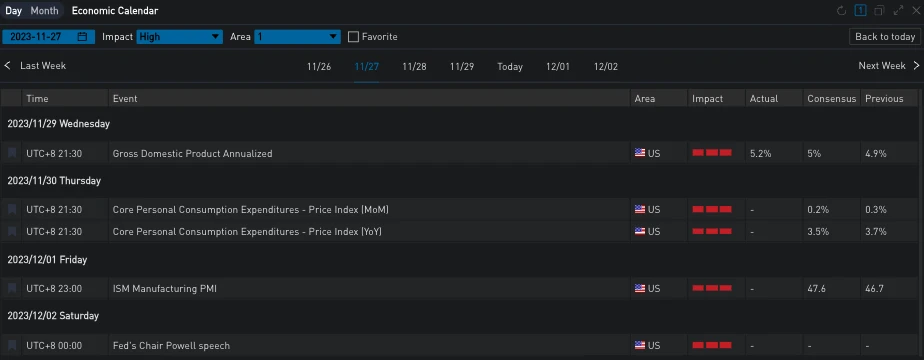

Yesterday (Nov 29), the U.S. released GDP data that exceeded expectations, causing the U.S. dollar index to rebound and break through the 130 level. Meanwhile, U.S. bond yields continued to decline, with the 2-year/10-year yields currently at 4.649%/4.279%. U.S. stock indices opened high and closed low, with the Dow rising by 0.04%, while the S&P 500 and Nasdaq fell by 0.09% and 0.19% respectively. Regarding future interest rate trends, the Federal Reserve's Mester stated that the current monetary policy is in a good position to flexibly assess future data, and whether to further raise interest rates depends on the data. Tonight (Nov 30, 21:30 UTC+8), the U.S. will release PCE data, which will further demonstrate the trajectory of inflation to the market.

