"Weekly Editor's Picks" is a "functional" section of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, the Planet Daily also publishes many high-quality in-depth analysis contents, which may be hidden in the information flow and hot news, passing by you.

Therefore, our editorial department will select some high-quality articles worth reading and collecting from the content published in the past 7 days every Saturday, bringing new inspiration to you in the encrypted world from the perspectives of data analysis, industry judgment, and opinion output.

Now, let's read together:

Investment and Entrepreneurship

Grayscale Research: Unveiling the Ownership Pattern of Bitcoin

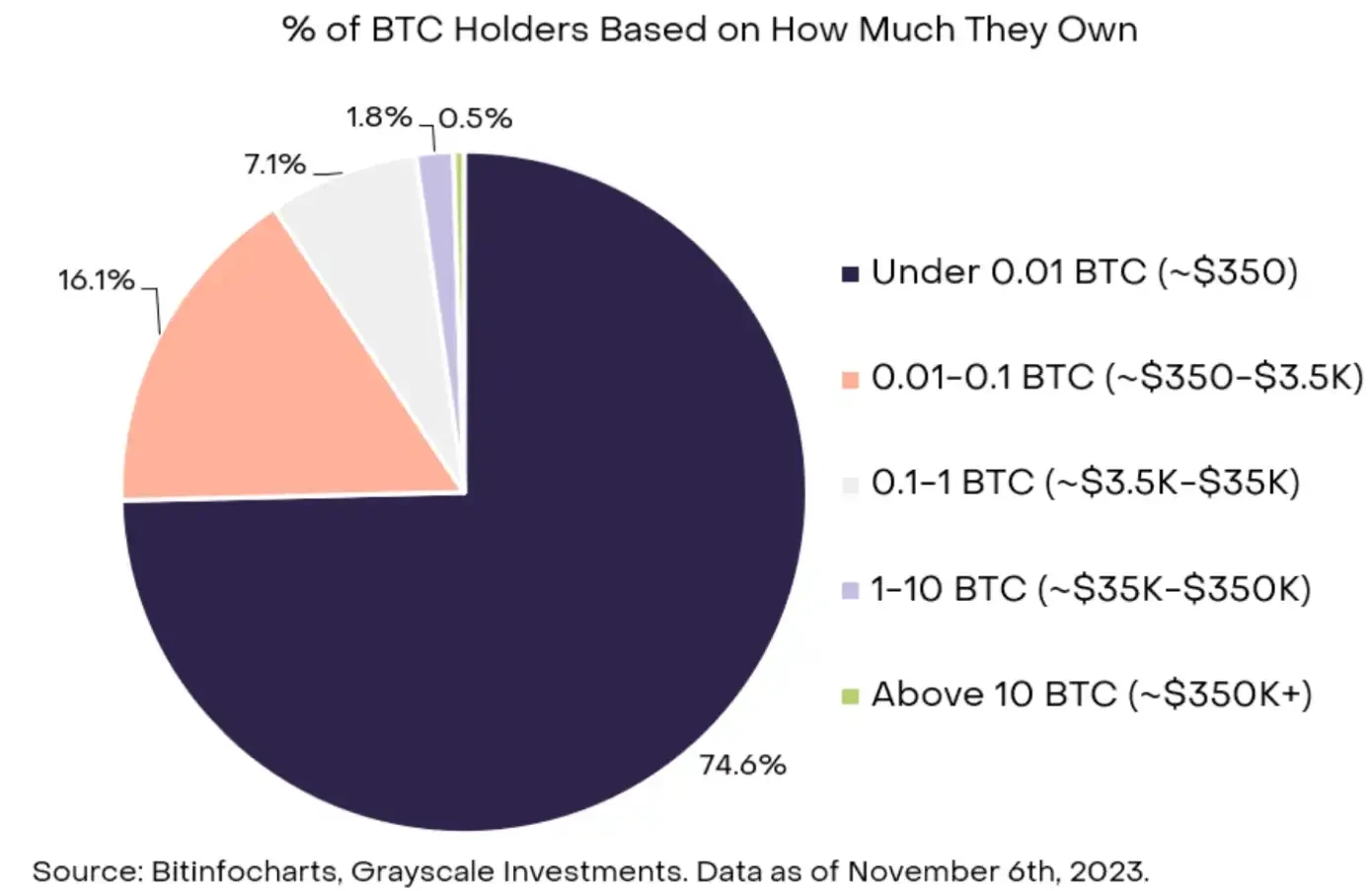

The ownership of Bitcoin is widely distributed among various groups. 74% of Bitcoin holders own less than 0.01 Bitcoin. About 40% of Bitcoin ownership belongs to identifiable categories, including trading platforms, miners, governments, assets and liabilities of listed companies, and dormant supplies. 14% of Bitcoin supply has not moved in 10 years. We believe this supply can be attributed to the original Bitcoin owned by Satoshi Nakamoto, lost Bitcoin or addresses, and long-term holders. Since 2019, the inactive supply has been growing and is currently at its highest level in history. Non-movable and long-term holder supplies have soared to unprecedented levels, while short-term supplies have dropped to the lowest level.

The dynamics of Bitcoin ownership may increasingly strengthen the impact of macro events, such as the evolution of global policies and regulations (e.g., the approval of the U.S. spot Bitcoin ETF), and the development of the crypto market, such as the 2024 Bitcoin halving.

Grayscale: With the Improvement of Crypto Fundamentals, Will Bitcoin Continue to Rise?

Some macro risks in the financial market have decreased, including geopolitical conflicts in the Middle East and the risk of a "hard landing" for the U.S. economy.

The combination of token supply "tightening," easing macro risks, and the focus of the U.S. presidential election on government over-borrowing may be favorable for the valuation of Bitcoin in 2024.

IOSG Ventures: Interpreting BTC Data, We Have Entered a New Bull Market Cycle

