Original Author: Ginger Lao Qin @Starbase (X: @ASuperGinger), Blocklike CEO

Preface to the article:

The decision to start writing this article was made in the new year of 2023, more than a month after the FTX collapse, out of great curiosity about how CZ was able to push the end of FTX through a few tweets and began to look for the development context of Binance. It took nearly 3 months to clarify the development history and business focus of Binance, but due to some key issues not being complete, it has not been published.

It wasn't until I saw the latest news about Binance: "Binance to Pay $4.3B to Settle U.S. Criminal Case; Changpeng 'CZ' Zhao Resigns as CEO and Pleads Guilty in Seattle." (from Coindesk 2023.11.22)

The regulatory sword hanging over Binance has fallen, the dust has settled on the CZ era of Binance, the missing core part of the article has been completed, and it can finally be published.

Table of Contents

Binance's thrilling debut and twists and turns to establish a foothold

Establishing a business moat

Expand the liquidity pool and enrich the trading scene

Capital operation stacking BUFF, increasing FOMO effect

Seizing the cycle, the fate gear rolls rapidly

Market slack period, all are moments of hunting for Binance

Decisively abandoning China, growing under global challenges

Under the public chain war, the decentralization transfer of BNB

Seizing FTX's asset security loophole, a fatal blow to the competitor

Difficult to break compliance constraints, a showdown leading to exit

Where is the future of Binance

Speculation 1: What crisis will Binance face in the future

Speculation 2: The race track that Binance may focus on in the next stage

Preface

Binance has become an enviable and awe-inspiring enterprise in the cryptocurrency industry.

This company, which is only over 6 years old, has become an unparalleled superstar team in the history of cryptocurrency under the leadership of CZ (Changpeng Zhao) through its globalization layout, the fast lane of market cycles, skilled and decisive decision-making, and a highly practical vision.

As of December 2022, Binance has over 120 million users worldwide, occupying over 70% of the entire cryptocurrency trading market share.

In 2022, the blockchain industry saw frequent bankruptcies, and the market's uncertainty about asset security reached a peak. Due to CZ's role in the FTX incident, catalyzing a new round of collapse, the industry suddenly entered a deep bear market. Many institutional and individual investors have not yet recovered from the shock of their assets being wiped out in half a day, and the domino effect of blockchain companies like FTX collapsing at lightning speed has not ended.

It's hard not to agree that after this round, there are no institutions that can compete with Binance. A sarcastic saying circulating in the industry can prove its status, "There are two types of exchanges, one is Binance, and the other is non-Binance." Perhaps many participants in the market have a subtle unease, which comes from the question: why in the decentralized field, a centralized institution occupies a dominant position in the industry, is this a delicate balance?

However, today's Binance is not just an exchange anymore.

Looking back at Binance in recent years, almost all the important decisions at key points were positive and effective. With the bull market in 2017 and the following two cycles, we seem to be able to clearly feel the turbulence of Binance and its continuously growing strength.

This article focuses on sorting out Binance's business actions and development path from its establishment to the present, from the perspective of the development laws of the cryptocurrency industry, and deeply analyzes the important nodes in Binance's entrepreneurial path. If there are different opinions, feel free to discuss and correct.

Binance's thrilling debut and twists and turns to establish a foothold

CZ is good at trading. Before founding Binance, he was already a very experienced player in the trading field. From Tokyo Securities to Fusion, from OK to Binance, trading has been with him for over a decade.

If the experience of going all in on blockchain in 2014 and the experience at OK made him understand the game rules of decentralized finance, then founding Binance was his practical understanding of the game rules. In this new and fluctuating industry, there is nothing more adventurous than creating a complex and vast business empire with one's own hands.

July 2, 2017, the first token issuance (ICO) raised $15 million.

August 30, 2017, server migration abroad

September 4, 2017, the People's Bank of China officially announced the ban on ICO

September 2017, affected by the 94 ban, Binance compensated nearly $6 million in losses to 4 ongoing ICO projects

September 2017, Binance, which had been online for only 50 days, already had users from over 180 countries worldwide.

January 10, 2018, Binance's registered users exceeded 5 million, and the trading volume exceeded $10 billion, becoming the world's number one digital currency exchange

Binance's debut was not smooth sailing, and it was even very thrilling. The ICO fundraising method was very exciting for CZ, as its advantages could eliminate the problems of institutional investors holding too much of the project, uneven distribution, and too much intervention from investors. This crowdfunding model, similar to the internet, was very popular in the cryptocurrency market at the time. Investors were mostly individuals, and the investment chips were relatively dispersed. Based on the community-initiated user belief, it could gather more people with common understanding, who would generally vote (fund) for the project because of the founder's personal experience and project concept, thus giving recognition to the project's debut.

Turning Point One: Token Price Drop

ICO shifted the fundraising of projects from institutional to community-based. Binance's first round of fundraising was a great success, raising the equivalent of $15 million in Bitcoin and Ethereum. A month later, Binance officially launched BNB, but there was a situation of token price drop, and the community gradually began to express distrust, mainly because the price of BNB was lower than the ICO, making the first round of participants feel that they had lost their investment. At that time, Binance's exchange products were not yet online, and users could not obtain specific information about whether Binance would fulfill the product plans in the white paper, nor could they know what achievements this former co-founder and CTO, who had parted ways with OK in a messy breakup, could make.

Ten days later, Binance Exchange was successfully launched, but it still could not dispel the accumulated doubts of users. In the blockchain industry, 10 days is like 10 months, and many extreme situations can change. CZ even invested his own funds to subscribe to BNB, but the effect was minimal (some have pointed out that CZ left a window of opportunity to buy low BNB). The price of BNB dropped from the ICO price of $0.15 to a low of $0.0997 in August.

