Introduction

After sorting out the technical solutions for CP and Layer 2 Stacks and the value and ecology of tokens in the previous article (technical solutions), we have provided corresponding selection ideas for developers and project parties based on the technical characteristics of both and the current ecological token empowerment (for developers and project parties). Parties can choose the solution that best suits their actual needs.

So, subjectively speaking, what is the current community's attitude towards this new force of Layer 2? How should major L2s develop their own superchain networks? In this article, the author will focus on exploring these two questions.

I. Industry Perspectives

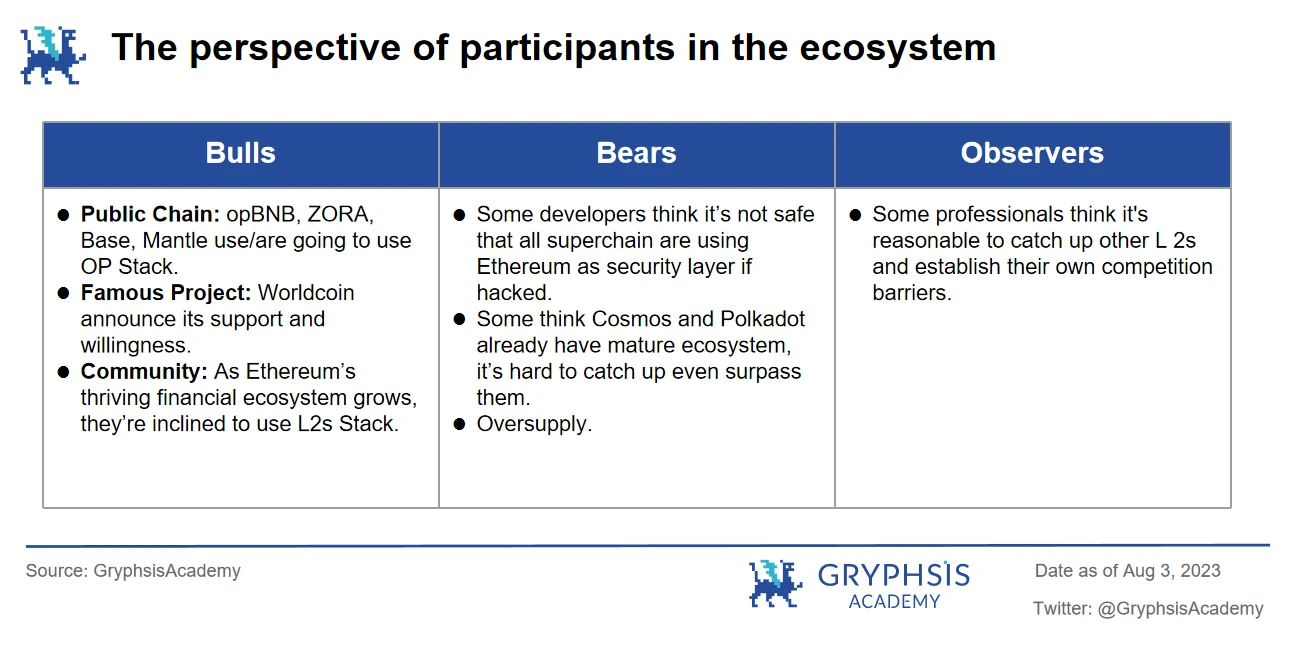

In order to comprehensively understand the current market voices, we have collected different perspectives on Layer 2 Stacks solutions within the industry and summarized them into three categories: Bulls, Bears, and Observers.

1. Bulls:

Public Chains: Public chains such as opBNB, ZORA, Base, and Mantle have announced their deployment to the OP Stack. Among them, BNB announced its support for OP Stack as early as February this year and created its own opBNB. After 1.5 months of the testnet release, there have been over 7 million transactions, 435,972 addresses, and over 40 Dapps deployed, including well-known projects such as iZUMi Finance, Math Wallet, and BaBYGODE, indicating a high level of acceptance of opBNB by the community and developers.

Project Parties: Taking Worldcoin as an example, it expressed its intention to deploy Worldcoin and World App on the OP mainnet as early as May this year, and began to implement it on the OP superchain in July. Worldcoin itself aims to create a global identity and DID system, combining it with the OP superchain to allow any user to freely manage their identity ID and assist OP Collective in on-chain governance. Additionally, Debank announced on August 11th that it plans to deploy a dedicated asset social L2 chain on the OP Stack. As a well-established brand that has been providing data asset services for over 5 years, regardless of its success, it already indicates the proactive attitude of project parties towards deploying L2 and the positive impact of choosing OP Stack as the preferred solution for OP.

