Why is Ethereum Layer 2 not the best solution for MakerDAO?

Author: Haotian

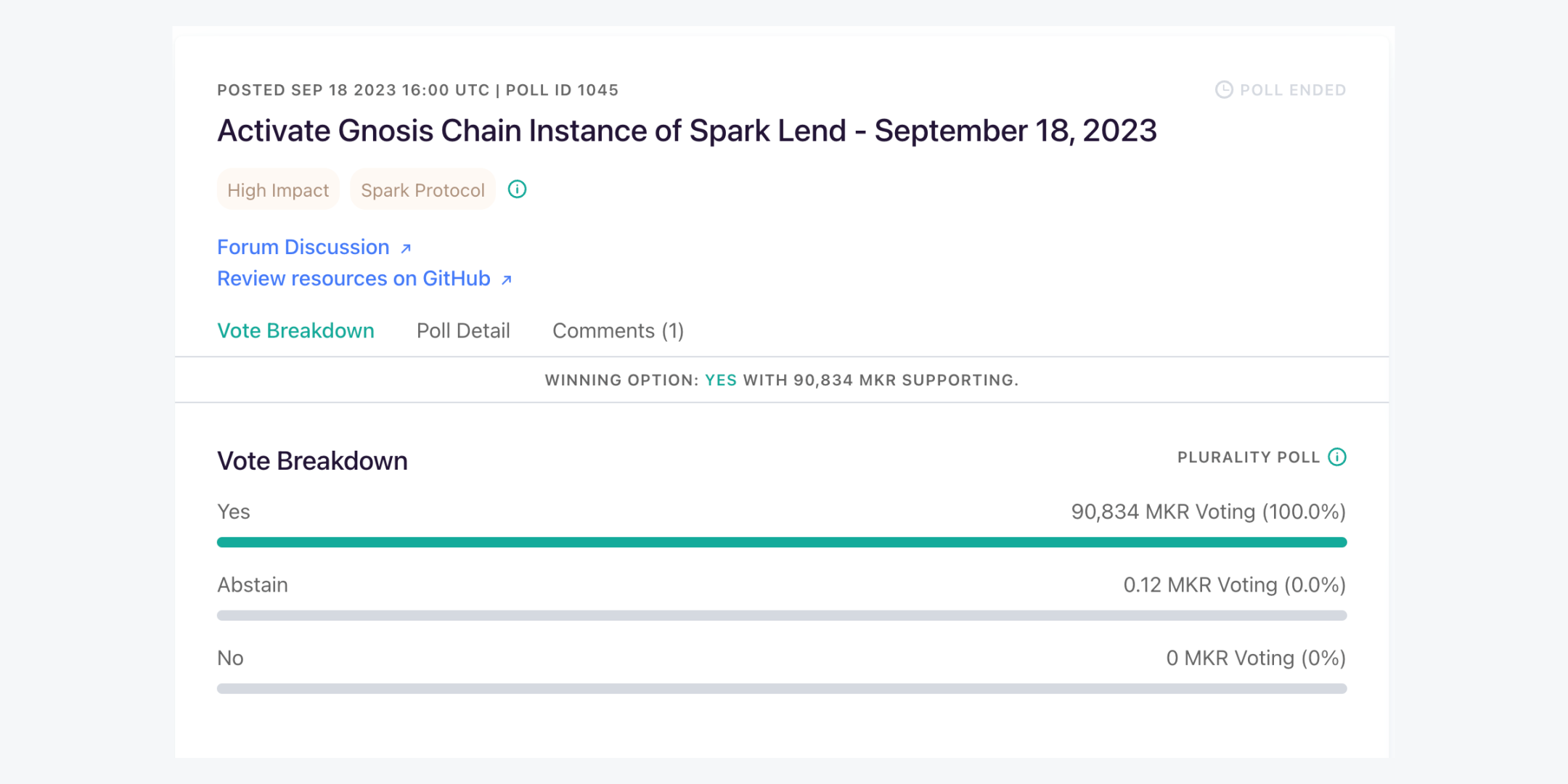

I originally thought that MakerDAO's Newchain plan had "fizzled out" amid a wave of public opinion, but unexpectedly, Spark Protocol, a lending protocol under MakerDAO, passed a proposal from Gnosis Chain just a day ago, and even went so far as to call it the kickoff of a multi-chain strategy, as if MakerDAO's expansion endgame was officially underway?

What is GnosisChain? The official explanation is that it is an independent public chain built on xDAI, which is essentially an equivalent EVM chain targeting Ethereum killers like BSC and Avalanche. At a critical time when everyone is discussing MakerDAO's potential departure from Ethereum, Spark Protocol has chosen to deeply integrate with a relatively unknown competing chain on Ethereum, which truly raises concerns about another MKR sell-off by Vitalik.

So, what motivations are hidden behind Spark Protocol's partnership with GnosisChain? Why is Ethereum Layer 2 not the best solution for MakerDAO? Why doesn't MakerDAO implement a multi-chain strategy like AAVE? Next, I will attempt to briefly analyze and provide some insights for reference:

Why choose Gnosis?

