Organizing | Odaily Planet Daily

Author | Qin Xiaofeng

I. Overall Overview

Grayscale Investment Company submitted an application to the U.S. Securities and Exchange Commission (SEC) on Tuesday for a new Ethereum futures ETF, which is filed under the 1933 Securities Act. This Act also governs the filing of commodity and spot Bitcoin ETFs. Previously, Grayscale had also applied for a standalone Ethereum futures ETF under the 1940 Investment Company Act, with most security-based ETFs being registered under this Act.

In addition, the SEC is reviewing applications for spot Ethereum ETFs from asset management companies ARK Invest and VanEck. The SEC has sought public opinion on the potential benefits and risks of approving these ETFs. The SEC has opened a 45-day public comment period for these two filings and stated, "The Commission is publishing this notice to solicit comments on proposed rule changes from interested persons."

Galaxy Research Vice President Christine Kim summarized the 118th Ethereum Core Developers Consensus Call (ACDC), which mainly discussed the preparation work for Devnet-9 and changes to the Ethereum Consensus Layer (CL). Ethereum Core Developer Tim Beiko raised questions about the Dencun test schedule, stating that if developers cannot confirm the release of Dencun on the public testnet before the Ethereum Developer Conference Devconnect in November 2023, the mainnet activation of Dencun is unlikely to occur this year.

In the secondary market, the price of ETH may continue to consolidate in the short term, with support at $1550 and resistance at $1600.

II. Secondary Market

1. Spot Market

Data from OKX Market shows that last week, ETH rose to 1670 USDT at one point and closed at 1590 USDT for the week, a decrease of 2.4% compared to the previous week.

ETH daily chart, from OKX

The daily chart shows that the price is currently consolidating around $1600, with support at $1550. If it falls below, it may further decline to $1500, with resistance at $1600.

2. Network Operation

Data from Etherscan shows that the Ethereum network produced 49948 blocks in the past week, a 0.4% increase compared to the previous week. The number of active addresses per week decreased by 23.3% to 2723878. Block reward income decreased by 12.1% to 2814 ETH, and the weekly ETH burn reached 9314, a 20.2% decrease compared to the previous week.

On September 21, Ethereum gas fees briefly surged to 300 gwei. The sudden increase in gas fees may be due to Binance consolidating wallets. In response, Binance stated that the platform was only consolidating when gas fees were low.

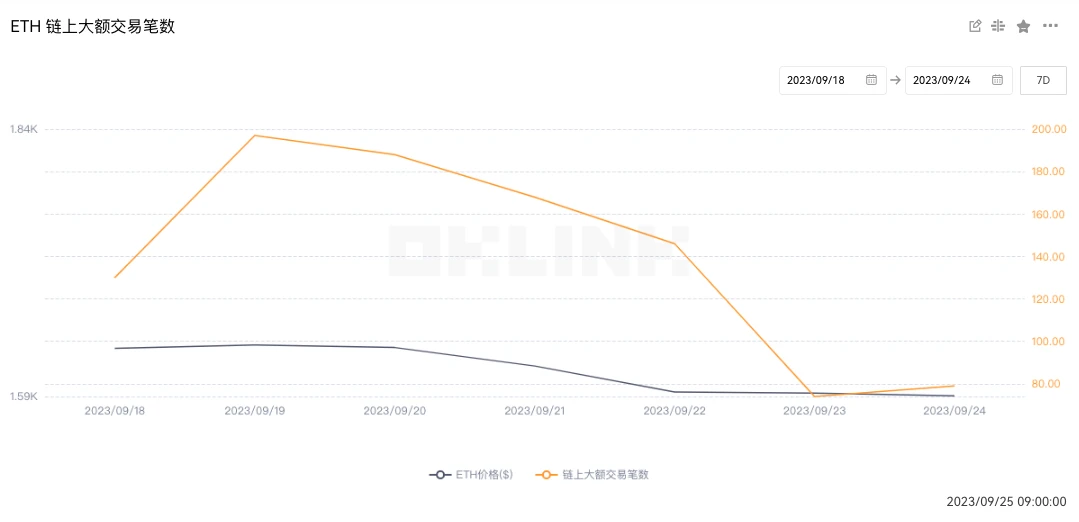

3. Large Transactions

Data from OKLink shows that the number of large on-chain transactions reached 982 last week, a 56.2% decrease compared to the previous week (2244), indicating a significant decrease in whale trading activity.

