Infinitas丨AC Capital Joint Production

Infinitas丨AC Capital Joint Production

Author: Xuan Rui丨0xDragon888

Editor & Reviewer: Echo | echoindahouse

Guidance: Hong Shuning

//

This article will combine Ordinals to bring a new normal to the BTC ecosystem, look at the challenges of BTC expansion from the perspective of asset issuance, and finally predict that assets issuance + application scenarios such as RGB & Taproot Assets have the potential to lead the next narrative.

Abstract (TL;DR)

- Ordinals ecosystem is on fire: opening up new possibilities for Bitcoin asset issuance

- Ordinals brings a new normal: competition for block space, UTXO inflation

- Evolution and challenges of BTC expansion from the perspective of asset issuance

- Scalability solutions with assets issuance + application scenarios have tremendous growth potential

Ordinals on fire: opening up new possibilities for Bitcoin asset issuance

As digital gold or currency, the Bitcoin community has been conservative since the hard fork in 2017, and there have been no new narratives in recent years. The Ordinals protocol at the beginning of 2023 set the fate of Bitcoin in motion, and with the explosive growth of the Ordinals ecosystem, on-chain transaction fees for Bitcoin surpassed Ethereum for the first time in six years, bringing the imaginative power of the crypto industry back to the Bitcoin blockchain.

Source: https://cryptofees.info/

Before the birth of the Ordinals protocol, there were several major upgrades to the BTC technical side. In 2017, the SegWit upgrade was activated, expanding the block space to 4 MB and increasing transaction throughput. This was followed by the development of the Lightning Network, bringing Bitcoin Layer2 into the public eye. The Taproot upgrade in 2021 brought a more secure, efficient, and private Bitcoin, enabling programmability for Bitcoin.

However, the technical improvements did not solve the real pain points until the appearance of Ordinals completely opened the door for BTC ecosystem landing. In December 2022, Casey introduced the Ordinals protocol, which is an extension protocol for the Bitcoin network that allows data to be inscribed on Bitcoin Satoshis, achieving expansion by assigning a unique number to each Satoshi and adding comments.

Inspired by the Ordinals protocol, Domo created the experimental Token standard BRC-20 for Bitcoin on March 8, 2023, using JSON data ordinals and Inscription to deploy token contracts, mint tokens, and transfer tokens. Using Satoshis to store and manage various token information.

There have been ways to mint and issue assets on Bitcoin before, such as colored coins in 2012 and Counterparty in 2014, but they did not address user pain points. The adoption of Fair launch + protocol-controlled assets on BRC-20 has sparked real user demand, and the explosive growth of BRC-20 has also opened up new possibilities for asset issuance on Bitcoin.

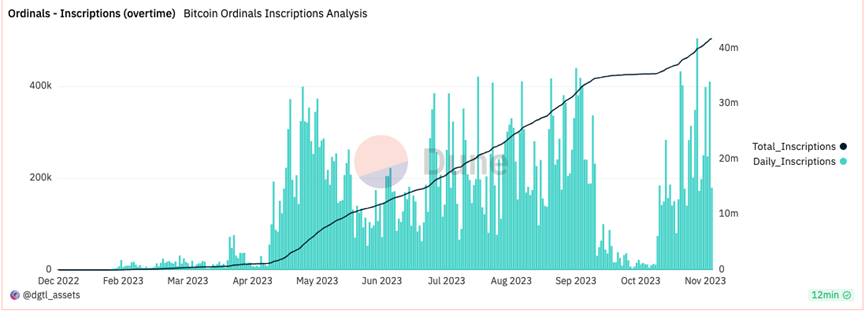

As of now, the Ordinals ecosystem has generated over 41 million inscriptions, which are inscribed on the oldest and most secure distributed ledger in the world, including images, text, audio, and even applications. Among them, text inscriptions (BRC-20) account for the largest proportion. The Ordinals ecosystem has spawned multiple innovative branch protocols such as BRC-20, ATOM, PIPE, and RUNES. Ordinals on fire brings new traffic to the BTC ecosystem, while also laying new pitfalls for the BTC ecosystem.