Community: The community has a high level of recognition/consensus for Ethereum, which is itself a financial superchain with a relatively rich application scenario. Therefore, developing L2 on Ethereum will have more community recognition than independently developing the Cosmos & Polkadot ecosystems. It is believed that due to its complete consensus layer, L2 will develop the superchain ecosystem at a faster pace compared to CP, completing it more quickly.

2. Bears:

Developers: Some developers believe that relying on a single Ethereum for the consensus layer of all superchains is too risky. If Ethereum, as a single infrastructure, experiences a failure or attack, all superchain networks will be affected. In comparison, CP has more thorough security considerations, as Cosmos allows each chain to customize validators for security verification, so even in the event of a failure, it only affects a single chain and related chains, without impacting the entire ecosystem. Polkadot provides more choices, allowing shared security with relay chains or custom security layers similar to Cosmos, significantly reducing the risk. Therefore, regardless of the situation, current Layer 2 Stacks should develop more solutions in terms of security.

Projects: The superchain networks of Layer 2 Stacks are slightly oversupplied. Without considering technical differences, the perception for ordinary projects is not strong, as fundamentally it is still Ethereum. Additionally, some project parties believe that this industry needs L1 (such as CP), and not all chains are suitable for L2.

Community: As Ethereum's scaling solution, Layer 2 is unlikely to exist independently of Ethereum in the short term, so handling the economic model of ETH and native tokens is a challenge. Compared to Cosmos, which has already connected to 246 chains, and Polkadot with a market value of 6.5 billion, without a well-established community drive, competing with CP seems somewhat weak.

3. Observers:

- Some developers believe that the development of Layer 2 Stacks is aimed at attracting more developers to create ecosystems. After the top L2s such as OP and Arb announced their superchain ideas, taking proactive measures can be seen as catering to market enthusiasm, which is understandable. Additionally, since L2 itself only handles and packages transactions (execution layer), when L3 packages transactions to L2, and L2 then repackages them, forming a recursive compression, greatly increasing throughput may not necessarily be a bad thing. However, being too hasty without examining the current on-chain ecosystem and economic incentives is somewhat reckless.

In the current situation, the author believes that the Stack solution, especially the OP Stack, is a favorable direction. BNB, Base, ZORA, Mantle, Worldcoin, Debank, and others are backed by top exchanges and well-known Web2 giants. The capital boost from these entities places OP Stack at the forefront of Layer 2, likely to become the preferred choice for future big-name projects to launch chains, indicating that the market and industry's logic towards L2 Stacks is recognized and can already be put into practice.

However, in the long term, the Ethereum ecosystem jointly built by ETH and Layer 2 will become increasingly prosperous. However, within the ecosystem, there are also some issues. For example, how Layer 2 handles its relationship with Ethereum, how to capture value from the multi-chain system it builds, how to establish core competitive barriers, or how to jointly create L2 superchain networks with other Layer 2s, will be the situations that Layer 2 will face next, and every step taken thereafter will greatly affect the future direction of Layer 2.

II. Development Approach

1. Technical Optimization

In the traditional development process of public chains, there exists the impossible triangle problem: scalability, security, and decentralization. The emergence of L2 has alleviated the scalability problem, and each introduced Stack focuses on the superchain network as the main target, solving the scalability of most underlying infrastructures. Apart from this, what kind of problems will arise in the development of Layer 2 Stacks?

1) Structural Security:

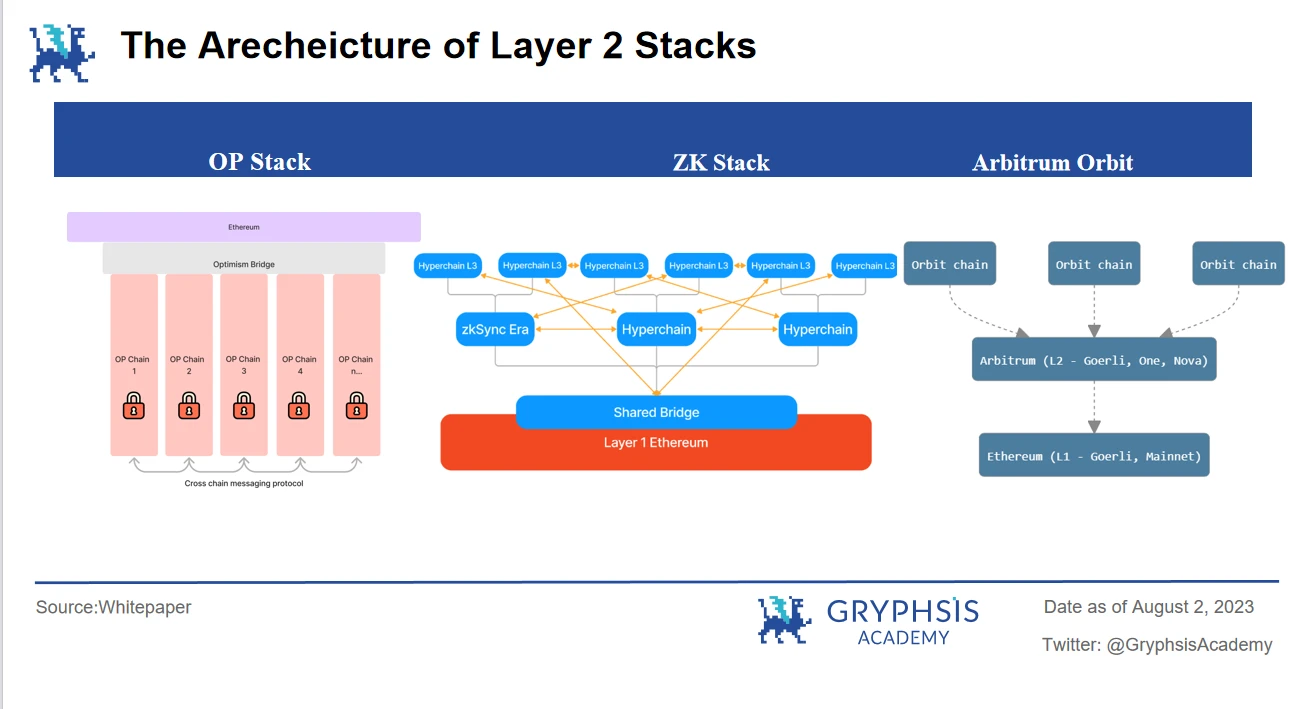

The emergence of superchain structures undoubtedly increases the complexity of Layer 2. Therefore, can the Stacks framework of L2 support the concurrency of a wide variety of application chains? We have conducted a structural analysis of the already released Stack frameworks Optimism, zksync, and Arbitrum.

OP Stack uses shared cross-chain bridges for asset transfer, and all OP Chains (1-n) created using the Stack solution are on par with the OP Mainnet. The underlying structure of ZK Stack & Arbitrum is similar, but they support the issuance of L3 and L4, forming a scalable superchain network. Polygon 2.0 (as a sidechain, not listed in the table) uses Ethereum as the staking layer, and the existing Polygon zkEVM public chain operates in parallel with the superchain, sharing an interoperable layer.

Their structural frameworks are similar and they all face the same type of problems, namely: all superchains rely on Ethereum as the underlying security consensus. So, if Ethereum is attacked, are the superchains safe? In terms of the coordination of superchains, Layer 2 primarily relies on shared communication bridges, so how should problems with the bridges be resolved? In response to such a single acceptance solution, Layer 2 should adopt multiple alternative solutions or directly optimize the framework to address these issues.

2) Risk Assessment

The high security of Ethereum is unquestionable, but whether Layer 2 can fully inherit the security of L1 is a question. As the mainstream Layer 2 based on Rollup, its most important current function is to transition "execution" operations to the native chain. However, when users initiate transactions on the L2 chain, although the cost is greatly reduced, can security be guaranteed? Are there corresponding escape mechanisms to protect user assets in a timely manner?