Turning Point Two: He Yi's Joining

In reality, Binance urgently needed to boost users' confidence. After enduring tremendous pressure for over twenty days, good news arrived: Binance announced He Yi's joining. Before this, He Yi had successfully led OK to break into the public eye as a senior media figure, and her role in OK's acquisition of traffic in mainland China cannot be ignored. Early users of the blockchain in China had high praise for her. Her joining was a shot in the arm for Binance, and based on users' trust in He Yi, the price of BNB gradually stabilized.

However, Binance's early crisis was not completely resolved. In August 2017, just two months after the completion of the ICO, rumors of the 94 ban reached Binance's office in Shanghai. For security reasons, CZ moved the entire team to Japan, completely leaving China. At that time, Japan was the world's first country to recognize cryptocurrency as a financial asset, and with a moderate regulatory environment, it could become fertile soil for the development of decentralized finance.

Turning Point Three: ICO Restrictions

In September 2017, Binance, which debuted through ICO, was responsible for launching multiple new projects in the same way. The "94 ban" had a very significant impact on it. The People's Bank of China officially announced the ban on ICO, and these new projects suffered greatly due to the sudden policy change. In order to maintain its reputation, Binance decided to compensate all the losses of nearly $6 million to its users. Binance's brand had just begun to build up.

Turning Point Four: Leaving Japan

In January 2018, cryptocurrency worth $530 million was stolen from Coincheck, making it the largest cryptocurrency theft at the time. Shortly thereafter, the Japanese Financial Services Agency issued eight "clean-up orders" and conducted inspections of 32 cryptocurrency exchanges in Japan. Many exchanges were either fined, ordered to rectify their operations, or shut down.

Binance, which had just established itself in Japan, faced a phishing attack and received warnings from the Japanese government regarding compliance and fund security issues. Due to Japan's ambiguous attitude, uncertain business conditions, and overly strict policies, Binance decided to abandon Japan as a key country for global business expansion and instead accepted an invitation from Malta, which had a more open attitude. From then on, Binance embarked on a global compliance exploration journey.

Turning Point Five: Crisis Resolution

The addition of excellent partners boosted confidence, established the brand, stabilized the token price, and established a foothold in a country with open policies, allowing Binance to overcome the first hurdle of the startup team. Addressing market confidence issues, sufficient cash flow, the bull market opportunity at the end of 2017, breaking free from regional policy restrictions, a good market reputation, and explosive growth in the number of users and trading volume gave Binance the confidence to expand significantly.

As the much-talked-about "frenzied bull market" slowly began in January 2018, the secondary market reached the peak of that cycle. In just six months, Binance completed its first overtaking maneuver with the help of market momentum, surpassing 5 million registered users and $10 billion in trading volume, securing the top position in the digital asset trading platform.

Establishing a business moat

If Binance hopes to replicate the "Malta olive branch" style of global compliance landing, it must have a more complete industry chain that can help local governments generate economic income, solve local employment issues, and bridge the trust gap between the blockchain industry and traditional industries.

Martial arts in the world are fast and unbreakable. Binance's business expansion is rapid. The essence of trading is the monetization of traffic, and increasing the efficiency of monetization is achieved by leveraging investment. Binance only needs to do three things to quickly complete the basic business loop: gain more traffic through the brand, improve more trading scenarios, and increase the efficiency of traffic monetization while strengthening the brand.

We can classify Binance's existing business structure according to a triangular structure, and we can see that no matter which line, the ultimate goal is to serve trading. Trading, like selling water, is all about traffic. While Binance is expanding its parallel businesses, its core goal remains to acquire traffic to serve trading itself.

Traffic expansion business: Listing, BSC ecosystem projects, external media, communities, wallets, live streaming, feeds, digital identity (BABT), market data platforms, Binance Academy.

Trading scenario business: CEX, DEX, NFT platform (IGO chain games), Launchpad, derivative trading (contracts, futures, leverage), cloud services, Binance Savings, earning business, staking business (mining pools, dollar-cost averaging, staking), financial services (exchange and payment, gift cards), institutional users (asset management, lending, brokers, OTC, API services), stablecoins (BUSD).

Branding business: Binance Labs incubator, BSC ecosystem fund, Binance Research Institute.

Expand the liquidity pool and enrich trading scenarios

In December 2022, CZ stated in a TechCrunch video interview that 90% of Binance's revenue comes from trading fees, and according to Bloomberg's analysis, Binance's revenue for the entire year of 2022 was approximately $20 billion.

Where does the traffic come from?

First and foremost is the attractiveness of the assets themselves, raising the threshold for listing spot assets, allowing popular assets with traffic and heat to be listed, and handling the trading volume of project transactions. It is generally expected that projects listed on Binance will have 20 times the baseline growth potential, and the instant traffic in the spot market is very high.

Secondly, the layout of wallets and data platforms, which are generally considered to be traffic gathering places in the blockchain market. The former can help the market accumulate users with different trading values, while the latter can help the market reach cryptocurrency enthusiasts.

Furthermore, in addition to listing more popular spot assets and improving existing trading scenarios within the platform, assets that cannot be selected by Binance's exchange have also expanded to more trading channels. For example, using payment products to access project parties, embedding payment channels for asset exchange using BNB, allows many assets to generate transaction fees without being listed on the exchange.

