Article Source: Silicon Research Lab

Author: Walnut

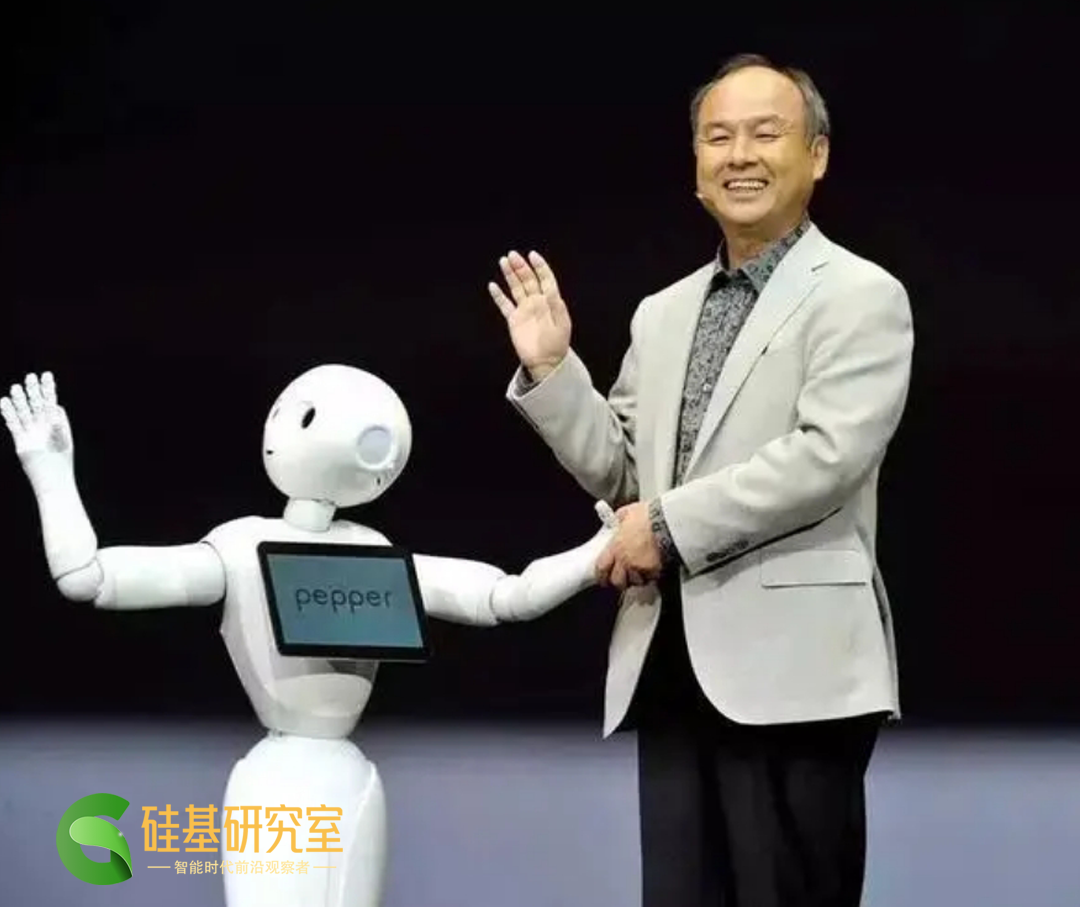

In the history of the venture capital industry, when the name "Masayoshi Son, the founder of SoftBank" is mentioned, there are definitely two different opinions.

One opinion is that he is a "game changer" who has changed the traditional venture capital model, and this growth investment model with huge amounts and a global perspective has been emulated by countless players. This aggressive posture has helped Masayoshi Son create many "home runs" - whether it's the former Yahoo, Alibaba, or the now-listed Arm, all are successful examples of Masayoshi Son's model.

But another opinion is that, compared to the past decisive actions, Masayoshi Son is facing confusion and melancholy. Failed unicorn investment cases, missed investments in artificial intelligence startups such as Anthropic and Cohere, and the investment returns of its Vision Fund are not optimistic. At SoftBank's shareholder meeting in June of this year, 66-year-old Masayoshi Son expressed his "sadness," saying that he has been thinking about "the remaining time as a businessman" and feeling ashamed of the many mistakes and bad investments he has made.

"How many years do I have left? What have I done? Sometimes I feel a little sad."

