Source: Deep Tide TechFlow

After the recent "Uptober" in the encryption market, signs of recovery have emerged in various tracks.

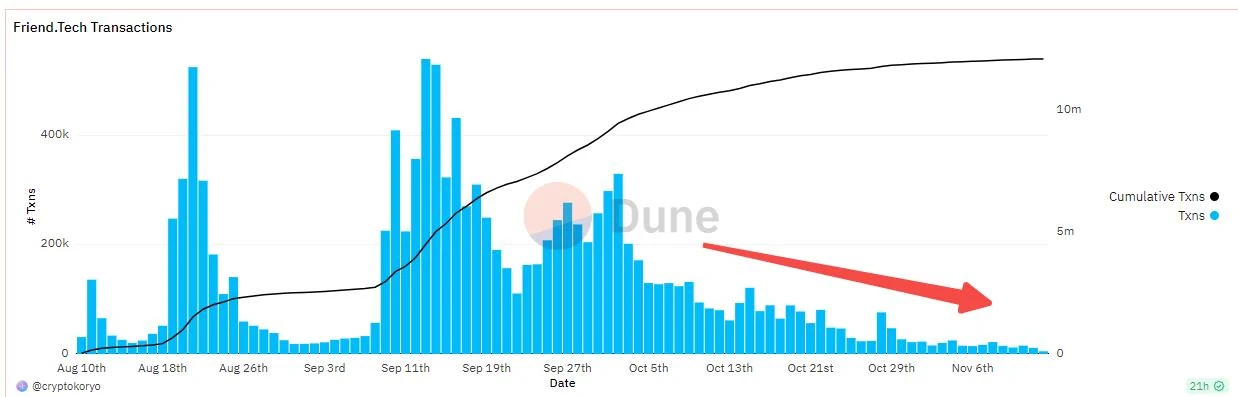

The Bitcoin ecosystem is leading the way, and gaming projects are becoming active again… But the once popular SocialFi seems to have lost its luster in this wave:

FriendTech's product updates are slow, and user growth and activity have stagnated; and the previously outstanding Star Arena, after experiencing theft and the departure of its founder, has also fallen into decline.

In a favorable market environment, the social track has encountered a period of stagnation.

But we all know that cryptocurrencies follow the logic of sector rotation. When the bull market emerges, funds and attention will also seek the best returns and narratives; after experiencing stagnation, if funds rotate back to Socialfi, will there be new projects to take over?

Following the principle of looking at the new rather than the old, which project can take over and ignite new enthusiasm in the same track?

To take over, in the same track, there must be different innovations. Pure imitation is difficult to attract new attention.

Previously, we introduced the new social project Soulcial on Optimisum in "From SixDegrees to FriendTech, Soulcial's Web3 Social Ignition Moment," which won awards at multiple hackathons, to some extent proving the industry's recognition of its innovation.

Recently, Soulcial's V2 version has been launched, and the Pump Epoch event has been simultaneously initiated, sparking discussions on social media.

Different from FriendTech (referred to as FT) and StarArena's pure share trading, Soulcial has introduced the new design of "Social Behavior Trait Indicators" (SBTI) and Pump Game:

The former in the Social part allows the social value and connection methods of the attention recipient to no longer rely solely on traditional social media influence; the latter in the Fi part allows participants to find new channels to obtain benefits and rewards.

Within 2 days of the product launch, there are currently 3,500 participants in NFT minting. In this issue, we will delve into its innovation in the social track from the perspective of Soulcial's product design, economic mechanism, and token value, while also providing reference for players who wish to participate.

Discovering more valuable people from more dimensions

Previously, the hot FT and various imitations mainly considered the user's value based on the influence of their Twitter account. But not all valuable people have high social media followers.

