Original translation: Kaori, BlockBeats

Editor's note:

Sommelier Finance is a protocol built on the Cosmos blockchain, aimed at expanding the capabilities of decentralized finance based on Ethereum. The project currently offers two main services - liquidity mining and algorithmic trading strategies. For users, simply choose one of them, lock the funds in the staking pool, and start earning. Crypto DeFi KOL Emperor Osmo (@Flowslikeosmo) wrote an article introducing several new staking pools launched by Sommelier.

dYdX V4 mainnet is about to go live and provide native DYDX staking and yield distribution. DeFi researcher Thor Hartvigsen (@ThorHartvigsen) has built a calculator to estimate DYDX staking yield and APY.

IPOR Labs aims to help mature DeFi money markets by building interest rate derivative financial tools, achieving interest rate standardization for the entire industry. IPOR stands for Inter Protocol Over-block Rate, a mid-market rate determined from block to block sources. Crypto KOL DeFi Made Here (@DeFi_Made_Here) wrote a research article on how IPOR Labs achieves different risk yields.

BlockBeats has compiled the above three tweets about DeFi protocol yields for readers to study, translated as follows:

Analysis of the three new staking pools of Sommelier Finance

Original author: Emperor Osmo, "Original link"

The fastest growing yield aggregator in the market is the Cosmos application chain. Sommelier Finance has maintained significant growth momentum, with TVL exceeding $40 million.

I previously discussed the significant growth prospects of Sommelier this year. In the past month, they have launched new staking pools with significantly increased yields, which has driven this growth. Now, let's delve into these strategies.

1. Real Yield ETH (APY 11.06%)

This staking pool, created by Seven Seas and Define Logic Labs, maximizes ETH yields in the following ways:

- Leverage staking on Aave

- In addition to Compound and Morpho, it also involves providing ETH liquidity staking tokens on Uniswap V3.

2. Turbo stETH (10.23% APY)

StETH is a highly liquid crypto asset that allows the staking pool to:

- Utilize various dynamic strategies such as leverage staking

- Exploit CL terms on DEX

- Create arbitrage opportunities between LST-ETH pegs to optimize users' ETH yields

3. Turbo GHO (APY 3.00%)

This staking pool utilizes Aave's over-collateralized stablecoin GHO. The goal of this reserve is:

- Pair LP on Uniswap V3 with GHO

- Pair with USDC, DAI, USDT, or LUSD

This allows users to earn substantial returns through stablecoin pairs.

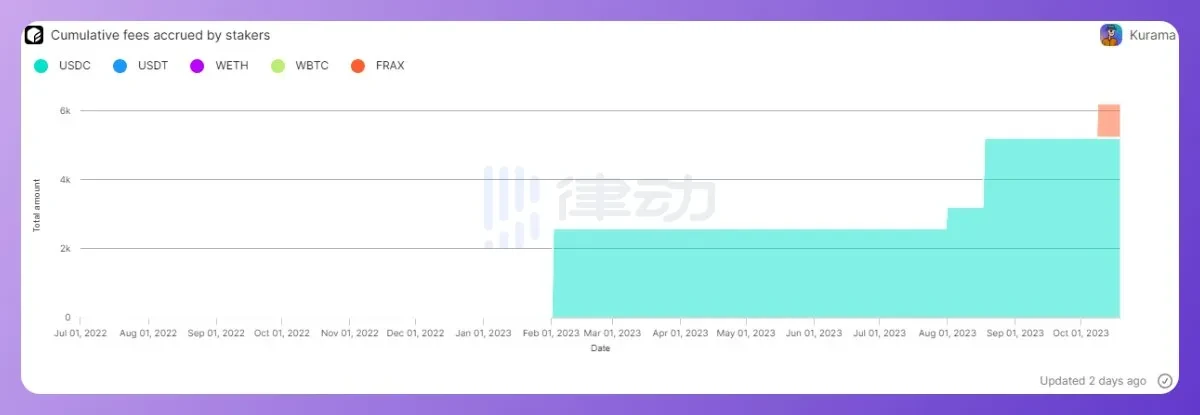

Sommelier Finance's growth has translated into more staking pools, bringing in more fees for stakers. The fees generated by SOMM stakers have continued to grow.

This is the result of a good product-market fit. Users are eager to earn returns through alpha assets like ETH, and Sommelier provides them with secure strategies to achieve this goal. For all stakeholders, this is just the beginning of a profitable journey.