We are currently in the middle of a medium-length bull market cycle, entering the climbing phase. Compared to previous cycles, the current Bitcoin bull market cycle is unusually stable, but according to historical patterns, IOSG expects at least 10 more pullback corrections (exceeding -5%) before reaching the peak of this cycle. Although the Bitcoin halving event coincides with the change in market cycles, they may not be the direct cause of market changes, but rather consistent with broader global economic trends.

The revival of POW projects is the result of multi-party efforts. Essentially, miners seek new POW projects for computing power, communities seek projects with low market value and good narratives, and mining machine manufacturers seek projects that can gain community support. At the same time, the rise of AI has raised computing power to the level of data-era infrastructure, and POW projects come with computing power, making it easy to combine with AI, causing a second overlay of narratives.

Brief summary of POW tokens with a market value exceeding 40 million USD

Outlook and Investment Guide for Crypto Narratives in 2024

The most important driving narrative for the bull market is: Bitcoin ETF, interest rate reduction, and Bitcoin halving. The author foresees a price drop after the interest rate cut, followed by an increase. Retail investors can stick to a simple investment approach. 2024 will be mainly dominated by institutions.

Considering ETF beneficiaries, the best investment choices are: COIN (stock) / BTC / ETH, derivative narratives: BRC-20 / LSTs. Considering the Lindy effect, the best choice is: SOL, derivative narratives: TIA / Aptos / L2. Considering regulatory and product market fit, the best investment choices are: MMX / dYdX, derivative narratives: other Perp DEXes. Considering decentralized AI, the top choice is: TAO / OLAS. Considering GameFi, the best investment choices are: Overworld / Treeverse / Prime / L3 E 7, derivative narratives: NFTs → BLUR.

Other potential narratives: dePIN / RWAs, deSci, Memes (BONK / DOGE / PEPE / HPOS 10 INU), RUNE / CACAO, GambleFi, airdrops (LayerZero / Starknet / ZKSync).

Inventory of 7 Major Protocols About to Undergo Major Launches

Frax V3 and Fraxchain, Synthetix Andromeda version and eliminating SNX inflation, Fluid in Instadapp, Eigenlayer + LRT, Uniswap V4, Satoshi Nakamoto upgrade in Stacks, single-layer L1 growth: Fantom 2.0 upgrade and SEI V2.

