12:19, CyberConnect token CYBER will unlock 1.26 million tokens (approximately $8.71 million), accounting for 8.51% of the circulating supply.

- On December 16th at 8:00, Flow token FLOW will unlock 2.6 million tokens (approximately $2.18 million), accounting for 0.18% of the circulating supply.

- On December 17th at 8:00, ApeCoin token APE will unlock 15.6 million tokens (approximately $28.08 million), accounting for 4.23% of the circulating supply.

This week, attention should be paid to the bearish effects of these tokens due to unlocking, avoiding spot trading, and seeking short opportunities in contracts. Of these, CYBER and APE have a relatively large unlocking magnitude and should be closely monitored.

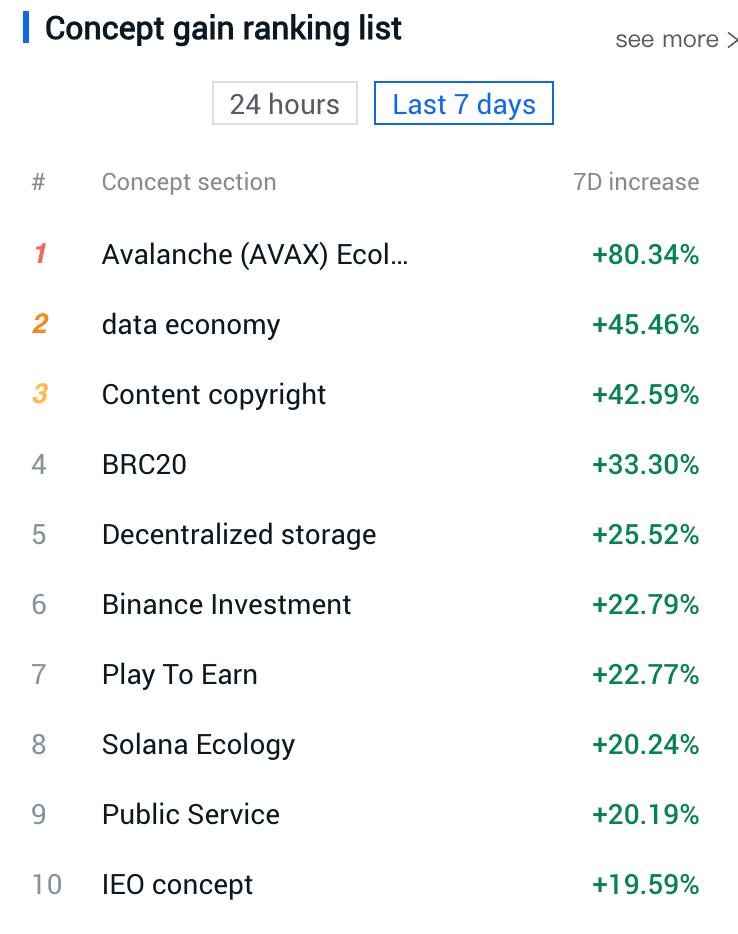

Eight, Top Gainers in the Cryptocurrency Market Last Week:

In the past week, the performance of specific concept sectors is as shown above. Based on the percentage change, the recent seven-day gains are as follows: Avalanche (AVAX) ecosystem +80.34%, data economy +45.46%, content copyright +42.59%, BRC20 +33.30%, and decentralized storage, among other sectors, leading the gains. Pay attention to the rotational speculative market of the above-mentioned coins with significant gains in their respective sectors.

Nine, Global Market Macro Analysis Overview:

Last Friday, the three major US stock indexes collectively closed higher. The US stock market has risen for the sixth consecutive week, with the Dow rising by 0.01% for the week. The S&P 500 rose by 0.21%, and the Nasdaq rose by 0.69%. The yield on the US ten-year Treasury bond rose to 1.855%, closing at 4.228%, with a spread of -49.5 basis points compared to the two-year Treasury bond yield. The VIX fear index fell by 5.44%, and Brent crude oil rose by 2.02%. Spot gold has been on a continuous decline since May 2023, after reaching a new high in November 2022, and has rebounded by 1.19% since October 5th, 2023, to $2004.26 per ounce. The US dollar index has been steadily declining from its high in October 2023, with some rebounds, closing up by 0.35% at 104. The German stock market has reached a new all-time high.