Masayoshi Son's sadness is not difficult to understand, as this sentiment belongs to both the individual and the entire venture capital industry. The reason it is said to "belong to the individual" is that many other venture capital giants of his time have mostly retired, such as Michael Moritz of Sequoia Capital and Bill Gurley, a partner at Benchmark who has clashed with SoftBank multiple times, both announced their retirement at their 50s several years ago, forming a sharp contrast with Masayoshi Son's "unwillingness to retire."

This sense of sadness also belongs to the entire venture capital industry, as the prosperous era has passed. Private equity data tracking firm Pitchbook's data shows that the scale of VC investments in China and the United States both dropped by more than one-third in 2022. KPMG has made a forecast for 2023: "As venture capitalists continue to avoid late-stage transactions, financing is declining globally."

For Masayoshi Son, he and SoftBank's reputation are facing an unprecedented crisis. Over the past six years, SoftBank has spent over $150 billion of external funds and its own capital to invest in startups through two Vision Funds, but the return on investment and profits are not optimistic. According to The Information, as of June, the return rate of SoftBank's first Vision Fund is only 14%.

The unreplicable wealth creation legend is reflected in Masayoshi Son's bet on Arm. Despite being the largest tech company IPO in 2023, Arm does not seem to have brought Masayoshi Son the ideal high-stakes return at the moment. The company's so-called neutral and independent business model is facing a new round of scrutiny in the capital market.

The latest news is that Masayoshi Son is gradually stepping back from the Vision Fund. An employee of the Vision Fund told The Information that since the bankruptcy of WeWork and a series of other failed bets caused turmoil in the company, Masayoshi Son only occasionally attends investment committee meetings, and some employees complain that they cannot reach Masayoshi Son by phone to discuss related transaction matters, and they have almost no idea about Masayoshi Son's next move.

Understanding Masayoshi Son and SoftBank has become an unresolved complex issue of this era.

01 Offensive and Conservative, the Swinging Investment Strategy

Some of SoftBank's employees have glimpsed the latest dynamics of "Captain" Masayoshi Son from media reports, such as his meeting with the founders of OpenAI.

In September of this year, according to several informed sources, Masayoshi Son participated in a discussion with Apple's renowned designer Jony Ive and Sam Altman about creating a new hardware. There are reports that SoftBank may invest in OpenAI, but there has been no clear response so far.

SoftBank and OpenAI, the former capital hunter and the most eye-catching AI startup globally, some people close to SoftBank said that Masayoshi Son's attempt to approach OpenAI has reminded them of the shadow of SoftBank's past, and the media also sees Masayoshi Son's proactive attitude as a signal of SoftBank's "switching from defense to offense."

Some details confirm the above view. In the few public appearances Masayoshi Son has made, he has expressed his interest in generative AI.

At a recent SoftBank World Corporate Conference, a photo of a "goldfish trapped in a bowl with a question mark" appeared on the screen behind 66-year-old Masayoshi Son. He asked the audience in front of him, "Do you want to become a goldfish?" In his view, the intellectual difference between those who are far from artificial intelligence and those who actively use artificial intelligence will be like "apes and humans."

Unlike value investors who hold a neutral attitude towards artificial intelligence, Masayoshi Son has packaged himself from a past "investment maniac" into a "technology believer." He said he communicates with ChatGPT every day, and when he gets tired, he creates different roles for them to continue debating, while he acts as the "judge."

However, this identity as a technology enthusiast has not been reflected in SoftBank's investments. One fact is that SoftBank's investment strategy remains very conservative and cautious in this new wave of artificial intelligence.

The most direct manifestation is that SoftBank's bets on unicorns and star companies are few and far between. Unlike SoftBank's collective investment in internet startups in the mobile internet era, in this wave of generative AI, from the model layer to the application layer, SoftBank has not made many bets.

According to Crunchbase data, since last November, the Vision Fund has made a total of four moves, including seed rounds and angel rounds. In January of this year, the Vision Fund invested in a digital banking service provider called Kwara.

In contrast, the venture capital firms behind OpenAI, including Tiger Global Management, Sequoia Capital, a16z, and Founders Fund, and the generative AI startup Cohere based in Toronto, Canada, also have the presence of institutions such as Index Ventures and Tiger Global Fund. However, SoftBank's presence is lacking in these valued startups.

