Original Author: Frank, Foresight News

"Interest Rate Benchmark" in the Crypto Market? In 2022, the UST/Anchor, which achieved a 20% fixed annualized return in the form of a "ladder cloud vertical" with the left foot stepping on the right foot, personally destroyed this grand vision and also opened the painful stage of the continuous decline in DeFi market interest rates.

As time changes, the 10-year US Treasury bond yield, known as the "anchor of global asset pricing," has been steadily climbing in the past two quarters, and last night it even broke through the 5% integer mark, reaching a 16-year high since July 2007. However, with the sudden collective about-face of "pandemic war god" Bill Ackman and "old bond king" Bill Gross, the US bond yield quickly declined during the trading day, closing below 5%.

Amidst this ebb and flow, the continuously rising US Treasury bond yields have also stimulated a multitude of institutions to launch a large number of "tokenized" projects supported by US Treasury bonds through the RWA channel, and the fixed income track of the crypto market has also begun to usher in a new golden age.

This article by Foresight News aims to provide an overview of the current DeFi fixed income projects in the crypto market that are pegged to US Treasury bonds, and to explore the sources of 4%, 5%, or even higher returns, as well as the potential future concerns of these projects in the context of the continuous rise in US bond rates.

Overview of "Tokenized" Fixed Income Products of US Treasury Bonds

The fixed income projects involving the "tokenization" of US Treasury bonds mainly refer to linking cryptocurrency assets with US Treasury bond assets, meaning that users holding on-chain tokens are equivalent to owning the underlying financial assets of the traditional market—US Treasury bonds.

Furthermore, US Treasury bonds, as underlying financial assets, are often held in custody by institutions to ensure redemption, while on-chain tokenization can provide better liquidity to the underlying financial assets and further financialization opportunities (leverage, lending, etc.) through other DeFi components.

In the current crypto market, in addition to established projects such as MakerDAO and Frax Finance, new players like Mountain Protocol and Ondo Finance have also entered the arena.

MakerDAO's EDSR

MakerDAO is currently the leading project in the RWA track, and it is no secret that the proportion of assets that MakerDAO can use to purchase government bonds is limited. Previously, MakerDAO had been using USDC from the PSM module to cash out and purchase government bonds, but if there are too many users storing DAI to earn interest, the interest rate may even drop below the government bond rate.

The current Enhanced DAI Savings Rate (EDSR) is 5%, with a total of 1.73 billion DAI in DSR, resulting in the overall utilization rate of the DSR contract (the amount of DAI in the DSR contract / total DAI supply) far exceeding the 20% threshold, reaching 31%.

If the utilization rate of DSR exceeds the 35% threshold, EDSR returns will continue to decrease:

Within the 35% - 50% range, the multiplier for EDSR is 1.35 times the base DAI savings rate, resulting in an EDSR value of approximately 4.15%;

When it exceeds 50%, EDSR will no longer be effective, and the contract will only use the base DSR value, which is 3.19%;

Mountain Protocol's USDM

As a yield-stable coin protocol in which Coinbase Ventures has invested, Mountain Protocol's yield-stable coin USDM is mainly supported by short-term US Treasury bonds. After completing KYB certification, investors worldwide can share the opportunity to earn the US Treasury bond yield.

In addition, USDM provides daily rewards to users in the form of Rebase, similar to the mechanism of stETH. The current annual interest rate is 5%, and it has been listed on Curve's crvUSD-USDM liquidity pool, which means that non-US users can indirectly purchase and hold USDM to earn returns.

OKLink data shows that the total circulation of USDM is approximately 4.81 million, with a total of 116 holding addresses.

The official documentation states that at least 99.5% of its total assets are invested in cash, US Treasury securities, notes, and other debts issued or guaranteed by the US Department of the Treasury, as well as repurchase agreements secured by such debts or cash, making it fully supported by US bonds, with specific asset details updated monthly.

Angle Protocol's stEUR

As a decentralized stablecoin protocol, Angle Protocol has launched a Euro savings solution called stEUR, which allows users to pledge Euro stablecoin agEUR to obtain stEUR and earn a 4% annualized return paid in agEUR. However, this 4% return is only an initial setting, and will be periodically updated based on the contract's usage.

It is mainly backed by short-term Euro bonds with a theoretical yield of around 3.6%, but the protocol distributes a portion of the income to agEUR holders, and the current protocol asset return rate is approximately 1.6%.

