The currency circle once again experienced extreme market conditions yesterday. Let's review the intense fluctuations and timeline:

Around 4:30 am yesterday, the price of Bitcoin successfully broke through the 31804 daily line level, and then experienced a small upward fluctuation, reaching 34741 in just 5 minutes at 6:40. However, it quickly fell back to around 32500 by 7:10, and then surged again to the highest point of 35280 by 10:25. After that, there was another significant fluctuation until around midnight.

Now let's take a look at two screenshots of the news:

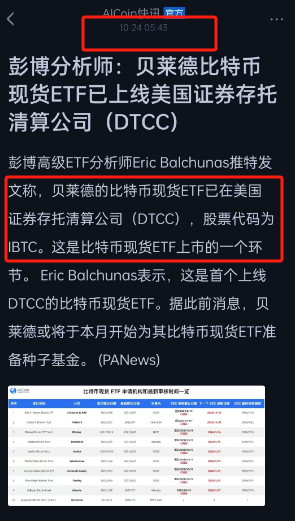

First, let's look at the first image: The news released at 5:43 triggered a violent surge around 6 o'clock due to the launch of the BlackRock spot ETF on DTCC.

Now, the second image: Another news release after midnight led to another significant fluctuation in the price of Bitcoin.

Next, let's take a look at a chart of the 24-hour liquidation across the entire network:

From the chart, we can see that the total liquidation amount across the network reached 281 million dollars within 24 hours. Details show that short positions liquidated 156 million, and long positions liquidated 125 million, resulting in nearly 2 billion RMB going up in smoke. It's obvious that both long and short positions were liquidated, and those who chased the high due to FOMO suffered a miserable fate.

What do you think about the issues revealed by the fluctuations in the price of Bitcoin and the liquidation data across the network?

BlackRock submitted its spot ETF S-1 amendment on October 17, a week before the news was released. Just before the submission of the amendment, the "SEC approved BlackRock's iShares Bitcoin Spot ETF" "mistake" occurred on October 16, causing a significant loss of wealth.

It's hard to believe that there were no shenanigans in between, and the large-scale sweeping and harvesting of retail investors during this period makes one shudder. The "Boy Who Cried Wolf" story on October 16 was reenacted just a week later!

Once again, it's worth noting that with the entry of traditional capital giants, the decentralized market is becoming more centralized. In an unregulated market, it's like a gaping mouth ready to devour people at any time, leaving nothing behind!

Stay away from contracts, stay away from high leverage!!!

When the price was at 25000, this account issued multiple warnings in the community: the overall direction is upward, do not short, even if it rises to the current level, it's still not the time to short!

Returning to the current market situation, with the stimulation of a wave of news, the market has once again entered a stalemate. This account's previous prediction around 25000 has been confirmed. The market is now in a state of oscillation, and many people may be fantasizing about the arrival of a bull market. However, it's important to temper expectations. The current conditions do not support a direct bull market, at most it's just oscillation at the daily level!

First, let's look at the daily chart. After breaking the high of the daily level, it has entered a divergence phase (it's important to distinguish between being in a divergence phase and having already diverged). This is worth our attention. However, the upward momentum is strong, and it's currently in a phase of increasing volume, making it difficult to judge whether the upward trend has ended. I have provided what I believe to be the most probable trend in the chart: after the end of the upward segment, it will continue to pull back to oscillate around the center, or even drop below 25000 to shake out more chasers. The only way to judge the arrival of a raging bull market is through a triple buy signal at the daily level!

Now, let's look at the 4-hour chart. The upward segment on the 4-hour chart is rising with increasing volume, and there is no central structure within the upward segment, making it difficult to accurately predict the future trend. The two possibilities given in the chart are what I believe to be the most probable trends.

As for operations, those with heavy spot positions can consider reducing their positions to prevent a direct downturn. Those with light positions can continue to hold. And for those who sold off, don't be too disheartened. This wave is just a small loss, and there will be many more opportunities to get in. We need to be patient and wait.

If you are interested in the Chande Kroll theory and want to access learning materials for free, watch public live broadcasts, participate in offline training camps, improve your trading skills with the Chande Kroll theory, and build your own trading system to achieve stable profitability, you can scan the QR code to follow the public account and message to add this account's WeChat to join the study group!

Special reminder: The advertisement below is not this account's contact information. Please be cautious!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。