Preface:

In October, the CPI was lower than expected, prompting market cheers. The U.S. stock market showed a long-awaited unilateral upward trend, with the three major stock indexes poised to challenge new highs. Bond yields responded by falling. Star stocks in the popular AI sector, such as Microsoft and Nvidia, hit historical highs, with Nvidia's Q3 financial report exceeding expectations. The Japanese and European stock markets both saw moderate gains.

In the cryptocurrency market, the bullish trend in October came to an end. The Binance penalty "shoe dropped," but did not have a substantial negative impact on the coin market. The market continued the bullish price trend from October, with high-level fluctuations. The Binance incident is a milestone on the compliance road in the cryptocurrency market and is undoubtedly beneficial in the long run.

October CPI Lower Than Expected Sparks Market Cheers

On November 14, the U.S. October CPI data was released—overall CPI was 3.24% year-on-year and 0.04% month-on-month; core CPI was 4.03% year-on-year and 0.23% month-on-month, both slightly lower than market expectations. The news stimulated global stock market gains, with all three major U.S. stock indexes opening significantly higher, and stock markets in A-shares and Hong Kong following suit.

Not only the CPI, but U.S. non-farm data and PMI also indicated economic "cooling": in October, the U.S. added 150,000 non-farm jobs (market expectation 180,000) with an unemployment rate of 3.9% (market expectation 3.8%). Boston Fed President Rosengren expressed satisfaction with the non-farm employment data. The November Markit Manufacturing PMI for the U.S. was 49.4, below the expected 49.9, falling below the expansion line. The Services PMI was 50.8, reaching a new high since July this year, with an expected 50.3.

The aggressive interest rate hike policy of the Federal Reserve has already been reflected in economic data, and the market has also voted with real money for the stock and bond markets: throughout November, the Nasdaq index rose by more than 10%, while the previously soaring U.S. bond yields continued to decline, with the 10-year U.S. bond yield falling to a low of less than 4.4%.

In fact, the market's expectation of the Fed's pause in interest rate hikes or even rate cuts is increasing. In September, the Bank of England had already announced a pause in interest rate hikes. The global stock market rally brought about by the lower-than-expected CPI clearly represents a violent release of long-suppressed market sentiment. With the mild cooling of the economy, there will also be a fundamental reversal in market expectations for the future. It is expected that risk assets may usher in a new spring, while the appeal of safe-haven assets may weaken. Taking gold as an example, its price has been rising continuously for nearly a year, becoming a new favorite in the market. However, looking at its recent trend, there is a clear resistance plateau in the technical aspect, hovering around $2000.

Impressive U.S. Stock Market Performance, AI Sector Continues to Strengthen

The U.S. stock market saw impressive gains this month, challenging the cyclical peak at the end of July. The Nasdaq rose by over 10%, the S&P 500 by over 8%, and the Dow by over 7%. The Nikkei 225, Germany's DAX30, and France's CAC40 also saw encouraging gains.

Undoubtedly, AI remains the hottest investment theme in November, and OpenAI's recent "palace drama" has added countless topics and popularity to AI. Both Microsoft and Nvidia hit historical highs in stock prices this month.

We once thought that although Microsoft was the "big brother" in the PC era, it missed the wave of mobile internet. Now, with the trend of AI, Microsoft, with its forward-looking tie-up with OpenAI, is once again leading the world's technological direction, and its stock price is soaring. After the financial report was released, Nvidia's stock price experienced three consecutive declines, despite the very impressive data in the report. Nvidia's Q3 total revenue was $18.1 billion, well above the market's expected $16.2 billion; gross margin was 74%, expected 72.48%; and net profit was $9.2 billion, exceeding the market's expected $8.4 billion. However, such "exceeding expectations" did not reflect in the stock price. Major investment banks have raised their target prices for Nvidia, almost all of which are above $600.

The current market's general concern is that Nvidia's sales in China will be affected due to the ban, which will in turn affect its performance in 2024. However, Nvidia plans to launch a separate chip design plan for China to bypass the U.S. ban. WealthBee believes that the long-term demand for computing power is unquestionable, and Nvidia's Cuda ecosystem is a strong moat. There is currently no sign of an event threatening Nvidia's position, so there is no need to be overly concerned about its long-term trend.

Binance Penalty "Shoe Drops," Clear Path Ahead for Compliance

The biggest event in the cryptocurrency circle this month was Binance's hefty fine: Binance pleaded guilty, paying a fine of about $4.3 billion, and Zhao Changpeng resigned as CEO of Binance. Thus, the eight-month dispute finally came to an end. However, this incident did not have a serious impact on the coin market. Apart from BNB, the decline in other mainstream coins was not significant, and the entire cryptocurrency market is still on an upward trend.