Its income distribution approach is also simple: the income of non-pledged agEUR holders is used to supplement the income of pledged users. Since not all agEUR holders will pledge as stEUR, the income of stEUR users will definitely be greater than 1.6%.

For example, if only 50% of the circulating agEUR is in the stEUR contract, it means that 50% of stEUR receives all of the agEUR income, which is a 3.2% return rate.

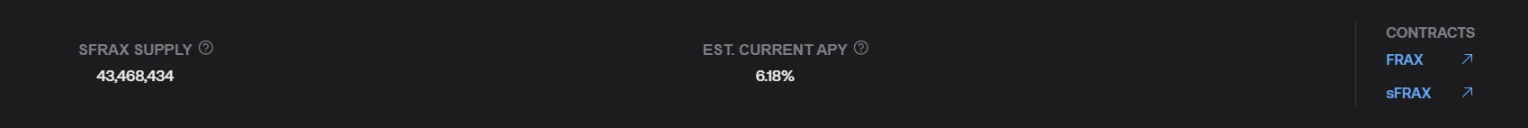

Frax Finance's sFRAX

Frax Finance has always been the most active project in DeFi to align with the Federal Reserve, including applying for a Federal Reserve master account (FMA) (Foresight News note: a Federal Reserve master account allows holding US dollars and directly trading with the Federal Reserve), thereby escaping the limitations of using USDC as collateral and the risk of bank failures, making FRAX the closest thing to risk-free US dollars.

Just on the 12th of this month, Frax Finance also launched the collateral pool sFRAX using US Treasury bond yields. It collaborates with Lead Bank in Kansas City to open a brokerage account to purchase US Treasury bonds, tracking the Federal Reserve interest rate to maintain relevance.

Users can deposit funds into sFRAX and earn a 10% return, and as the scale grows, the corresponding return rate will gradually shrink to the current IORB rate of the Federal Reserve, approximately 5.4%.

As of the time of publication, the total amount of sFRAX collateral has exceeded 43.46 million, achieving such remarkable results in less than half a month, and the current annualized interest rate has already dropped to 6.18%.

Ondo Finance USDY

In August, Ondo Finance also launched the tokenized note USD Yield (USDY) backed by short-term US Treasury bonds and bank demand deposits. However, US users and institutions cannot use USDY, and it can be transferred on-chain 40 to 50 days after purchase.

As an anonymous note, USDY can pay variable interest rates to holders, starting from 5% annual interest rate. Individuals and institutions do not require any certification requirements and can directly cooperate with Ondo to mint or redeem USDY daily.

Ondo has currently launched four bond funds: the US Money Market Fund (OMMF), the Short-Term US Treasury Bond Fund (OUSG), the Short-Term Investment Grade Bond Fund (OSTB), and the High-Yield Corporate Bond Fund (OHYG). OMMF has an annualized return of 4.7%, while OUSG's return can reach 5.5%.

Overall, most projects are allocated to short-term bonds and bond repurchase agreements, and the interest rates provided to external parties are mostly concentrated in the 4%-5% range, which also aligns with the current interest rate space of US bonds. Some high returns are supplemented by other income (such as EDSR) or compensate collateral users by sacrificing some non-collateralized users (such as stEUR).

Where Do High Returns Come From?

Where do high returns come from? It's simple—they come from the increasing "risk-free interest" of US Treasury bonds (the few projects mentioned earlier, such as stEUR, are anchored to government bonds of the respective country/region).

It's important to note that as of now, the possibility of default on US national debt is still extremely low, so the US Treasury bond yield is generally considered a risk-free interest rate by the capital market. This means that holding US Treasury bonds is similar to holding US dollars in terms of risk, but it also provides additional interest income.

In summary, the core idea of these fixed income projects is to raise dollars from users, buy US Treasury bonds, and share the generated (partial) interest with users.

In short, these fixed income projects will launch yield-stable coins supported by US Treasury bonds, and holders only need to hold the stable coin as proof to receive the "interest income" from the underlying financial asset, which is the US bond:

Users who have completed KYC/KYB can mint/exchange for $1, and the project will buy the corresponding government bonds, allowing stable coin holders to enjoy the opportunity to earn from government bond yields, maximizing the transmission of government bond interest to stable coin deposit users.

Currently, the yield of US medium-term government bonds is close to or exceeds 5%, so the interest rates of the majority of fixed income projects supported by US bonds are mostly in the 4%-5% range.

