Under the strong light, there are no clouds, and the sun is always shining through.

I want to dance with Zhuang, just for a certain look from you. 24-hour real-time guidance, helping to quickly turn over positions.

Trend/position/skill, all three are indispensable!

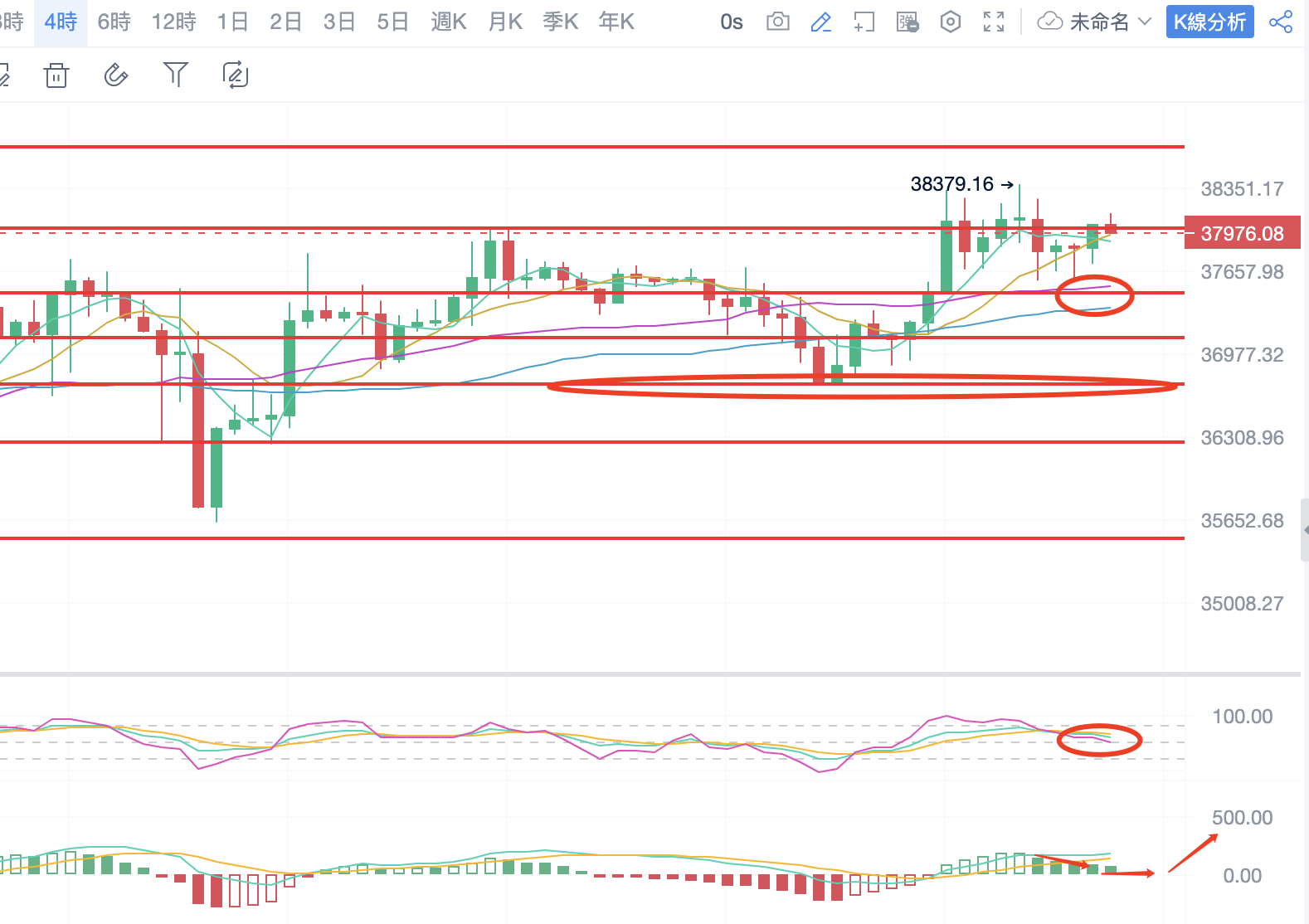

Bitcoin climbed to a new high in the sixth cycle yesterday. There were dozens of attempts near 38000-38500 on the same day. It is not difficult to see from the behavior of the market that its only purpose is to achieve a breakthrough. Prior to this, in the previous original article, I had informed everyone in advance that every time it reached a new high, it was mainly supported by a large box at 35300-35500, and in the recent two market movements, it did not return to the original support, but instead slightly fell back and continued to fluctuate around the previous narrow range box pressure of 37200-37400. I have said before that oscillation is accumulation of power, and accumulation of power is to determine the direction. The obvious upward movement of support indicates that this position may form a top-to-bottom conversion, and it will continue to test new highs in this area. As expected, it moved up from this position the day before yesterday, and yesterday it directly surged at the top-to-bottom conversion, repeatedly testing and breaking through dozens of times, forming shorter and shorter breakthrough cycles. The above is the reason and consequence of the market trend brought by me, which may be understood more thoroughly. As for the strategy given last night, support is given to short positions near 37300-37500, and resistance is given to short positions near 38000-38500. Long positions can refer to support for entry and resistance for exit, while short positions can refer to resistance for entry and support for exit. I have repeatedly mentioned these in the original article. I am afraid of novice users who, although given the strategy in advance, do not know how to use it, which is a pity. Short positions near 38000-38500 were traded many times throughout the day yesterday, and both internal guidance and external fans, I believe, were well-fed. The overall gain yesterday was at least 2000 points! At present, after falling back to the support range given in the evening and then rising to a new high in the morning, it has been proven that the support has indeed moved up, further confirming my previous prediction. Therefore, for the current market, everyone can pay attention to the resistance near 38300-38500 and the support near 37300-37500, and those who are more conservative can pay attention to the support range near 36600-36800. The idea is very simple: if the new high is stably broken, directly chase long positions; if not, continue short positions.

In general, the overall trend of Ethereum is actually similar to that of Bitcoin. However, looking at yesterday's market trend, although the trend is the same, those who are a little more attentive should be able to notice that while Bitcoin was repeatedly testing new highs throughout the day, Ethereum was also testing the upside, but not at the new high, but near the short-term resistance of 2060-2080. After Bitcoin's surge ended, it will be Ethereum's turn to exert force. I believe that overall, Ethereum is still mainly bullish. The 4-hour chart shows that the 30-day moving average and the 60-day moving average are at the top of the candlestick, indicating a downward trend. Combined with the current chart indicators, Ethereum may first fall back and then complete the upward surge. The key focus is on the short-term resistance near 2060-2080. For those who want to go short at this resistance, they need to be aware that since Ethereum is mainly bullish overall, the short-term resistance carries greater risk. If you want to go short, you can only focus on short positions and must set a good stop loss. The aggressive support is around 2020, and if there are short positions entered earlier, the short-term exit can focus on this support, while the conservative support is around 1960-1980, and the bottom of the box is around 1910-1930. At this time, based on the fluctuation range of Bitcoin yesterday, we need to pay close attention to the new high resistance near 2120-2140. If it is not broken, continue short positions; otherwise, the opposite. The general direction is not much different from Bitcoin.

Daily guidance updates are available on the Coinshangcheng public account for friends who trade small coins!

This article is exclusively created by Teacher Chengcheng, specializing in the style of mobile lock-up warfare focusing on high and low support and pressure, short-term band high and low, and medium and long-term trend trades.

Friendly reminder: The content at the end of the article and in the comments section is unrelated to the author. Please discern carefully. Thank you for reading!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。