It's more accurate to say that Gnosis has successfully risen to power by taking advantage of the entanglement between MakerDAO and Ethereum, rather than MakerDAO choosing Gnosis. According to DefiLlama data, the total value locked (TVL) of the entire Gnosis chain is only $77 million across 50 protocols, while Spark Protocol's TVL on Ethereum alone is as high as $427 million. It seems a bit self-deprecating for MakerDAO to choose Gnosis, doesn't it? Why Gnosis specifically? Simply put, Gnosis was originally named the xDai Chain, aiming to use the world's first algorithmic stablecoin DAI, and to be compatible with and expand Ethereum, attracting Ethereum users, especially MakerDAO's users.

It's not difficult to see that Gnosis is a chain born for MakerDAO (to hitch a ride on), and now the spare tire has finally been promoted, simply because of its fast transaction speed, low fees, and good cross-chain interaction capabilities? I believe that this is a signal flare released by MakerDAO's execution of the Endgame plan: unwilling to be confined within the framework of Ethereum. The inclusion of Gnosis in the strategic plan truly gives a feeling of "when the gods fight, the mortals gain."

Why is Ethereum Layer 2 not the best solution?

In my previous article, I analyzed that Ethereum's layer 2 expansion is limited (you can refer to the main page highlights article), constrained by the capacity of the mainnet rollup contracts. As the father of DeFi, it's understandable that MakerDAO holds a bit of arrogance and recklessness, wanting to break through to higher performance. However, lending and borrowing, as low-frequency scenarios, clearly do not prioritize performance. MakerDAO's ambition is to have a chain that can have hard fork decision-making power and be secure and controllable. To achieve this fundamental goal, it cannot overly rely on layer 2.

In fact, if we look at AAVE's layer 2 development strategy, we can also find some reasons why MakerDAO is disdainful of layer 2. AAVE has deployed on 9 chains, with the majority of TVL still on layer 1 mainnet, and Arbitrum only has $145 million, while in comparison, GMX's TVL is $422 million. Although it may be somewhat subjective to define layer 2 as unsuitable for the development of lending protocols, considering the nature of layer 2 as a sidechain and its tendency towards centralization, and looking at the core position of lending on layer 1 chains, it's not difficult to see that layer 2 cannot support the grand vision of lending and borrowing platforms.

Furthermore, adding to this, after MakerDAO announced a deep collaboration with Gnosis, it also quietly proposed deployment to zkSync, and MakerDAO has not made much of a move within the two major OP-Rollup camps, Arbitrum and Optimism. This may be interpreted as MakerDAO looking down on the security of OP-Rollup. If it chooses layer 2 and only chooses the ZK-Rollup track, it's hard not to make this kind of association. I've even seen many people in the Maker forum calling for MakerDAO to land on the Base chain. Whether this is feasible or not, given MakerDAO's current security requirements, is a bit difficult.

What is the endpoint of MakerDAO's multi-chain strategy?

Based on current data, MakerDAO's CDP alone has a TVL of $4.68 billion, surpassing AAVE's deployment on 9 chains, and with Spark Protocol's $427 million, MakerDAO is still the leader in DeFi. AAVE's TVL of $45.6 billion, with non-Ethereum chains accounting for only $5 billion, clearly demonstrates that AAVE has set an example for MakerDAO in multi-chain expansion. Simply from a data perspective, the temptation of a comprehensive multi-chain strategy is not great, and MakerDAO's multi-chain strategy is definitely more than just covering protocols on various chains.

Because if MakerDAO simply wants to pursue a multi-chain route, Avalanche, Polygon, and other layer 1 chains are also good choices. By directly ignoring these well-known layer 1 chains and layer 2 solutions, and choosing a relatively unknown backup chain, isn't its intention unclear? It's precisely because of Gnosis' affinity with MakerDAO and its ability to satisfy MakerDAO's multi-chain expansion without sacrificing strategic control.

Of course, this is a positive development for Gnosis Chain. Regardless, this is a warm embrace from MakerDAO, and Gnosis' layout in RWA may also be a key attraction for MakerDAO. However, overall, Gnosis is just one piece in MakerDAO's chessboard. I have roughly looked at the Endgame plan, which actually outlines 5 stages. MakerDAO's multi-chain, cross-chain, and even the launch of the NewChain application all confirm one thing: MakerDAO does not want to be limited by any single chain and aims to seamlessly integrate into various financial application scenarios, ultimately realizing a highly autonomous financial service community composed of multiple SubDAOs.

Although born from Ethereum, developed from Ethereum, and shining from Ethereum, Vitalik and everyone hope that MakerDAO will always remain focused on Ethereum. However, the reality proves that while Ethereum is solid as a rock, MakerDAO flows like water, and MakerDAO does not want to be restricted by any framework.

Lastly, a little-known fact: MakerDAO's official website app entrance has been changed to Spark Protocol, indicating a redirection to Spark. If users want to participate in CDP lending, they have to go to Oasis trade, and Oasis was renamed to Summerfi a month ago. Not only did it inexplicably change its name, but the entrance is also deeply hidden, making it difficult for ordinary people to find.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。