Currently, the Bitcoin ecosystem is one of the most discussed topics in the crypto community. In addition to the FOMO frenzy and the continuous development of various token protocols, investors who are more cautious are paying attention to the DeFi scene within the Bitcoin ecosystem.

With the recent surge in various BRC tokens over the past month, the related assets within the Bitcoin ecosystem have accumulated to a considerable scale. According to Coingecko data, the market value of BRC-20 has now exceeded 600 million US dollars. Following this is the increasing demand for liquidity from BRC-20 asset investors.

Recently, several DeFi protocols within the Bitcoin ecosystem have shown new developments, as compiled by BlockBeats:

Cross-chain Bridge

Exploring DeFi applications in the Bitcoin network without smart contracts is relatively efficient by bringing BTC assets into public chains such as Ethereum that have smart contract functionality, directly utilizing their sophisticated DeFi infrastructure. Bridges are a key infrastructure of Web3, and Bitcoin is no exception. Without decentralized/composable bridges, dApps built on Bitcoin are unable to integrate cross-chain liquidity, thus limiting their growth potential. This use case has given rise to projects focused on cross-chain integration of Bitcoin assets.

MultiBit

Multibit is a bridging protocol that emerged in May this year, connecting BRC20 assets to the EVM network, allowing users to seamlessly transfer tokens between the ETH chain, BNB chain, and BTC network. On November 12, Multibit completed an IDO auction on the Bounce Finance platform, raising 88 ETH. On November 4, it completed another IDO on the TurtSat Bitcoin network donation platform at the same unit price, raising 4.64 BTC. The total fundraising from both auctions amounted to approximately 350,000 US dollars.

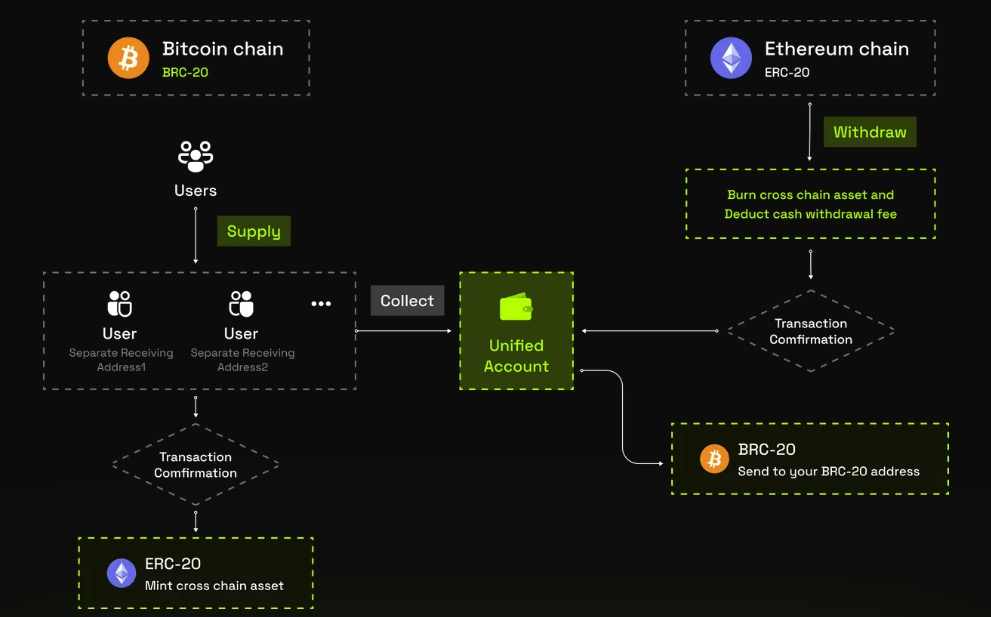

MultiBit simplifies the token transfer process between Bitcoin's BRC20 and the EVM network. First, users transfer BRC20 tokens to a dedicated BRC20 address. After confirmation, the Multibit protocol begins operation, minting an equivalent amount of tokens on the Ethereum or BNB chain. The Multibit Protocol collects tokens from all distributed unique addresses, securely transferring these tokens to a unified cold wallet. When users need to withdraw tokens, the Multibit Protocol destroys the corresponding number of tokens on the EVM chain and then transfers the equivalent tokens from the secure cold wallet to the user.

