Recently, the cryptocurrency market has surged significantly. With strong optimism in the market, the price of Bitcoin once broke through $35,000 and is currently hovering around this price.

While retail investors are cheering for the rise of BTC, let's shift our focus back to the "whales" in the market - institutional investors.

After this round of significant increase, what are the investment positions of the traditional institutions that once brought joy to the cryptocurrency market? Are they currently making profits or losses?

According to Coingecko data, there are currently 28 publicly listed companies globally holding Bitcoin, with a total of 239,494 BTC, valued at approximately $8.1 billion.

In addition to publicly listed companies, sovereign countries are also alternative "investors" in cryptocurrencies, actively or passively (due to legal reasons) holding a large amount of Bitcoin, with El Salvador being the most well-known.

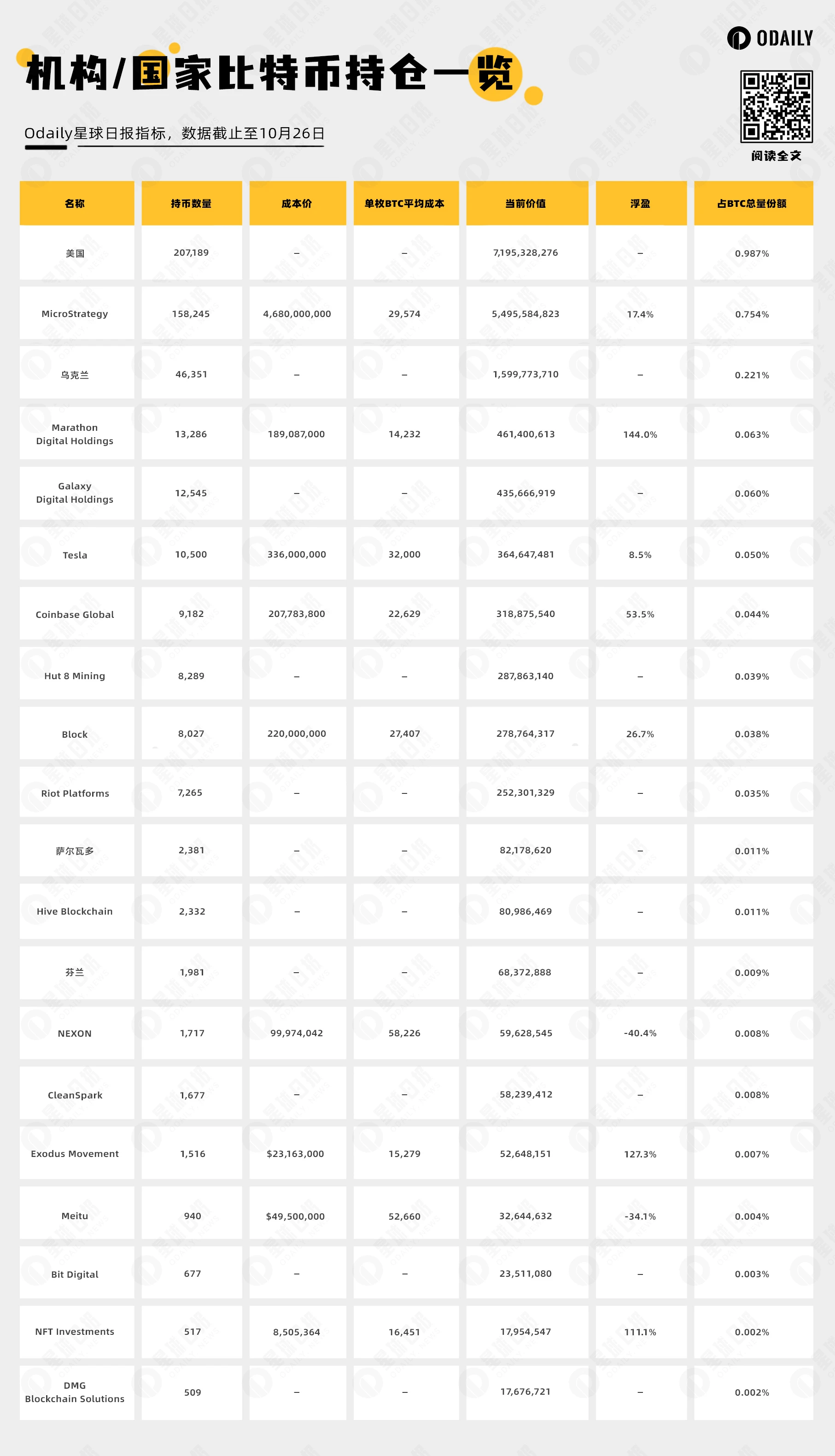

Odaily Planet Daily has compiled the mainstream institutions and countries' Bitcoin holdings, as follows:

Among the 28 publicly listed companies, 16 hold over 500 BTC. Additionally, 4 sovereign countries also hold more than 500 BTC.

United States Government

The U.S. government is the most notable entity among the Bitcoin whales. This holder is neither a cryptocurrency investor nor a financial institution, but inadvertently, the U.S. government has become a leading Bitcoin tycoon in the crypto world, and interestingly, it is indifferent to the fluctuations of this digital currency.

Jarod Koopman, director of the Cybercrime and Forensic Services at the Internal Revenue Service, once publicly stated, "We don't play the market. We basically set up our processes."

Unlike other whales who accumulate Bitcoin through purchases, the majority of the U.S. government's Bitcoin comes from seizures. Just three recent seizures have added over 200,000 BTC to the government's treasury. Previously, the U.S. government had sold approximately 20,000 BTC, causing turmoil in the cryptocurrency market with each "liquidation."