According to a person familiar with the Vision Fund's investments, in the spring of this year, SoftBank abandoned investments in artificial intelligence startups such as Anthropic and Cohere due to valuation issues.

This "hands-off" attitude does not align with people's past understanding of Masayoshi Son's investment style. Summarizing Masayoshi Son's past investment tactics, we can see three typical characteristics:

First, use high pricing to gain a monopoly position. Masayoshi Son is never stingy with large investments in technology companies. He is adept at using a sufficiently attractive large check to seek a large stake in the invested company, persuading the company to quickly gain a monopoly advantage.

Second, cognitive arbitrage, becoming the absolute controller behind similar companies. The most typical case is Masayoshi Son's investment in Uber, where he invested in almost all of Uber's competitors and finally invested in Uber in 2018, with an investment as high as $7.7 billion.

Third, using legendary cases to build a network of relationships. Masayoshi Son is adept at using his network of relationships for rapid expansion, which is both horizontal. He uses his "theory of time" to make his venture capital business global.

He has ventured into venture capital business in South Korea, Japan, and Hong Kong, and cooperated with Murdoch's News Corporation to invest in Australia, New Zealand, and India; in Europe, he established a cooperative relationship with the French media group Vivendi, and also set up venture capital offices in some cities in Latin America.

This expansion is also both vertical and horizontal. Masayoshi Son realized early on that investment is a business that relies on reputation and performance to reinforce each other. After the successful investment case of "Alibaba," Masayoshi Son repeatedly emphasized his keen judgment to the outside world.

Anthony Tan, the founder of Southeast Asian ride-hailing giant Grab, recalled a scene to Bloomberg Businessweek. When persuading Anthony Tan to accept SoftBank's investment, Masayoshi Son mentioned his support for Jack Ma. Masayoshi Son said, "Many years ago, Jack Ma was sitting there. It's good for you to take my money, and it's good for me too. If you don't, it's not good for you."

But now, the investment strategy seems to have failed, and Masayoshi Son's judgment no longer seems sharp.

In addition to missing out on many unicorn companies, SoftBank also missed out on "Nvidia," the water seller. SoftBank invested approximately $4 billion in Nvidia in May 2017 and held a 4.9% stake, but in 2019, SoftBank sold all of its Nvidia shares. At that time, Masayoshi Son may not have anticipated the subsequent surge in Nvidia's stock price.

Reflected in SoftBank's fundamentals, in recent years, SoftBank has still been digesting the impact of the sky-high investments in tech companies in the past. According to SoftBank's financial reports, since its establishment in 2017, the two Vision Funds have invested in a total of 379 projects, with only 31 exits, resulting in an overall book loss of $6.2 billion for the two funds.

The listing of Arm seems to be Masayoshi Son's last-ditch effort, a shift to an offensive mode of ammunition, but the outside world has not shown much attention to this. A long-time analyst of SoftBank's business pointed out, "What everyone is really concerned about is whether Masayoshi Son has truly learned from the mistakes of Vision Fund 1 and 2?"

02 New Kings and Old Kings, the Unrepeatable Era of Deification

Masayoshi Son's sense of loss in the new wave of generative AI actually stems from SoftBank's own path dependence.

In the eyes of analysts, this path dependence has become the "lesson" of this era. But to be fair, in the previous era, Masayoshi Son's high-stakes bets did indeed subvert the traditional venture capital model and brought countless wealth and reputation to Masayoshi Son and SoftBank.

Former Sequoia Capital partner Michael Moritz once praised Masayoshi Son's "massive growth investment" model, realizing that venture capital must constantly adjust its strategy according to the situation, and venture capitalists do not have to limit their focus to Silicon Valley. Sequoia later efficiently applied these experiences to itself, gaining a dominant position in the industry.

The lengthening investment cycle, the increasingly massive fund size, and the ability to bet a fortune on a single company have also given venture capitalists the ability to create large commercial empires. This may have been the best era for venture capital, as the rising mobile internet companies naturally needed to rely on network effects to achieve more growth, and venture capitalists naturally changed their localized business models to ones with a more global perspective.

On the other hand, generational changes have given rise to the "rebel culture" in Silicon Valley, and Masayoshi Son is not the only one rebelling.

The subsequent Founders Fund of Peter Thiel, Y Combinator of Paul Graham, although not all believers in massive funds, their support for young startups has led to the rise of a group of startups.