Two weeks ago, MultiBit garnered significant attention from the community due to the massive surge in its token MUBI. MUBI completed an auction on the Bounce Finance platform on the Ethereum chain on the 12th, with an IDO unit price of 0.00047 USD, raising 88 ETH. On the 14th, it completed an IDO on the TurtSat Bitcoin network donation platform at the same unit price, raising 4.64 BTC. The total fundraising from both auctions amounted to approximately 350,000 US dollars. On November 14, MUBI's opening surge reached 1140%, and on the 16th, it saw a 122% surge within 24 hours, pushing the price to 0.01385 USD.

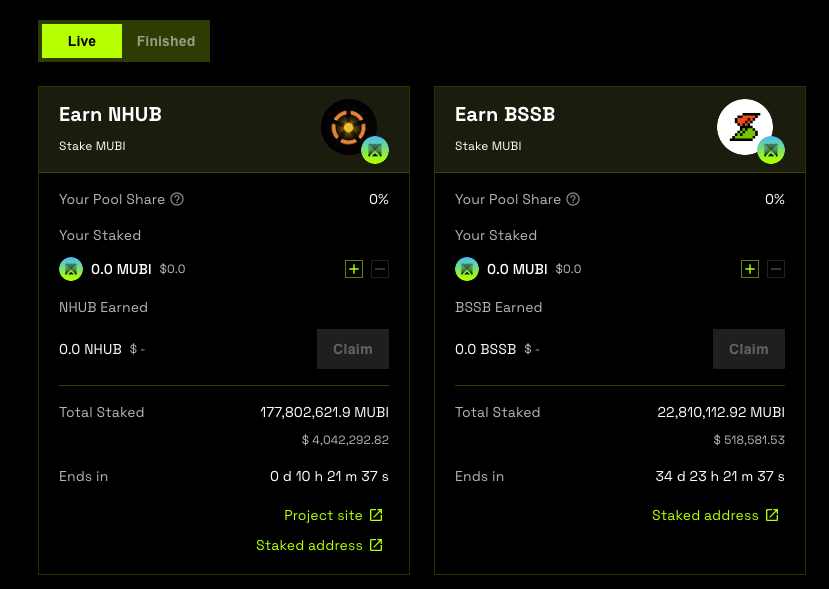

On November 26, MultiBit launched a staking system. Users can stake $MUBI tokens on the Mutibit platform to receive rewards in the form of ERC20 or BRC20 tokens. Currently, users can stake to receive NHUB and BSSB tokens, and at the time of writing, over 200 million MUBI tokens have been staked on Mutibit.

XLink

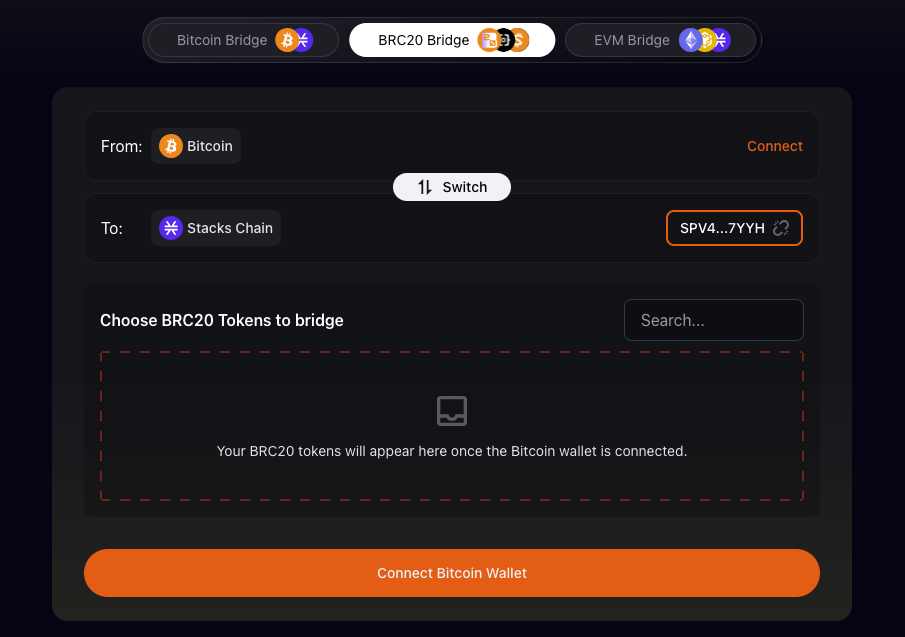

On November 24, the Bitcoin DeFi platform ALEX announced that its cross-chain component ALEX Bridge will transform into "XLink."