Blockchain interaction experts may be unknown, NFT Degen may disdain speaking out, and people who actively contribute to the community governance may be active behind the scenes…

Therefore, Soulcial has introduced "Social Behavior Trait Indicators" (SBTI), attempting to more comprehensively discover the value of a Web3 user from multiple dimensions:

For example, Influence represents the influence in social media; Connection signifies the scale of the user's connections within the product; Energy reflects the user's participation in on-chain activities; Wisdom indicates whether the user actively participates in community governance; Art more directly shows the number of NFTs held by the user, while Courage demonstrates the frequency and scale of on-chain interactions…

These 6 dimensions basically cover all aspects of behavior in the Web3 world, also reflecting the user's unique "on-chain personality."

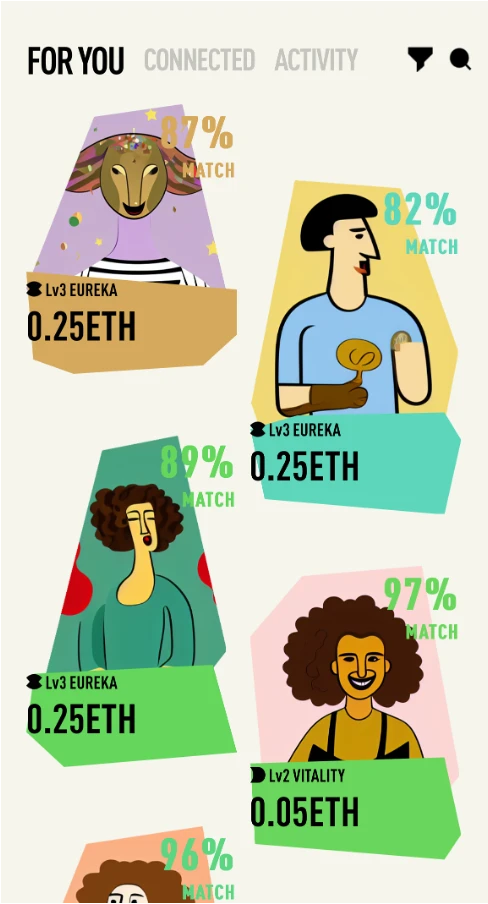

At the same time, based on the personality judged from the 6 dimensions, supplemented by AI co-creation, Soulcial will generate a unique Soulcast NFT for each participating user.

By quickly viewing the tags of the NFT and the corresponding dimensions, you can quickly understand the user's personal traits, and also quickly discover their "useful" social value to you.

What's even more interesting is that the system will recommend other users with similar 6 dimensions of personality and display the matching degree based on personality and behavior traits. In addition, you can also actively use the connect function to connect with like-minded people.

Through the use of light social methods, users can also precipitate the network value of their social graph during the connect process, finding more like-minded people.

After purchasing another user's NFT, you can unlock the function to chat one-on-one with them, further deepening the connection. At the same time, if you participate in purchasing an NFT but are unsuccessful, you can also join the group created by the NFT user and become a group member.

The rules and process related to purchasing NFTs also constitute Soulcial's unique asset pricing method, which we will detail in the subsequent economic section and will not describe in detail here.

In addition to the introduction of more evaluation dimensions, Soulcial has also made efforts to lower the usage threshold.

Whether using a computer and mobile browser or a PWA (Progressive Web App) mode similar to FT, you can easily log in.

Based on this, Soulcial introduced social login from the beginning, allowing users to access using familiar Web2 accounts, while also integrating deposit solutions, eliminating the awkwardness of new users participating in the first step without gas fees, making the product easier to spread and gain popularity.

Clearly, from core product design to related details, Soulcial has its own characteristics.

But beyond product functionality, the topic that interests us more is whether its economic part also has innovations that are clearly distinct from its competitors?

Pump Game, a differentiated asset pricing new model

By evaluating and discovering a user's social value from more dimensions, it essentially involves pricing people as assets.

And all pricing ultimately needs to be implemented in user participation.

What users are more concerned about when participating in Soulcial is how to profit from it? Furthermore, whether its economic gameplay is attractive and can continuously generate income?

To understand these questions, it is necessary to deeply understand the core asset trading mechanism of Soulcial.

Different from the simple Bonding Curve model used by FriendTech and other imitations, Soulcial combines "equivalent auction + liquidity incentive + bonding curve" in a way that makes significant innovations in asset appreciation and user participation.

