BlockBeats News, September 25th, according to on-chain analyst Yu Jin's monitoring, the Arbitrum airdrop has been claimed by Ethereum block 18208000. Among them, 69,448,385 ARB tokens, equivalent to approximately 56.54 million USD, which were unclaimed, have been transferred from the airdrop contract to the DAO treasury.

The six-month ARB airdrop claiming has officially ended, previously triggering the "DAO fund gate" incident

On the evening of March 16th, Arbitrum officially announced the launch of DAO governance and governance token ARB for the Arbitrum One and Arbitrum Nova networks, and also disclosed the highly anticipated airdrop details.

According to the team's official announcement, the initial total supply of Arbitrum token ARB is 10 billion, with a maximum annual inflation of 2%. Regarding token airdrops, 11.62% of the initial total supply will be airdropped to Arbitrum users, and 1.13% will be airdropped to the DAO treasury for applications built on Arbitrum.

Related reading: "Arbitrum Announces Token Economics: Initial Total Supply of 10 Billion Tokens; 11.62% Airdropped to Users"

However, just one month after the launch of the Arbitrum airdrop, Arbitrum was involved in the "DAO fund gate" incident, raising questions in the community about the centralization level of the Arbitrum DAO.

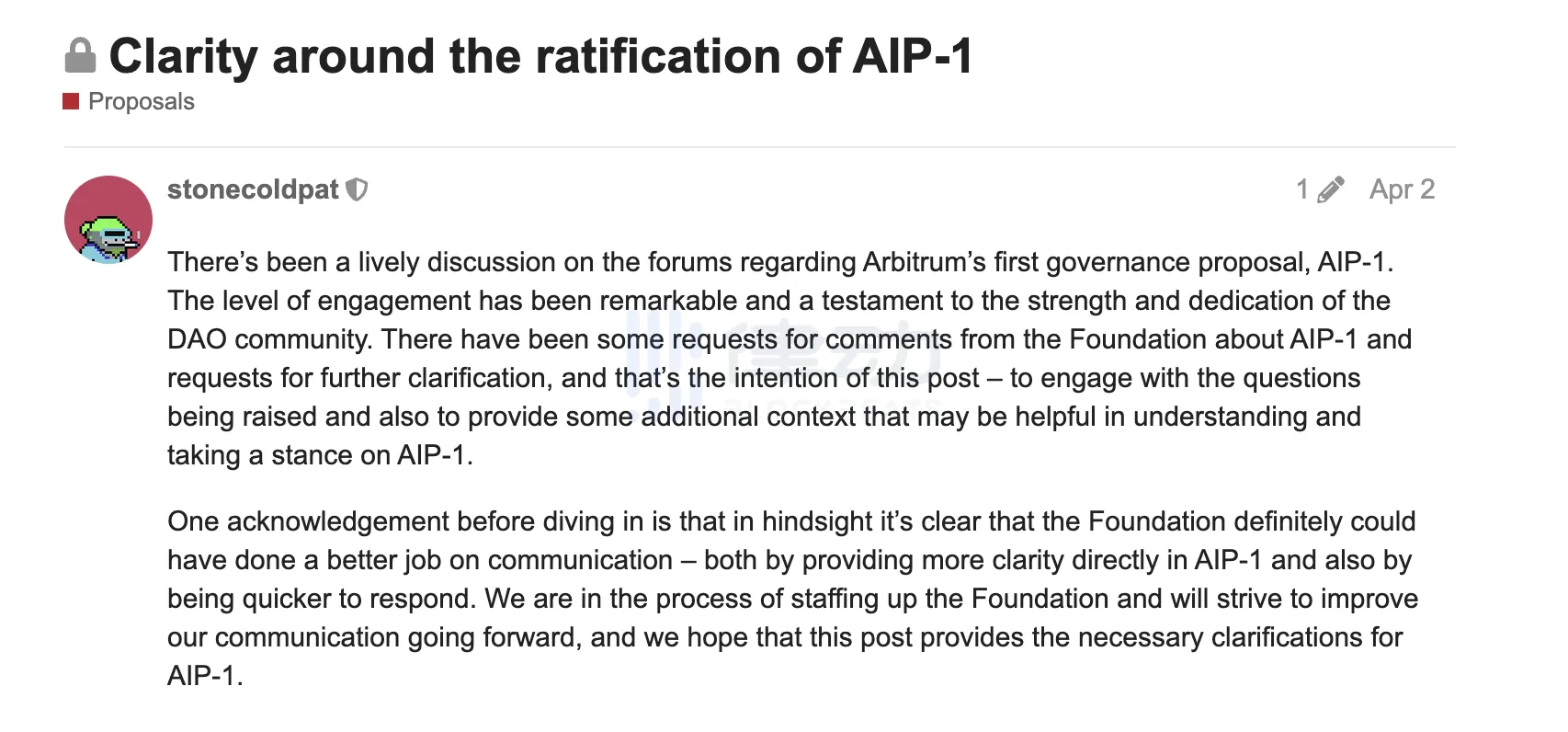

According to previous BlockBeats reports, on April 2nd, in a community blog post, it was claimed that the Arbitrum Foundation began selling ARB tokens for stablecoins before the "approval" of nearly 1 billion USD budget by its token holders' governance community, sparking controversy. Previously, the Arbitrum governance hawks had called for the foundation's "special allocation" plan.

According to the proposal, the foundation would receive 750 million ARB tokens (approximately 1 billion USD) to be used without the approval of token holders. According to Patrick McCorry, the foundation had already started using these tokens for the benefit of the DAO before the proposal was approved, including converting some funds into stablecoins for operational purposes.

On April 3rd, the official Arbitrum response on social media regarding the recent community debate about "foundation selling tokens before AIP-1 proposal was voted on" stated that Arbitrum's decentralized governance is proceeding according to the original plan, but many decisions must be made before the formal launch of the DAO.

In addition, Arbitrum added that its foundation did not sell 50 million ARB tokens in advance, with 40 million ARB tokens already allocated as loans to mature participants in the financial market sector, and the remaining 10 million ARB tokens exchanged for fiat to cover operational costs.

On the same day as the official Arbitrum response, the decentralized gaming ecosystem TreasureDAO stated on its social platform that as the largest governance representative in the Arbitrum ecosystem, it had voted against the AIP-1 proposal submitted by the Arbitrum Foundation. Additionally, TreasureDAO requested Arbitrum to resubmit a proposal that clearly outlines the scope of the special allocation plan and to split the AIP-1 proposal.

