Original Author: Lawyer Zhou Fengxuan - Senior Lawyer at Shanghai Mankun Law Firm

Some time ago, a client came to Mankun for consultation. The basic situation was as follows: the client, as a foreign trade company in Guangzhou, intended to settle the payment through legitimate channels after completing a transaction with an overseas company. However, the overseas company was unable to make the payment through traditional means, so they proposed a feasible solution to settle the payment in USDT. After careful consideration, the client agreed and quickly received the USDT payment from the overseas company. They then approached a domestic "service provider" to cash out the USDT (exchange it for RMB). As expected, after seeking legal assistance from Mankun, the "service provider" became uncontactable and could not be found after receiving the USDT.

Many people may initially think that "dealing with virtual currency is bound to be risky" upon hearing about this consultation. Given that virtual currency is regulated differently in different countries, settling payments in USDT has become one of the options for some foreign trade companies. However, traditional payment methods in the foreign trade industry already have many pitfalls and risks. Is choosing USDT as a payment method really appropriate?

01 Common Challenges for Cross-Border Foreign Trade Businesses in Receiving Payments

It is very easy for small and medium-sized foreign trade enterprises to encounter difficulties in cross-border payments, and some companies even fall victim to scams and ultimately exit the market. Therefore, in foreign trade transactions, payment is a matter of great concern for both buyers and sellers. Small and medium-sized foreign trade companies face rising comprehensive costs, high operational risks, and pressures, leading to phenomena such as "daring not to accept orders" and "increasing revenue without increasing profits." This is because foreign trade enterprises encounter many problems when collecting payments, including but not limited to: ① lengthy account opening processes, slow payment processing, and high withdrawal fees; ② support for too few currencies, with existing channels not supporting small currencies; ③ limited RMB withdrawal limits; ④ inability to withdraw based on real-time exchange rates; ⑤ inability to make direct payments to suppliers; ⑥ difficulties in receiving payments from high-risk regions; ⑦ and even encountering troubles such as card freezing and fund freezing. For domestic and foreign trade businesses, the return of funds in cross-border settlements is a crucial link, and the difficulty in receiving payments is a practical problem faced in order to avoid the challenges that arise in reality. Nowadays, many foreign trade businesses choose to collect funds through "underground banks" rather than through legal and compliant methods and channels.

02 Operation Modes of Cross-Border "Underground Banks"

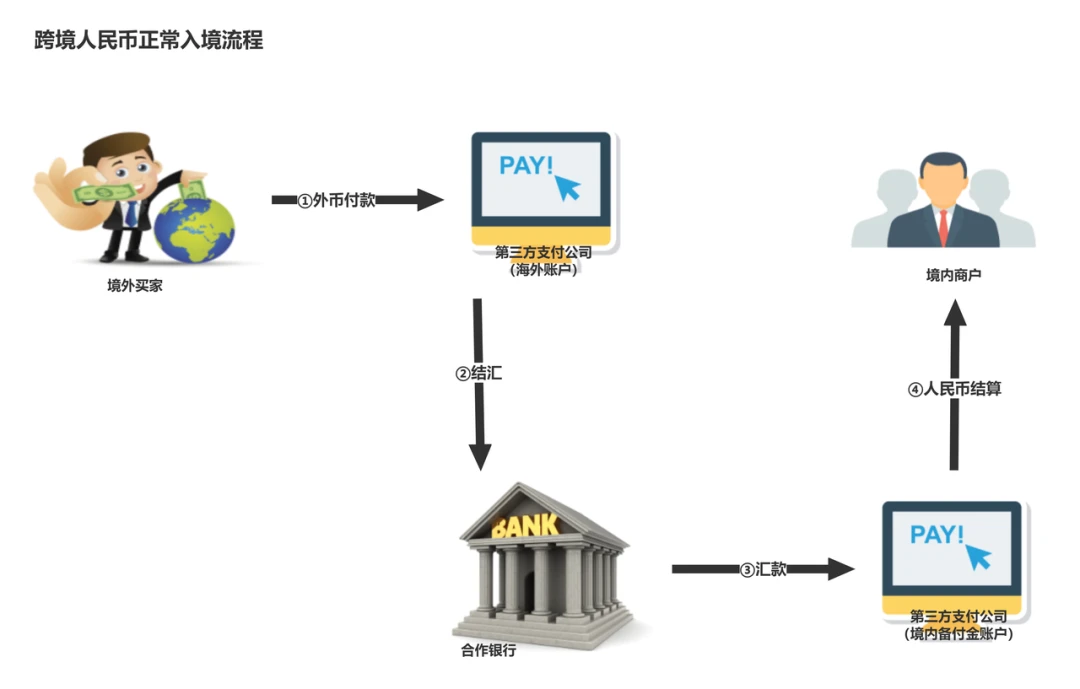

Normally, cross-border payments refer to the transfer of funds across countries or regions for international trade, international investment, and other international debt and credit transactions, using certain settlement tools and payment systems. In actual economic activities, there are many instances in China where cross-border trade settlements are conducted through underground banks.

