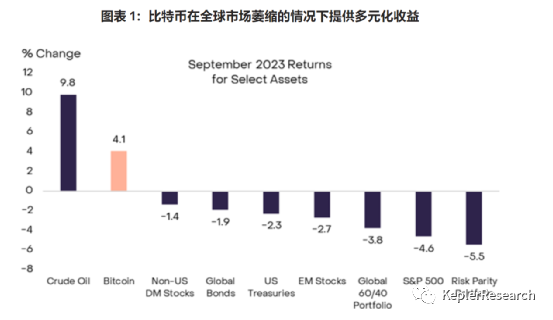

Bitcoin rose in September, while many traditional assets suffered significant losses, highlighting the diversification characteristics of cryptocurrencies. Global market pressure seems to stem from rising government bond yields and oil prices.

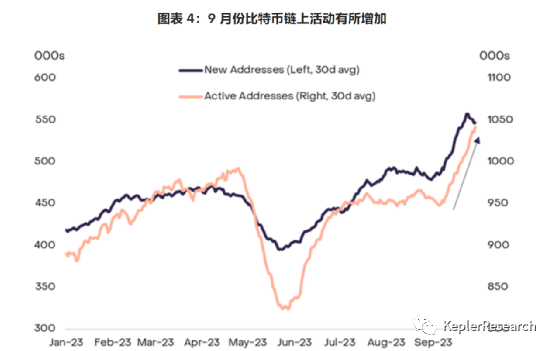

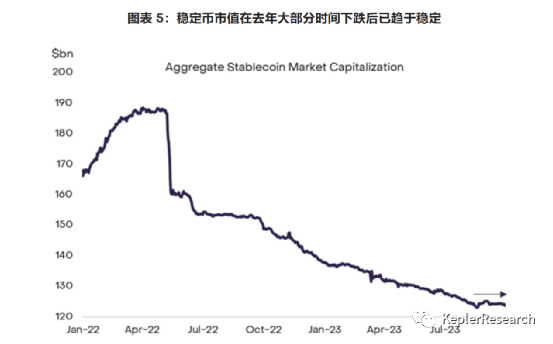

With the improvement of Bitcoin's on-chain indicators this month, strong fundamentals have played a key role. After stabilizing following a decline last year, the stablecoin market value continues to stabilize, and the digital asset market remains focused on the development of Layer 2 blockchains and the potential approval of a spot Bitcoin ETF in the US market.

Despite encouraging signs in the cryptocurrency industry itself, the broader financial market background may still be challenging at the moment. However, Bitcoin's recent stability suggests that once the macroeconomic background improves, its valuation may begin to recover.

Bitcoin (BTC) rose by 4% in September, a sharp contrast to the significant losses suffered by many traditional assets that month. Cryptocurrencies now have a stronger correlation with other markets, but in this challenging market environment, they continue to provide investors with a certain degree of diversification.

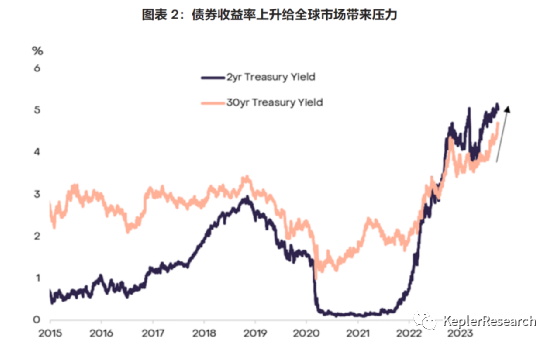

The latest pressure on global assets seems to come from the US bond market: the Federal Reserve can partially explain this. At its mid-September meeting, the central bank indicated that it may raise interest rates again later this year, and the pace of rate cuts next year may be slower than previously expected. The Fed's updated guidance helps push up short-term bond yields and boost the value of the US dollar.