Additionally, Binance places great importance on Key Opinion Leaders (KOLs) because they have large traffic. Policies and benefits for KOLs, such as trading rebates and CZ's attention, can allow KOLs to promote Binance in their social circles. In addition to PR in the early years, KOL gatherings are the only events Binance attends at any conference or industry event.

The Academy and Research Institute are responsible for basic and in-depth education for users, converting the most difficult-to-activate users through content.

Where does the traffic go?

Binance has successively captured mainstream trading users through spot trading, new coin Launchpad, and derivative trading businesses. At the same time, it has gradually established compliant cryptocurrency exchanges and fiat exchanges worldwide, updated products in over 40 languages, and captured trading traffic globally.

With the rise of DeFi in the cryptocurrency space, Binance has not missed out, decisively launching Dex, stablecoins, and lending businesses, gradually penetrating more traditional trading scenarios.

In response to large capital, Binance provides services for institutional users, offering convenience for market makers and institutions to enter and exit, expanding trading business to low-frequency high-value scenarios.

Binance has also capitalized on the hot trends of NFT and GameFi, pioneering the opening of an NFT trading section within the Cex exchange, attracting active users in the global Web3 direction, and expanding trading scenarios to the popular NFT track.

Binance's trading landscape covers over a dozen fields and more than 30 trading scenarios, which can maximize the digestion of trading users with different needs from various fields.

Capital operation stacking BUFF, increasing FOMO effect

Scene + traffic + brand is the stable architecture of Binance's business expansion. The best way to acquire traffic is through projects, planting a seed, watering it, flowering, and harvesting the fruits. In this financial game market, strengthening the brand with capital is undoubtedly the amplifier for all businesses.

Traffic assets/KOL/brand outreach to a wide market → Global hackathons → Public chains (BSC) access projects → Support funds (MVP) acceleration → Binance Labs investment incubation → Import of Binance system resources → LaunchPad (IGO)/NFT market (IGO) → Cex/Dex secondary circulation → Cryptocurrency use cases

Regardless of which stage a project (team/developer) enters from, it can be labeled with the Binance brand, which allows it to ride the fast train brought by the Binance brand in its development path. Once all aspects of this business logic are connected, Binance can become a mature "dream factory," obtaining more monetization from projects. In this process, the power of capital can be fully utilized.

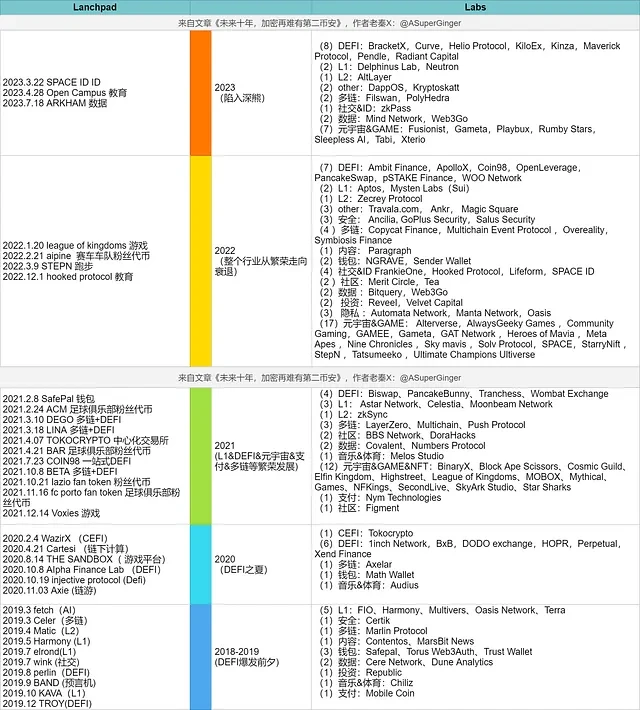

Binance Labs is a business unit formed after the release of Binance products, and its investments and acquisitions have spanned all paths of Binance's development to date. Comparing Binance's market investment direction and investment decisions with Launchpad can clearly sense its grasp of the market rhythm.

(The following are all public data, and undisclosed investment information is not included in the analysis)

Looking solely at Binance's past acquisition cases, from the controversial acquisition of Coinmarketcap, the acquisition of the JEX futures trading platform, to the Indian cryptocurrency exchange WazirX, all of these are part of its efforts to build a complete cryptocurrency landscape. At that time, there was no dominant exchange among the top-ranked exchanges worldwide. Binance's acquisition cases and the corresponding opening of each traffic entry point have allowed it to gain the upper hand in global layout, with each cycle's hotspots erupting and influencing investment trends and publicity.

Binance Labs can be summarized around two main themes: industry ecosystem positioning with a layout trend of large traffic bursts, and Binance ecosystem expansion with short-term external traffic effects and traffic circulation capabilities.

Industry Ecosystem Positioning

Binance Labs has invested in numerous fields and concepts, not just staying within its familiar areas.

- 2018–2019

Binance Launchpad & Binance Labs accurately seized the L1 track, launching well-known public chain projects such as Harmony, KAVA, Terra, and Oasis Network, most of which achieved brilliance in the 2020–2021 period.

- The DeFi summer of 2020

Binance Labs invested in many well-known DeFi projects such as 1inch Network, DODO, and also ventured into the non-mainstream GameFi track at the time, launching Axie & Sand Box, leading the way for the subsequent explosion of GameFi and metaverse concepts.

- Binance Labs' large-scale investment phase in 2021–2022

Included numerous traffic-oriented projects such as NFT and GameFi. However, during this period, apart from a few projects like StepN, it has been difficult to replicate the brilliance of 2019. This may be due to the significant entry of Western capital such as A16Z, Paradigm, Coinbase, which has gained a significant amount of influence.