"Underground banks" is not a specific, standardized legal concept. It mainly refers to "a special type of illegal financial organization that operates outside the financial regulatory system, using or partially using the settlement network of financial institutions to engage in illegal foreign exchange trading, cross-border fund transfers, fund storage, and illegal financial activities such as lending." Its essence is an underground bank that operates without approval from the state, engaging in foreign exchange, cross-border fund transfers, and payment settlements, providing channels for corruption, gambling, smuggling, tax evasion, and money laundering, which is also a form of money laundering crime (related regulations: "Anti-Money Laundering Report" issued by the People's Bank of China in 2005, and the "Measures for the Prohibition of Illegal Financial Institutions and Illegal Financial Business Activities" promulgated and implemented by the State Council on January 8, 2011).

Although labeled as "illegal," the existence and prosperity of "underground banks" have always been an open secret. Currently, the operation modes of "underground banks" in China mainly include three types: cross-border "matching" mode, "payment settlement" mode, and other illegal operation modes.

1. Cross-Border "Matching" Mode

This involves using onshore settlement of RMB and offshore settlement of foreign currency, a non-cross-border exchange of funds (referred to as the "cross-border exchange mode"), to achieve the actual exchange and cross-border transfer of funds. This is currently the main operating mode of underground banks, mainly used to transfer onshore illegal proceeds through underground banks to offshore locations and to evade foreign exchange controls in cross-border trade through underground banks.

2. "Payment Settlement" Mode

This involves using deceptive means to fabricate or construct legitimate transaction forms to conceal illegal cross-border fund transfers, known as the "payment settlement mode." For example, using props for import and export to achieve cross-border fund transfers, and conducting public-to-private transfers through shell companies and fake trades.

3. Other Illegal Operation Modes

The operation modes of underground bank groups are often diverse and also known as comprehensive underground banks. Common methods include illegal currency exchange by scalpers, illegal modification and transfer of overseas POS machines, overseas card swiping and cash withdrawals, illegal splitting of foreign exchange purchases, and cash smuggling. In order to evade crackdowns, there have also been cases in recent years of illegal cross-border fund transfers using virtual currencies and fourth-party payment platforms.

In summary, regardless of the mode mentioned above, the profit model of "underground banks" can generally be summarized as follows: earning the price difference through buying and selling foreign currency at a low price, extracting a certain percentage of fees or commissions from clients through exchange transactions and fund lending, and engaging in illegal profits such as trading rewards and export tax rebates through cross-border arbitrage.

03 Risks of Choosing to Receive USDT in Cross-Border Trade Settlements

When domestic and foreign trade businesses choose settlement methods, the reason for choosing to receive USDT is likely based on the aforementioned existing challenges. Choosing USDT conveniently avoids some of the difficulties in receiving payments. However, the received funds are ultimately virtual currency, not physical money. After receiving the funds, domestic businesses need to consider whether to hold, invest, or cash out, which are practical issues to be considered given the current strict regulatory policies on virtual currency in China.

1. Risks of Receiving USDT

If overseas buyers exchange their foreign currency into USDT through "underground banks" or over-the-counter (OTC) exchanges, and domestic businesses provide a USDT wallet address to receive the payment, the overseas buyers pay USDT as requested by the domestic businesses. On the surface, receiving payments in USDT seems very efficient, avoiding restrictions on currency, foreign exchange, and taxes. However, upon deeper analysis, we will find that it is difficult for domestic businesses to identify the legality of the source of funds when overseas buyers exchange their own funds into USDT through "underground banks" or OTC exchanges, and risks follow accordingly.

Assuming that the funds of the overseas buyers are illegal, based on our experience in handling previous cases, it can be preliminarily predicted that the reason why overseas buyers want to exchange their own funds into virtual currency is to launder the originally illegal funds through "underground banks" or OTC exchanges. As a link in receiving USDT (or other virtual currencies), domestic businesses are very likely to be implicated in the process of investigating the case. In the end, the failure to recover the foreign trade funds from this transaction is a minor issue, but if it is determined to be a criminal offense, the consequences will not be worth it.

2. Risks of Holding USDT

After domestic businesses receive USDT, if the aforementioned criminal risks do not materialize, can they consider the matter resolved? In fact, this is not the case. The value of virtual currency in China may not be realized, but some countries have already recognized virtual currency as legal property. If domestic businesses receive USDT and do not immediately exchange it for RMB, planning to observe the international market conditions before making a decision, and the value of USDT appreciates, why not take advantage of it?

However, virtual currency (whether Bitcoin or USDT) being stolen in the cryptocurrency circle is not a new occurrence. It is believed that in the hope of recovering even a small portion, domestic businesses will attempt to file a criminal report. However, due to the current legal and regulatory policies in China, combined with our experience in handling previous cases and the judgments of publicly available criminal cases, whether virtual currency has property attributes is a key factor in determining whether it can be classified as a criminal offense. Some courts have recognized the property attributes of virtual currency, and it is generally investigated as a theft case. However, from practical experience, regardless of whether a criminal case is filed or not, the difficulty in recovering stolen virtual currency (USDT) is quite high.