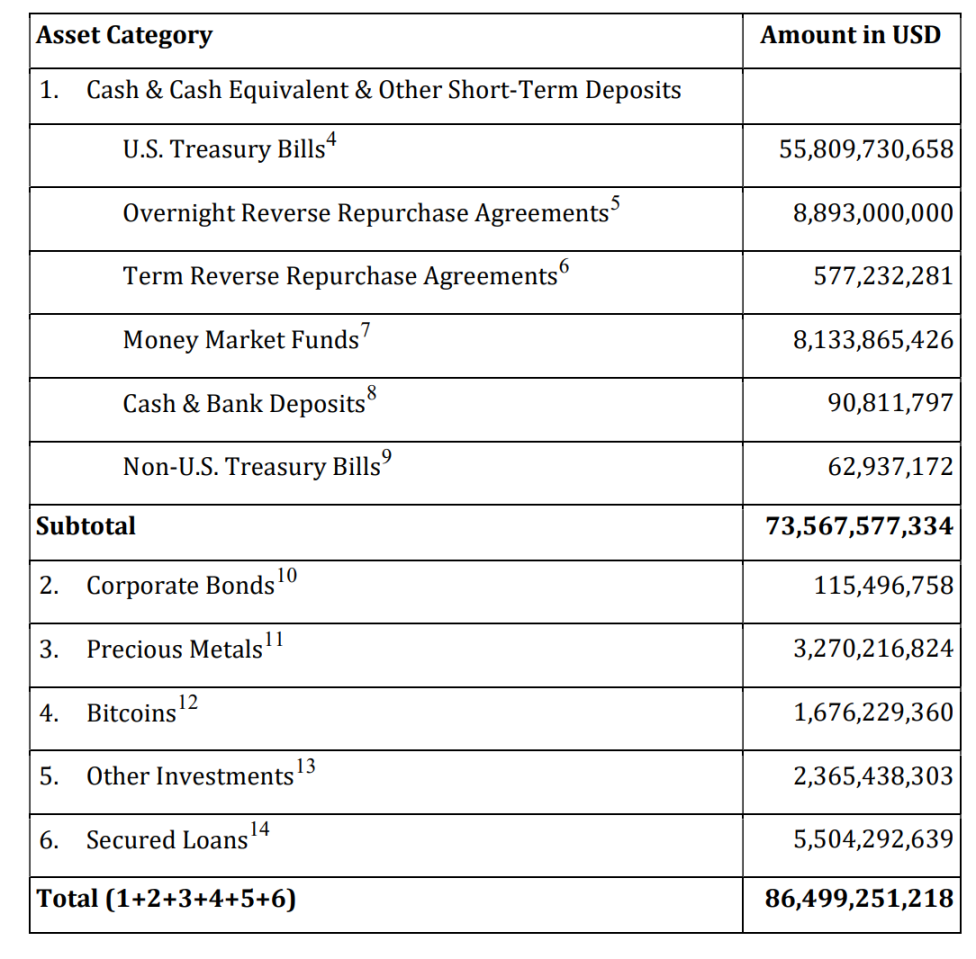

An example might make it more intuitive—these yield-stable coins are essentially distributing the government bond interest income that Tether/USDT monopolizes to a wide range of stable coin holders:

It's important to note that the process of Tether issuing USDT essentially involves crypto users using dollars to "purchase" USDT from Tether—Tether issuing $10 billion of USDT means that crypto users have deposited $10 billion to Tether to obtain $10 billion of USDT.

After receiving this $10 billion, Tether does not need to pay interest to the corresponding users, essentially obtaining real dollar funds from crypto users at zero cost. If they buy US Treasury bonds, it's zero-cost, risk-free interest income.

According to Tether's disclosed second-quarter audit report, it directly holds $55.8 billion in US government bonds. At the current 5% government bond yield, this means Tether earns approximately $2.8 billion annually (about $700 million per quarter). The second-quarter operating profit of Tether exceeding $1 billion also confirms the profitability of this model.

Additionally, these stable coins can be freely used in DeFi, including meeting derivative demands such as leverage and lending through other DeFi protocol components.