Binance Ecosystem Expansion

Binance Labs has invested in numerous platform projects, including cryptocurrency infrastructure, compliant exchanges in various countries, financial platforms, investment platforms, and quantitative platforms. This is an extension of its own market and business, as well as a demonstration of its strength through investment actions.

- Around 2018

Its investments in infrastructure, such as wallets Safepal, Trust Wallet, are deeply tied to Binance.

- 2020–2021

Cryptocurrency market holdings and liquidity have a certain foundation, and the derivatives market has become a battleground for exchanges. Binance successfully entered the derivatives market with the internal testing of its futures product and the acquisition of JEX. In the same year, there were cases such as WazirX, Tokocrypto, which helped Binance expand into the Indonesian and Indian markets.

- 2022

Binance Labs' investment target WOO Network provides liquidity in a dark pool manner, helping Binance manage liquidity.

- 2023

Projects invested in by Binance Labs, such as Open Campus, Hooked Protocol, CyberConnect, have gone online on the BSC Chain, deepening their ties to the Binance ecosystem, sparking community speculation about the exchange of benefits. Binance also launched a Web3 wallet with low usage barriers, integrating 1inch, theoretically breaking down the barriers between Binance exchange users and DeFi users.

Binance Labs' investment in numerous GameFi projects has greatly aided traffic growth and enriched Binance's asset types.

From this perspective, the expansion of the Binance ecosystem is both horizontal and vertical: one direction is the expansion beneficial to the Binance trading platform, broadening Binance's strength and consolidating its cryptocurrency landscape; the other direction is to promote concepts that may develop into trends, including predicting future market trends, creating heat, forming trends, and ultimately bringing alpha returns, benefiting the entire ecosystem.

Binance Labs' investments over the past six years, due to the platform's own attributes, are different from other native cryptocurrency investment institutions. Binance's investments do not solely focus on the pure secondary market investment returns, but rather on seizing opportunities and generating traffic effects, making money first, and then discussing ideals. It must be said that the "short-sightedness" of a business expansion period with a single goal is a strategic approach.

Seizing the Cycle, the Fate Gear Rolls Rapidly

Combining the development cycles of the blockchain industry and Binance's annual announcements and media reports, a summary of Binance's business progress over the years reveals that from trading expansion to investments, infrastructure, ecosystem, brand public welfare, and other business lines, Binance has almost hit every suitable timing in the cryptocurrency cycle, with its business moat steadily growing year by year.

2017–2018

Cryptocurrency Market Keywords: ICOs, Stablecoins, Public Chains & Dapps

The bull market in 2017 was driven by the ICO frenzy, with over 2,000 new projects added globally, and policies in various countries began to tighten in 2018.

Stablecoin markets were in the spotlight as a value anchor.

The top 30 mainstream cryptocurrencies saw the highest growth in the public chain field, with a concentrated outbreak in the second half of 2017.

DApps took over the public chain's popularity, but security issues made them a target for hackers.

80% of Bitcoin and Ethereum's hash power was concentrated in China, but the policy changes in September 2018 led to a migration of hash power, and market funds were heavily invested in bubble projects. The Ethereum fork and the rise in Ethereum prices led to a death spiral for projects that raised funds using ETH, and the market plummeted.

Binance Keywords: Trading Traffic, BNB, Basic Business Development

Binance only had spot and futures trading, and to expand its trading user base, it implemented two very simple and effective policies: new coin listings and establishing the value of BNB.

Through zero fees, trading rewards, rebates, project token rewards, trading competitions, and developing a global ambassador program, Binance captured active users in the cryptocurrency market. BNB began to be linked to functions such as trading platform fee discounts, profit sharing, voting for listings, and participating in trading platform decisions.

Binance's basic business structure, such as Labs, Binance Chain, Launchpad, DEX, Charity, Academy, Research, Trust Wallet (acquisition), and Uganda, played a crucial role in capturing market traffic and providing brand value for later stages.

2019

Cryptocurrency Market Keywords: Institutional Entry, DeFi's First Year

The IEO led by Binance drove the first half of the year, but the ICO bubble dominated by the Ethereum ecosystem continued to burst, with Bitcoin's "siphon effect" capturing up to 70% of the market share.

Native crypto VCs experienced a mass extinction, with over half of the top ten active crypto funds in the United States.

Traditional institutions represented by Grayscale and Fidelity attracted over $20 billion in venture capital.

Huobi Global, OKEX, Binance, Coinbase, and BitMEX dominated the market.

The liquidity of the spot market dried up, and blockchain applications shifted towards DeFi, with financial services (settlement and clearing, cross-border payments, insurance, securities) gradually maturing. The DeFi triumvirate (stablecoin market, lending market, Dex market) gradually demonstrated scale amidst regulatory challenges.

Binance Keywords: IEO, derivatives, BSC, compliance

After the launch of Launchpad in 2017, there weren't many projects, but the first project BTT relaunched in 2019 and sparked a new market trend.

Only 33 tokens were listed in 2019 due to low liquidity in the spot market. Binance introduced futures trading and laid out derivatives such as lending, futures, and wealth management to increase user trading frequency.

Binance Chain and Binance DEX were launched, with 121 trading pairs going live on Dex throughout the year, and a total of 165 BEP2 tokens issued based on Binance Chain.

BNB's global use cases expanded to over 180.

Binance Incubator incubated 21 blockchain projects and directly invested in 14 blockchain projects.

In September, the compliant stablecoin BUSD was issued, receiving approval from the New York Department of Financial Services (NYDFS) through a partnership with Paxos.

