Push forward the development of decentralized and modular blockchain, focusing on building stable systems, cross-chain communication, and modularization of Bitcoin direction.

Author: Zeke, YBB Capital / Source: https://medium.com/ybbcapital/modular-blockchain-a-new-persp

Translation: HuoHuo / Plain Language Blockchain

1. Preface

The "impossible triangle" of blockchain has always been a gap that the industry has been difficult to overcome, and previous public chain projects have always tried to cross this gap through the design of different architectures, aiming to become the so-called "Ethereum killer." However, the fact is cruel. Over the years, Ethereum's dominant position has never been surpassed, and the impossible triangle of blockchain remains unbreakable. So, is there a way for public chains to fill the gap of the "impossible triangle"? This is the birth of Mustafa Albasan's idea of modular blockchain.

2. Origin of Modularization

The birth of modular blockchain originated from two white papers, one of which was co-authored by Mustafa Albasan and Vitalik in 2018, titled "Data Availability Sampling and Fraud Proofs." This paper describes how to solve the scalability problem of blockchain without sacrificing security and decentralization, by allowing light clients to receive and verify fraud proofs from full nodes, and designing a data availability proof system to reduce the trade-off between on-chain capacity and security.

Then in 2019, Mustafa Albasan wrote the white paper for Lazy Ledger, detailing a new architecture where the blockchain is only used for ordering and ensuring the availability of transaction data, and is not responsible for transaction execution and verification. The purpose of this architecture is to solve the scalability problem of existing blockchain systems. At that time, he referred to it as "smart contract client."

Smart contracts are executed on another execution layer, Celestia (the first modular blockchain), on this client. The emergence of Rollup made this concept clearer. Because Rollup's logic is to execute smart contracts off-chain, then aggregate the results into proofs and upload them to the "client's" execution layer.

By rethinking the architecture of blockchain and new scaling technologies, he defined a new paradigm, which he called "modular blockchain."

3. What is Modular Blockchain?

The traditional integrated blockchain architecture usually consists of four functional layers:

(1) Execution Layer - The execution layer is mainly responsible for processing transactions and executing smart contracts. It includes transaction verification, execution, and state updates.

(2) Data Availability Layer - The data availability layer in modular blockchain is responsible for ensuring that data in the network can be accessed and verified. It typically includes functions such as data storage, transmission, and verification to ensure the transparency and trust of the blockchain network.

(3) Consensus Layer - Responsible for the protocol between nodes to achieve consistency of data and transactions in the network. It verifies transactions and creates new blocks through specific consensus algorithms (such as Proof of Work (PoW) or Proof of Stake (PoS)).

(4) Settlement Layer - Responsible for the final settlement of transactions, ensuring the transfer of assets and recording them permanently on the blockchain, determining the final state of the blockchain.

The integrated design of these components in a monolithic blockchain inevitably leads to inherent problems, such as poor scalability, lack of flexibility, and difficulty in maintenance and updates.

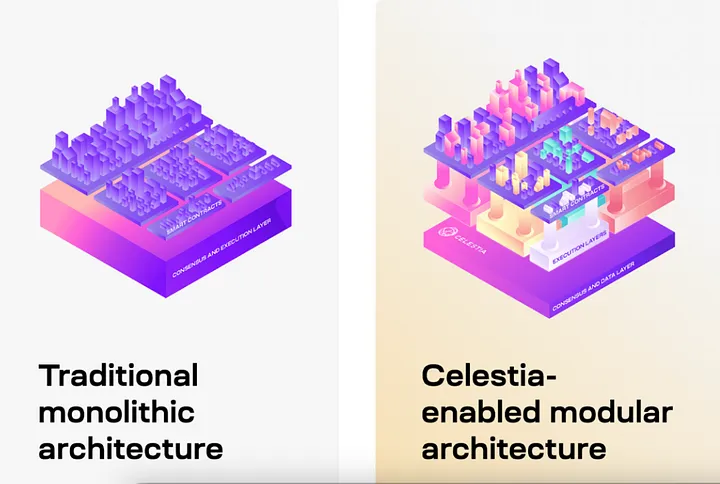

However, Celestia believes that a monolithic blockchain no longer needs to do everything on its own. The future evolution of Web3 will be "modular blockchain," by modularizing the blockchain and dividing its processes into multiple "specialized layers," each handling specific functional layers, creating a better system that is independent, secure, and scalable.

