Let's take a look at some methods that, once mastered, will allow you to conduct a more in-depth analysis of upcoming token unlocks.

How to Discover Upcoming Unlocks?

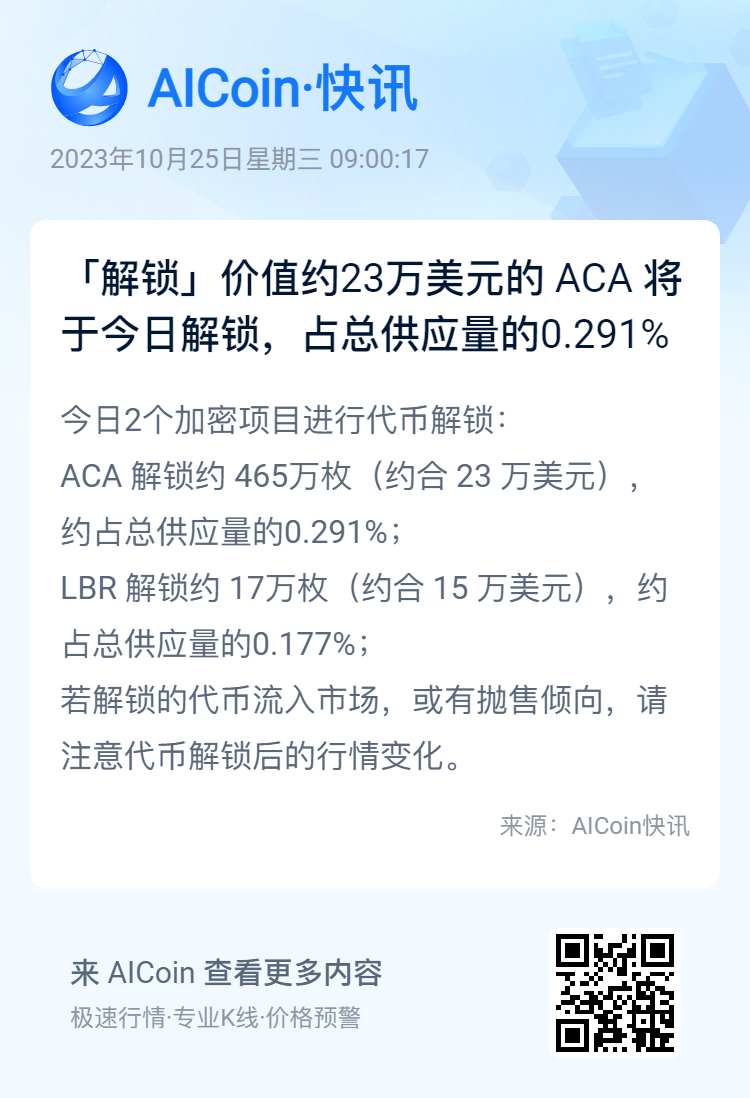

You can check the token unlock situation on the AICoin website. Alternatively, you can follow AICoin Express, which sends out the unlocking currency at 9:00 am every day.

https://www.aicoin.com/?longliveaicoin=true

What Impact Does Token Unlocking Have on Prices?

1. Increase in Supply: When tokens are unlocked, previously locked tokens become available for trading. This can lead to an increase in the supply, potentially causing downward pressure on prices if the demand does not increase correspondingly.

2. Market Sentiment: Unlocking dates usually cause fluctuations in market sentiment. If the unlocking date is seen as negative news by the market, investors may sell off tokens, leading to a price drop.

3. Investor Behavior: Unlocking dates may influence investor behavior. Some investors may choose to sell tokens after unlocking to make a profit, while others may hold onto the tokens. This behavior depends on their confidence in the future performance of the tokens.

4. Project Performance: Token unlocking may be related to the project's milestones or performance. If the project achieves successful milestones before unlocking, it may enhance investor confidence and help support the price. Conversely, if the project encounters issues or fails to meet its promises, unlocking may have a negative impact on prices.

5. Liquidity: Unlocked tokens can be traded more easily on the secondary market. This increases the liquidity of the tokens, allowing more people to participate in the market, but it may also lead to price fluctuations.

6. Market Trends: The impact of token unlocking also depends on the overall market trends. If the market is in a bull run, unlocking may have a relatively small impact on prices, while it may cause larger fluctuations in a bear market.

It is important to note that the unlocking mechanisms and scales vary for different projects, so the impact varies from project to project. Investors typically pay attention to unlocking plans and make decisions based on their own risk and return expectations. In cryptocurrency investment, unlocking events are one of the factors that need to be closely monitored.

Conclusion

There is a clear negative correlation with larger-scale unlocking events (where the circulating supply increases by more than 1 %). As the unlocking scale increases, prices decrease. Tokens with a large portion already unlocked (over 70 %) have significantly lower volatility and relatively higher prices, while tokens in the early stages of unlocking have relatively lower prices. Protocols with more allocations to private sales (such as teams and investors) perform slightly better compared to public sales (e.g., ecosystems and communities).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。