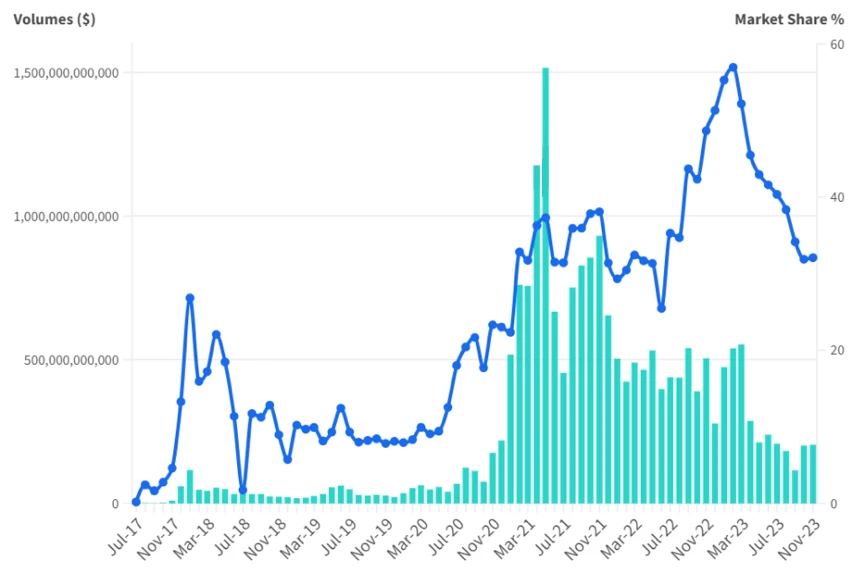

Although this incident did not disrupt the trend of the coin market, it undoubtedly shook Binance's market position. Binance's market share has been declining since the allegations, dropping from a peak of 60% to just over 30%.

However, the U.S. Department of Justice's penalty against Binance is intriguing. Although the Department of Justice's press release mentioned that Binance "funneled money to terrorists," the entire document actually emphasizes that Binance committed money laundering and is not under U.S. control, without categorizing Binance as "aiding terrorism." In the end, Binance reached a settlement with the U.S. by paying a fine and Zhao Changpeng resigning as CEO, and the U.S. did not push Binance to the brink of collapse.

The press release also mentioned, "U.S. investors, regardless of size, have shown a desire to include digital asset products in their investment portfolios. We have a responsibility to ensure that when they do so, the comprehensive protection provided by our regulatory oversight is in place, and to quickly address illegal and illicit activities." From this, it can be seen that the U.S. places more emphasis on compliance, and the official vision is to make cryptocurrencies a more compliant new investment product, to reduce various financial crimes and maintain national security (prevent funds from flowing to terrorism).

As virtual currencies become increasingly mainstream and compliance issues are resolved, more off-exchange funds are bound to enter the market. Binance's admission of guilt in this instance will subject it to more legal control and push it further towards compliance, transforming it into a regulated cryptocurrency entity and tool. In the long run, this is positive for Binance and the entire cryptocurrency market.

From recent public opinion, it seems that the launch of a Bitcoin spot ETF is getting closer. On November 23, U.S. SEC Commissioner Hester Pierce stated that the SEC has no reason to prevent the launch of a Bitcoin spot ETF. When considering Binance's regulatory actions and the current public opinion on spot ETFs together, it seems to be a mutual confirmation. Additionally, the impact of public opinion on ETFs on market sentiment is diminishing, with an increasing number of long-term holders indicating high expectations and indifference to short-term fluctuations.

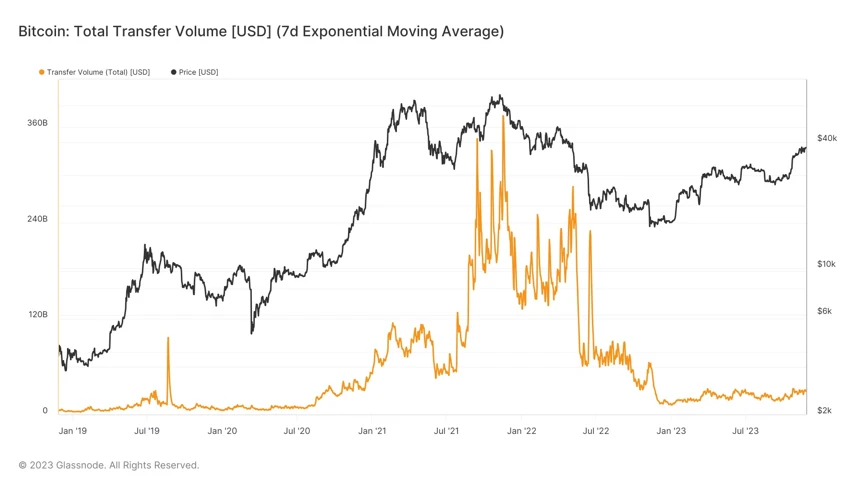

Bitcoin is currently fluctuating around $38,000, and there is no significant increase in trading volume, indicating a lack of external funds entering the market. If a spot ETF is approved, it will not only bring incremental funds from the ETF but may also attract conservative off-exchange investors. The incremental funds at that time may exceed BlackRock's estimated $200 billion.

Conclusion:

The Federal Reserve's interest rate hikes have undoubtedly been the core issue affecting the stock market and the entire secondary market in recent years. The market's concerns about this issue are gradually being alleviated, and the factors suppressing market sentiment no longer exist. Binance's issues have also been resolved, and compliance issues are gradually being addressed, everything seems to be developing in a better and clearer direction. The market has not seen a structural market trend like the "bullish stock and coin" structure in November for a long time. In the midst of the winter, holders have found warmth. However, any market rally is the result of capital driving it, and there is still no significant influx of off-exchange funds into the cryptocurrency market. The recent rise in the cryptocurrency market is still the result of on-exchange funds changing hands, so caution is still necessary, and "aggressive all-in" should be avoided.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。