We can break it down to gain a clearer understanding of the gameplay and rules.

1. Trading Process: Pump Game under Equivalent Auction Rules

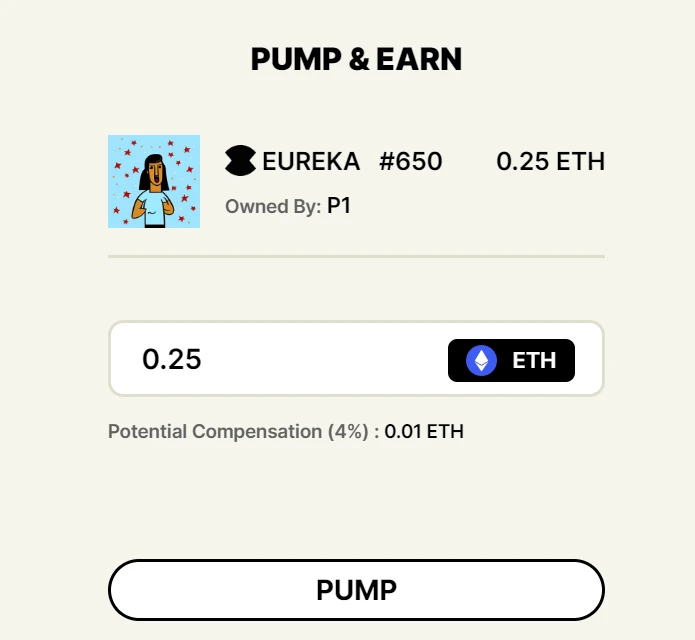

First is the equivalent auction, corresponding to the NFT trading process in the Soulcial product, which is the Pump Game we see on the product page:

- Initial Pricing: The user's Soulcast NFT is assigned a different level based on the system's evaluation of the six-dimensional scores, and an initial price is calculated based on the level data.

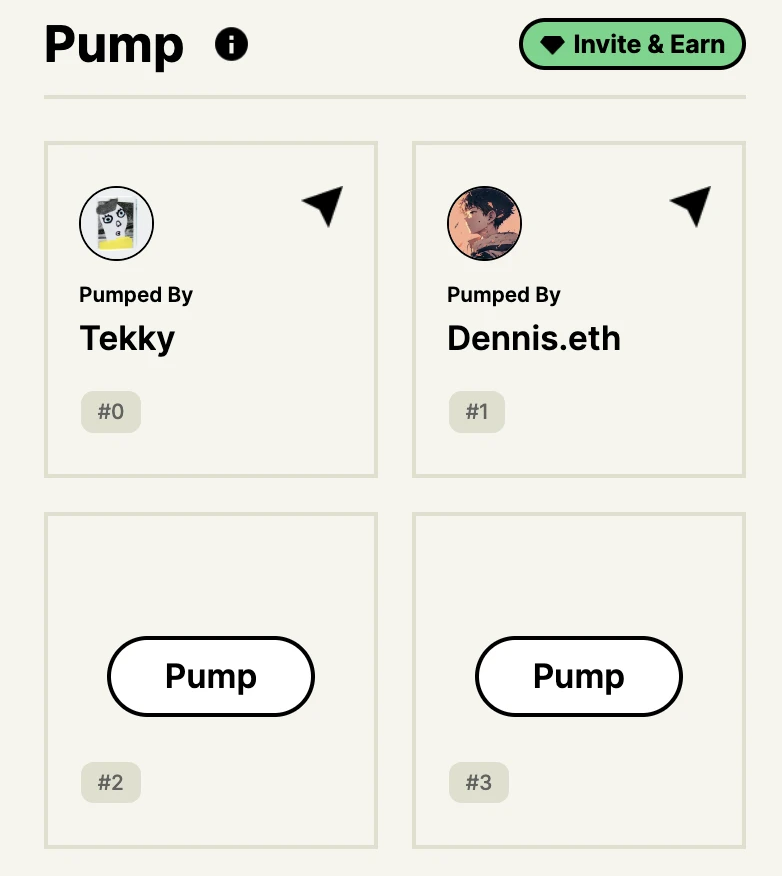

- Price Discovery: If the user is deemed valuable, the NFT has appreciation potential, or there is a desire to unlock the right to chat with the user, a group of 4 people is required to participate in a Pump Game—where 4 people bid the same purchase price, initiating a round of "equivalent auction."