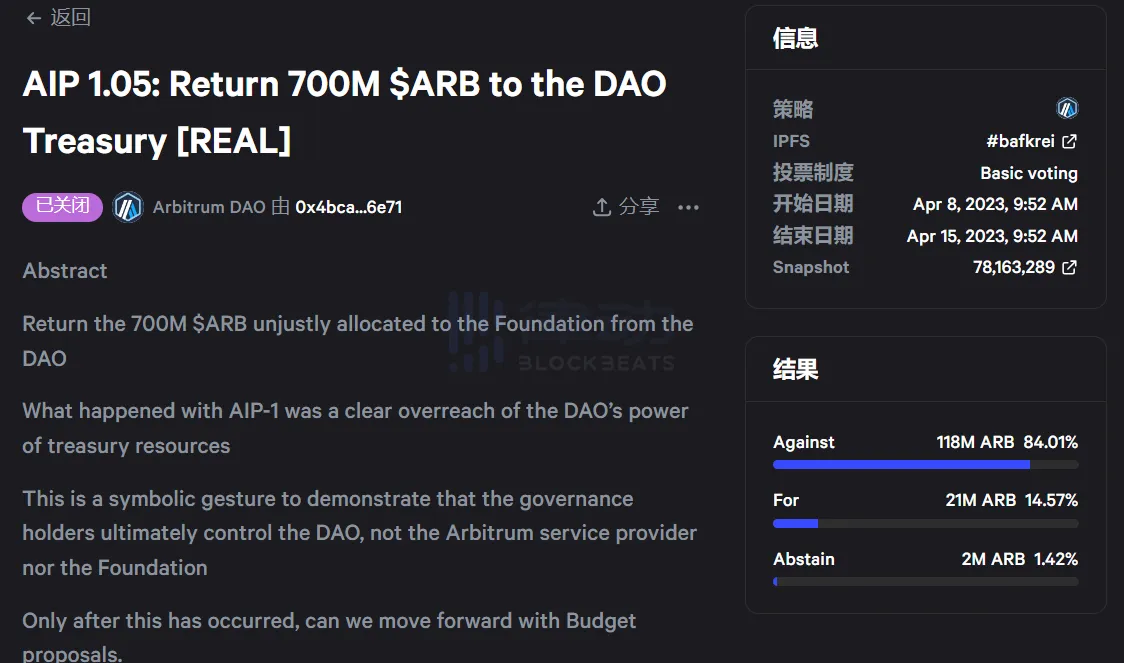

On April 15th, according to snapshot data, the governance proposal for Arbitrum to "return 700 million ARB to the DAO treasury" did not receive enough votes, with opposing votes totaling 118 million ARB, accounting for 84.01% of the total voting quantity.

In a May interview with BlockBeats, Arbitrum founder Ed Felten responded to the "DAO fund gate" incident, stating that there was a misunderstanding between the community and the team, and the involved ARB tokens were not transferred, and no transactions moved these tokens anywhere.

Related reading: "Exclusive Interview with Arbitrum Founder: 3 People, 9 Years, 2 Billion Market Value" "In short, my view is that the actions taken by the team are reasonable and fair, but due to poor communication, the community's expectations did not match the actual situation. However, from another perspective, this also reflects a very good point, which is that it shows that the DAO does indeed have control. If anyone thinks that the Arbitrum Foundation is acting according to its own will and the opinions of the DAO are irrelevant, I believe this incident has shown them that the DAO does have actual control. I hope that once AIP-1.1 and 1.2 are passed through on-chain voting by the DAO, it will clearly demonstrate that the foundation is developing in accordance with the DAO's wishes, while also clearly demonstrating that the foundation is indeed accountable to the DAO."

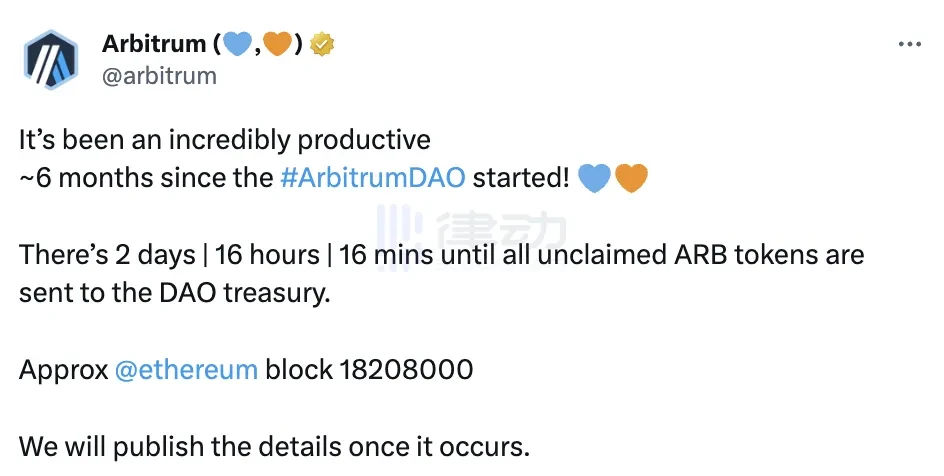

On September 22nd, the official Arbitrum announcement on social media stated that all unclaimed ARB airdrop tokens would be sent to the DAO treasury at Ethereum network block height 18208000 (approximately 2 days and 10 hours later). Among them, 69,448,385 unclaimed ARB tokens, equivalent to approximately 56.54 million USD.

TVL falls below 5 billion USD, community launches a series of incentive measures

BlockBeats reported in mid-September that according to public data, the Arbitrum network experienced a 5.28% decline in a week, and ARB has been on a downward trend since reaching a high of 1.35 USD in mid-July, briefly falling below 0.74 USD, with a decline of approximately 45% in the past 2 months and a 24-hour decline of 10.46%, with TVL falling below 5 billion USD.

Subsequently, the Arbitrum team and community initiated a series of "incentive plans" in an effort to revive its ecosystem vitality.