Binance established five fiat platforms covering over 170 countries and regions globally, supporting 300+ payment methods.

2020

Cryptocurrency Market Keywords: Bitcoin value return, Ethereum as the king of public chains, Polkadot/NFT rise

The total cryptocurrency market value increased by nearly 400% year-on-year in 2020, with various institutions and enterprises led by Grayscale Trust continuing to increase their holdings of Bitcoin, which accounted for up to 69% of the total market value.

The total value locked in Defi protocols increased 23 times from 2019, and the Dex, lending, stablecoin, aggregator, and other markets saw a frenzy of activity.

Layer2 scaling solutions emerged, the launch of 2.0 beacon chain, and the prosperity of DeFi made Ethereum the application chain.

Polkadot, NEAR, Cosmos, Solana, Avalanche, BSC, and OKEXChain also entered the DeFi space.

From September, the sales volume and amount of NFTs increased significantly, with major applications and transactions focused on games, virtual worlds, and crypto art collections, with OpenSea as the leading exchange.

Binance Keywords: DeFi, smart chain (BSC), comprehensive business

Binance's total trading volume exceeded $3 trillion, with 184 spot listings.

BSC project deployment accelerated, with a $100 million seed fund established. BNB shifted from a platform token (centralized business anchor) to supporting decentralized business, with a total market value reaching $5.3 billion and 27 new applications/platforms supporting BNB.

Binance's total trading volume for contracts, options, and spot leverage exceeded $1.7 trillion, with a total fiat order volume exceeding $31.9 billion, C2C total order volume exceeding $6 billion, and OTC commodity trading platform total trading volume reaching $700 million.

BUSD ranked 4th in the global stablecoin market, Trust Wallet users surpassed 5 million, and Binance Mining Pool ranked 3rd globally in network hash rate.

Binance Launchpad sold 6 tokens, raising $14.72 million; Binance's new coin mining Launchpool provided liquidity pools for 8 projects, with a total locked value (TVL) of $9 billion.

2021

Cryptocurrency Market Keywords: Mining migration, Meme coins, NFT, regulatory tightening, institutional reshuffle

The total cryptocurrency market value reached $3 trillion at one point, with a thriving primary market and mainstream capital entering the space.

Bitcoin reached a price of $64,000 per coin, China's severe crackdown on Bitcoin mining led to a 50% price drop, and the industry experienced a historic migration of mining operations.

Leading Meme coins entered the top 10 cryptocurrencies, and NFTs from NBA Top Shot, Beeple, CryptoPunks, and BAYC-like blue-chip NFTs flooded the market.

The NFT market and infrastructure exploded, new public chain ecosystems emerged, GameFi and DeFi continued to evolve, and leaders in various sectors such as the metaverse and DAO were born.

The SEC approved a Bitcoin futures ETF; Bitcoin became legal tender in El Salvador; compliant crypto companies like Coinbase went public; NFTs continued to penetrate traditional domains; and Chinese institutions gradually lost ground in the crypto battleground.

Binance Keywords: BSC, NFT, investment

The DeFi summer was an opportunity for Binance to advance BSC, with active projects on Ethereum gradually joining BSC.

Within a year of its mainnet launch, BSC's daily transaction volume surpassed Ethereum by nearly 7 times.

The NFT market officially launched, with over 2.5 million NFTs issued on Binance in 2021, including over 1 million blind boxes covering art, sports, entertainment, fashion, virtual land, and over 1 million game NFTs from over 60 game projects.

2022

Cryptocurrency Market Keywords: Fed rate hikes, hacker attacks, Ethereum upgrade, new public chains, Hong Kong opening

In January, StepN's market value peaked and then abruptly entered a death spiral.

The largest-scale hacker attack in history, with projects like Ronin Cross-Chain Bridge, Horizon Bridge, and Nomad Bridge being collectively hacked for $3.8 billion.

The collapse of Luna and Terra led to a liquidity crisis for mass lending institutions, with Three Arrows Capital going bankrupt and Celsius, Genesis, and others severely affected.

FTX's collapse, including platforms and institutions like Grayscale, DCG, and Amber Group, faced severe liquidity crises.

Ethereum's transition from POW to POS, with new public chains led by Aleo and Aptos becoming market narrative hotspots.

Binance issued a soul token; Web3 exploration by Web2 brands like Starbucks and Nike; and Hong Kong's embrace of the virtual asset industry.

Binance Keywords: Chain games, RWA, investment

The NFT sector has become more community-oriented, entering the chain game track, supporting IGO, and minting and listing over 2.6 million NFTs, and reaching top-level cooperation with some well-known figures in sports, music, and entertainment.

In addition to the continued activity of Binance Live, in 2022, Binance launched Feed, providing a platform for over 1,000 crypto content creators, covering over 1 million daily active users.

Binance launched and tested Binance Card in 6 countries, allowing users to directly use the Binance Wallet to make cryptocurrency purchases at merchants that support Visa or Mastercard. Binance Pay added 7,983 merchants and partners, supporting over 70 cryptocurrencies for use in 70 different markets, covering scenarios such as recharging, travel, consumption, accommodation, ticketing, and tipping.

Binance Labs invested in Layer 1, Layer 2, DeFi, security, multi-chain, content, wallets, social, etc., with the metaverse, GameFi, and NFT projects remaining the main targets.

From the tumultuous history of blockchain technology development to the rise of crypto finance, the past few years have been a brilliant period for decentralized finance in the world, as well as a few years of grassroots surprise accompanying the battle of the gods. CZ led Binance to find opportunities for overtaking in different fields:

In 2018, IEO started and created a listing effect.