Result Determination: A random number is generated on-chain, and only 1 out of the 4 people will be lucky enough to win and successfully purchase the user's NFT.

Next Round: The successful bidder in this round can choose to hold the NFT or initiate the next round of equivalent auction, which is also a 4-to-1 chance Pump Game, but the NFT itself will appreciate in subsequent rounds.

It is important to note that if you already hold an NFT, participating in the Pump Game can earn you vSOUL points as a reward from the system, and NFTs of different levels correspond to different bonus multiplier coefficients.

vSOUL can be exchanged for the project's token SOUL, and we will provide detailed rules in the subsequent economic section.

2. NFT Asset Price Changes: Creating FOMO Effect with Bonding Curve

Why does the NFT appreciate in the next round of Pump Game in the auction process described above? The answer lies in the design of the Bonding Curve.

Similar to other social products, the Bonding Curve controls the price of social assets through a certain variable. However, what sets Soulcial apart is that the NFT price controlled by the Bonding Curve only increases and does not decrease.

This is why the auction process is called "Pump Game"—each round of price discovery for the NFT in the Pump Game causes its price to rise, and multiple rounds of increase attract more attention, thereby expanding the influence of a user's NFT and encouraging more people to participate in the bidding process.

So, how does the Bonding Curve specifically achieve price appreciation?

In the current version of Soulcial, the price increase after each round of bidding for the NFT is 10%. According to the project team, it will be upgraded to a dynamic price increase mechanism in the future, which can automatically determine the increase based on the market supply and demand curve, but the minimum increase will not be less than 10%.

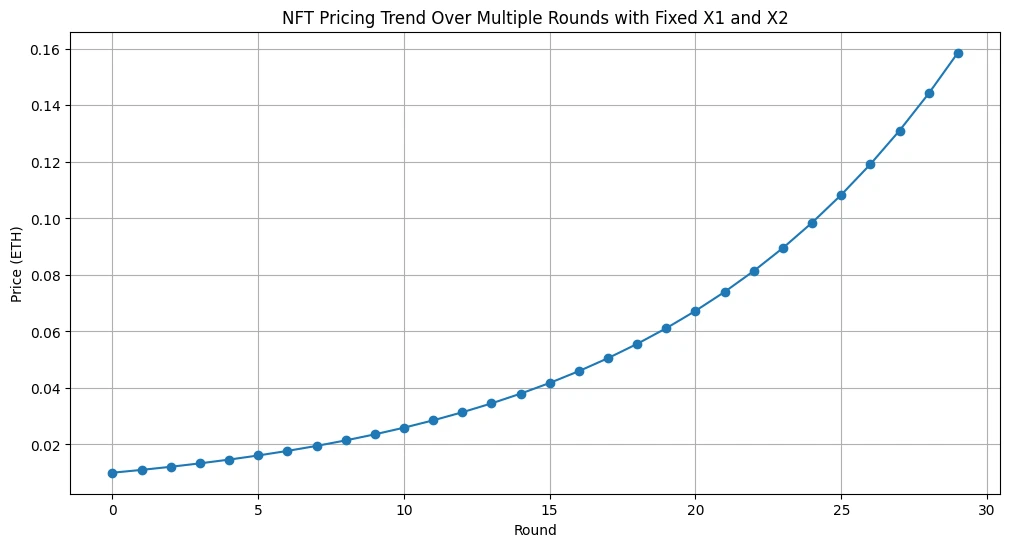

This means that currently, participating in the Pump Game allows for a 10% price increase for the NFT after each round. With dynamic adjustments in the future, we can anticipate that:

The more people participate in the pump game for NFTs of the same level (the more people want to buy), and the fewer orders are placed (the fewer people want to sell), the higher the price increase will be, following the market demand, determined by supply and demand, but without a decrease.