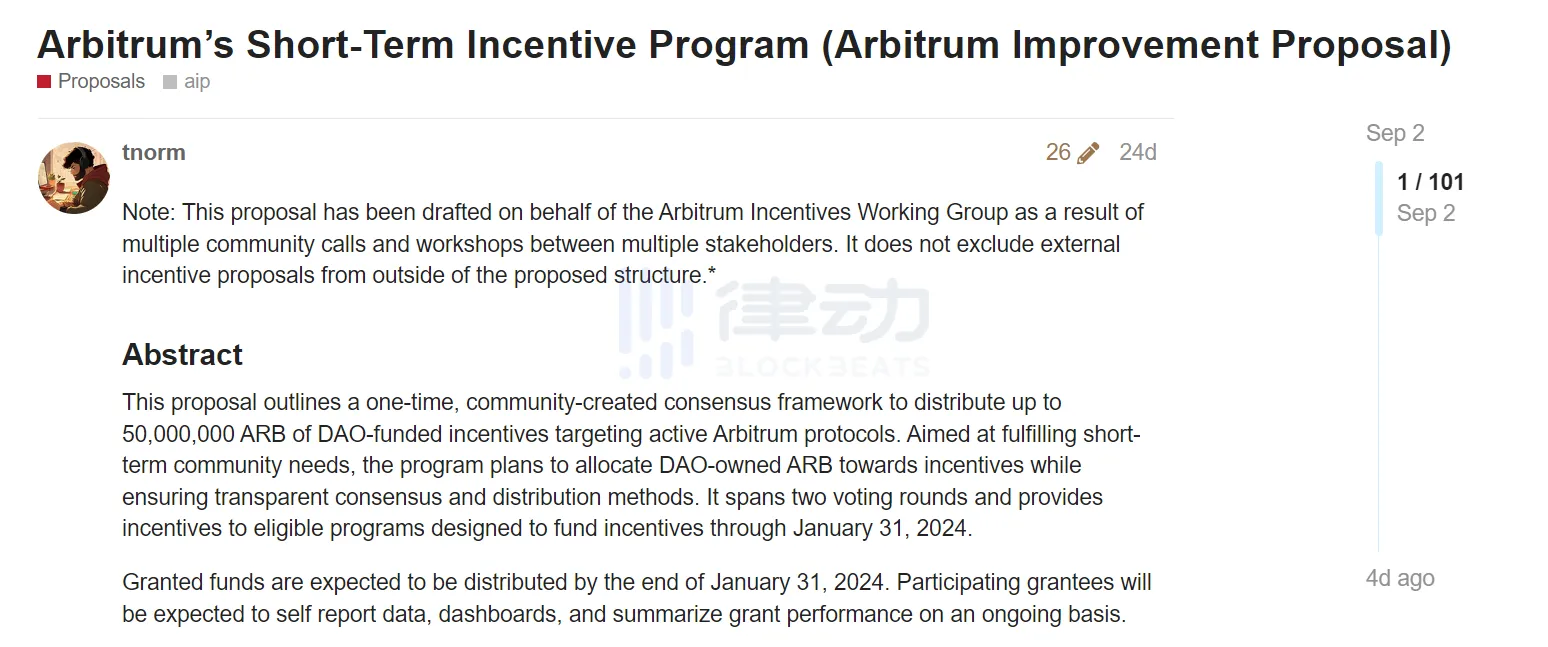

On September 4th, BlockBeats reported that the Arbitrum incentive working group submitted the "Arbitrum Short-Term Incentive Plan" AIP proposal on the Arbitrum community forum, aiming to allocate a maximum of 75 million ARB rewards from the DAO treasury to active Arbitrum protocols to meet short-term community needs.

On September 11th, the Arbitrum community initiated the "Proposal to distribute 75 million ARB for incentive funding to active protocols in the Arbitrum ecosystem," aiming to meet short-term community needs. The plan is to allocate ARB owned by the DAO to incentive projects, while ensuring a transparent consensus and distribution method. On the 18th, the proposal passed with 0 opposing votes recorded.

On September 20th, the official announcement from Arbitrum stated that Odyssey will relaunch next week, with this edition of Odyssey partnering with the Web3 community event platform Galxe for a duration of 7 weeks. Completing tasks and exploring 13 projects on Arbitrum One will earn participants custom badges. According to official documentation, the relaunch of Arbitrum Odyssey will not involve any form of airdrop or reward.