In 2019, it entered the top tier of exchanges through spot contracts.

In 2020, DeFi exploded, BSC captured traffic, and the ecosystem fund seized new projects.

In 2021, the NFT craze injected blood into the trading sector, and IGO ignited high-frequency traffic in GameFi.

In 2022, it embraced compliance and tradition through payments, and seized the largest competitor from the biggest security vulnerabilities.

The market's slack period was all moments of Binance's hunting.

Decisively abandoning China, growing under global challenges

In the early stages of blockchain market development, China, as a population dividend market, has always been the core active area of the global cryptocurrency market, and also has the largest community of Bitcoin miners and traders.

The "94 ban" made Binance determined to leave China. At this point, other exchanges that rely on the Chinese user market were hesitant, as once they leave, there is no turning back. Many exchanges claimed to clear out Chinese users, but their actual operations were tacitly carried out in China. The core teams did not directly leave China like Binance did until the policies in 2021 broke the dreams of domestic exchanges operating in mainland China, and they gradually left China.

In May 2021, China initiated a crackdown on virtual currency mining and clearing activities.

In September 2021, China completely banned virtual currency trading.

By completely cutting off the connection between the company and the mainland and fully expanding globally with users, whether in the past or present, it was the right decision, but also very difficult. CZ, who experienced the era of postal and telecommunication cards, deeply understands the unpredictability of the domestic trading environment. Although there are restrictions on compliance in overseas development, at least it won't lead to complete destruction. Under the suppression of various domestic policies, Binance's overseas expansion has actually gained more survival space in the exchange track.

In the first few years of going global, Binance had almost no major competitors in business expansion. Factors such as relatively lenient global policies, slow work pace of overseas teams, fast and simple product updates by Binance, Chinese users who rely on centralized exchanges, and the trust of Chinese crypto founders in CZ, allowed Binance to gain the first core users.

Although updating products to multilingual versions, recruiting more staff from language regions, researching and communicating with various country policies, and localizing account opening and licensing applications in any country are not easy tasks, Binance's focus on trading and users, combined with a global perspective, has given it a significant lead over exchanges restricted by domestic policies. While other competitors were struggling and trying every means to grow domestically, Binance had already expanded globally through legal and business operations.

Under the public chain war, BNB's decentralized shift

Binance has always been attacked by so-called "absolutely correct" investors for not being decentralized enough, and BNB tokens being dominant. However, the rise of BSC during the public chain war, coupled with the transitional phase of BUSD, transformed the value of BNB from an exchange token to a platform token. There were both active and passive elements in this process, but it cannot be denied that the exchange's public chain drove the ecosystem towards decentralization, and Binance delivered a relatively perfect answer.

In 2019, Binance launched a public chain, and the DEX based on Binance Chain officially went live. For Binance, the purpose was very simple: to acquire more on-chain projects and traffic. However, due to the lack of a mature business model and relatively centralized operation, the public chain competition was chaotic, and a few top decentralized public chains still occupied the absolute majority of traffic. However, batch acquisition of on-chain traffic is a trend, and the limitations of Ethereum in the market allowed Binance to not give up its attempts in this area. In September 2020, Binance restarted its underlying layout, launching the smart chain BSC, supporting EVM, compatible with Ethereum, supporting cross-chain interoperability, and fully integrating with Binance DEX.

In 2021, the DeFi market began with Ethereum, and at the beginning of the year, the total locked value of DeFi protocols exceeded $22 billion for the first time. "Liquidity mining" and other gameplay brought in over 1.2 million user addresses. Ethereum appeared congested due to the DeFi explosion, and its scaling solutions continued to be optimized. Polkadot received the highest attention due to its innovative governance collaboration mechanism, with over 320 ecosystem projects. The number of projects using Binance Smart Chain in the same year was 60. The important roles in the DeFi track have completed their initial positioning:

Chain (base layer): Layer1: Polkadot & Cosmos (dual chain), NEAR (sharded network), Solana (PoH clock mechanism), Avalanche (trichain structure); Layer2: Optimistic, ZK-rollup, etc.

Stablecoins: DAI (crypto asset collateralized), USDT, PAX, Basis Cash, etc.

Protocols/Applications: Compound, Aave, Synthetix, UMA, etc.

Automated Market Makers (AMM) or Dex: Uniswap, Sushiswap, Curve, Tokenlon

DeFi Tools: Aggregator (Yearn Finance, 1inch exchange aggregator, etc.), Oracle (Maker, ChainLink), Wallet (Metamask), etc.

The crypto market rapidly surged into a bull market due to the DeFi craze, and it was also a year when exchanges' smart chains joined the battle. The main characters of the DeFi summer are already in place. Ethereum's ecosystem overflowed, dividing traffic into several major factions: Polygon, which focuses on scaling; Polkadot, which focuses on mechanism innovation; Avalanche, Near, Solana, which focus on consensus innovation; and BSC, OKExChain, Heco, which focus on exchanges.

BSC's first ecological expansion is coming. Faster trading experience, lower gas fees, and Metamask support. The two key applications, AMM and lending protocols, are the first to lead the way: PancakeSwap and Venus, aiming at Uniswap and Compound. Binance has put a lot of effort into operating means under the $100 million ecological fund, establishing the MVP plan to support and assist developers; conducting farmer festivals to stimulate on-chain interactions; organizing global hackathons through Dorahacks to explore ecological projects; and accelerating the sales of NFT and GameFi in the NFT market sector.