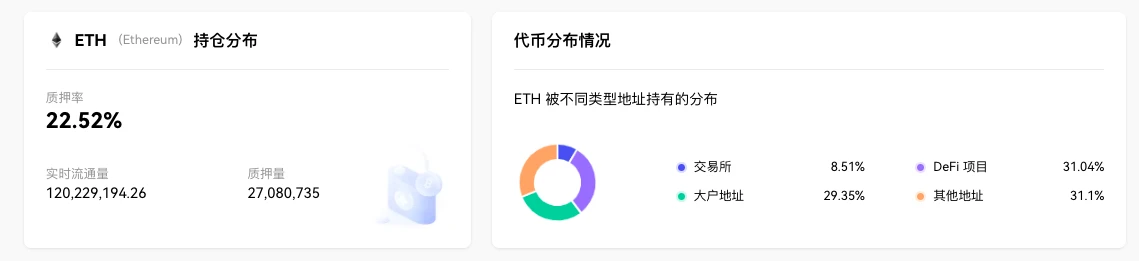

4. Whale Address Rankings

Data from OKLink shows that the total deposit amount of ETH2.0 has reached 27.08 million ETH, with a staking rate of 22.52%. In terms of ETH holding address distribution, exchanges account for 8.51%, a decrease of 0.07% compared to the previous period; DeFi projects account for 31.04%, an increase of 0.26%; the top 1000 addresses excluding exchanges and DeFi projects account for 29.35%, a decrease of 0.03%; and other addresses account for 31.1%, a decrease of 0.16%.

In terms of whale actions, a whale address deposited 6000 ETH (worth approximately $9.96 million) into Kraken on September 19. This address had participated in the Ethereum ICO and received 254,908 ETH (currently worth $422.6 million), with the ICO price of ETH being approximately $0.31.

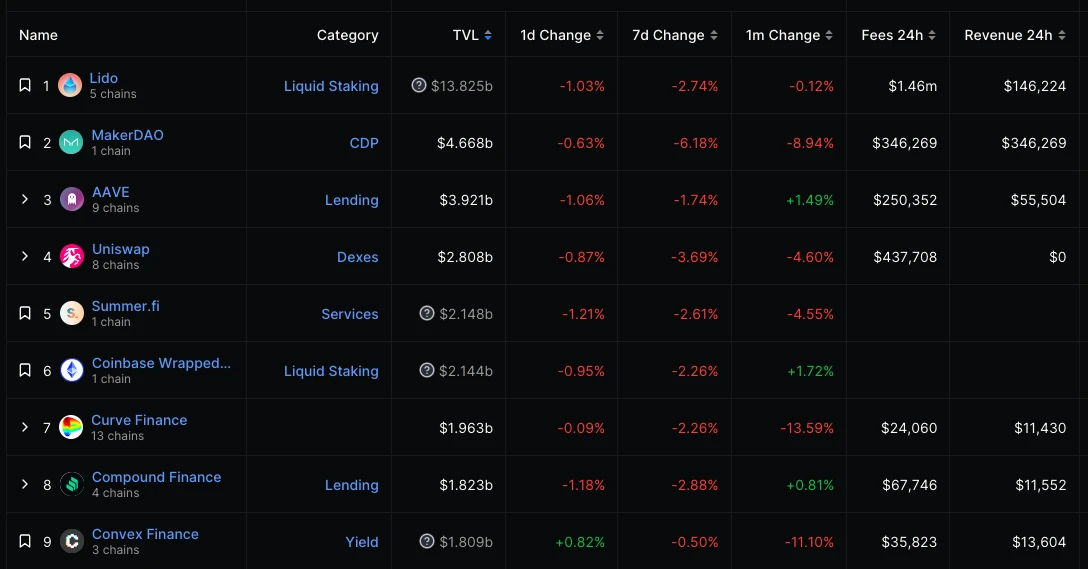

5. Lock-up Data

Data from DeFiLlama shows that the total value of on-chain locked collateral decreased from $213.3 billion to $206.3 billion last week, a decrease of 3.2%. The top three locked values for individual projects are: Lido at $138.2 billion; MakerDAO at $46.6 billion; Aave at $39.2 billion.

III. Ecosystem and Technology

1. Technological Progress

_Galaxy Research Vice President Christine Kim summarized the 118th Ethereum Core Developers Consensus Call (ACDC), which mainly discussed the preparation work for Devnet-9 and changes to the Ethereum Consensus Layer (CL). Devnet-9 is the second testnet, including a full set of code changes in the Dencun upgrade. Devnet-9 will be the first testnet to activate EIP-7514 and EIP-7516, both of which were added to the Dencun upgrade at the last execution layer meeting.

Parithosh Jayanthi, a DevOps engineer at the Ethereum Foundation, stated that his team will launch Devnet-9 on September 27. Client teams such as Lodestar, EthereumJS, Lighthouse, and Geth have confirmed their readiness for this testnet release.

Additionally, developers discussed the deployment strategy for EIP-4788, as well as deploying trusted settings for EIP 4844 on Devnet-9.

Ethereum Core Developer Tim Beiko raised questions about the Dencun test schedule, stating that if developers cannot confirm the release of Dencun on the public testnet before the Ethereum Developer Conference Devconnect in November 2023, the mainnet activation of Dencun is unlikely to occur this year. Previously, Tim Beiko suggested launching Dencun on the Holesky, Goerli, and Sepolia testnets in that order, but due to the failed launch of Holesky on September 15, which will be re-launched on September 28, Jayanthi proposed launching Dencun on Goerli first, followed by Holesky. Since Goerli is a testnet that is about to be deprecated, developers can freely experiment with modifying Dencun specifications.