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

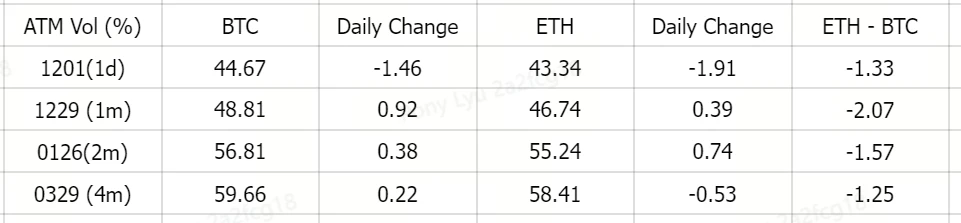

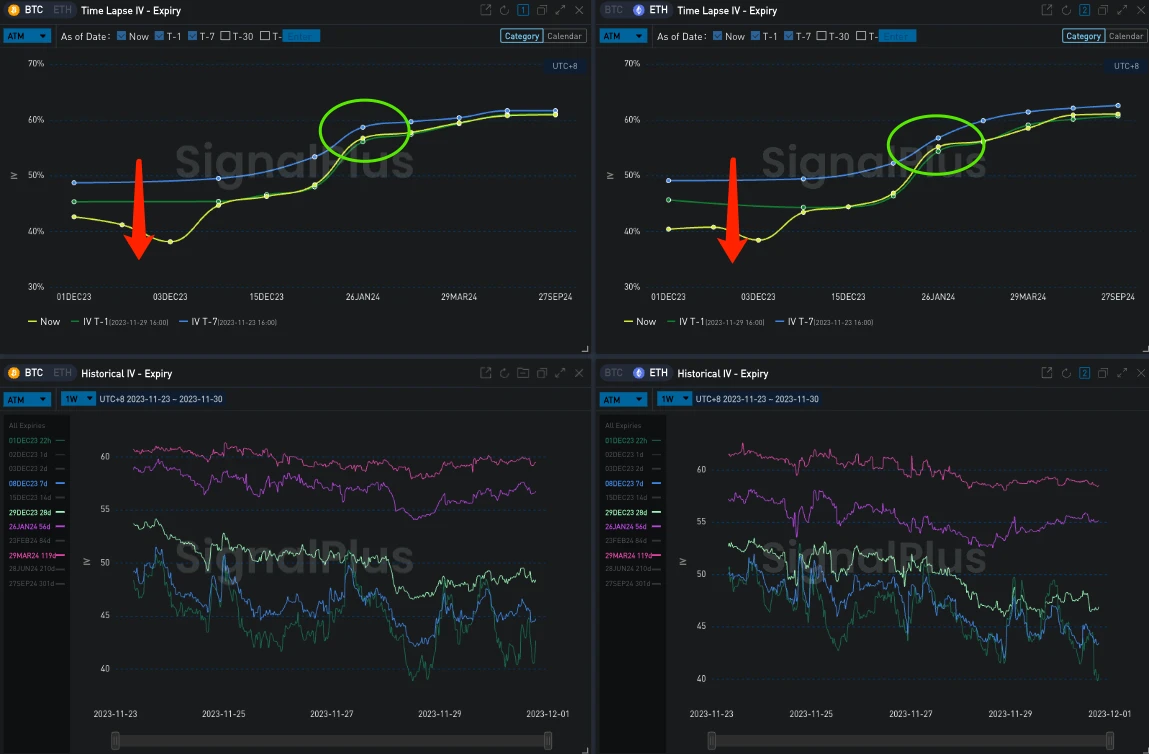

In the cryptocurrency market, BTC/ETH are fluctuating around 38000/2050, with a slight decline to 37815.36 (-0.803%) / 2034.97 (-1.16%). As for implied volatility, apart from a slight decrease of around 1.5%Vol in the IV of end-date options, there have been no significant changes in other maturities.

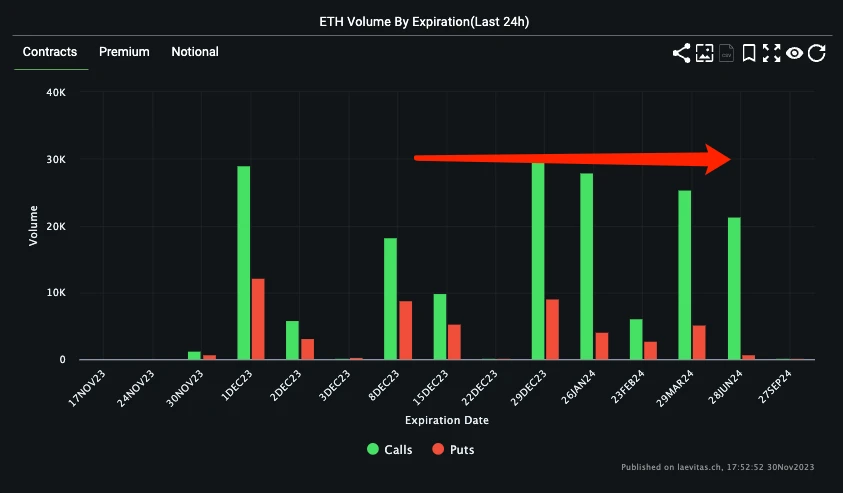

From a trading perspective, bullish strategy trading for BTC at the end of December remains hot, including representative bullish call spreads such as Buy 40000 vs Sell 45000, as well as the 36000-40000-44000 Sell Fly. Similarly, ETH is also dominated by bullish strategies, with a shift in trading distribution towards longer maturities. The bullish call spread/triangle spread between March and June has become a trading hotspot. Additionally, there are also many Call Spread strategies in January betting on the SEC's next move, which to some extent has maintained a steeper slope for the forward IV in January relative to the end of the year, reflecting the market's expectation for a further return of volatility after the new year.

Source: Deribit (as of Nov 30, 16:00 UTC+8)

Source: SignalPlus, IV of end-date options decreased, January-end IV premium remains high

Source: Laevitas, Shift in trading distribution of bullish strategies for ETH towards longer maturities

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。