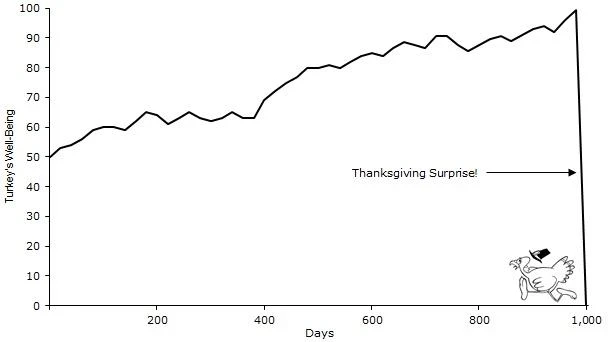

The "turkey problem," proposed by Nassim Taleb in his best-selling book "The Black Swan," tells the story of a turkey in a coop. Every morning, the farmer would bring a bowl of corn to feed it. Over time, the turkey developed a habit and learned to associate the sound of the farmer approaching the coop with mealtime. It concluded that whenever the farmer approached, it was time for a feast, the happiest time of its day.

On Thanksgiving Day, the farmer, as usual, approached the coop, and the turkey, as usual, rejoiced. However, to the turkey's surprise, the farmer was not carrying corn but an axe. Because it was Thanksgiving, the farmer was coming to slaughter the turkey for the feast. The poor turkey, facing its demise, may not have understood why its rule of "farmer comes, there's corn to eat" no longer applied.

The essence of the turkey problem is our tendency to seek patterns in events that have no inherent pattern, or to generalize based on limited samples. Such behavior is prevalent in financial investments.

In the investment field, we often encounter strategies or models with outstanding backtesting results, but when applied to actual trading, their performance falls far short of expectations. This phenomenon is vividly referred to as the "turkey strategy," akin to fattening a turkey only to slaughter it. This article will explore how to avoid investing in seemingly ideal but underperforming strategies to protect investors' interests.

In the current environment of rising interest rates, more and more investors are turning their attention to the diminishing risk-return ratio of real estate and traditional industry investments, leading to increased interest in quantitative investment. However, the market has seen the emergence of many uneven quantitative investment teams, some of which have achieved remarkable returns in a short period and begun aggressively promoting financing. Yet, when the market environment changes or a black swan event occurs, these teams' performance experiences a precipitous decline, ultimately becoming failures in the industry.

These quantitative teams face common problems. Firstly, their live trading experience is relatively short, lacking the test of different market environments. The lack of long-term market validation renders their strategies unable to operate stably in various market conditions. Secondly, these teams have imperfect risk control systems. Effective risk control is crucial in investments, but these teams often have deficiencies in establishing and executing risk control systems, unable to promptly respond to market volatility. Additionally, their profit logic often lacks clarity, with a lack of deep understanding of the principles behind their strategies, resulting in low adaptability to the market and an inability to flexibly respond to various situations.

To prevent investors from falling into these problems, we need to take measures to improve the understanding of quantitative investment.

Firstly, investors should choose quantitative investment teams with long-term validation, demonstrating their ability to maintain stable returns in different market environments. This means the team needs to have a long period of live trading experience and prove that their strategies can effectively execute in various market conditions.

Secondly, it is essential to ensure that the team has a sound risk control system, capable of promptly identifying and controlling risks to protect investors' interests. This includes establishing effective stop-loss mechanisms, diversifying investment risks, and regularly evaluating and adjusting strategies.

Furthermore, investors should deeply understand the team's profit logic to ensure the reasonableness and feasibility of the strategy's underlying principles. Only by understanding the essence and execution of the strategy can investors better assess its potential risks and returns.

In investment decision-making, we should be wary of the existence of "turkey strategies" and consider the following important factors when selecting quantitative investment teams:

- Understanding the limitations of backtesting? Backtesting can only simulate based on past data and cannot predict changes in future markets.

- Possession of long-term live trading experience? The team's live trading experience can prove the performance of their strategy in real market conditions.

- Having a sound risk control system? Risk control is crucial for protecting investors' interests. The team should be able to promptly respond to market fluctuations and take corresponding risk management measures.

- Having a clear profit logic? Investors need to deeply understand the principles behind the team's strategy to ensure its reasonableness and feasibility.

- Ability to adapt to different market environments? The team should be able to flexibly respond to various market conditions, rather than relying solely on specific market conditions.

- Possession of unique competitive advantages? The team should have unique characteristics or technical advantages that enable them to stand out in a competitive market.

In conclusion, to avoid falling victim to turkey strategies, investors should carefully select quantitative investment teams and consider factors such as the team's live trading experience, risk control system, profit logic, market adaptability, and competitive advantages. Through rational selection and investment portfolio management, investors can better protect their interests and achieve long-term stable returns.

Twitter: @DerivativesCN

Website: https://dcbot.ai/

Medium: https://medium.com/@DerivativesCN

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。