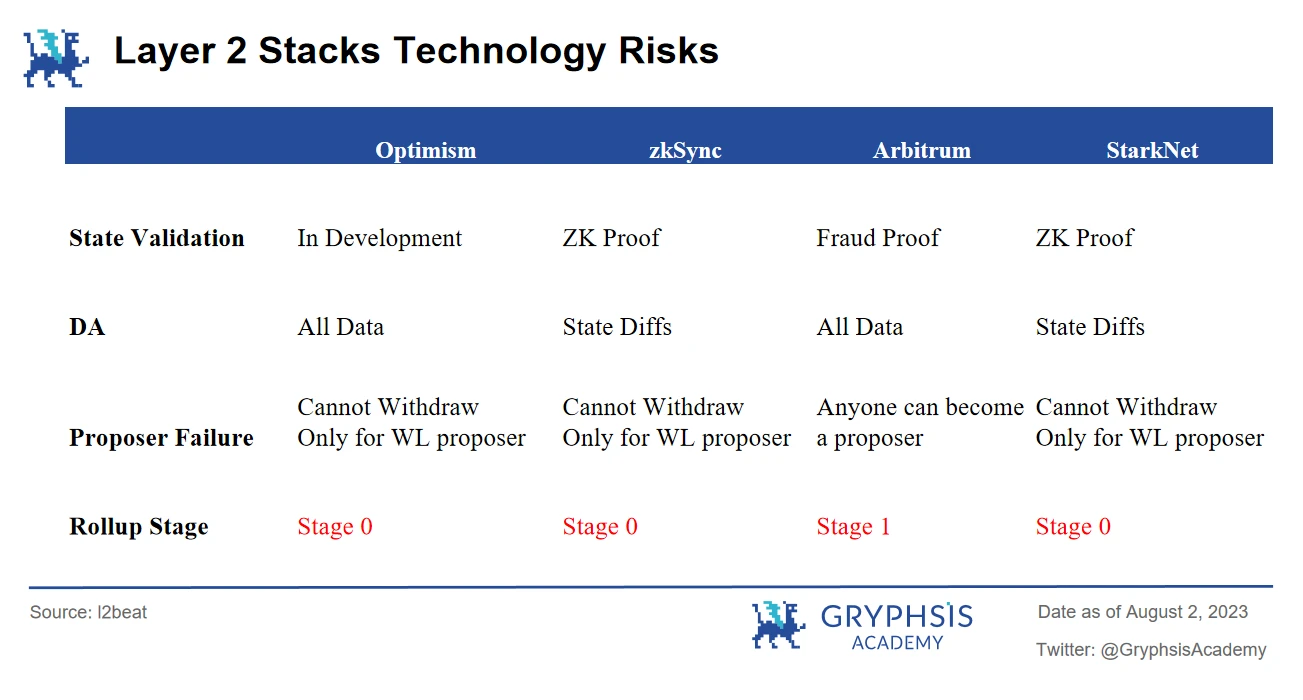

To assess the current risk deficiencies of Layer 2, we have compiled several important indicators from the l2beat website:

State Validation: This refers to the mechanism used by Layer 2 to validate the correctness of transactions. From the table, we can see that Optimism, the first network to use OP Rollup, has not fully developed its validation mechanism at the current stage. In comparison, Arbitrum has a fraud proof mechanism for validation, and its Rollup Stage development progress is higher than Optimism's. In terms of transaction security/correctness, Arbitrum has a comparative advantage. Additionally, zkSync and StarkNet both use ZK Proofs, and their Rollup Stage is at the same level.

DA: Data Availability, defined differently in the market, is analyzed based on l2beat's interpretation. Data availability refers to the correctness of publicly disclosed state transitions. There is no need to broadcast complete transaction data, which would violate user privacy. All this data must be on-chain, allowing those capable of verifying "state transitions" to do so on-chain. From the table, we can see that the current data of these L2s is On-Chain. OP Rollup uploads all transaction-related data to L1, while ZK Rollup only sends "state variables" to the chain, greatly reducing transaction costs and blockage.

Proposer Failure: This refers to a node/proposer being unable to complete a task for some reason, which can lead to network errors or interruptions, causing transaction failures and data loss. This means users cannot withdraw their assets from L2 to L1, also known as an escape mechanism. Currently, all L2s on the market have not fully implemented an escape mechanism. Additionally, all L2s are Whitelist Proposers, meaning only they have the right to submit the state root of L2 to L1. Therefore, if they are attacked, users are helpless, and their assets can be frozen. Arbitrum has a slight advantage in that it allows anyone to apply to become a Proposer after about a week of inactivity/failure of a node/proposer. This mechanism does provide some level of protection, but Whitelist Proposer is essentially a closed system, contradicting the decentralized and open nature of blockchain. Although users can apply to become a Proposer, the process still has a high technical threshold, and there is no active application in the market or corresponding incentive mechanism for these Proposers. Therefore, the current asset emergency measures of Layer 2 are not sufficient.

Rollup Stage: Stage2 is the endpoint for all L2s to inherit security, and currently, Arbitrum appears to be the safest, with the most complete risk mechanism. Considering its upcoming BOLD mechanism, a new permissionless verification solution, which strengthens its dispute protocol to defend against a form of denial-of-service attack called "delay attack," may further accelerate its decentralization.