1) Modular Design Principles:

If the design decomposes the system into smaller parts that can be replaced or substituted, the design is modular. The core idea is to focus on doing only a few things well (working on part or single functional layer), rather than trying to do everything. Examples of modular projects we are familiar with in the past include Cosmos Zones and Polkadot parallel chains.

2) New Perspective

Based on the modular perspective, the redesign space of monolithic blockchain and its modular stack will be greatly improved. Modular blockchains with different specific purposes and architectures can work together. With multiple design possibilities, this approach has also given birth to many interesting and innovative projects. The following discussion will focus on the current controversies about different functional layers and how Celestia explains "modularization" from a modular perspective.

4. Execution Layer Centered on Ethereum

If we consider Rollup as a modular execution layer, we will find that almost all modular execution layer projects are built on top of Ethereum. The reason is obvious. Ethereum has a large amount of resources as a moat, and its decentralization is the strongest choice, but its scalability is poor, so there is great potential for redesigning the functional layer. Comparing the recent lukewarm response of the Move system language public chain (APT, SUI) with the unprecedented enthusiasm for Layer2 on Ethereum, it is not difficult to see that the narrative of blockchain infrastructure has shifted from building public chains to building Ethereum Layer2. So, is the existence of modularization good or bad? Will the Ethereum-centered execution layer stifle public chain innovation?

1) Blockchain Scaling Chart

First, from the perspective of the execution layer, reclassify the existing chains. Here, we refer to Nosleepjon's article "Tatooine's Double Sun" to explain the current classification of blockchain execution levels.

Current blockchains can be divided into four categories:

(1) Single-threaded Monolithic Blockchain: A single blockchain that processes one transaction at a time. Due to limitations, most of them have shifted to the Rollup or horizontal scaling roadmap. Representative projects: Ethereum, Polygon, Binance Smart Chain, Avalanche

(2) Parallel Processing Monolithic Blockchain: Monolithic blockchains that process multiple transactions simultaneously. Representative projects: Solana, Monad, Aptos, Sui

(3) Single-threaded Modular Blockchain: Modular blockchains that process one transaction at a time. Representative projects: Arbitrum, Optimism, zkSync, Starknet

(4) Parallel Processing Modular Blockchain: Modular blockchains that process multiple transactions simultaneously. Representative projects: Eclipse, Fuel

2) Monolithic Parallel Processing Architecture and Modular Architecture

There is much discussion about which approach to take, especially when it comes to the concepts of modularization and global parallel processing. There are also three camps:

(1) Modularization Camp: Advocates of modularization (mostly Ethereum advocates) believe that a single monolithic blockchain cannot solve the impossible triangle of blockchain. Stacking Lego blocks on Ethereum is the only way to achieve scalability while maintaining security and decentralization. Modularization also offers more control and customizability.

(2) Monolithic Parallel Processing Camp: This camp (quoting Kodi and espresso's views in "Monolithic vs. Modular: Who is the Future of Blockchain?") believes that the new public chain architecture of single-piece parallel processing (Move system, Solona, etc.) has high integration and overall performance will be better than fragmented modular design, and modular architecture is not secure, especially requiring a lot of cross-chain communication, expanding the attack surface for hackers.

(3) Neutral Camp: Of course, there are also those who take a neutral stance, believing that both can ultimately coexist. For example, Nosleepjon believes that the ultimate game is that both sides have their own advantages, and the competition between public chains still exists, and Rollup will also compete with each other.

3) End of the Game

The focus of this issue can actually be summarized as whether the friction disadvantages of modularization (such as insecure cross-chain communication and poor system processes) outweigh the centralization issues of new public chains. From the market debate, neither the drawbacks of centralization in Rollup nor the insecurity of cross-chain bridges have led people to turn to new public chains. That's because all of these issues seem to have room for improvement, and new public chains cannot replicate the massive ecosystem moat and decentralization advantage of the Ethereum chain.

On the other hand, while new public chains have performance and integration advantages in architecture, they are simply forks of the Ethereum ecosystem, with a high degree of homogeneity and a lack of liquidity. There is no exclusive application that can demonstrate its own architectural advantages, so there is no reason for people to abandon the Ethereum ecosystem.