In November, the seasonally adjusted non-farm payrolls in the US increased by 199,000, exceeding the market's expectation of 180,000. According to the Fed funds futures contracts, after the release of the non-farm payroll data, the market's bet on a rate cut by the Federal Reserve in 2024 has decreased. Traders have lowered their expectations for a rate cut by the European Central Bank, now expecting a 125 basis point cut in 2024. According to a statement, the US Department of Energy is seeking up to 3 million barrels of oil reserves. Russian President Putin has stated that he will run for president in 2024.

In the past week, the international market has seen dramatic changes, with gold hitting a new all-time high and experiencing a significant shakeup, while the central banks of Australia and Canada have remained unchanged, and international oil prices have fluctuated lower.

On the domestic front, the upcoming Economic Work Conference may be convened; key data such as industrial production, investment, consumption, credit, and housing prices for November in China will be released; and the market is closely watching the situation of the People's Bank of China's Medium-term Lending Facility (MLF).

Regarding the Federal Reserve's interest rate decision, El Elian, Chief Economic Advisor at Allianz, stated that the market is eager to digest the expectation of a US rate cut, which may actually limit the Federal Reserve's long-awaited shift to a dovish policy. Although Federal Reserve Chairman Powell recently stated that it is "too early" to discuss a rate cut and added that the Federal Reserve is prepared to continue tightening policy when necessary, according to the CME FedWatch tool, the market currently generally expects five rate cuts in 2024.

However, some Wall Street banks have poured cold water on the market's expectations of a rate cut by the Federal Reserve. A recent Goldman Sachs research report stated that the financial markets are overly optimistic about the magnitude of the rate cuts by the Federal Reserve in 2024, providing options traders with an opportunity to profit from betting against the market's expectations.

Ten, Future Market Analysis:

The BTC daily chart shows that since December 1st, after breaking through the key resistance at $38,400, it has continued to rise, reaching a high of $44,700. However, a significant decline occurred this Monday. The reason for the decline has been analyzed from the perspective of major funds moving BTC to exchanges in the previous text. Additionally, we mentioned that after the historical high in open interest options contracts for Bitcoin, there is a possibility of a reversal at a certain level, as open interest cannot remain open indefinitely. When large-scale closing behavior occurs, it will lead to significant fluctuations.

The current rally is the result of multiple factors, such as the hot trend of the Bitcoin inscription BRC20 concept, future rate cut expectations by the Federal Reserve, historical highs in gold, five consecutive weekly gains in US stocks, and the expectation of the approval of a Bitcoin spot ETF, among others. Of course, the driving factor behind the market surge is also the issuance of USDT. In the past 30 days, Tether has issued a net amount of 3.98 billion USDT tokens on the Ethereum and Tron chains. This means an average issuance of approximately $132 million in tokens per day, or nearly $200 million in tokens per working day.

After the decline in BTC, it is expected to enter a phase of corrective adjustment. Considering the potential death cross on the daily chart this week, but also taking into account the previous strong bullish trend, there is a high probability of short-term oscillations in the range of $40,000 to $43,000. It may be worth considering high selling and low buying operations within this range. If the market breaks out of this range, the strong resistance above is near the recent high of $44,700, and the strong support below is near $38,400, which is the future extension position of the upward trend line shown in the chart, currently around $37,300. As time passes, it will gradually move upward. If the upward trend line is not broken in the middle and late stages of this month, then the area near $38,400 can be considered.

Follow us:

Lao Li Mortar

Deepcoin Research Institute

December 11, 2023

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。