Source: https://dune.com/dgtl_assets/bitcoin-ordinals-analysis

Ordinals brings a new normal on-chain: competition for block space, UTXO inflation

The Ordinals frenzy is also reflected in the high transaction fees paid by users. Text inscription data occupies a small space, and BRC-20 users are willing to pay high transaction fees. Miners fill block space with a record number of transactions, and excessive BRC-20 transactions can occupy transaction bandwidth, leading to longer transaction confirmation times and higher fees.

In 2022, miners earned a total of 5374 BTC from transaction fees, while since the casting of Ordinals, 2886 BTC has been consumed in transaction fees. The appearance of Ordinals has made miners' income no longer dependent on Bitcoin rewards, ensuring that Bitcoin miners reduce their reliance on pure block rewards, significantly increasing the proportion of transaction fees, bringing a second curve to miner income.

Source: https://studio.glassnode.com/workbench/btc-transaction-count-momentum

After the rapid growth of inscriptions in the Ordinals ecosystem, the broader Bitcoin community has engaged in intense debates about its impact on Bitcoin. Opponents argue that at the expense of financial transactions, Ordinals transactions will only increase the Mempool backlog of the Bitcoin network, raise transaction fees, and ultimately hinder peer-to-peer transactions.

Casey, the founder of the Ordinals protocol, stated in September that 99.9% of the homogenized token protocols on the Bitcoin blockchain are scams and memes. However, they do not seem to disappear quickly, just as casinos do not "disappear" quickly. Establishing a better asset issuance protocol, Runes, so that gamblers can continue to gamble without creating a large number of UTXOs and increasing the burden on nodes.

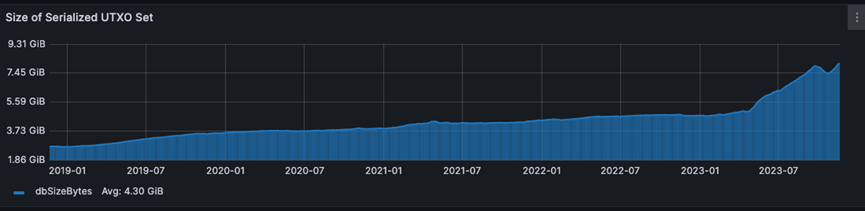

Also expressing concerns is Ajian, the founder of BTCStudy, who stated that from a technical perspective, BRC-20 is a backward technology. The minting and transfer of BRC-20 clearly do not require associations on UTXOs, yet it restricts the quantity of tokens that can be minted on a single UTXO, which are likely to remain in UTXO sets forever, resulting in UTXO set inflation, increasing the burden on Bitcoin full nodes, and significantly affecting the Bitcoin network's auditability and trustlessness.

Since the start of BRC-20 transactions in April 2023, the Bitcoin UTXO set has expanded from 5 GB to 8.16 GB. The Bitcoin development community has been debating whether to use technical means to shield inscription transactions, as the UTXO inflation caused by inscription transactions is eroding the Bitcoin network.

Source: https://statoshi.info/d/000000009/unspent-transaction-output

The Ordinals ecosystem believes that the Ordinals frenzy brings new traffic and user habits to the Bitcoin ecosystem, and the BTC ecosystem also needs to adapt to the new on-chain normal brought by Ordinals. The next step in the narrative of the Ordinals ecosystem should focus on solving UTXO inflation, ultimately, a better way of asset issuance is needed to enable the Bitcoin ecosystem to have a more native application ecosystem and drive the sustainable development of the Bitcoin ecosystem.