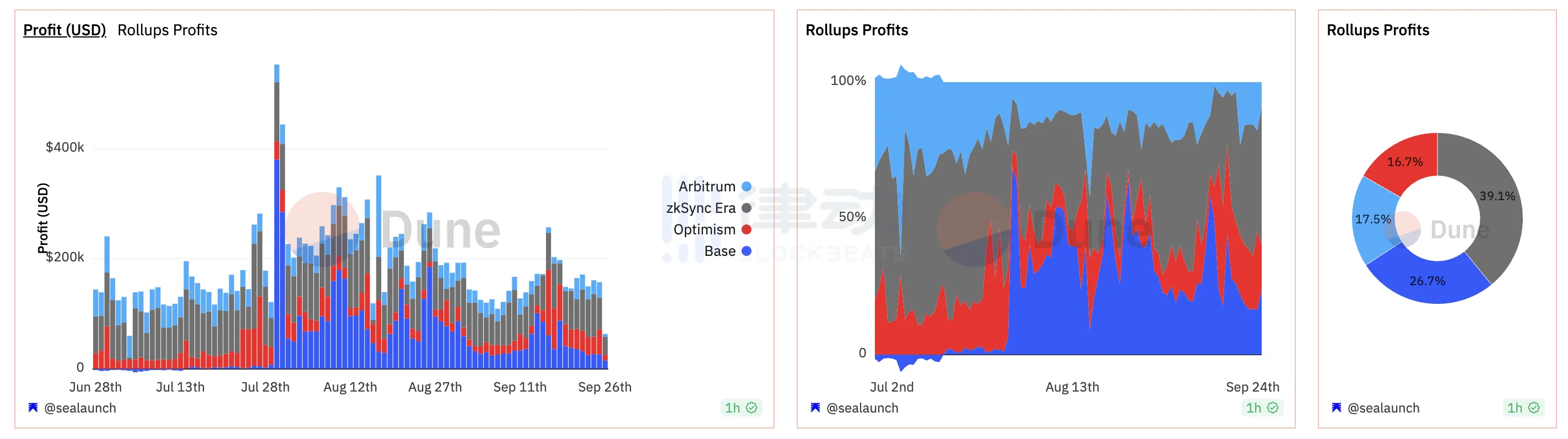

However, the series of incentive measures by Arbitrum did not bring about an improvement in its ecosystem activity. Arbitrum's TVL has not shown significant growth in the past few months. As of now, according to L2BEAT data, Arbitrum's TVL is 5.6 billion USD, and the ARB token price is 0.81 USD. Additionally, according to Dune Analytics data, most L2 networks have shown weak revenue growth over the past two months, with Arbitrum's share of revenue shrinking the most noticeably.

Projects leveraging incentives for "ecosystem arbitrage"

After Arbitrum proposed incentive measures, many projects began submitting proposals to the Arbitrum community to request ARB funding.

BlockBeats reported on September 21st that the cross-chain protocol Wormhole submitted a funding proposal to the Arbitrum community. The proposal aims to incentivize users to mint native USDC on Arbitrum using Wormhole and its partner Circle's Cross-Chain Transfer Protocol (CCTP), with the goal of attracting 100 million USDC to migrate to Arbitrum within 12 weeks. For this, Wormhole requested a maximum of 2,500,000 ARB in funding to provide users with a maximum 8% annualized return.

On September 26th, the cross-chain lending protocol Radiant Capital submitted a strategic proposal to the Arbitrum DAO, aiming to further drive ecosystem growth. Radiant requested funding ranging from 52,126 to 3,359,302 ARB to expand its impact in the core areas of sticky liquidity, ecosystem enrichment, and future integration.

On the same day, the decentralized trading platform Trader Joe posted a proposal in the Arbitrum community, requesting 1.83 million ARB from the Arbitrum DAO treasury to enhance spot liquidity and trading efficiency, promote the development of the Arbitrum ecosystem, and attract more users to join the Arbitrum ecosystem.

Will Arbitrum's incentive measures attract more projects to join and help revive its ecosystem? BlockBeats will continue to track and report on this.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。