DeFi

The Growth Story of Uniswap: From Zero to Infinity

Reviewing the steps of Uniswap from v0 to v4: concept validation → functional DEX → capital efficiency → ultimate platform.

Uniswap v4 brings efficiency and custom features to the AMM design space, supporting the creation of pools with different characteristics and functions. This is a great advancement, but the cost is foreseeable: as the number of pools increases, liquidity fragmentation intensifies, making routing more challenging.

E2M Research: Is Decentralized Lending Led by Aave a Good Business Model?

A very long article, covering basically everything we need to know about Aave.

MT Capital Analyzes Jito: Reshaping the Staking Market Landscape on Solana

Jito is the first liquidity staking protocol on Solana that combines MEV revenue with staking revenue, with TVL rising by nearly 70% in the past 30 days, expected to reshape the staking market landscape on Solana.

Jito is about to launch its governance token JTO, with limited circulation of JTO in the early market, and the main selling pressure comes from airdrop users. The use cases for JTO are relatively limited, and its value capture ability is poor. Jito needs new incentives and ecosystem expansion to stimulate the continuous growth of Jito TVL, to some extent alleviate the selling pressure from airdrop users, and maintain the stability of JTO value.

Backed by the influx of new assets and users on Solana, as well as the increase in trading volume, and the extremely low liquidity staking ratio on Solana, the LSD protocol represented by Jito is expected to capture a higher staking TVL. The potential huge MEV value of Solana gives Jito more room for imagination.

NFT

Bankless: Holding Two Potential Trump Cards, Can OpenSea Rebound from the Bottom?

The author believes that the opportunity for OpenSea lies in not yet releasing its own token or its own L2.

Web 3.0

The article mainly introduces Zero Knowledge Proof (ZK) and Fully Homomorphic Encryption (FHE) and their representative projects.

From a technical perspective, ZK focuses on proving correctness while protecting the privacy of statements; FHE focuses on performing calculations without decryption, protecting the privacy of data.

From the perspective of blockchain industry development, projects using ZK technology have developed early, from ZCash, which only had transfer functionality, to the currently under development zkVM blockchain that supports smart contracts, showing more technical accumulation in the blockchain industry compared to FHE. FHE theory was born much later than ZK and was a hot topic in academia, and it was not until recently that Web3 projects using FHE technology for fundraising appeared, so its development started later than ZK.

Both point to the development relying on computing power, and the development of the privacy track benefits from the explosion of computing power.

In-depth Discussion of DePIN: Decentralized Hardware Meets the New Data Economy

DePIN may become a turning point for the adoption of "web3" in the "real world".

1kx: In-depth Analysis of Decentralized Social Protocols

Bitcoin Ecosystem

What Other Potential Projects are Worth Paying Attention to in the Bitcoin L2 Narrative?

The article focuses on Tectum and BEVM.

Interactive Guide: How to Purchase Other Hot Targets in the Bitcoin Ecosystem Besides Ordi?

Includes the purchase methods for $Nostr, $ATOM, BSSB, ALEX, and other BTC protocol tokens, as well as TOOTHY (NFT).

Ethereum and Scalability

Has the Advantage Peaked? A Discussion of Ethereum's Prospects and Challenges

In terms of relative valuation and relative adoption compared to all crypto assets (ETH.D), Ethereum is in a leading position. The reasons that made Ethereum successful in the past are the same reasons that will make it fail in the future. There was a time when Ethereum was the only viable smart contract platform for developers to build on. Legitimate use cases (DeFi, NFTs) put ETH ahead by a large margin. But at this stage, the focus has shifted to value accumulation (sound money) and competition with Bitcoin, becoming the de facto platform for storing value on the internet (flippening). The desire to be both a smart contract platform and a decentralized "sound money" has added significant resistance for edge users and developers (higher gas costs, network congestion).

Modular blockchain frameworks provide a set of trade-offs to choose from. We are now in a state where blockchain infrastructure that supports various points on the trade-off curve is beginning to emerge. In terms of blockchain design, Ethereum is no longer at the efficient frontier. Unless Ethereum undergoes fundamental changes in its mode of operation, both as a community and as an organization, the relative advantage in terms of valuation and usage has reached its peak.