If this is still difficult to understand, let's make a hypothetical assumption: with a 10% price increase, if a user's NFT's initial price is 0.01e, after 30 rounds of equivalent auction, the price of the NFT can reach around 0.16e, an increase of 16 times from the initial price. Considering that each round requires 4 players to participate, without considering the same person participating, it only takes 120 people to raise the price of the NFT.

Of course, the above calculation is only an ideal scenario, and the actual situation may be more complex.

However, from the design of the Bonding Curve, we can clearly see a FOMO effect: because each round of the pump game requires very little liquidity (4 people), early participants can discover the price earlier and quickly participate in the bidding, thereby driving up the price of the NFT. The earlier the participation, the lower the cost, and there may be fewer competitors.

3. Profit Distribution: Social Version of "Liquidity Mining," Incentivizing Spread and Scale Expansion

At this point, you may be wondering why the other 3 out of the 4 participants in each round of equivalent auction would eagerly participate in a game of chance with only a 25% chance of winning? What motivates them to participate in a game with such low odds of winning?

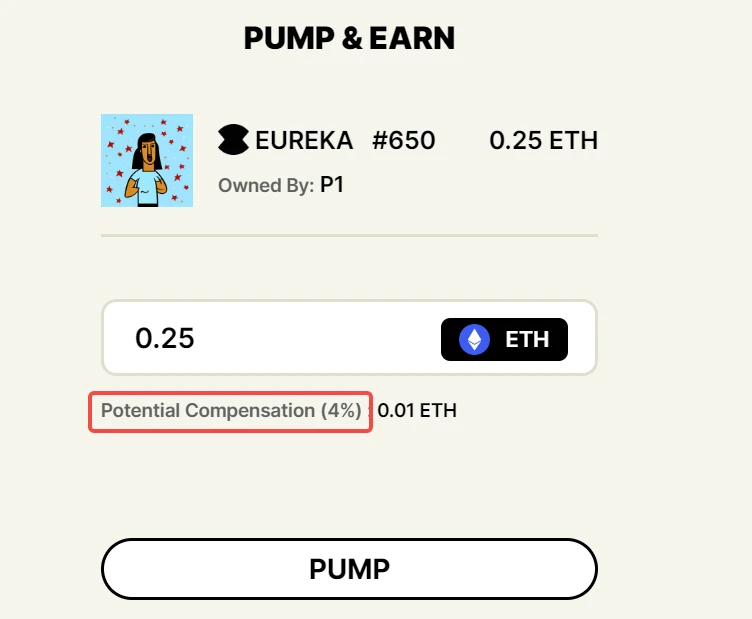

Don't forget, equivalent auction means that different people provide the same amount of ETH to participate in the auction, essentially providing liquidity. If you do not win, the ETH you provided will be refunded in full, and on top of that, the system will compensate you with 4% of the auction price as a reward for providing liquidity.

This means that in an NFT transaction, even if you do not successfully bid, the other 3 participants will each receive 4% of the transaction price as a commission and will also receive a refund of their bidding capital.

At the same time, choosing to participate in the Pump Game early to discover more valuable NFTs becomes a guaranteed profitable business. Once you participate in the auction, you effectively engage in a different kind of "liquidity mining" in the social version:

Your participation actively contributes to price discovery and facilitates the completion of NFT transactions. As a reward, the system will inevitably compensate you with a commission, just like LPs participating in liquidity provision in DeFi earn returns.

However, unlike DeFi, in Soulcial, with continued liquidity provision, the APY of liquidity mining does not decrease but increases with the higher transaction price of the NFT (4% remains constant, but the NFT transaction price increases).

However, as the rounds progress, the difficulty of participation increases, because the higher NFT prices are discovered, the greater the competition for liquidity provision, and the competition to grab the 4-person slots will also significantly increase.

It is clear that the system encourages early participation, with a greater likelihood of earning profits.