Hidden Concerns of US Bond Turmoil

Overall, the potential risks faced by fixed income projects supported by government bonds and the stable coins they launch mainly come from three aspects:

Psychological risk of continuous decline in US bond prices. If the assets (US bond value) do not cover the liabilities (stable coin market value), once it falls to a psychological threshold, it may trigger an avalanche of disanchoring;

Liquidity risk due to maturity mismatch. If there is a significant fluctuation in the crypto market, users selling stable coins to replenish liquidity may lead to a run on the bank;

Custodian risk. It still heavily relies on trust in the custodian of the underlying government bond assets;

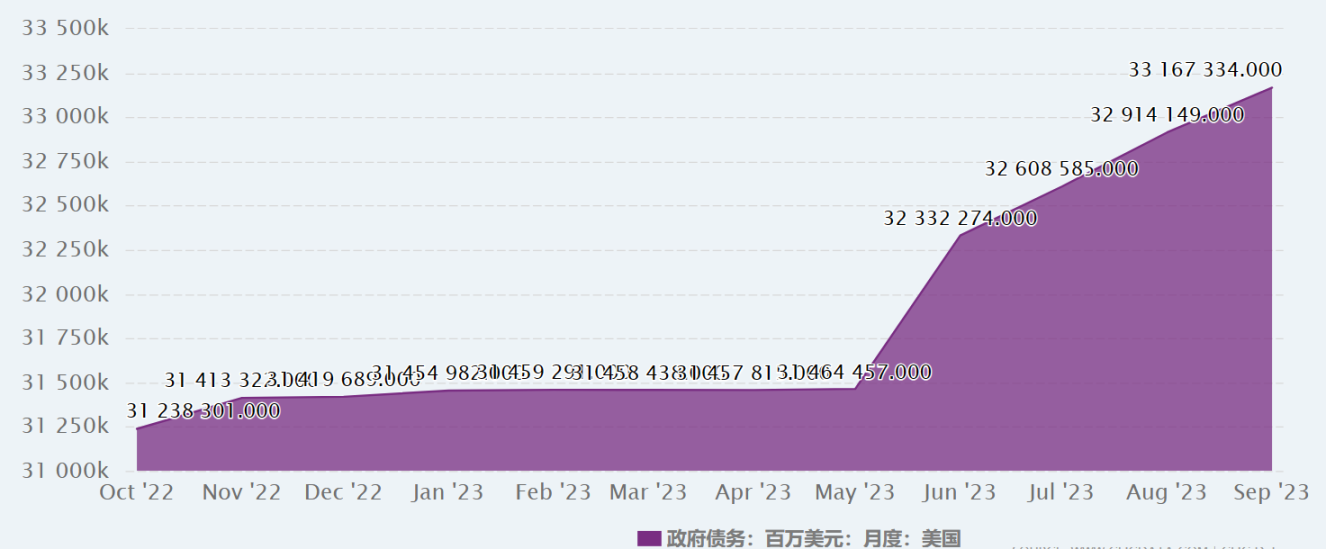

Risk of US Bond Decline

It is well known that bond yields and prices are two sides of the same coin. Therefore, the continuous rise in US bond yields, reaching a period high, also means that the price of US bonds has been continuously declining, reaching a period low.

The trigger behind the mentioned breaking of the 5% mark by the 10-year US bond yield, including the debt ceiling negotiation in June, has led to a far larger issuance of US bonds since the debt ceiling was opened in June:

As of the end of May, the US government debt was $31.4 trillion, and since the debt ceiling was opened in June, the total debt has exceeded $33 trillion, disrupting the supply and demand relationship of government bonds in the market.

This also means that the market value of the underlying financial assets (i.e., US bonds) supporting these yield-stable coins is actually depreciating with the continuous rise in yields. However, as long as they are not actually sold, it is still only a paper loss, presenting a hidden "insolvency."

It is predicted that US bond issuance in the fourth quarter may still be at a high level. If this supply-demand deviation continues, the price of US bonds will undoubtedly remain under pressure.

This is a key point of risk accumulation—if US bond yields continue to rise, the price of US bonds will continue to decline. Once users realize that the asset price behind it has shrunk to an unacceptable level, reaching a psychological threshold and initiating redemption, the "paper loss becomes a real loss," and the insolvency situation will become a reality, ultimately triggering an avalanche.

Liquidity Risk

Liquidity risk is also a potential technical risk worth paying attention to. If the decline in US bond prices is passively causing the value of the assets behind the yield-stable coins to decrease, then it is actively exacerbating this problem through the imbalance of the asset-liability structure.

The core issue is that the interest earned by the project from holding US bonds is due at maturity, but the RWA assets (i.e., the stable coins launched by various projects) held by users do not need to wait for the maturity of US bonds to redeem the interest. Where does the money come from?

For example, taking the 10-year US bond yield that has just broken the 5% mark, even if the project currently buys it, it will need to wait for 10 years to pocket the average annualized 5% return. However, at the same time, on-chain token holders can redeem almost immediately. Why?

Maturity mismatch.