In its announcement, XLink's positioning is to "serve as the infrastructure connecting Bitcoin and its derivatives (such as BRC20), integrating the Bitcoin Oracle supported by ALEX to achieve seamless and secure bridging between Bitcoin and Bitcoin L1 assets." XLink can provide "native-like" BRC20 AMM or other DeFi applications for Bitcoin.

Before the separation of XLink, ALEX was an open-source DeFi protocol based on the Stacks public chain, with current mainnet features including Swap, lending, staking, yield farming, and Launchpad.

LSD

Fairlight CDP

FairLight CDP is a collateralized debt position protocol that allows users to deposit BRC-20 tokens, borrow BRC-20 synthetic assets sats, and then deposit sats to earn a portion of the borrowing interest as a reward. Users can also use FCDP tokens to participate in protocol governance and share protocol fees. On November 28, Fairlight appeared as a partner on the official website of UniSat.

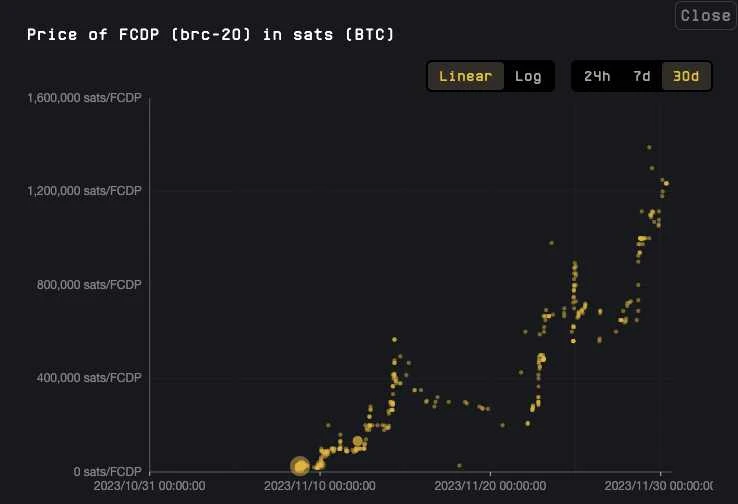

Developers have deployed a BRC-20 token called "FCDP" with a total supply of 16,180 (commemorating the birth of the natural logarithm base Euler's number e in 1618), with each inscription limited to 1. Developers have minted 207 tokens at the deployment address, accounting for 1.27% of the total supply, and all inscriptions have now been minted.

Fairlight's economic model aims to create a sustainable and growth-oriented DeFi ecosystem. The model revolves around the strategic use of SATS tokens and their integration with the UniSat Swap module, creating a stable and prosperous environment for all participants.

In DeFi, CDPs can facilitate various financial operations such as borrowing, leveraged shorting, and arbitrage. Therefore, FairLight CDP is expected to bring more trading volume and liquidity to BTC-20. Its token FCDP has also been well received by the community. According to UniSat data, since the launch of FCDP less than a month ago, its price has more than tripled. At the time of writing, its floor price is 0.01 BTC, and the total trading volume has exceeded 22 BTC.

CEX

Orders Exchange

Orders Exchange is the first fully operational decentralized exchange (DEX) with an order book on the Bitcoin network, combining the Ordinals protocol, PSBT technology, Bitcoin scripts, and the revolutionary Nostr protocol to create an interconnected on-chain trading market. Last week, Orders Exchange launched a liquidity mining activity.

PSBT (Partially Signed Bitcoin Transaction) is a standard format designed to simplify the processing of Bitcoin transactions that are not yet finalized. PSBT was initially introduced in Bitcoin Improvement Proposal (BIP) 174, and its core value lies in providing an efficient and secure collaborative process for constructing transactions, especially in cases requiring multiple signatures. By using PSBT, entities involved in the transaction can independently sign incrementally without disclosing sensitive data to each other.

By utilizing PSBT and multi-signature technology, Orders Exchange can implement completely trustless BRC20 liquidity pools. The liquidity provided by users is essentially a PSBT single-signature asset pair, with its output pointing to a multi-signature address shared by the user and the exchange. This design ensures that the exchange cannot directly cash out the PSBT and take the user's assets, thus protecting the liquidity provider's assets.

