Different people have different views on finance.

In the traditional financial field, the product matrix including stocks, bonds, funds, futures, options, etc. is already very rich.

As an innovative emerging financial industry, the crypto industry has, on one hand, innovated tools such as lending and liquidity mining under decentralized finance (DeFi), reforming many drawbacks of traditional finance. On the other hand, through the migration of traditional financial tools, it uses crypto assets as a carrier to continue the development of inclusive finance.

Currently, in the crypto industry, there is already a good accumulation of asset types under standards such as ERC20, ERC-721, ERC-1155. OKX integrates centralized exchanges and decentralized wallets into the same app, building powerful financial tools for the future.

If the OKX Web3 wallet is responsible for financial tool innovation, then the OKX exchange is responsible for the migration and popularization of financial tools. Recently, OKX announced the official launch of Seagull, becoming the first exchange to launch this structured product in the industry, once again demonstrating its comprehensive offering of financial products.

This article will use the Seagull product as a clue to explore the financial product landscape of the OKX exchange.

I. OKX Exclusive Launch of Seagull

Structured products are innovative financial tools for earning profits from the futures, options, and other derivative markets. They are already very mature in the traditional financial market. However, due to the highly customized nature of structured products, balancing different asset combinations and risk control is necessary. Currently, there are not many exchanges in the crypto industry that offer structured products. However, OKX has previously successively launched products such as Shark Fin, Dual Currency, and Snowball, which have advantages such as zero fees, high annualized returns, and the freedom to choose the level of risk.

Users can choose products based on the current market conditions and risk preferences, capturing potential returns while avoiding risks.

For example, the price of wheat is currently 100 yuan, but it is easily affected by various factors such as seasons and demand. Farmer Wang is worried about the future price of wheat falling, so he buys a put option, while bakery owner Zhang is worried about the price of wheat rising, so he buys a call option. If, on the expiration date, the price of wheat falls below 100 yuan, Farmer Wang can exercise the put option to sell wheat at 100 yuan, thus avoiding risk. Bakery owner Zhang can choose not to exercise the call option, although he loses the option premium, he can now buy wheat at a lower price, and vice versa.

Seagull is the first structured product launched by OKX in the industry, and is essentially similar to traditional financial seagull options, consisting of a combination of three ordinary options strategies with the same expiration date. OKX's Seagull products are divided into Bullish Seagull and Bearish Seagull, with Bullish Seagull supporting USDT investment and Bearish Seagull supporting BTC and ETH investment. Next, taking the example of the Bullish Seagull-BTC product, let's analyze the potential returns and risks of this product.

