When trading, you should choose the appropriate position size based on your risk tolerance. Generally, the risk of each trade should not exceed 2-3% of the total capital. By controlling risk, excessive leverage and excessive loss of funds can be avoided. Understanding fundamental and technical analysis is the basis for trading. Learning and mastering different analysis methods can help make wiser trading decisions.

As the Fed once again hit the "pause button" as scheduled, oil prices surged, the U.S. auto industry faced a major strike, and the potential government shutdown still threatens the market. The first two risks are likely to reignite U.S. inflation, making the Fed's job even more challenging. In the coming week, we will continue to focus on these three major risks. This week, several Fed officials, including Powell, will give speeches, and the market will continue to look for signals about future policy direction from their remarks. In terms of data, Thursday's initial jobless claims, U.S. second-quarter GDP and core PCE reports, as well as Friday's August core PCE price index and U.S. one-year inflation rate expectations, will continue to affect investors' nerves.

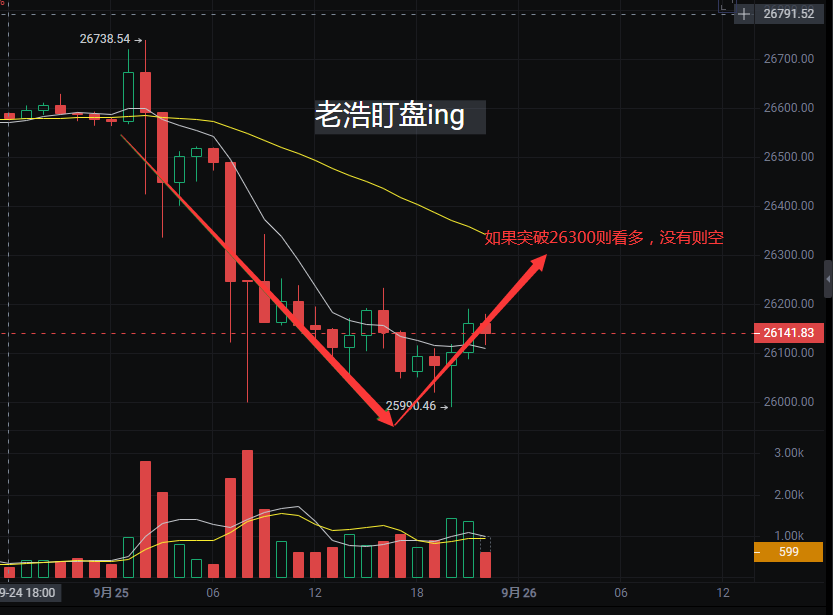

Today's market review: Taking Bitcoin as an example, a bullish rally started early this morning, reaching around 26700, hitting a resistance level, and then starting a downward trend, reaching around 26000 this morning. A new round of oscillating operation began, with an average value of 26150 and a fluctuation of no more than 100 points. However, around 20:00 in the evening, it broke through a new low of around 25990, and then started a new round of rebound to around 26150. The current price is around 26100.

At a glance from the chart, it is clear that if the right shoulder bottom forms, the rebound will oscillate within the angle. Bitcoin is currently in an awkward position, showing signs of a rebound in form. In the short term, we continue to focus on the resistance at 26300-26500 for Bitcoin. If it still cannot stabilize around 26350 before midnight, it is advisable to decisively open a short position near 26300 and look for a slow decline. However, the focus below is on the 25800 area, and we can continue to participate in the high-short strategy around midnight.

Bitcoin strategy: Short near 26200-26300, target 25800

Ethereum strategy: Short near 1580-1590, target 1530

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。