Glassnode: Dynamic Changes in Ethereum Staking Pool and Market Activity

The number of Ethereum staking validators exiting the pool has gradually increased recently, leading to a slowdown in ETH issuance growth. At the same time, the surge in network activity, especially the push for token transfers and stablecoins, has led to an increase in transaction demand, putting upward pressure on gas prices, and the daily cost of ETH fees burned through EIP 1559 has also increased. The combination of these two forces has led to a renewed trend of global ETH supply contraction.

Since October, CEX has been leading the staking withdrawal events, with Kraken and Coinbase's outflows being the most significant.

Another recommended article for mechanism design interpretation: "In-depth Interpretation of Why Rollups Need Security Committees?".

Multi-Ecosystem

In-depth Discussion of the Differences Between Ethereum and Solana

To ensure the security of the blockchain, some form of value proposition is needed. Solana charges state rent to decentralized application (DApp) teams and voting fees to validators, meaning validators must pay to participate in block voting.

These two features do not exist in Ethereum, and they create additional value drivers for Solana's token (SOL), which to some extent offsets the impact of the lack of transaction fee demand on the price of SOL, while also alleviating some security and public resource issues (such as state bloat). The problem is that these two may limit decentralization (as the fixed cost of becoming a validator increases), and also limit the immutability of DApps due to the difficulty of coordinating payments at the "community" level.

On the other hand, this model and the cNFT model also show how costs are sometimes hidden. If there are too many rent-seekers, user costs may increase, and Solana structurally provides some opportunities that Ethereum does not. At the same time, cNFTs are very attractive to users and can provide them with lower costs, thereby reducing overall costs. These reduced costs will be passed on to DApp teams to pay for RPC (remote procedure call) fees to maintain data.

While Ethereum has at least theoretically achieved immutability, autonomy, and censorship resistance, and correspondingly charges users high premiums, Solana is cheap, shifting the security costs to validators and DApp providers. Solana DApps will find it more difficult to gain trust minimization from their teams (affecting autonomy), and theoretically, the scale economies of Solana validation should be at least larger than Ethereum validators (decentralization).

Weekly Hot Topics Review

In the past week, Bitcoin broke through 40,000 USDT, the total market value of cryptocurrencies exceeded 1.6 trillion US dollars, the Korean won surpassed the US dollar to become the largest fiat currency trading pair for Bitcoin, accounting for 42.8% in November, Bitcoin Core developers "kill" inscriptions, sparking controversy, Bitwise submits revised second version of Bitcoin spot ETF application to SEC, BlackRock submits revised Bitcoin spot ETF application, Reuters: SEC is negotiating key details with applicants for Bitcoin spot ETF;

In addition, in terms of policies and macro markets, Federal Reserve Chairman Powell: If the timing is right, the Fed is prepared to further tighten monetary policy;

In terms of opinions and voices, a U.S. Space Force official: Bitcoin has "national strategic importance", President of El Salvador: The country's Bitcoin investment has a floating profit of 3.6 million US dollars and will be held long-term, Glassnode: The vast majority of BTC investors have recovered floating profits, and multiple indicators have entered the "uptrend" area, IOSG founder: The bull market is returning, we need to move away from speculation and memes, Coinbase CEO: No plans to launch Base Network token, Cosine: Safe multi-signature wallets need to improve interactive security design to address phishing attacks with identical start and end addresses, Founder of Ordinals: Currently, all Runes protocols are not related to me;

Institutions, major companies, and leading projects, LayerZero Labs states that the protocol has a native token and will focus on token distribution, expected to be completed in the first half of 2024, Discussion on "hard fork" caused by Arbitrum ArbOS upgrade, Unusual price of AEUR, the Euro stablecoin, on Binance, Jito announces airdrop details, Ordinals project BitcoinShrooms featured on Sotheby's;

In the NFT and GameFi fields, Ouyang Jing releases new song "Nobody," teasing a new NFT from Stephen Chow … Well, it's been another eventful week.

Attached is the "Weekly Editor's Picks" series link.

Until next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。