Due to the similarity of BSC's iteration and deployment of applications to Ethereum, ecosystem projects have rapidly landed almost by copying and pasting, gathering Dex, Swap, banks, yield farming pools, stablecoins, insurance, oracles, and other track projects. It has also attracted continuous integration of projects from Ethereum, and then, due to the rapid trend of supporting GameFi, it has taken over the enthusiasm of the DeFi market.

BNB is no longer just the original exchange token; it has evolved to circulate throughout the entire blockchain ecosystem, even having a wider range of applications, playing an important role within and outside the Binance ecosystem. These applications include, but are not limited to: using BNB as trading fees on the Binance exchange; paying for transaction gas fees; participating in on-chain governance; providing trading support for hundreds of DApps, protocols, and games on the BSC chain; participating in the Binance ecosystem, such as in IEOs on Launchpad, staking on Launchpool, donations to Binance Charity, and making payments in thousands of online and offline consumption scenarios through Binance Pay/Binance Card.

After continuous expansion, BNB has become the fourth largest cryptocurrency in the market: with a total market value exceeding $36 billion, a circulating supply of over 150 million, and over 100 million total addresses holding BNB. Its price has also grown from the initial $0.1 to the current $237.

Seizing FTX's Security Vulnerability, Dealing a Fatal Blow to Competitors

In the second half of 2022, the crypto market, which had just experienced a black swan event, was hit hard again—FTX, the world's second-largest CEX, declared bankruptcy amidst global attention. FTX, as Binance's biggest competitor at the time, plummeted from the peak to the abyss in just a few days. With the collapse of SBF's crypto empire, the crypto community faced a Lehman moment, and Binance emerged victorious.

On November 2, 2022, Coindesk published an article pointing out that most of the net assets of Alameda Research, a cryptocurrency trading company owned by SBF, consisted of FTX's platform token FTT and tokens "controlled" by FTX. Of the company's $8 billion debt, $7.4 billion was actual US dollar debt. This meant that there was an abnormal and close relationship between FTX and Alameda, and if these tokens faced liquidity shortages and price fluctuations in the market, both would be at risk of insolvency. Coindesk's article became the catalyst for the entire incident, and in the following days, CZ used this vulnerability to swiftly attack FTX, accelerating FTX's demise.

In the early hours of November 6, a Twitter user named Autism Capital stated that Binance was preparing to sell the remaining 23 million FTT tokens in its account. This news quickly spread. On the evening of the 6th, Alameda CEO Caroline denied the rumor that "Alameda/FTX is insolvent," and then CZ tweeted that due to the recent exposure of the news, Binance had decided to liquidate all remaining FTT on its books. The price of FTT quickly dropped from around $24 to around $21. Although Caroline urgently tried to reduce the impact on the secondary market, nearly $1 billion in assets flowed out of FTX and Alameda's related wallet addresses that day. CZ's multiple tweets and mockery, along with questioning and "encirclement" from KOLs and the community, made SBF's defense seem weak and feeble.

The aftermath of Luna's collapse had not completely dissipated, and users could not bear the consequences of a major exchange that held the economic lifeline of many users collapsing. With a "better safe than sorry" attitude, a large amount of assets continued to flow out of FTX, leading to a rapid depletion of FTX's platform reserves. FTX-related coins such as FTT and SOL plummeted, continuously breaking through key price levels. On the evening of November 8, FTX suspended withdrawal requests on Ethereum, Solana, and Tron. Shortly after, SBF and CZ announced that Binance would acquire FTX. According to a report by WSJ on November 10, FTX faced a liquidity gap of up to $8 billion. Subsequently, Binance officially announced that, based on the results of the company's due diligence and the latest reports, it had decided not to seek a potential acquisition of FTX.com. FTX's collapse directly led to massive losses for investment institutions such as Sequoia Capital, Temasek, Tiger Global, SoftBank Group, Paradigm, and many platforms associated with FTX faced a liquidity crisis. The overall cryptocurrency market declined, and a large number of users who were originally with FTX flocked to Binance.

At this point, the outcome of this battle was basically determined. If CZ's previous actions played more of a supporting role, then the announcement of the acquisition of FTX and the subsequent withdrawal at a critical moment dealt a fatal blow to SBF. From an objective perspective, even if FTX had not collapsed at that time, it might have faced a crisis with the same situation in the future. CZ, with Binance's strong business operations, successfully hunted down the competition.

In fact, the feud between CZ and SBF had been going on for a long time, with both sides experiencing different stages from allies to friends and then to enemies. The struggle between CZ and SBF is not only due to conflicts and competition in business and ecosystem layout, but some believe that the struggle between the two is actually a collision of the forces/interest groups they represent. SBF has shaped an image of a white elite on Wall Street, representing the traditional financial power centered on Wall Street, while CZ represents an emerging, non-US-favored, crypto force led by a minority ethnic group (Chinese), building his own crypto empire with a global mindset.

Looking back at the entire process, CZ has always shown composure. As a leading exchange that controls the lifeline of a large number of users, Binance could not stay out of the market's condemnation of FTX. CZ may not have anticipated this, but he still chose to take decisive action. However, Binance experienced a certain degree of backlash—on December 13, Binance announced a temporary suspension of USDC withdrawals, intensifying market panic. Between December 12 and 14, net withdrawals from the Binance platform reached $6 billion. On December 14, CZ stated that this large-scale withdrawal event was a "stress test," which "helps build credibility for exchanges that pass the test." This reflects CZ's full confidence in his own abilities, Binance's sufficient funds, and its ability to "exit unscathed." This was partially validated in the subsequent regulatory and trust crisis that flowed into Binance.

