BTC once again experienced extreme market conditions in the early hours of today. After a significant drop to 24800 in the early hours of yesterday, it surged to a new high of 37980 in just one day, with the current price at 27850.

Such a trend is truly abnormal. This account has previously mentioned in an article that such rapid and drastic fluctuations pose great challenges for short-term contract trading, making it very easy to incur losses or even liquidation. Originally, it was expected that there would be a 30-minute downward correction after a three-wave sell-off, but last night around 7 o'clock, the rebound to around 36200 seemed off. The rebound momentum kept increasing, especially after the community warned not to short yet, and if shorting, the stop loss had to be set at 36680, i.e., the first line of the 30-minute three-wave sell-off. In reality, the market directly made a small turn into a big V, with a 30-minute surge breaking through the center and reaching a new high. In such extreme market conditions, if stop losses are not set in advance for contract trading, once the direction reverses, it can easily lead to huge losses!

It has been repeatedly emphasized before to maintain long-term positions, which serve as a cornerstone for coping with unpredictable trends. This is because one of the greatest uncertainties in the future is when the BTC spot ETF will be approved. Once approved, it will quickly trigger a market frenzy. Regardless of how the market changes, this part of the position will not be missed. In addition, the halving of Bitcoin next April and the imminent interest rate cut and liquidity injection by the Americans in the second quarter of next year will contribute to an anticipated major bull market!

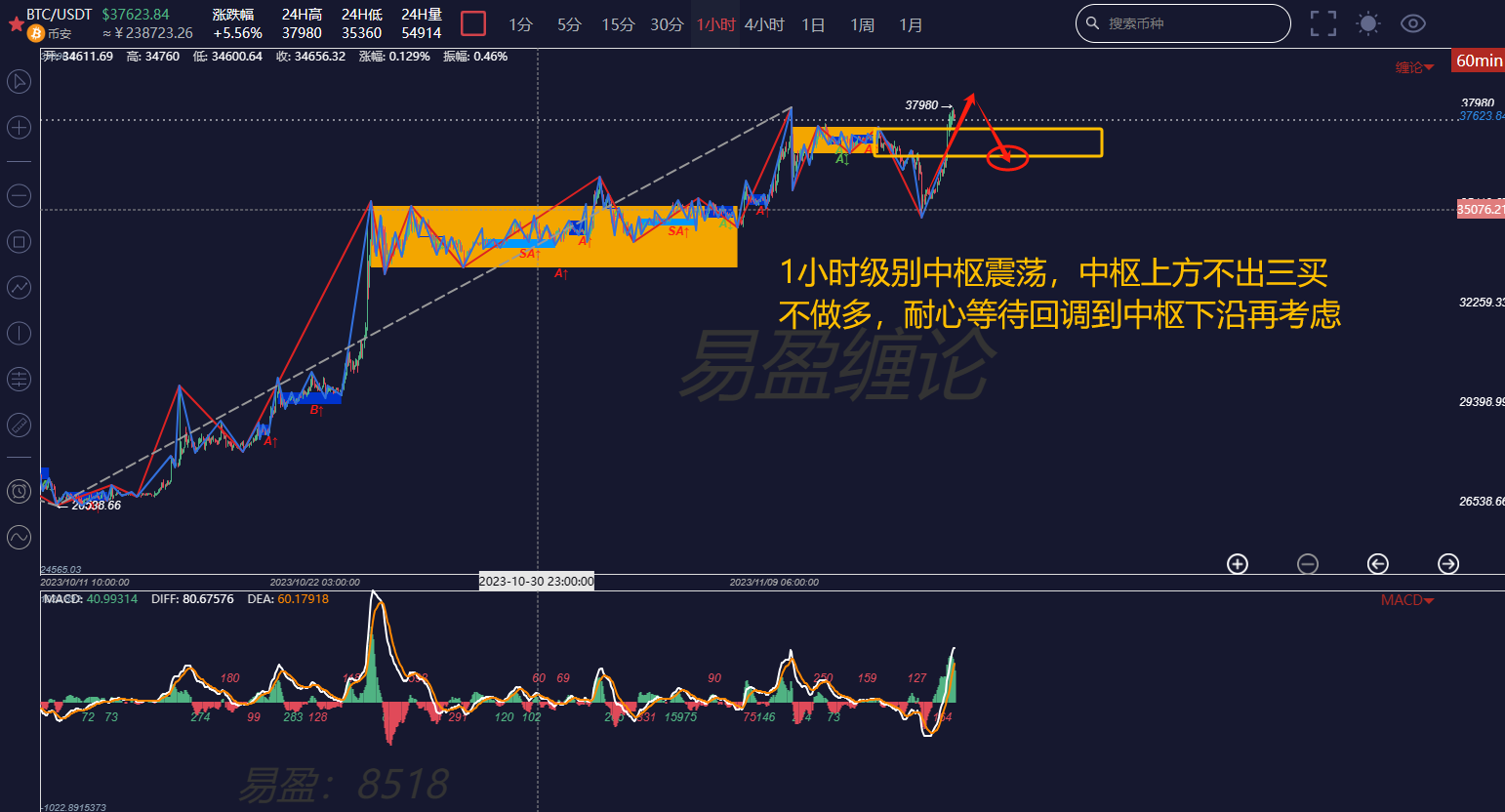

Returning to the current market situation, the new high has been broken, so it is definitely not advisable to chase after higher prices at the moment! Whether it will continue to surge with increased volume or it is a trap for long positions remains to be seen. For short to medium-term operations, focus on the oscillation of the central axis at the hourly level, and do not go long if there is no three-wave buy-off above the central axis.

Looking at the hourly chart, after breaking the new high, this can be seen as a continuation of the upward trend at the hourly level. It is not advisable to chase after higher prices above the central axis, and if one wants to chase, they should wait for a downward correction before considering it. The core remains the oscillation of the central axis at the hourly level.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。