[Reports on the Settlement between the US Department of Justice and Binance]

According to the settlement agreement reached between the US Department of Justice and Binance, Binance CEO Changpeng Zhao admitted to money laundering and violating US sanctions. Binance agreed to pay a fine of $4,316,126,163, which includes a $3.4 billion fine from the US Department of the Treasury's Financial Crimes Enforcement Network (FINCEN) and a $0.968 billion fine from the Office of Foreign Assets Control (OFAC). This transaction will allow Changpeng Zhao to retain the majority of his shares in Binance, but he will be unable to hold any executive positions in the company. Changpeng Zhao has been released on bail after paying a $175 million personal guarantee, and the sentencing hearing is scheduled for February 24 at 1:00 Beijing time. Binance was not charged with embezzlement of user funds or involvement in market manipulation.

Binance's former Chief Compliance Officer, Samuel Lim, will also pay a $1.5 million fine and is prohibited from acting as an unregistered futures broker or operating any illegal cryptocurrency derivatives platform. This is the first time the CFTC has held individual responsibility for a compliance executive.

Conor Grogan, head of Coinbase, stated that according to Binance's Proof of Reserves (PoR), its cryptocurrency holdings amount to $6.35 billion, excluding off-chain cash balances or funds not in the PoR wallet. Binance is highly likely to fully pay the $4.3 billion fine without selling cryptocurrency assets.

The latest report from Matrixport indicates that with CZ stepping down as CEO and the fine amount being lower than the previously feared $10 billion, Binance is likely to remain one of the top three exchanges in the next 2-3 years. There may be pressure to "rationalize" the company with 6,000 employees. Although this plea agreement does not include the US SEC, it is a very favorable outcome for CZ and Binance itself. More exchanges will strengthen their compliance plans and become part of a monitoring sharing agreement, which will help in the approval of a Bitcoin ETF in the US.

JPMorgan believes that Binance reaching a settlement with US prosecutors is a good thing for its business and the cryptocurrency industry. Their analyst, Nikolaos Panigirtzoglou, stated that the smart chain business will benefit. The settlement agreement eliminates the potential systemic risk brought about by the assumed collapse of Binance for cryptocurrency investments.

Binance's new CEO, Richard Teng, responded to the $4.3 billion fine by stating that Binance's business fundamentals are very strong. Binance remains the world's largest cryptocurrency exchange by trading volume, has a debt-free capital structure, and moderate expenses. Despite charging low fees to users, Binance has substantial revenue and profits. In the past 24 hours, Binance has seen a net outflow of approximately $747 million in assets, while OKX has seen a net inflow of $145 million. However, Binance still holds the largest scale, with over $67.9 billion in assets, of which $59.1 billion are clean assets.

Jiuge's View: In the short term, the market value and price of exchanges and the global cryptocurrency market will be affected, but in the long term, it will not change the already emerging trend. It's surprising how quickly the cryptocurrency market rebounded.

[BTC Market Analysis]

On the daily chart, BTC has found effective support around 35,600U and has started to rebound. Pay attention to the breakthrough at 38,000 points and the retest of the trend line for entry opportunities.

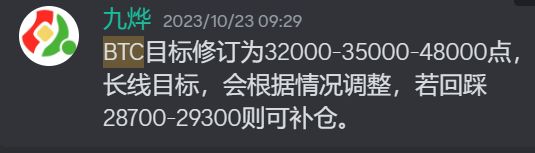

[BTC Phase Target Adjustment Recommendation]

After the launch at 27,200, on October 23, we adjusted the targets based on the actual trend of Bitcoin to 32,000-35,000-48,000 points. The price has already reached the 35,000 point level and has also broken through 36,000 points, reaching a high of 38,000 points. Now, it is a post-breakthrough correction trend, and Jiuge believes that the adjustment of the bullish trend is for a better upward movement.

Risk Warning: The daily chart MACD indicator shows a confirmed bearish divergence, and the indicator is still under repair. The daily chart adjustment has not ended, and the new support area is 35,000-35,600U. This level has received effective support. Next, closely monitor the breakthrough at 38,000 points and the retest of the trend line for entry opportunities.

[Trend Analysis: BTC Breakthrough After 4 Years]

On the monthly chart, BTC's performance has been excellent, with a 28% increase last week. The one-yang crossing three on the monthly chart and the golden cross of the 5-month and 10-month lines above the 30-month line indicate a positive accelerating uptrend. Additionally, the MACD golden cross below the zero axis shows the beginning of a bullish trend, and the KDJ has turned upwards again.

After 4 years, BTC has once again seen a one-yang crossing three on the monthly chart, indicating that it is in the early stage of a bull market, and a true one at that.

Although history does not repeat itself, it will certainly rhyme, just with different versions, characters, and stories.

[ETH Market Analysis]

On the daily chart, ETH has tested the 1912-1880 area and rebounded to 2050U, but was suppressed by the downtrend line and began a second retracement. It has already reached the support level of 1900U, which is the lifeline position. ETH has broken through the downtrend line and formed a bullish engulfing candlestick pattern, with support at 2020U.

On the weekly chart, ETH's closing has confirmed the formation of a bullish triangle pattern, and the 5-week line near 1880U has received effective support.

Currently, ETH's price is being suppressed by the previous high of 2141, similar to Bitcoin's suppression at 38,000. There are two scenarios to consider for adding positions: 1) a breakthrough of the previous high will open a new market, and 2) stabilization at the lifeline of 1900 or 1750U can be considered for adding positions. Spot positions have been added near the 1900 level.

[Jiuge's Quotes]

Candlestick language is a result, and everything we know or don't know, whether it is happening or will happen in the future, will be reflected in the candlestick language.

The best reason for an uptrend is the uptrend itself, and the best reason for a downtrend is the downtrend itself.

Once a trend is formed, it will not change easily. You just need to follow the trend, ignore all external news, focus on the candlestick language, focus on the trading system, and ignore everything else as it is just a distraction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。