The flexibility of Rollup is high, and there is still a lot of room for improvement in the new architecture of Rollup. When Rollup also has most of the advantages of non-EVM chains in the future, it will be difficult to see another "Solana Summer." So in this case, I believe that the friction disadvantages of modularization are smaller than the centralization issues of public chains. And the neutral situation seems to not exist, as the Ethereum's network effect will attract a large number of developers focused on scalability to the second layer, and new public chains will become ghost towns.

So, regarding the future of infrastructure, I undoubtedly lean towards modularization. Ethereum's categorized scaling will also mark the beginning of the endgame of public chain competition, the competition between Layer2 of general chains, and the competition between Layer3 of super application chains.

The projects funded in the primary market currently confirm this point. Apart from a large number of Ethereum Layer2 projects, there are almost no new public chains, except for Bitcoin's scaling projects.

But then again, this industry has always been built on the development of Ethereum, and the current trend is a bit too concentrated. Is this situation really good? Lack of competition may hinder the development of an industry. This industry needs diversity and more choices. If user experience gradually becomes homogeneous, how will new public chains create breakthroughs? This is not yet seen. As Ethereum continues to improve its own shortcomings, how to find a greater gap to make precise strikes against non-EVM systems needs to be a focus.

5. Stage of DA Plan

The controversy over the execution layer has shifted to the controversy over the data availability layer (DA layer). The recent debate about which data availability scheme Rollup should adopt has become a hot topic in the industry. This was sparked by a tweet from Dankrad Feist, a researcher at the Ethereum Foundation, discussing the issue, and in his view, a Rollup without Ethereum DA is not Layer2. Will the past Layer1 war evolve into a war between orthodox (with Ethereum DA) Layer2 and unorthodox Layer2? Currently, the industry mainly has three solutions for DA:

1) Public Chains as Settlement Layer

Taking Ethereum as an example, the fees submitted to Ethereum when conducting transactions in Rollup mainly include the following categories:

(1) Execution fees: Compensation for the computational resources required to execute transactions on the platform. It includes gas fees required to execute transactions, usually proportional to the complexity and execution time of the transaction. In Rollup, execution fees may include the cost of off-chain transaction execution and the cost of generating and verifying transaction proofs.

(2) State fees: Related to updating the state on the Ethereum main chain. In Rollup, this includes the cost of submitting a new state root to the main chain. Each time the Rollup aggregator generates a new state root and submits it to the main chain, state fees are incurred. This cost may be proportional to the frequency and complexity of state updates.

(3) Data availability fees: The cost of publishing data to Layer1.

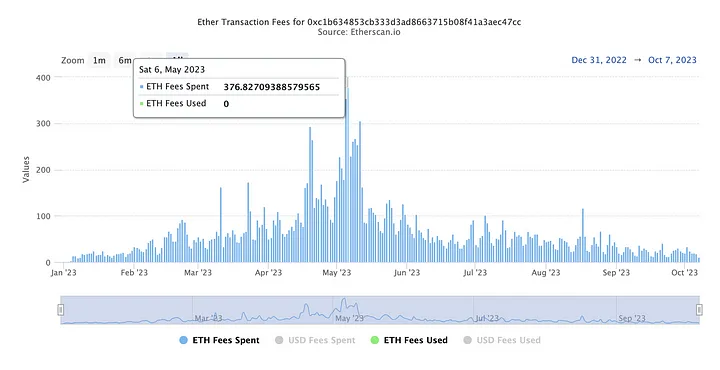

Among these fees, data availability fees account for the largest proportion and are costly. For example, on May 6th of this year, Arbitrum paid 376.8 ETH in gas fees to Ethereum due to the explosion of gas fees.

This is because Rollup uploads data to Ethereum in the form of Calldata and permanently stores this data, making it very expensive. However, the benefit is that the security and legitimacy of Rollup is the best among the three solutions, and the cost of this solution is lower than the update after the Cancun upgrade to EIP-4844. By introducing transaction formats and using Blob to carry transactions, the transaction format carries Layer2 data with an additional Blob bit. And the Blob data will be deleted by the node one month later, greatly saving storage space.

The transaction format of Blob provides data availability at a lower cost than Calldata. There are two main reasons for this: On the one hand, Calldata exists in the Execution Payload, while Blob data is stored in Prysm nodes or Lighthouse nodes (not Geth), and when a contract needs to read Calldata, it consumes more resources. On the other hand, Blob data is short-term storage, and nodes will delete Blob data one month later. However, the GAS cost will still be higher than the latter two solutions.