Compliance Constraints Unbreakable, Exiting the Game

Binance had been trying to obtain a "partially legal" status in some global regions through diplomacy, acquisitions, joint investments, and charitable funding partnerships with local governments or compliance companies for a period of time from 2017 to the present.

In June 2021, amidst a booming new bull market and frequent asset theft incidents caused by the DeFi summer craze, global regulations became tense. Additionally, the Chinese government issued the strictest crypto ban in history, and the hash rates of Bitcoin and Ethereum were in a state of global migration. On the other hand, the Fomo sentiment driven by Meme in the secondary market had created a market bubble that was gradually bursting. Various exchanges around the world were affected to varying degrees, and Binance also began to face pressure from regulatory authorities worldwide.

With the changing forms of global crypto regulation and the gradual standardization of policies in various countries, compliance risks, along with issues such as opaque asset management, market confidence erosion, and resistance from independent national policies, continued to put Binance at risk of having to close local operations at any time, creating a crisis on the new battlefield. Although Binance had done better than any other crypto company globally, the expansion of its global business allowed it to avoid a devastating blow from the policies of a single country, and Binance's revenue soared in the industry wave during the crypto cycle.

Some people once joked that CZ "didn't have time to found a country," indicating that Binance's most challenging issue is still global compliance. So far, this is not an urgent issue for any company in the world, but it was for the past Binance, and it was dangerous and painful.

BUSD, once valued at over $22 billion and among the top three stablecoins, has exited the stage of history, and Binance has begun to yield to the SEC. However, what is surprising is that Binance's solution to the compliance issue is so magnificent, initially causing disbelief but upon closer examination, it is flawless.

There has been much discussion about CZ stepping down and Binance being fined. This introduction pays tribute to Binance's efforts to achieve global recognition and planning, as well as to CZ as the leader of the crypto industry. His clarity, decisiveness, and courage have charted the most stable path for Binance.

Speculation 1: The Crises Binance May Face in the Future

- Decision-making Mistakes by Top Executives

Under CZ's leadership, Binance's decision-making has always been "fast, accurate, stable, and fierce." Many decisions are based on CZ's intuition, and the strong speed of decision-making, where business actions do not affect the overall strategy. However, as the crypto market becomes broader and the industry grows larger, Richard Teng, as the new CEO, will face more market scrutiny in leading Binance forward, unless Richard Teng is just a spokesperson for CZ at Binance. If the management team's trust is very strong, there will be fewer problems. However, if there is inconsistency in decision-making and lack of mutual trust, rumors about the external management team or decision-making mistakes will significantly affect the overall brand and ecosystem strategy. The past development period was a test for CZ, but the future test will be for the management team.

- Structural Talent Gaps in the Team

The consensus in the overall market is that with the explosion of the application layer, the transition of Web 2 traffic to Web3, Binance's team may not be young in the crypto market, but they are very young in the overall finance and internet fields. This poses a significant challenge for the market operation and management capabilities of middle-level employees in each business line. Although the total market value of crypto companies may be higher than that of traditional companies, it does not affect the ongoing issues of collaboration, circulation, and management within the internal business. Attracting traditional talent (understanding Web3) and implementing (using Web 2 capabilities) will be a lengthy process.

Speculation 2: The Tracks Binance May Focus on in the Next Stage

- Storage & AI

The storage track has always been considered the final piece of the puzzle in the crypto world, and the explosive growth of the AI track has gradually released the demand for storage in the application layer.

Integrating computing power, allocating computing power, managing data, utilizing data, and ensuring data security are topics that the crypto market cannot avoid in the future.

- Decentralized Financial Play in the Web2 Business Model

GameFi and SocialFi are still the main drivers of active traffic, but there may be more assets in the Web 2 domain that can be explored. If these assets affect the future crypto market, these Web 2 assets may have the following labels: high-frequency trading, low transaction amounts, and long transaction cycles for individual users. These assets are mainly concentrated in social influence, content creation, copyright, casual games, and IP derivative fields.

The investment logic in the crypto market is gradually weakening in this area, and there is a lot of space for Fi-based incubation and service-oriented businesses.

- Compliance Infrastructure for the Transition of Traditional Finance

In the coming years, at least in the next round, more traditional companies will enter the crypto market, and blockchain technology and decentralized finance will be popularized in the traditional sense. The integration of stock markets, fiat markets, and traditional asset markets will increase the overall volume of the crypto market.

The compliance infrastructure and solutions for the transition of traditional finance (assets, funds) to the crypto market will be important construction directions due to the influx of more traffic.

In conclusion, the world of blockchain is attracting various talents with its decentralized spirit, but in the early stages of industry development, the unified operation of centralized institutions is the most scalable. It will be difficult to see another giant enterprise that can build a capital, asset, traffic, brand, and influence from scratch in a short period of time in the next ten years.

The blockchain world is gradually approaching reality and entering a state of rational convergence. With the continuous improvement of the industry's infrastructure and the rapid development of core positioning tracks, the wild and passionate wealth creation myths are difficult to replicate, and the market landscape cannot be reproduced as it was in its heyday.

Looking ahead, any blockchain company faces a common problem: how to acquire effective traffic from Web2.0. This means that success on a large scale cannot be achieved solely through creativity and a simple organizational structure. Cognition, rationality, and professionalism will become important industry survival rules, and most institutions do not have the answers to what preparations should be made before the next bull market arrives.

In conclusion, this article is only an external analysis and summary of Binance, and it is hoped that there will be an opportunity to interview CZ after he steps down.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。