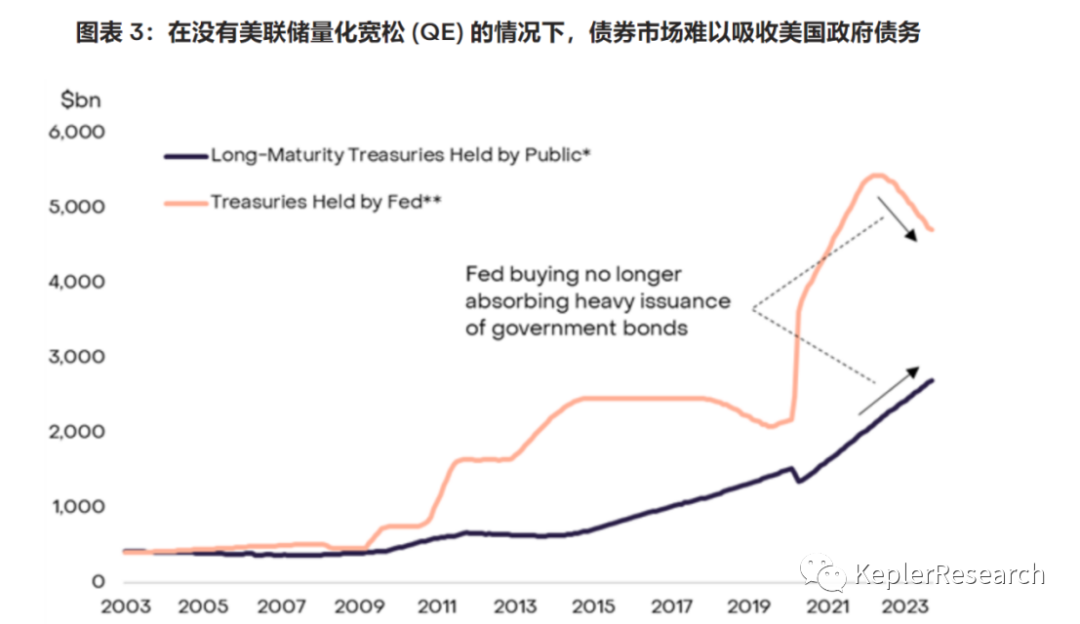

However, the greater challenge facing the fixed income market may be the excess of long-term government bonds. The 30-year Treasury bond yield rose by nearly 50 basis points (bp) in September, reaching its highest level since 2011. Long-term bonds (e.g. those with remaining maturities of over ten years) are typically less sensitive to small changes in Fed interest rate guidance.

Instead, the bond market seems to be struggling to absorb the large amount of borrowing by the US Department of the Treasury—caused by the government's massive budget deficit. Although the budget deficit has been large for some time, the Fed's purchases ("quantitative easing") have previously absorbed some of the bond supply. Now, as the Fed is shrinking its balance sheet ("quantitative tightening"), more government borrowing is hitting the open market, putting upward pressure on interest rates.

Rising bond yields and oil price increases seem to have put pressure on the stock market and most other risk assets. The S&P 500 index fell by nearly 5% in September, with sectors related to the health of the US economy leading the decline: residential builders, industrials, and companies related to retail performance.

Bitcoin has largely been unaffected by the shrinkage of traditional assets and has outperformed most other large cryptocurrencies. Although trading volume continues to decline this month, various on-chain indicators for Bitcoin have improved: the number of funding addresses, active addresses, and transaction volume have all increased.

Given the progress made by the spot Bitcoin ETF at the end of August, the recovery in on-chain activity may represent new investors positioning themselves before potential approval by regulatory agencies. Bitcoin may also have been supported by the news that the trustee of the now-defunct cryptocurrency exchange Mt. Gox will postpone the repayment of creditors until October 2024. Holding approximately 138,000 bitcoins, currently valued at $3.7 billion, this decision may temporarily prevent this supply from entering the market.

Meanwhile, the price of Ethereum (ETH) tokens has slightly declined compared to last month, with the ETH/BTC ratio falling to a one-year low. The price volatility of the second-largest cryptocurrency is also very low: as of September 30, the 30-day annualized price volatility of ETH is only 25%, lower than that of BTC during the same period, with an average volatility of about 60% since January 2022. Unlike Bitcoin, there has been little change in Ethereum's on-chain fundamentals. Later this month, market attention focused on the potential approval of an ETH futures ETF, and the ETH/BTC ratio partially rebounded.

In addition to BTC and ETH, a significant fundamental development in September was the stabilization of stablecoin market value after a long decline. According to data from DeFi Llama, the total market value of stablecoins stabilized at around $124 billion after almost continuous decline last year. Since mid-August, the circulation of DAI and True USD (TUSD) has significantly increased, while the supply of Tether (USDT) has slightly grown since early September.

The continued development of Layer 2 blockchains—discussed in a recent report by Grayscale Research—is noteworthy. It is worth noting that the social media app friend.tech on BASE (Lyear2) collected more fees in September than the decentralized exchange Uniswap. From a price perspective, other strong performers include major DeFi tokens AAVE, CRV, and MKR, as well as the oracle protocol token LINK, which we believe has benefited from recent announcements related to collaborations with Swift and BASE.

Despite these encouraging signs, the broader financial market background may still be challenging at the moment: "The Fed is still tightening policy, government bond yields may still be seeking a new balance, and the uncertainty of a 'soft landing' for the US economy. However, Bitcoin's recent stability suggests that once the macroeconomic background improves, its valuation may begin to recover."

Note: All content represents the author's personal views and is not investment advice, nor should it be interpreted in any way as tax, accounting, legal, business, financial, or regulatory advice. Before making any investment decisions, you should seek independent legal and financial advice, including advice on tax consequences!

For more content, follow: Public Account KeplerResearch Twitter @kepler008

Join the Kepler community to get the latest market information and trading strategies!!!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。