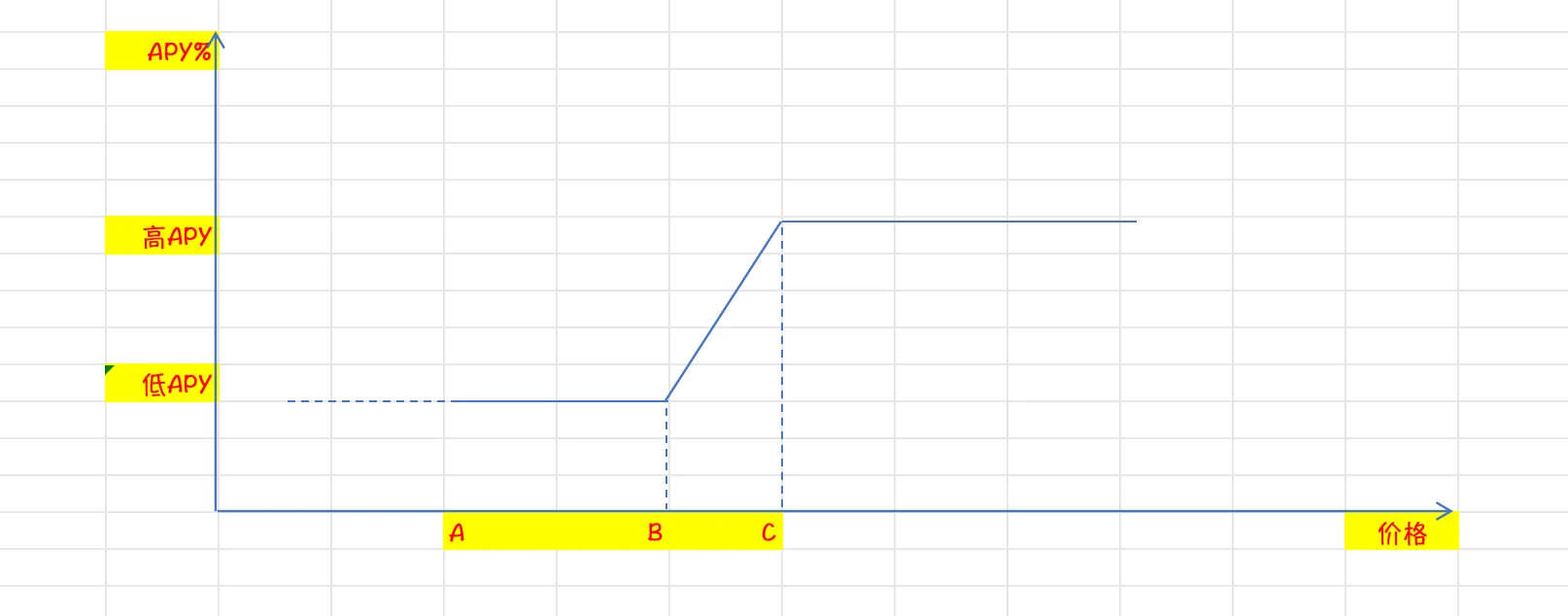

There are mainly 4 situations: when the price of ABTC is B, you will receive the principal and low APY USDT rewards; when B≤BTC price≤C, you will receive the principal and low APY to high APY USDT rewards; when the BTC price≥C, you will receive the principal and high APY USDT rewards; if the BTC price≤A, you will receive the corresponding BTC.

Overall, OKX's Seagull products have low costs and risks, but the maximum returns are also limited, mainly suitable for expecting a slight rise in the market or a fluctuating decline. This helps investors hedge at low or even zero cost, without the need to understand complex derivatives. They only need to invest in USDT or BTC based on their market judgment and risk preferences.

II. Comparison of OKX Structured Products

As mentioned earlier, OKX has a rich array of structured products, including Shark Fin, Dual Currency, Snowball, and the newly launched Seagull.

All of OKX's structured products do not charge fees and have good potential returns and a relatively good risk control system. However, faced with an increasingly detailed matrix of structured products, many users still have a relatively fragmented understanding of the products. Therefore, a simple comparison of OKX's structured products will be made from the perspectives of applicable market conditions and reference annualized returns, hoping to provide a basic reference, but the actual situation should prevail due to the many variables:

OKX's financial section currently provides three core sections: Earn, Lend, and Jumpstart. Among them, Earn includes Simple Earn, Structured Products, and On-Chain Earn, with Seagull being one of the structured products.

In addition, the Lend section of OKX aims to meet users' investment and consumption needs, allowing lending against digital assets. The Jumpstart section is for early discovery of high-quality new projects globally, and OKB holders can easily participate.

III. Building Powerful Financial Tools for the Future

In the era of globalization, finance is a vast network, and everyone is an economic entity on this network, affecting the whole body with a slight movement. Exchange rates, interest rates, CPI, GDP, annualized returns, P/E ratios, PMI... These obscure and complex terms frequently mentioned by financial experts are actually statistics, quantification, and abstract summaries of people's daily lives and activities. High inflation pressure has put the US and even the global financial system at systemic risk, and what we can do is to use financial tools and strategies to find alpha while ensuring risk defense.

The crypto industry is an extension and innovation of the millennium-long history of financial development. As a leading crypto exchange and Web3 technology company, OKX is building powerful financial tools for the future.

In addition to structured financial products that have evolved from traditional finance, the centralized exchange and decentralized product Web3 wallet are also in a leading position in the industry through continuous innovation. According to the latest ecosystem overview released by OKX Web3 wallet, the wallet section has access to 70+ public chains, the DeFi section supports over 120+ protocols, the NFT market aggregation platform covers 30+, and supports multiple ecosystems such as Game, Social, MEME, Tool, totaling over 300 platforms and protocols. In addition, it also has the most powerful DEX and cross-chain aggregator, as well as a flexible and comprehensive Discovery section, and more.

The emergence of crypto assets and OKX tools will bring new and fair financial participation opportunities to users worldwide.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。