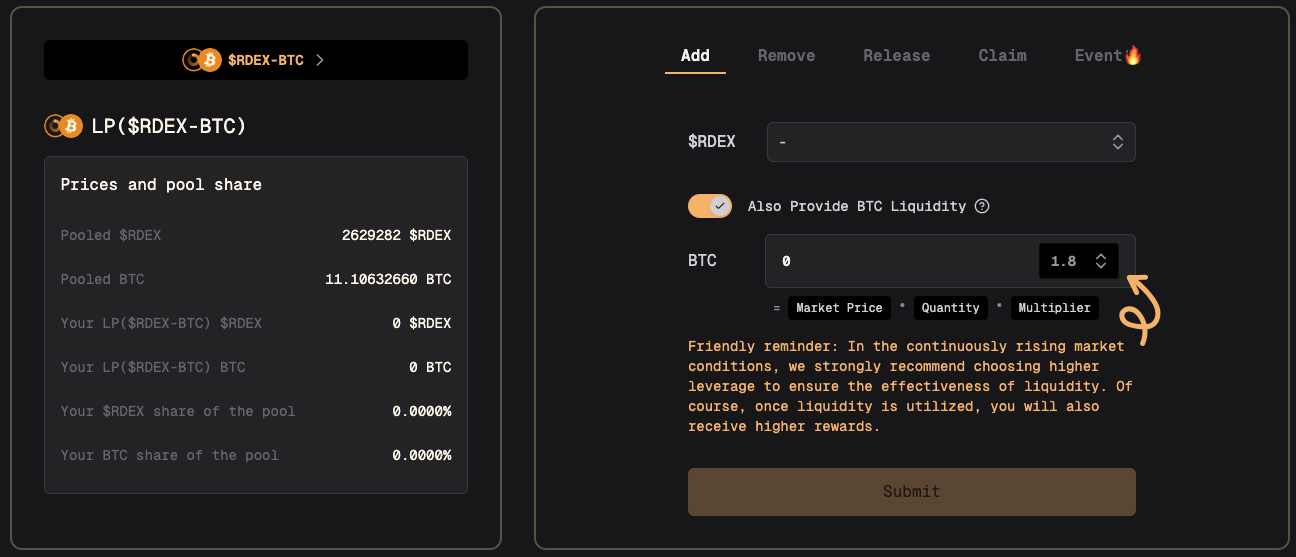

On November 24, Orders Exchange launched a 10-day "first-ever liquidity mining on the Bitcoin network" event, aimed at rewarding users providing liquidity and executing trades, and handling service fees for BID orders through buyback and burn. Users participating in the event can receive rewards in $RDEX tokens. Currently, the liquidity pool of Orders Exchange holds over 2.6 million RDEX tokens, valued at approximately 11 BTC.

Stablecoin

BitStable

BitStable is a decentralized asset protocol based on the Bitcoin network, allowing anyone to generate $DAII stablecoins collateralized against assets in the Bitcoin ecosystem through the platform. On November 29, BitStable completed an IDO on the Bounce Finance platform, but distribution issues arose due to a DDOS attack.

Related reading: "BSSB was attacked as soon as it went online, BitStable was questioned by the community for being a 'Rug'"

BitStable has a dual-token system and cross-chain compatible structure, with its tokens being $DAII and $BSSB. According to the official website, DAII is a stablecoin whose value and stability come from the robustness of assets in the Bitcoin ecosystem, including BRC20, RSK, and the Lightning Network, among others. Additionally, in BitStable's vision, with its cross-chain capabilities, DAII can also bring the Ethereum community into the Bitcoin ecosystem. The total supply of $DAII is 1 billion tokens.

BSSB is the platform's governance token, used by the community to maintain the system and manage DAII. BitStable also incentivizes holders of $BSSB through dividends and other measures.

Conclusion

In addition to the DeFi protocols listed above, there are also some early-stage DeFi protocols in the Bitcoin ecosystem, such as the open-source Bitcoin DeFi platform ALEX based on the Stacks ecosystem, whose token saw a surge of over 40% in the past two weeks. Furthermore, lending protocol MoneyOnChain and DeFi platform Sovryn on the Bitcoin sidechain RSK have also accumulated a certain amount of liquidity.

BlockBeats reminds that the development of DeFi applications in the Bitcoin ecosystem is still in its early stages, with significant uncertainty and risks. Investors are advised to fully understand the protocols involved, assess their risk tolerance, and make decisions cautiously before making any investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。