Evolution and challenges of BTC expansion from the perspective of asset issuance

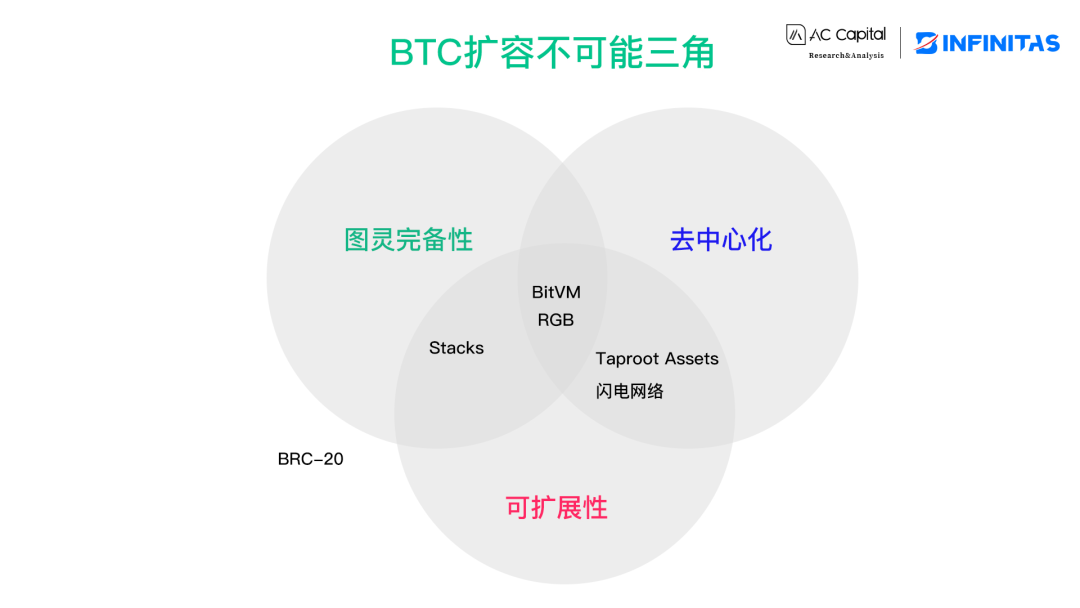

The BTC ecosystem currently lacks smart contracts and scalability, not asset issuance protocols. Scalability determines the development potential and lifecycle of a certain direction of BTC expansion. The complexity of Bitcoin Layer1 scalability solutions is high, and what is more accepted by the community is to build new Layer2 solutions based on Bitcoin Layer1, which is compatible with and does not affect the Bitcoin system, while solving on-chain congestion.

After completing SegWit, the Bitcoin ecosystem has been moving towards Layer2 solutions such as the Lightning Network and sidechains. Whether it's the Lightning Network, sidechains, or the RGB protocol, the development of Bitcoin Layer2 is progressing rapidly. Here, we will not discuss the Liquid federated sidechain. From the perspective of better asset issuance, compared to BRC-20, Stacks, BitVM, the Lightning Network, RGB, and Taproot Assets, there are important challenges in terms of Turing completeness, decentralization, and scalability:

Sidechain Stacks: The leading sidechain Stacks currently has an on-chain TVL of 19.3 MTVL. Stacks has many benefits, especially the ability to directly port existing Ethereum applications. However, sidechain solutions such as Stacks and RSK are facing centralization issues. The Stacks Nakamoto upgrade is expected in Q4, and sBTC as a smart contract is about to go live.

BRC20: The leader of the inscription ecosystem, BRC-20, is a Bitcoin script. It is not Turing complete, but has a large user base and a simple protocol. However, it occupies too much on-chain space, and the security of funds on BRC-20 is too centralized, lacking scalability and Turing incompleteness, which limits the further development of BRC-20. Currently, Rune, Arc-20, Pipe, BRC-20Swap, and others are further addressing these issues.

Lightning Network: The Lightning Network is the largest and most influential Layer2 solution in the Bitcoin ecosystem. More and more companies are entering the Lightning Network ecosystem, which enables off-chain payments through specific state channels and final settlement on the Bitcoin chain. However, the Lightning Network cannot issue tokens, is only suitable for high-frequency payments, and lacks smart contract functionality. It has poor Turing completeness, and the number of users and use cases for the Lightning Network is still limited. However, protocols developed based on the Lightning Network such as Taproot Assets and RGB have more room for imagination.