DYDX Delta Neutral Staking Arbitrage (20-30%+ APY)

Original author: THOR HARTVIGSEN; "Original link"

I built a calculator to estimate DYDX staking yield and APY (if you hedge this risk by shorting DYDX on Vertex).

1. What is the annual interest rate for DYDX staking?

First, we need to estimate how much of the total DYDX circulation will be staked. Here are some other perps for comparison:

SNX - 58% staked

GMX - 74% staked

GNS - 73% staked

On average, an estimated 68% of the DYDX supply will be staked. How about the fees allocated to stakers? Assuming all fees are allocated to stakers and using the annualized fees from the beginning of the year, we get:

An annual fee allocation of $79 million (assuming no growth, hence assuming a small scale) results in a staking annual interest rate of 26.4% - quite crazy!

But now we face DYDX price risk. So let's go further:

2. Short an equivalent amount of DYDX on Vertex

Vertex is a cross-margin order book and AMM trading protocol, which recently added DYDX-perp.

Using the calculator shown below, you can choose your preferred leverage and see the amount of DYDX you need to short to hedge the price risk.

Due to the very active funds in the DYDX-perp Vertex market, you can earn returns by shorting DYDX.

In summary, there are:

- Current Vertex funding rate

- 5x leverage when shorting DYDX

- Assumed DYDX staking annual interest rate

Your annual interest rate is 31%, while maintaining Delta neutrality. Similar to earning a 31% annual interest rate through stablecoins, but with the following risks:

- Smart contract risk (dYdX and Vertex)

- Liquidation risk if the leverage on Vertex is set too high

You can copy it to your own Google Sheets account using this link. Please note that this operation cannot be completed until DYDX staking goes live.How to achieve different risk yields at IPOR Labs

Original author: DeFi Made Here; "Original link" 9% stablecoin yield 20-50% stablecoin yield with ipor exposure 40% quasi-DN yield 20% risk-free ETH yield All of these can be achieved through IPOR Labs, which is becoming one of the most attractive farms in the DeFi space and the best place to implement high-yield complex strategies. With the launch of v2, LPing and running liquidity mining strategies on Ipor have become more attractive. Some whales have realized this and moved their stablecoins from underlying protocols to Ipor to gain additional exchange fees + ipor mining incentives. (For example, this whale is worth 650,000 DAI) Liquidity providers can further increase their yields through pwIPOR (staking ipor). In fact, Ipor has become a place for whales to earn 20%-50% annual interest rates in stablecoins. But Ipor offers more than just LPing; you can also run multiple strategies to increase returns. The simplest way to passively earn high yields on stablecoins is to put LP into the pool, with an annual interest rate of about 7-9% being "very competitive" stablecoin yield. This strategy is the most passive and has the lowest risk, but it also has the lowest profit. Yields can be further increased through pwIPOR (staking ipor), and with only 3.8% ipor exposure, you can increase the annualized return to 18.5%. The token value would have to drop by 80% for this strategy to be less profitable than simple liquidity mining. Trader Nicolas (@TradingAlpinist) has a fondness for staking 700 IPOR and delegating 1000 DAI, generating about 30% return with a 44% risk. More risk = more return. Nicolas has been trading interest rate derivatives for 27 years. He shared several more complex strategies, such as a quasi-Delta neutral position in ETH, with an expected return of 40%. The idea is to sell futures on leverage and farm stock pools on IPOR to increase pwIPOR. An easier way to achieve high DN yields on IPOR is to borrow USDC on Aave, with an annualized return of 8.7% (reaching 13%+ at the time of writing), and then borrow ETH at a 3.3% annualized return. Then deposit the ETH into the Ipor pool, and you will get a 12.2% DN annualized return at a 70% loan-to-value ratio (LTV). (These yields may change over time). With only 3.5% ipor exposure, you can increase your staking yield and generate a 19.1% annualized return with a 70% loan-to-value ratio (DN). (USDC at 8.7% + ETH on Ipor at 13.7% - Aave at 3.3%) Nicolas's latest strategy involves buying options to hedge ETH's downside risk, and with no downside risk and unlimited upside potential, you can earn about 20% on ETH. This strategy has the highest risk-return ratio, but it's more complex + you will be exposed to ipor. These are just some examples of how users maximize returns while using IPOR for liquidity mining. The entire protocol is not just about liquidity mining, but if you're looking for above-average stablecoin/ETH yields, you should check out IPOR Labs. For more mature users, Ipor is a good hedging tool. Sometimes, the spread between fixed rates and actual rates is only 10 basis points. It's also a good tool for speculating on rates.免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。