Financial historian Sebastian Mallaby described Masayoshi Son as the "first person to eat crab" in this wave. For an industry that believes in the index principle and the Pareto principle, "whoever sees the change in the situation first and has the capital to meet the new demand can reap rich rewards before competitors realize it."

But why did Masayoshi Son lose the first-mover advantage? The key reasons behind this are both the reasons of the times and the personal stubbornness of Masayoshi Son.

One direct reason is that Masayoshi Son no longer encountered the big opportunities of the past mobile internet era. And in the early outbreak of generative AI, many AI companies that Masayoshi Son had previously invested in had not experienced the expected explosive growth. In the deteriorating value of the investment portfolio, SoftBank's cost of missing out on emerging AI unicorns may be greater than imagined, especially as SoftBank is saving cash.

In addition to giving up on Anthropic and Cohere, the Vision Fund also strongly considered investment deals with Stripe and Databricks earlier this year. The former is a mobile payment company in the United States, with a valuation of around $50 billion as of March this year. The latter is a data analysis and artificial intelligence software manufacturer that Nvidia has bet on. Some believe that the investment deals completed by these two companies are similar to financing rounds just before an IPO.

But SoftBank claims that the reason for not following up is still that "they are too expensive."

In a world of the index principle, the hidden cost of missed opportunities is far greater than the risk cost of losing the investment capital, and luck is sometimes more important.

Another factor that cannot be ignored is the challenge from large tech companies. Whether for ecosystem expansion or business synergy, establishing their own VC institutions has become commonplace for them. The rise of Corporate Venture Capital (CVC) allows tech giants to invest in potential competitors, turning them into their friends, and also gives them a keen sense of cutting-edge technology.

Such cases are not uncommon, such as Microsoft's investment in OpenAI and Amazon's bet on Anthropic. Currently, globally renowned CVC institutions are also dominated by tech giants, such as Intel Capital, Google's GV venture department, and Microsoft's M12. A person in charge of Microsoft's M12 once mentioned in a speech that CVC should do better than VC, as the former has something unique to offer to entrepreneurs.

The so-called unique thing includes business-level synergy, understanding and consensus of the industry, and a stronger long-term investment willingness. The investment cycle for general VCs is 7 to 10 years, while CVC investment projects often last for more than 10 years, and sometimes do not even consider exiting.

In addition to the unfortunate timing, as mentioned earlier, Masayoshi Son realized early on that investment relies on reputation and performance to reinforce each other. In many past examples, the success of venture capital firms often comes from the influence brought by the founder's experience and status, rather than the innovative methods they claim.

When this "personal worship" is shattered by repeated failed investments, what follows is the demystification of SoftBank and Masayoshi Son. The most typical case is SoftBank's failed investment in WeWork. After the WeWork scandal, Masayoshi Son, who rarely bows his head, admitted his mistake: "My investment judgment is very poor."

People have gradually realized that in this unicorn investment, SoftBank's encouragement of unicorns to grow excessively rather than turning to solidify their own moats has instead plunged startups into deeper trouble. Masayoshi Son once told WeWork's founder Adam Neumann when investing in WeWork, "In a battle, madmen are more likely to win than smart people."

This excessive catalyzation of founder ambitions is actually a microcosm of Masayoshi Son's personal ambition. When this ambition matched the dividends of the early mobile internet era, SoftBank and Masayoshi Son also created their own mythology.

But when the music stops and the wave of dividends ends, the mythology also stops.

03 Tyrant and Mediocrity, Masayoshi Son's A and B Sides

Whether to continue the past high-stakes bets or to tend towards conservatism, this contradiction in Masayoshi Son is more pronounced in today's SoftBank.

According to "The Information," Masayoshi Son is increasingly focusing on investments through other departments of SoftBank. In the past year, he has not been involved in the day-to-day work of the Vision Fund, while in the past few years, Masayoshi Son frequently held trading meetings with Vision Fund partners several times a week.

The Vision Fund has three main offices globally, in Tokyo, Japan, New York, USA, and London, UK. An insider said they can invest up to $3 billion without needing permission from Masayoshi Son or other Tokyo executives. Some Vision Fund employees are frustrated as they cannot reach Masayoshi Son by phone to discuss related trading matters, and they are almost clueless about Masayoshi Son's next steps.

This "leadership vacuum" phenomenon contrasts sharply with Masayoshi Son's past "tyrant" image.