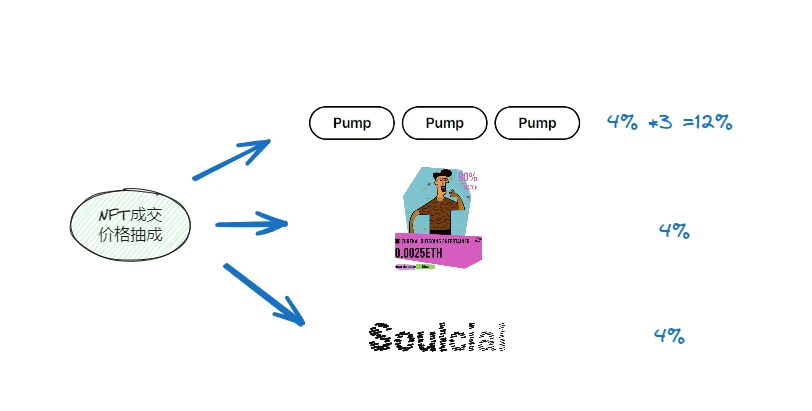

Finally, let's summarize the overall profit distribution method of Soulcial: In the NFT transaction price, 12% (4% * 3) goes to the other 3 participants who did not successfully bid, 4% goes to the NFT creator, and the platform collects a 4% fee, totaling 20%.

Based on the comprehensive design of "equivalent auction + liquidity incentive + bonding curve," we can summarize the asset pricing model of Soulcial as follows:

Avoid direct competition, differentiated design: It is neither the order book model with counterpart orders like small avatar NFTs, nor the FT pure Bonding Curve model without counterpart orders that can ensure the continuity of the price curve and users' lossless transactions under the state of very few people providing liquidity.

Users earn profits in the process of making market for others' social assets, thereby encouraging the continuous expansion of the Soulcial social network.

There is an obvious Pareto structure in the design, which is easy to spread and propagate rapidly in the early stages. However, this Pareto is not a simple zero-sum game. Other participants also benefit from continuous market-making, rewarding each participant's unique role and contribution.

NFT prices will not decrease, making price discovery for high-quality users more direct:

In the FT model, capable and high-quality individuals who want to monetize have only one way, which is to operate and expand their social media influence. However, not everyone has the energy, ability, and willingness to operate a social media account.

The price discovery mechanism of Soulcial provides high-quality individuals with another way to quantify their value and then convert it into the possibility of selling products.

From points to SOUL tokens, users and the project share the same fate

From the generation of Soulcast NFTs to the Pump Game mode, we can intuitively see the current benefits. However, a model that only focuses on immediate benefits cannot sustain itself in the crypto world in the long run.

If there is no long-term value and planning to support the rush of participants, it may lead to a scattered effort.

Therefore, in the process of price discovery and participating in asset transactions, Soulcial also provides participants with ways to obtain long-term value.