Tim Beiko and Del Fante agreed to test Dencun on Goerli before Holesky, and several developers also supported releasing Dencun on the public testnet before Devconnect.

In addition, there are community voices and project developments, including statements from former Ethereum advisor Steven Nerayoff, a report from JPMorgan about the Ethereum Shanghai upgrade, and updates on projects such as Lido, Aave, and Scroll._

Based on zkRollup, Ethereum Layer 2 network Taiko has announced the launch of the Alpha-5 testnet Jólnir, introducing a proposal and proof implementation mechanism inspired by Proposer-Builder Separation (PBS).

In Jólnir, a Proposer needs to obtain a bond from the Prover in order to propose a block. The Prover needs to deposit some TTKOj tokens to obtain the bond. If the Prover proves the block allocated to them within the specified proof time target, they will reclaim the bond and retain the prepayment received from the off-chain Proposer. TTKOj has been distributed to A1 and A2 testnet Proposers and Provers (2.5 TTKOj per address). A3 and A4 testnet Proposers and Provers will also receive TTKOj soon. Additionally, Taiko will no longer support Eldfell L3. Grímsvötn L2 will continue to operate until October 31 to support project migration.

(5)Optimism opens RetroPGF Round 3 applications, allocating 30 million OP tokens

Optimism has announced the opening of applications for the third round of RetroPGF (Retroactive Public Goods Funding). Applications are open until October 23 and will allocate 30 million OP tokens to builders, artists, creators, and educators who demonstrate impact within the Optimism Collective. Contributors of every type within the Optimism ecosystem are eligible for RetroPGF. Whether it's Ethereum execution client developers or educators creating Optimism video content, they are all eligible.

The Wormhole Foundation has initiated a proposal seeking funding of 2.5 million ARB to import 100 million USDC into Arbitrum, providing users who mint native USDC on Arbitrum through Wormhole and its partner Circle's Cross-Chain Transfer Protocol (CCTP) an 8% annualized return, with the reward period lasting up to 3 months and accumulating weekly. This means users can potentially earn up to 2% in total returns within 3 months.

(7)Grayscale announces abandonment of PoW Ethereum token-related rights

Grayscale has announced the abandonment of all rights related to PoW Ethereum (ETHPoW) tokens post-Merge. After thorough review, Grayscale determined that ETHPoW tokens lack liquidity and are not supported by product custodians.

The Ethereum Merge event was completed on September 15, 2022, forking the Ethereum blockchain into the primary PoS ETH and the secondary PoW EthereumPoW (ETHW) tokens. Grayscale had considered acquiring EthereumPoW on behalf of shareholders and selling ETHW, but ultimately abandoned the idea due to uncertainty surrounding support for ETHW tokens by digital asset custodians and exchanges.

(8)Grayscale applies for new Ether futures ETF

Grayscale Investments has submitted an application to the U.S. Securities and Exchange Commission (SEC) for a new Ether futures ETF, which is filed under the 1933 Securities Act, the same act that governs the filing of commodity and spot Bitcoin ETFs. Previously, Grayscale had applied for a standalone Ether futures ETF under the 1940 Investment Company Act, with most security-based ETFs registered under this act.

(9)SEC seeks public comments on ARK Invest and VanEck's spot Ethereum ETFs

The U.S. SEC is reviewing applications for spot Ethereum ETFs from asset management companies ARK Invest and VanEck. The SEC has opened a 45-day public comment period for these two filings and stated, "The Commission is publishing this notice to solicit comments on proposed rule changes from interested persons."

NYDIG stated that the SEC must respond to Nasdaq's request for the listing of the iSharesBitcoinTrust ETF by October 17 (either approval, rejection, or delay). The SEC also has until October 16 to respond to Bitwise's Bitcoin ETP Trust. Additionally, October 13 is the deadline for appeals regarding the SEC's decision on the Grayscale case, which may provide clues on how the agency is considering its position on spot ETFs.

(10)Ethereum Gas median hits new low since November 2022

Dune statistics show that the Ethereum Gas median hit a new low since November 2022, dropping to 9.7 gwei on September 17, with the previous low being 8.8 gwei on October 30, 2022.

(11)ETH/BTC ratio drops to 14-month low

According to TradingView data, the ETH/BTC ratio dropped to around 0.0602, reaching its lowest point since July of last year, marking a 14-month low. Marcus Thielen, Director of Strategy and Research at Matrixport, stated that Ethereum's protocol revenue has been declining for the past three months and expects BTC to continue outperforming a broader range of crypto markets, including ETH. Crypto analyst Benjamin Cowen suggested that the valuation of ETH relative to BTC may experience a collapse.

(12)Arbitrum airdrop claim ends, nearly 70 million unclaimed ARB transferred to DAO treasury

The Arbitrum airdrop claim has ended at Ethereum network block height 18208000, and 69,448,385 unclaimed ARB tokens (approximately $56.54 million) have been transferred from the airdrop contract to the DAO treasury.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。