3) Inter-chain Security:

Taking OP Stack as an example, its goal is to provide a unified, modular development stack, seamlessly connecting communication between superchains. The modular architecture allows any developer to use the framework to develop their own blockchain, but it also means that anyone can develop and request messages. Additionally, OP Stack allows developers to easily abstract different components of the blockchain and insert different modules to modify it.

In simpler terms, if you want to replace your fraud proof with validity proof, or want to replace the data availability layer with something else, OP Stack allows it. This raises the question: when diffusion becomes division, when the OP Stack modules no longer form a system, and OP becomes a tool for launching chains at the base level, how should the security between different chains be managed?

4) Cross-chain Coordination:

As Polkadot founder Gavin Wood said, shared chains/bridges as communication are essentially fragmented. Although chains can communicate with each other, it is essentially a single chain + bridge model. However, Polkadot conveys communication between parallel chains through relay chains. Applied to Layer 2 Stacks, OP, ZK, and Polygon all use shared cross-chain bridges.

So, how can seamless communication and interaction between chains be achieved? Although the current communication framework of Layer 2 Stacks has some drawbacks, is it also an opportunity for some cross-chain protocols, or even for the development of public chains? Here, we list several possibilities:

Public chains lacking growth drivers: For example, Celo and Pontem, whose market value is only 1/10 compared to the current EVM L2, and have low ecosystem activity. If their ecosystems can be integrated into Stack, relying on the underlying super financial chain ETH and rich parallel superchains, it will undoubtedly bring them a new opportunity for growth, whether it's ecosystem cooperation or interaction needs between Dapps. Some public chains have already started deploying:

Celo initiated a vote in July this year, and the proposal to transition from the original EVM L1 to the OP Stack solution L2 has been approved.

Pontem Network plans to develop a new Move VM L2 using OP Stack.

DApps with high cohesion and low external coupling: For example, derivative exchanges, GameFi, Socialfi, etc., with complex and diverse internal transaction types and high frequency, but with less dependence on external assets or projects. For these applications with low cross-chain requirements but high internal transaction processing efficiency, Stack may be the best development platform for them.

Cross-chain protocols: For example, the recently popular Owlto Finance, a DeFi protocol for cross-chain interaction on L2 Rollups public chains, currently supporting all ETH Layer 2 chain interoperability. Additionally, there is Socket Protocol (more well-known for its Bungee), dedicated to developing cross-chain protocol Stack. If it can be deployed on OP Stack, it will undoubtedly play a crucial role in asset and information communication between superchains.

2. Ecosystem Incentives

In addition to attracting developer and user support through technology, Layer 2 can quickly build its ecosystem through direct incentives. Taking Optimism & Polygon as examples, let's see how Layer 2 might use various methods to build its ecosystem.

OP Grants: A continuous developer incentive program for Optimism, providing funding to developers to guide them in building Dapps and tools on Optimism, with over $30M invested.

RetroPGF (Retroactive Public Goods Funding):

In March 2023, RetroPGF Round 2 provided $10 million in $OP to incentivize ecosystem projects. It mainly targeted projects/developers in the categories of Tool, Infrastructure, and Education, with a total of 195 projects/developers receiving rewards.

In June 2023, RetroPGF Round 3 provided $30 million in $OP to incentivize contributors to OP Stack, Collective Governance, Developer Ecosystem, End User Experience & Adoption, and more.

OP Warriors Season: Users can earn NFT rewards by participating in community activities (ecosystem projects).

Bridging Summer: On August 3, 2023, OP officially sponsored the Socket cross-chain protocol with 400,000 $OP. Any project participating in cross-chain activities during Bridging Summer will receive a certain amount of $OP. For example, if you conduct a cross-chain transfer worth $100U from Polygon to OP and need to pay a fee of $2.5, you will receive $2.25 worth of $OP, and you can claim it monthly.

It can be seen that Optimism has been continuously launching various activities to enrich the ecosystem and attract more users. Furthermore, OP already has a mature incentive mechanism. In the early Grant rounds, many projects disappeared after receiving sponsorship, failing to fulfill their promises to develop in the OP ecosystem. OP has learned from these experiences and gradually improved the rules in the recent Grant rounds to ensure maximum utilization.

OP's governance mechanism is becoming more refined, and the incentive projects are becoming more diverse. These can be applied to future Stack development, replacing Dapps with superchain L2.