2) Validiums DA Mode

For application chain-type Rollups (such as previous dYdX, Immutable, etc.), they usually use Validiums introduced by the Layer 2 scalability engine of header Rollup projects (currently the most common is StarkEx, but ZK series header projects have similar plans). Under the DA mode, due to the large amount of computation on the application chain, they prefer to use Validiums, which is a low-cost, high-throughput solution. Validium aims to use off-chain data availability and computation, similar to ZK-rollup, to verify off-chain transactions on Ethereum by publishing zero-knowledge proofs. However, unlike ZK-rollup, which keeps data on-chain, Validiums keep data off-chain and cost 90% less than using Ethereum, making it the most cost-effective solution in alternative scenarios.

However, since the data is still off-chain, the operator of Validium can freeze users' funds. To prevent extreme situations, the Data Availability Committee (DAC) plan must be reintroduced, and the DAC must confirm receipt of the data by signing each state update with its statutory number of signatures. This is a controversial practice because you must first trust the security of the entity, not the chain. Dankrad Feist, the creator of EIP-4844 mentioned this solution directly in his tweet.

3) Modular DA

From a modular perspective, there are many ways to redesign the DA layer, which may lead to different specific implementations for different projects. Therefore, a detailed description of modular DA projects requires a lot of space, and the description of the DA project is represented by Celestia.

Celestia

As the first proposer of the modular blockchain concept at the beginning of this article, Celestia is the most well-known and earliest project in this field. Its vision is to solve the scalability and modularization issues of blockchain. Based on the COSMOS architecture, Celestia provides developers with greater flexibility, allowing them to deploy and maintain blockchain applications more easily. At the same time, it supports the needs of various applications and services by providing a modular and scalable blockchain architecture for dApp creators and blockchain developers, thereby reducing the cost and complexity of deploying blockchains.

Its Operation and Architecture

Decoupling Execution: Celestia's logic is to divide the protocol into different layers, each focusing on specific functions, and then recombine them to build blockchains and applications. Celestia focuses on the consensus layer and data availability layer in the hierarchical structure. Similar to some Layer1 solutions, Celestia uses Tendermint (a Byzantine Fault Tolerance (BFT) consensus algorithm) to order transactions, but unlike other Layer1 solutions, Celestia does not validate the transactions or execute them. It only packages, orders, and broadcasts the transactions, and all transaction validity rules are enforced by the client's Rollup nodes (i.e., decoupling the consensus layer and execution layer). A key point to note is "do not validate transaction validity." Malicious blocks hiding transaction data can also be published to Celestia. So how should the verification process be implemented? Celestia introduces two core elements here, 2D Reed-Solomon encoding and Data Availability Sampling (DAS).

The overall architecture of the blockchain contrasts sharply with Celestia's modular architecture.

DAS: This scheme is used for light nodes to verify the availability of block data without needing to download the entire block. It only requires a part of the block to sample the data (specific implementation requires 2D Reed-Solomon encoding, which will be explained in detail below). Unlike the previously mentioned DAC, DAS does not require trust in the security of entities; it only requires the chain to be sufficiently decentralized for the data to be trusted.

2D Reed-Solomon Encoding (Erasure Coding): The basic idea of 2D Reed-Solomon encoding is to apply Reed-Solomon encoding to rows and columns separately. This way, even if some rows and columns of the 2D data are corrupted, they can still be corrected. By encoding the block data, the data is divided into k blocks, arranged into a k×k matrix, and then expanded into a 2k×2k extended matrix through multiple Reed-Solomon encodings. The 4k independent Merkle roots of the rows and columns of the extended matrix are calculated, and these roots are used as commitments for the block data in the block. Celestia's light nodes sample the 2k×2k data blocks. Each light node randomly selects a unique set of coordinates in the extended matrix and queries the full node for the data block corresponding to these coordinates and the respective Merkle proof. The received data block with the correct Merkle proof is then broadcast to the network.

In abstract terms, it can also be said that the block data is divided into a matrix (e.g., 8x8), and through encoding, additional "check" rows and columns are added to the original data to form a larger matrix (16x16). By randomly sampling and verifying the accuracy of a portion of the data within this larger matrix, the integrity and availability of the overall data can be ensured. Even if some data is lost or corrupted, the checksum data can be used to recover the entire data.