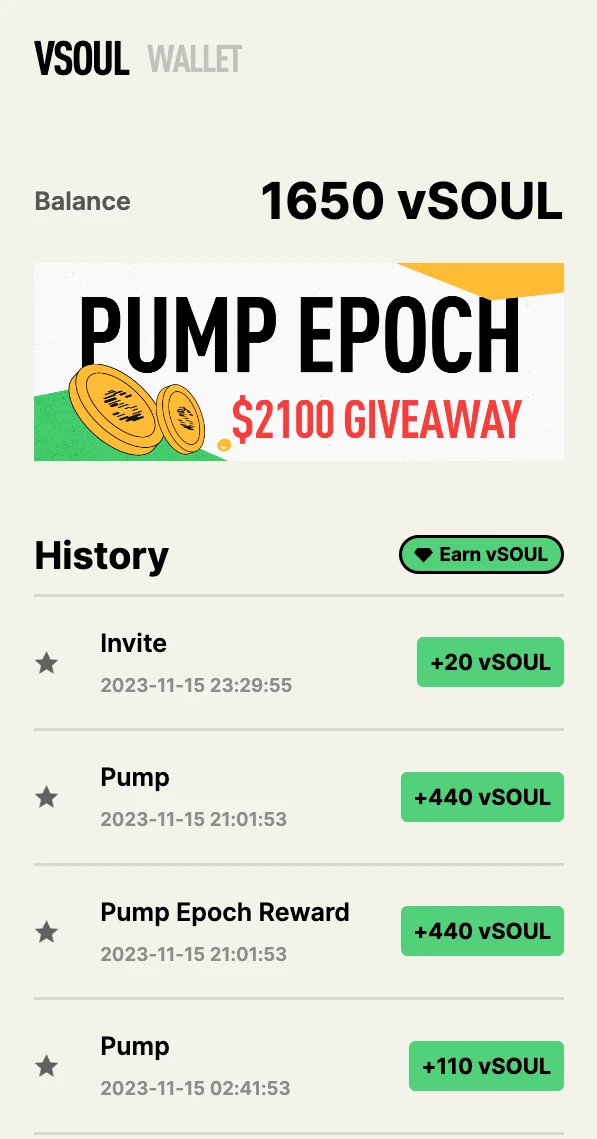

From the current product page, we can see that in addition to the assets in the user's wallet and collected NFTs, users can also earn project points vSOUL, which permeates every step of the user's participation:

- Inviting others to register using an invitation code can earn points

- Inviting others to participate in the Pump Game can earn points

- Participating in the Pump Game can also earn points

- Winners of the Pump Game can earn more points than non-winners, and the amount of points earned also varies based on the amount of NFTs held

It is important to note that in order to participate in the Pump Game and earn points, the prerequisite is to hold at least one NFT.

This also means that users need to make their own decisions, whether to sell NFTs immediately to earn profits or choose to hold NFTs to participate in more rounds of equivalent auctions to earn points and seek long-term profits.

Based on the rules currently announced by Soulcial, vSOUL points can be converted into the project's SOUL tokens.

Since SOUL will be fully airdropped to all users in different seasons, without any reservations or early rounds, the value of this fairly launched token depends entirely on the consensus and level of participation of the users in the project.

However, the ratio of vSOUL that can be exchanged for SOUL tokens will decrease over time, which means that early participants will earn higher profits. From the perspective of project propagation, the expected early profits can also stimulate the launch and expansion of the social network.

From a long-term perspective, a 100% fair launch actually turns the project into a fully shared ownership model.

The success of Soulcial's development and the value of the SOUL token depend on whether all users are active and participate, essentially creating a community with shared interests. To seek profits, one must participate in the project earlier and more actively, amplify the project's voice while gaining value.

Assets come first, and Soulcial will rely on long-term operations

Overall, I believe that the advantages of Soulcial are:

- A unique economic model that is beneficial for rapid early expansion and creating excitement

- Differentiated asset pricing model to avoid becoming purely imitative

- In the social track, there may be an opportunity for explosive growth when funds are warming up

However, at the same time, we need to maintain a skeptical attitude and objectively consider the following:

- Can the value of Soulcast NFTs be sustained in the long term?

With the experience and lessons of FriendTech in mind, it is important to focus on the model and operations, and continuously unlock more gameplay and value for the assets. The future empowerment of NFTs by Soulcial, providing more value such as assembly props in the social metaverse and enjoying long-term dividends from the project, and deep cultivation in long-term operations may determine the fate of the project.

- Anti-bot mechanism

The early-bird profit model needs to consider the issue of preventing bots from gaming the Pump Game, which may lead to a situation where real users have no chance to participate in profit sharing, thereby disrupting the entire ecosystem and activity.

- Does unlocking the chat function have more value?

If the first and last NFT buyers both have the opportunity to chat one-on-one with each other, but the content of the chat is similar, will the latter be willing to pay a higher price to unlock the same function?

Therefore, in terms of the functions and permissions associated with NFTs, it may be worth observing the project's subsequent design and changes.

Finally, diligence is the key to success. Social media is a track that requires continuous operation and daily work. The diligent operation of the project and the unlocking of more valuable gameplay will affect the pace and success of development.

Similarly, for users, Web3 is always about assets first rather than complete actions. Diligently researching projects and choosing the right time to experience them is the optimal way to gain value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。