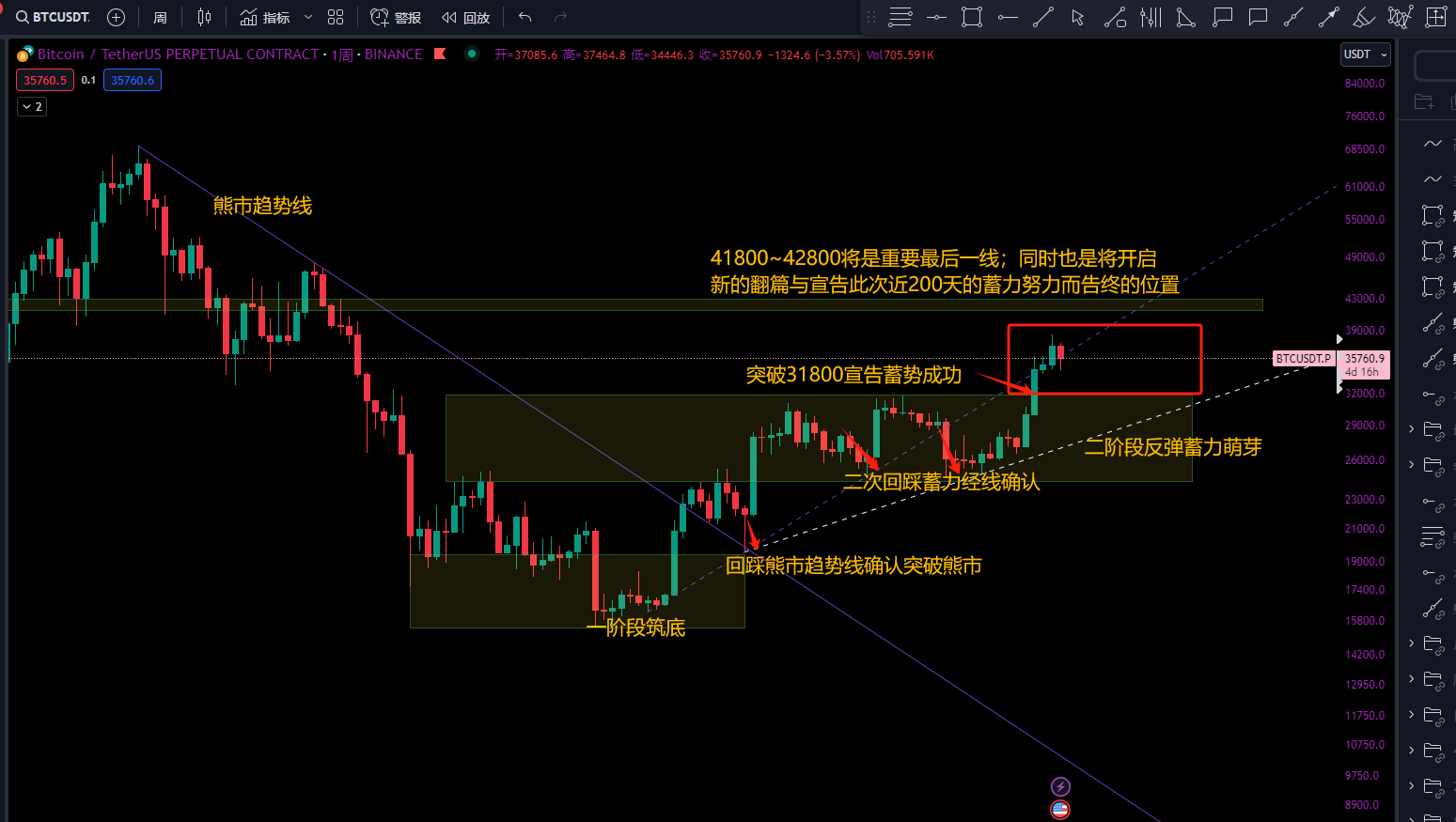

Bitcoin Weekly Chart

Visualizing the weekly level makes it clearer to review:

Since the beginning of the year, breaking through the bear market trend line and confirming the start of this accumulation phase in March, the market officially broke through the 25,000 mark and confirmed it twice, ranging from 25,000 to 31,800, directly approaching the 200-day mark. It was only after firmly breaking through the 31,800 mark that the accumulation reached over 200 days. From a different perspective, the current 31,800 mark is also the support for the 200-day accumulation.

The current market is at the midpoint between 31,800 and the final hurdle of 41,800. It is currently more inclined to be seen as continuing to accumulate before taking off.

The ultimate target for this round of the market is the final hurdle of 41,800 to 42,800. This is the last hurdle, and it will determine whether Bitcoin will continue its upward trend or if this round of accumulation will reach its endpoint at the 200-day mark. At least 2 weekly candlesticks should be used as a reference for confirmation.

From the first point of view, the conclusion can be drawn that as long as the market does not effectively fall below the 31,800 mark, we can still see the price reach the final hurdle of 41,800 to 42,800. If the market effectively falls below the 31,800 mark, it will enter a longer period of actual accumulation, making it less likely to see new highs within the year.

Bitcoin 4-hour Chart

Reference positions for entering on a smaller 4-hour timeframe:

Although it fell to around 34,500 last night, it does not appear to be weak at the moment. It can also be understood as a pullback, a rebound after panic selling in the futures market.

Please pay attention to the best trading positions in the upper right corner of the chart, which are the three positions below the chart.

As shown in the chart, if the price falls below the first green line near 33,200 and then reclaims the 33,200 mark, you can try to enter low-leverage and multi-long positions.

The second position worth noting is 32,500. This position has been watched for a pullback since October, but it has not been tested. Remember, at that time, most people hoped for a pullback to this position, which probably would not happen. Therefore, it is advisable to enter long positions when the market next comes to this position. If the market comes to this position again, it is likely to be broken through. Similar to the blue route on the chart, breaking through the consolidation introduces short positions. The best entry for long positions is when the price returns above 32,500.

In summary:

Bitcoin is experiencing a pullback, and we are waiting for opportunities to enter on the level of pullback. The bullish view on the larger timeframe remains unchanged, and what is supposed to happen will happen sooner or later. Regarding spot ambush, when it's time to ambush, it will be sent out for discussion together.

This is a visual for a larger timeframe, not a short-term view on a smaller timeframe.

I am Orange; if you are in the process of chasing highs and lows, you might as well slow down and learn steadily. Just like a small snowball, there is a starting point in the snowy forest, and you may not be sure which way to roll. But you might as well start rolling, as there is snow everywhere, and rolling will make you thicker wherever you go. You may have taken a detour, or later found that the direction was wrong, but you will eventually become stronger and turn into a big snowball. After becoming bigger, roll to where you want to go, and you will always be faster. To fly, you must first have the belief to fly. Without this belief, it is impossible to fly. But as long as you have the belief to fly, combined with your efforts, it is possible to fly. Success is the same; to succeed, you must first have the belief to succeed, and then constantly strive for this belief. If you can do these two things, success is not far away from us.

For the latest market layout, the market changes rapidly. For more market information, please follow me!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。