RGB: Inspired by the concept of Single-use seal and Client-Side Validation proposed by Peter Todd in 2016, RGB introduces smart contract functionality to the Lightning Network. In April 2023, GRB v.010 was released, but the technical complexity has prevented the ecosystem from landing. Projects such as Infinitas, Bitlight Labs, Diba, Bitswap, and Pandora Prime Inc are gradually opening up the possibility of RGB landing. The CEO of Tether also stated that RGB is the best choice for issuing stablecoins on the Bitcoin chain, and Tether is considering the possibility of issuing USDT through RGB.

Taproot Assets: Also a client-side asset verification protocol, Taproot Assets v0.3 mainnet alpha version was released in October 2023, aiming to expand Bitcoin into a scalable multi-asset network. However, the asset issuance of Taproot Assets is distribution-based, distributed by the project party rather than actively minted by users. The application scenarios of Taproot Assets are more suitable for the issuance of assets by projects and institutions. Currently, the new protocol Nostr Assets Protocol, based on Taproot Assets, is introducing assets into the Nostr social protocol.

BitVM: The white paper was released in October 2023. BitVM uses a similar approach to Rollups to execute complex programs off-chain and then puts key evidence on-chain. Similarly, it aims to bring Turing complete smart contracts to Bitcoin, but BitVM has very high requirements for computational power and is only theoretically executable. Further understanding is needed for its scalability and commercial landing.

Scalability solutions with assets issuance + application scenarios have tremendous growth potential for BTC

As various infrastructure in the Bitcoin ecosystem becomes increasingly complete, various scalability solutions are gradually staking their claims. The next phase of BTC scalability competition has two core issues that need to be urgently addressed:

From the perspective of asset issuance: Is the technical roadmap suitable for landing application scenarios? Is it decentralized, Turing complete, and scalable?

From the perspective of asset circulation: Can the progress of the protocol gain adoption and support from the industry's infrastructure and users?

From the perspective of asset issuance, BTC currently lags behind Ethereum in terms of asset issuance. One reason is the lack of well-known projects, and the other is that the user base is not as large as Ethereum. However, as the blockchain network with the highest market value, BTC Layer2 with asset issuance protocols + application scenarios has tremendous growth potential.

The current Ordinals has completely opened up the possibility of asset issuance on Bitcoin, but Ordinals cannot support on-chain computation like Ethereum. How the BTC ecosystem can complete asset settlement like Ethereum, from the technical evolution of BTC asset issuance, paradigms such as RGB & Taproot Assets have the potential to take over from Ordinals inscriptions and become a new important narrative ecosystem.

In the future multi-asset era of Bitcoin, the BTC ecosystem explosion also needs diversified application scenarios. The premise of diversified application scenarios is based on stablecoins, and the Lightning Network is the best platform for issuing stablecoins. However, there are not enough stablecoins deposited. Taproot Assets and RGB have the potential to accelerate development in areas such as high-frequency payments, stablecoins, DeFi, NFTs, covering more tracks and users, and expanding the diversified application scenarios of the Lightning Network.

Conclusion

The current Bitcoin ecosystem has ushered in the first round of the Ordinals frenzy. In addition to asset issuance, the Bitcoin ecosystem also needs more complex and sustainable application scenarios. From the perspective of the technical evolution of asset issuance, paradigms such as RGB & Taproot Assets are driving change, with less on-chain computation and more on-chain verification, giving birth to a more reasonable way of asset issuance in the Bitcoin ecosystem.

If you are a developer in the field of RGB & Taproot Assets and believe in the potential of client-side verification paradigms for Mass Adoption, please feel free to contact AC Capital and Infinitas. If you have different opinions, you are also welcome to leave a comment for discussion.

Reference

https://github.com/tylev/awesome-bitcoin-layer2

https://www.binance.com/en/research/analysis/a-new-era-for-bitcoin

https://twitter.com/AurtrianAjian/status/1686379305520234497

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。