From a young age, Masayoshi Son has been a goal-oriented and exceptionally determined person. His most admired idol is the late Edo period samurai Ryoma Sakamoto. The way Sakamoto, a key figure in overthrowing the Tokugawa shogunate, lived by "abandoning his hometown and family, and sticking to his own beliefs," touched Masayoshi Son's heart. He dropped out of high school and went to the United States alone, where he was captivated by the atmosphere of freedom. He later described it as "my own secession."

After achieving outstanding success, when someone asked him for an autograph, Masayoshi Son always wrote the four characters "志存高远" (ambitious and far-reaching).

The absolute protagonist of each high-stakes bet that SoftBank has launched so far is still Masayoshi Son. He seeks people similar to himself and encourages them to be as ambitious as he is. When he first met Jack Ma in 1999, Masayoshi Son said, "I saw the charm of a leader in his eyes, maybe it can be said to be an animal-like scent."

He gave an example: "If (Jack Ma) orders 100 subordinates to jump into the water, everyone will obey, and even if he tells them to rush into the fire, there will be people who will do it." It was because he felt this kind of power that Masayoshi Son took out a $40 million check on the spot during his first 5-minute meeting with Jack Ma.

This ambition also made Masayoshi Son the sole decision-maker at SoftBank.

In 2016, Nikesh Arora, once seen as the "successor" to Masayoshi Son at SoftBank, left due to internal conflicts of interest. Later, Arora, who left SoftBank, told the media, "At SoftBank, Masayoshi Son asked me to find the seeds of future business for him. I feel like I did my best, in my own way, of course, different from his (way)."

In the biography "The Legend of Masayoshi Son," biographer Takashi Sagimoto recorded the final "farewell moment" between the two, where Masayoshi Son told Arora, "I hope you find a new ship, I will continue to be the captain of this ship."

Rajeev Misra, who succeeded Arora, helped Masayoshi Son win a $45 billion Saudi fund and also announced his resignation last year. He has now started his own new venture, founding the OneIM fund, which has raised an initial $6.8 billion.

A person close to the Vision Fund said that Masayoshi Son has now entrusted SoftBank executive Vikas J. Parekh to develop AI and logistics strategies. From his investment portfolio, which includes AI startups Vianai Systems, big data marketing service provider 6sense, website hosting platform Pantheo, and his participation in WeWork's financing in 2019, Masayoshi Son is seen as a "calm member in a chaotic and pretentious company at the time."

After the departure of successors and long-term deputies, Captain Masayoshi Son, despite chanting the slogan of "attack," has gradually chosen to fade out of the spotlight, making the Vision Fund gradually "mediocre." A former SoftBank investor commented, "The Vision Fund now resembles any other fund you see elsewhere."

Perhaps the biggest dilemma for SoftBank and Masayoshi Son is that they have not completed their own renewal in the coming era. One is the innovation of the investment model, because no one can lie on the "merit book" forever. The other is to establish a better internal power structure and corporate culture for succession.

But for Masayoshi Son and his SoftBank, at least on these two points, they have not provided convincing answers. Technology is rapidly iterating, and venture capital is committed to investing in disruptive innovation, and it is also constantly being disrupted. Masayoshi Son and his peers themselves have risen and fallen in the cycle, relying on factors such as luck, skills, and intelligence to achieve success, and of course, they have also encountered difficulties. In the past, Masayoshi Son has re-emerged in adversity time and time again, personally participating in and leading the fate of many large companies today, giving him enough confidence.

Now, gradually fading out of the Vision Fund, Masayoshi Son seems to be bidding farewell to the past. He has started to talk openly about his insights into AI and, according to the media, he is focusing on SoftBank investments independent of the Vision Fund. The fund is currently conducting a project codenamed "Project R."

At 66, Masayoshi Son has returned to the starting point of his life, just like when he was questioned in his youth, except this time, he faces greater challenges. It is an era of declining dividends, and a huge conglomerate in distress still has even greater ambitions.

Reference materials:

1. The Information: "SoftBank’s Masayoshi Son Looks for Investing Redemption"

2. Caijing: "No one can afford Masayoshi Son"

3. Sebastian Mallaby: "The History of Venture Capital"

4. Takashi Sagimoto: "The Legend of Masayoshi Son: Building an Empire for 300 Years"

5. Jiemian News: "SoftBank is 'betraying' its own investment strategy"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。