3. Risks of Investing in Virtual Currency

Of course, holding USDT is not the ultimate goal for domestic businesses. Ultimately, they may want to use USDT for investment purposes. In real economic activities, most of the time, when entrusting others to invest in virtual currency on their behalf, written contracts are not signed, which is what Lawyer Zhou often refers to as "naked" investments. In the event of "investment failure" (which could be due to the project genuinely failing or the project party not fulfilling their obligations), the court generally determines the establishment of the entrusted investment contract based on chat records, transfer records, and other materials between the parties. However, the establishment of the entrusted contract does not necessarily mean it is valid. Many court judgments have deemed contracts invalid due to violations of financial regulatory policies, virtual currency being an illegal subject matter, or violations of public order and good customs. Of course, there are also a few typical cases that recognize the validity of entrusted investment contracts involving virtual currency.

The legal consequences of an entrusted investment contract being deemed invalid vary. Some courts require both parties to bear partial responsibility, while others believe that, according to the "Announcement on Preventing Risks of Token Issuance and Financing," the investor should bear the investment risks. There are also courts that believe that virtual currency-related debts are illegal, and therefore the law does not protect the investor's property.

Therefore, if domestic businesses involved in cross-border trade receive USDT and consider using it for investment, they should be aware of the potential consequences of the contract being deemed invalid and the risks they may bear, and make investment decisions cautiously.

4. Risks of Cashing Out USDT

Whether using traditional payment methods or receiving USDT, the main goal for domestic businesses is to receive payments and facilitate the flow of funds. As mentioned at the beginning, the ultimate goal is to exchange USDT for RMB. However, based on the current regulatory policies in China, the possibility of legally exchanging USDT for RMB through domestic institutions is very slim. Therefore, the only options for cashing out are through exchanges or over-the-counter (OTC) platforms (or underground banks). Regardless of which service provider is chosen, bypassing the legal and compliant process for the entry of RMB into the country, the process of receiving USDT payments can be summarized as follows: overseas businesses exchange foreign currency for USDT → domestic businesses provide a wallet address to the overseas businesses → the overseas businesses transfer USDT to the wallet address provided by the domestic businesses → the domestic businesses exchange USDT for RMB through exchanges, OTC platforms (or underground banks), perfectly bypassing the national foreign exchange and tax management system and overcoming the challenge of slow processing. However, there are numerous risks involved. If the RMB obtained from exchanging USDT is from illegal funds, it could lead to consequences such as frozen bank accounts or funds, cooperation requests from public security agencies for investigations, and prolonged unfreezing periods. There is also the possibility of being suspected of money laundering or concealing criminal proceeds in criminal cases. Even if the RMB obtained from exchanging USDT is from legal funds, bypassing the legal and compliant entry process for RMB could constitute illegal foreign exchange trading, tax evasion, and other violations. If relevant authorities decide to investigate, it could lead to criminal or administrative penalties.

Even if relevant authorities or departments do not pursue the matter, the process of cashing out USDT is not necessarily foolproof. As in the case of the client who consulted us at the beginning, the situation of service providers becoming uncontactable and running off after receiving USDT is not an isolated incident. This is also due to the current strict prohibition of speculation in virtual currency in China. It can be imagined that the difficulty of recovering paid USDT is quite high. In the end, what was thought to be a way to avoid challenges such as foreign exchange, taxes, high fees, and slow processing may end up yielding no results.

Conclusion by Lawyer Mankun

At this point, I believe that domestic businesses have their own thoughts on whether to choose USDT (or other virtual currencies) for settlement. As a law firm engaged in the web3.0 industry, we have always been following the process of legalizing virtual currency in China. It can only be said that the current regulatory measures are strict. We recommend that domestic businesses choose cross-border settlement methods under legal and compliant conditions. Finally, to summarize today's topic:

1. The main reasons for the difficulty in receiving payments for domestic and foreign trade businesses are: lengthy account opening processes, slow payment processing, high withdrawal fees, support for too few currencies, limited RMB withdrawal limits, inability to withdraw based on real-time exchange rates, inability to make direct payments to suppliers, difficulties in receiving payments from high-risk regions, and troubles such as card freezing and fund freezing.

2. The three main operation modes of cross-border underground banks are: cross-border "matching" mode, "payment settlement" mode, and other illegal operation modes. Regardless of the mode, they may be subject to criminal or administrative penalties.

3. The risks of receiving USDT in cross-border trade settlements mainly include: (1) Risks of receiving USDT: inability to recover funds, and the possibility of becoming a link in a criminal offense; (2) Risks of holding USDT: significant price fluctuations leading to depreciation, or inability to recover stolen funds; (3) Risks of investing in USDT: the possibility of the entrusted investment contract being deemed invalid and bearing the risks; (4) Risks of cashing out USDT: service providers running off, causing financial losses, violations of foreign exchange, tax, and other national management regulations, and facing criminal or administrative penalties.

Special Statement:

This article is an original work by Shanghai Mankun Law Firm, representing the personal views of the author and does not constitute legal advice on specific matters. If the article needs to be reproduced, please contact the staff of Mankun Law Firm: MankunLawFirm

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。