Coingecko shows that the U.S. government currently holds over 207,000 BTC, valued at approximately $7.19 billion. In comparison, the renowned Bitcoin "enthusiast" MicroStrategy currently holds only 158,000 BTC.

Related Readings:

The Wall Street Journal: Where Did the $5 Billion in Bitcoin Held by the U.S. Government Come From?

MicroStrategy

Unrealized gains: approximately $816 million (17.4%)

MicroStrategy was one of the earliest publicly listed U.S. companies to purchase a large amount of Bitcoin and currently holds the largest amount among U.S. publicly listed companies. Since August 2020, MicroStrategy has announced 28 BTC purchases, accumulating a total of 158,245 BTC at an average holding price of $29,582.

The company is well-known not only for its large Bitcoin purchases but also for its "enthusiasm" for Bitcoin. Since its initial purchase, the company has never sold BTC, and its diamond hands have weathered both bull and bear markets.

According to Coingecko data, the BTC purchased by the company has generated unrealized gains of $815,584,823, approximately 17.4%.

Since MicroStrategy's first Bitcoin purchase in August 2020, Bitcoin has risen by 147% during this period, while the S&P 500 index has risen by 26%, the Nasdaq index by 18%; gold has fallen by 3%, silver by 19%, and bonds by 24%. Undoubtedly, Bitcoin has been the best-performing asset class during this period. MicroStrategy's diamond hands have reaped significant returns.

Apart from its diamond hands, MicroStrategy's purchasing behavior has also been the subject of speculation in the market, with some suggesting a mystical connection between the company's BTC purchases and market prices.

Related Readings:

Is Each Announcement of BTC Purchase by MicroStrategy a Signal for a Market Decline?

Another Type of BTC ETF: Behind MicroStrategy's Continuous Large-Scale Bitcoin Purchases

Tesla

Unrealized gains: approximately $364 million (8.5%)

When it comes to the most influential figure in the cryptocurrency market, there is perhaps only one option for all investors - Tesla CEO, SpaceX CEO, and self-proclaimed "Dogecoin CEO" Elon Musk.

Whenever Musk makes a "call," the market experiences significant fluctuations. Not only does Musk make calls himself, but the company he leads, Tesla, has also deeply engaged in the cryptocurrency market, acquiring a large amount of Bitcoin.

In mid-October, Tesla released its latest financial report, which showed that the company did not buy or sell any Bitcoin in the third quarter, marking the fifth consecutive quarter of unchanged holdings.

Coingecko data shows that Tesla holds approximately 10,500 BTC, valued at around $364 million.

Bitcoin Mining Companies

Marathon's unrealized gains: approximately $461 million (144%)

Unlike the "speculation" of other companies listed in this article, mining companies are a relatively unique presence among institutional holdings. For example, both Marathon and Hut 8 adopt a business model of self-mining and long-term investment in BTC.

Their Bitcoin holdings do not rely on large purchases but rather a significant portion comes from their own production. As a result, their Bitcoin holding costs are much lower than those of other companies. In terms of returns, Marathon sits at the top of publicly listed companies with a return rate as high as 144%.

Marathon was registered in Nevada in 2010 under the name VerveVentures, Inc. In 2017, the company purchased digital asset mining equipment and established data centers in Canada for mining digital assets. However, the company ceased operations in Canada in 2020 and merged all operations into the United States. Since then, the company has expanded its Bitcoin mining activities in the U.S. and internationally. The company was renamed Marathon Digital Holdings, Inc. on March 1, 2021.

Currently, the company's main business is self-mining Bitcoin. Its operating strategy involves financing the purchase of mining machines, deploying mining farms, and holding Bitcoin as a long-term investment after paying the production's cash operating costs.

Hut 8 is a Bitcoin mining company based in Canada, focusing on Bitcoin mining using advanced hardware and data center resources. It is one of the largest publicly traded Bitcoin mining companies in North America. In addition to mining operations, Hut 8 also provides other services and solutions related to cryptocurrencies, such as high-performance computing.

Hut 8 typically sets up its mining facilities in areas with low energy costs, such as some remote areas in Canada, to reduce operating costs and improve efficiency. This allows the company to remain competitive in the highly competitive cryptocurrency mining market.

An interesting piece of data is that while Bitcoin has seen significant returns in recent times, the stocks of Bitcoin mining companies have outperformed Bitcoin.

According to CoinGecko's data, except for Argo Blockchain and TeraWulf, the year-to-date return rates of all cryptocurrency mining companies' stocks have outperformed Bitcoin, averaging around 150%, while Bitcoin's return rate is 84.61%. This also indicates the market's positive sentiment towards Bitcoin from another perspective.

Related Readings:

2023 Cryptocurrency Mining Company Survival Guide

Meitu

Unrealized losses: approximately $16.86 million (-34.1%)

Meitu is the only Chinese company mentioned in this article. Currently, its holdings of BTC and ETH have a combined unrealized loss of $16,855,368.

Last month, Meitu released its mid-year performance report for 2023. The report shows that in the first half of this year, Meitu's revenue reached 1.261 billion Hong Kong dollars, a year-on-year increase of 29.83%; net profit was 151 million Hong Kong dollars, a year-on-year increase of 320.4%; and the net profit attributable to shareholders reached 228 million Hong Kong dollars, turning losses into gains compared to the same period last year, and exceeding the previously forecasted range of 220 million to 265 million Hong Kong dollars.

The company's investment in cryptocurrencies has an unrealized loss of approximately 670 million Hong Kong dollars, but due to the market's recovery this year, there was a reversal of impairment losses of 186 million Hong Kong dollars.

As early as 2021, Meitu purchased 31,000 ETH and 940.89 BTC. The company has been holding these cryptocurrencies, stating, "The Group has no plans to buy or sell any cryptocurrencies based on a cryptocurrency investment plan."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。