Block Scaling: Celestia scales with the increase in the number of light nodes. As long as there are enough nodes on the network to sample the entire block, Celestia remains secure. This means that as more nodes join the network for sampling, the block size can increase accordingly without sacrificing security or decentralization. Doing this on a traditional whole blockchain would sacrifice decentralization because larger block sizes would increase the hardware requirements for nodes to download and verify data.

Sovereign Rollup: This is also a concept pioneered by Celestia, combining elements of various blockchain designs, including Layer 1 blockchains, rollups, and early Bitcoin networks like Mastercoin. The main difference between Sovereign rollup and smart contract rollups (e.g., Optimistic rollups, Arbitrum, ZK rollups, etc.) lies in the way transactions are verified. In smart contract rollups, transactions are verified by smart contracts on Ethereum. In contrast, in Sovereign rollups, the aggregating nodes themselves verify the transactions.

Sovereign rollup publishes its transactions to another blockchain (e.g., Celestia) for ordering and data availability. Then, the nodes of Sovereign Rollups determine the correct chain. This design allows Sovereign rollups to inherit multiple security aspects from the data availability (DA) layer, including liveness, security, resistance to reorganization, and resistance to censorship.

For smart contract rollups, upgrades depend on the smart contracts at the settlement layer. Upgrading a rollup requires changing the smart contracts. It may require multiple signatures to control who can initiate the update of the smart contracts. While team-controlled upgrade multisigs are common, it is possible to control multisigs through governance. Since smart contracts exist at the settlement layer, they are also subject to social consensus at the settlement layer.

Sovereign rollup upgrades through forks, similar to Layer 1 blockchains. New software versions are released, and nodes can choose to update their software to the latest version. If nodes disagree with the upgrade, they can continue using the old software. Providing the option allows the community (those running nodes) to decide whether to accept the new changes. Even if the majority of nodes upgrade, they cannot force others to accept the upgrade. This feature makes Sovereign rollup "sovereign" compared to smart contract rollups.

Quantum Gravity Bridge (QGB): A key component of the Celestia ecosystem, serving as a bridge between Celestia and Ethereum (or other EVM L1 chains) to facilitate the transfer of data and assets between the two networks. By introducing the concept of Celestium (EVM L2 rollup), using Celestia for data availability, but choosing Ethereum, it leverages the advantages of both networks: the scalability and data availability of Celestia, and the security and decentralization of Ethereum. Validators on Celestia can run QGB, enabling Celestium to provide strong data availability guarantees for block data at a cost only a fraction of Ethereum calldata.

QGB is a key part of Celestia's vision for a scalable, secure, and decentralized blockchain ecosystem. It achieves the interoperability needed for the future of blockchain technology. The project is currently researching Zk QGB to further reduce the gas cost of verification.

6. DA Economics

Let's talk about the future economic value of DA.

This assumption was made by Delphi researcher Jon Charbonneau, based on the prediction of Polygon Hermez, that they will eventually only need 14 bytes per transaction in Danksharding. Similarly, based on the EIP-4844 specification mentioned above, in the case of 1.3 MB/s, Layer2 can achieve around 100,000 TPS, resulting in an estimated revenue of a staggering $30 billion.

With such a huge opportunity, the future competition in the DA market will be very intense. In addition to the three major solutions, Stark's Layer3, zkPorter, and several modular DA projects will also join the competition. So, from the perspective of existing Layer2 projects, the general chain tends to use Ethereum DA. Application chains and long-tail chains will be the main customers of "unconventional DA". In my opinion, modular DA and soon-to-come Layer3 will be the mainstream choice in the future.

7. Conclusion

Moving towards decentralization is still the mainstream concept in the industry, and modular blockchain is essentially an extension of the value of Ethereum, as well as an attempt to break the blockchain trilemma. Although the design is diverse, it also makes construction more complex. Due to the various choices of modules in modular construction, there is a risk of blind boxes, and how to build a more stable modular system is an area of concern. On the other hand, driven by the trend of modularity, dozens of Layer2 solutions will once again reduce liquidity, and cross-chain communication and security will also be the focus of the future. Bitcoin's modularity is also a recent hot trend, with some slightly feasible solutions that are worth paying attention to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。