As mentioned in the analysis of the sources of high returns, since the main purpose of the stable coins launched by various projects is not to serve as a direct exchange medium, but to provide income to holders, the underlying financial assets are basically government bonds of different maturities.

To ensure a balanced risk and return for the investment portfolio and provide as high a fixed income as possible to on-chain token holders (not to mention the temporary inversion of US bond short-term and long-term yields, among others), it undoubtedly combines "long-term bonds" and "short-term bonds" to balance liquidity (prevent user redemptions) and provide fixed income.

This is understandable, as one of the essential aspects of finance is maturity mismatch, which is a major source of income in the finance industry. However, don't forget that it is also an important source of liquidity risk.

We just need to imagine a scenario—significant fluctuations in the crypto market, leading to widespread liquidation or near-liquidation of investors, which may prompt holders to replenish liquidity by selling RWA.

Under such liquidity risk shocks, the project can only recover liquidity by selling US bonds. Initially, it would naturally be short-term bonds with good liquidity and small discounts. However, once the redemption demand exceeds the remaining short-term bond quantity, they would have to choose to sell long-term bonds at a discount.

Especially since the underlying financial assets (i.e., US bonds) are only traded during working hours on weekdays, while the tokenized assets on the chain are traded 24/7. This mismatch in trading hours could potentially hinder the project from selling US bonds to recover liquidity in a timely manner, further exacerbating selling pressure during market turmoil.

At this point, the project either has to lower the advertised fixed interest rate or quietly make provisions for losses. However, once the advertised fixed interest rate is lowered, it could likely trigger a crisis of trust and lead to a run on the bank, exacerbating the selling frenzy, which could easily lead to stable coin disanchoring and further exacerbate liquidity risk.

Does this sound very familiar?

Yes, this is almost exactly the same risk chain and transmission pathway that started in the Silicon Valley bank crisis in March this year, which almost led to the bankruptcy of several banks, including Silicon Valley Bank and Signature Bank, and almost caused systemic risk.

Custodian Risk

Of course, to some extent, the connection between the tokenization of US Treasury bonds in the crypto market and the traditional financial market is also two-way. Extreme fluctuations in the crypto market may potentially transmit "RWA-US bonds" to the traditional financial market.

However, the scale of the tokenization of US Treasury bonds in the crypto market is still very limited, and the liquidity of the US bond market is very sufficient to withstand such an impact, so it is currently very difficult for such selling to affect the price of the underlying financial assets.

This leads to another potential risk point—the reliability of custodian institutions. Taking Circle, a leading crypto project holding a massive amount of US bonds, as an example, it is mostly custodied by US financial institutions such as BlackRock (Circle Reserve Fund), which is relatively safe.

Currently, the stable coins supported by various fixed income government bonds still heavily rely on trust in the custodian institutions of the underlying government bond assets, and the disclosure of information is very limited, which is also a risk point that cannot be ignored.

Conclusion

Amidst the interest rate feast, will this brutal pleasure ultimately end in a brutal manner?

For the vast majority of ordinary investors, the fixed income projects tokenizing US bonds through RWA provide an opportunity to participate in sharing the income from US Treasury bonds, although most of them have corresponding entry barriers.

It also introduces more abundant funds and high-quality underlying assets to the DeFi field and the crypto market, which is a positive factor for the entire crypto market.

However, as the short-term US bond supply has surged since June, the US government has already overcome the dilemma of issuing bonds to alleviate funding gaps. Therefore, since the 5% mentioned earlier is an important psychological threshold, it also means that the actual yield cannot sustainably remain in the current high range.

For users currently hoping to earn income through the tokenization of US bonds, it is undoubtedly necessary to manage expectations and control risks:

On the one hand, it is important to understand that no one can guarantee that the 4%, 5%, or even higher US bond yield will continue, and there is a critical point between "yield - price." Once the US bond price falls below a certain point, the insolvency (US bond value not covering stable coin market value) could materialize, and a disanchoring avalanche could occur in an instant.

On the other hand, projects offering fixed interest rates above 5% imply a more complex "long-short bond" maturity mismatch—as mentioned earlier, this also means that the higher the fixed interest rate of the project, the higher the potential liquidity risk, and the occurrence of a run on the bank could be more likely.

There is no eternal feast in the financial market, especially in the crypto industry.

What is given will be taken away, and all will return to one place. Having experienced UST/Anchor, perhaps we should be more aware that no matter how grand the high-yield narrative is, if it cannot exit the stage in its entirety, it will only be a mirage.

Time will give us the answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。