The opportunities in the field of encrypted payments are enormous, providing a cheaper, faster, and global payment method that helps increase transparency, security, and efficiency, driving the recognition and acceptance of cryptocurrencies.

Author: @kayphillips / Source: https://twitter.com/kayphillips/status/1713941226624307691

About encrypted payments, there are two in-depth reports: https://rb.gy/oudpl and company database: https://rb.gy/jg4ma (continuously adding). Here are some highlights summarized by the author in the report.

Recently, I published a post about the next huge opportunity for payments in the cryptocurrency field, and payments have shown strong momentum in both Web2 and Web3.

1. How big are the opportunities in the field of encrypted payments?

By 2026, 80% of global financial leaders will incorporate encrypted payments into their businesses. By 2028, the global stablecoin market size will reach $28 trillion. This is a huge opportunity for cryptocurrencies. Blockchain and cryptocurrencies provide a cheaper, faster global payment method, which has already begun to prove its practicality worldwide. The payment field provides an opportunity for the cryptocurrency industry to gain greater legitimacy, as blockchain and stablecoins can become the cornerstone of the open, global financial infrastructure that many envision for the future. By playing a role in the payment field, cryptocurrencies are expected to inject more transparency, security, and efficiency into the global financial system, thereby gaining wider recognition and acceptance in the industry.

2. What is the role of encrypted payments?

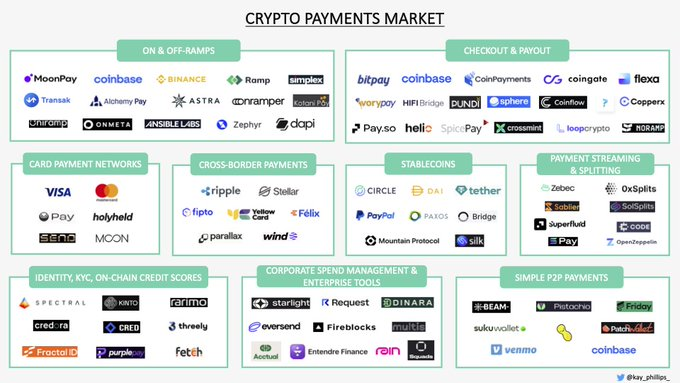

The value-added role of cryptocurrencies in the payment field includes: - Lower transaction costs (cryptocurrency costs 0-1%, while the average credit card fee is 2.24%) - Instant, 24/7 payments and settlements - Borderless payments on a global scale - No refund risk and reduced fraud risk. Therefore, what roles can cryptocurrency startups play in this field? I break it down into the following sub-industries:

1) Stablecoins

Non-dollar stablecoins will become increasingly popular, including Euro stablecoins and new stablecoin models such as flatcoins, @MountainUSDM, and @SilkStable. After PayPal launched PYUSD, other Web2 fintech companies may introduce open or closed-loop stablecoins. Stablecoin infrastructure, such as http://bridge.xyz, will need to bridge between the two.

2) Card payment networks

Visa and Mastercard have long-standing network effects that are difficult to compete with, but Web3 companies launching a suite of products can start similar card networks to those of Web2 and ideally build network effects that enhance their competitive barriers. gnosispay has made significant progress in its decentralized, vertically integrated Web3 card network. Users can access 2 Safe wallets (L1 Safe is a savings account; L2 Safe is a spending account), Visa debit cards, and other real-world payment solutions (SEPA, Apple Pay, etc.).

3) Payment gateways (checkout, payments)

The conversion of fiat currency to cryptocurrency may still be a less convenient user experience, but companies are addressing this issue from various angles. -coinflow and Ansible Labs are integrating fiat RTP (real-time payments) to speed up merchant payments. -loopcrypto.xyz is using automation technology to allow users to set and forget payment operations. -noramp and Zephyr Exchange are using zero-knowledge proof (ZKP) technology for decentralized on/off-ramp operations.

4) Corporate spending management

Today, we have Web2 solutions and Web3 solutions, but we need a "Web2.5-oriented Brex" (a unified fiat > cryptocurrency platform) so that financial directors do not have to worry about two separate stacks. The best and most powerful Web2.5 solution I have seen is starlightmoney.

5) Streaming payments and split payments

Streaming payments make subscription, continuous interest, on-demand payments, on-demand wage access, and micropayments possible. Sablier's dynamic issuance provides a more powerful incentive design. Split payments enable programmable royalties, licensing, and partner payments.

6) Simple peer-to-peer payments and WaaS

Account abstraction drives significant improvements in user experience, resulting in: 1) "Unhosted Venmo" platforms that offer simple peer-to-peer payments, such as beameco. 2) URL-based peer-to-peer payments with automatic wallet creation, such as Peanut Protocol and patchwallet. For those interested, the full report (https://t.co/5awhdTNzZB) contains many additional insights and excellent companies building in the field of encrypted payments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。