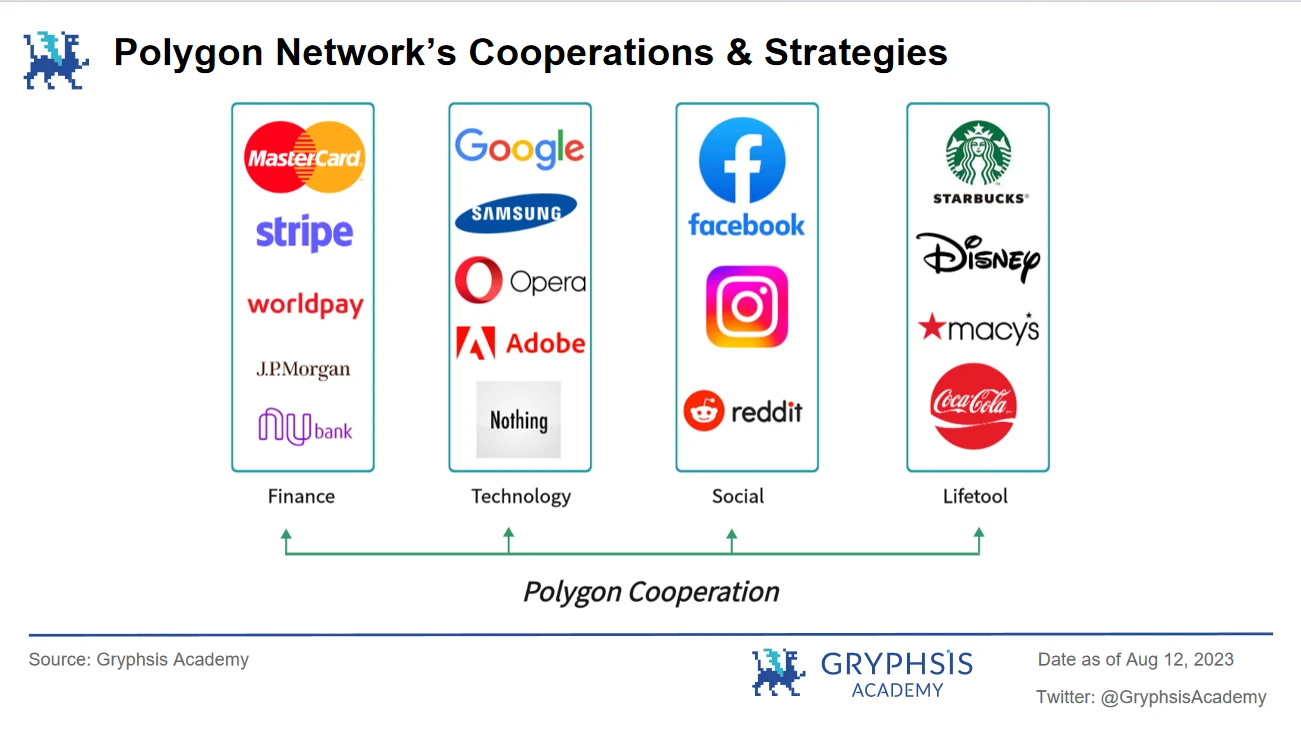

In addition, Polygon's approach to ecosystem development through business partnerships is also noteworthy:

Government: Collaborating with India to issue "caste" certificates on Polygon to prevent vulnerable groups from making fraudulent claims for government welfare; collaborating with Singapore to facilitate cross-trading of digital rupees and dollars using Polygon and Aave.

Finance: Partnering with payment giant MasterCard to launch the MasterCard Artist Accelerator, helping music artists learn how to expand their brand through minting NFTs and building online communities; WorldPay (a payment giant), a subsidiary of the FIS Group, added support for Polygon USDC.

Technology: Collaborating with software giants like Adobe and PS developers to integrate NFTs into their social platform Behance; Google's BigQuery, a big data analytics service, added support for Polygon blockchain data; Samsung issued NFTs wearable in the metaverse platform Decentraland through Polygon.

Social: Meta's Facebook and Instagram plan to develop an NFT marketplace based on Polygon and integrate it into both platforms, allowing users to create and sell their NFTs; Reddit launched NFT series "Collectible Avatars" on Polygon.

Lifestyle: Starbucks launched the loyalty program "Odyssey" on the Polygon network; selected as one of the 6 companies in the "2022 Disney Accelerator Program"; collaborated with Coca-Cola artists to release 136 NFTs to pay tribute to the brand's 136-year history.

Gaming, music, entertainment, fashion & beauty, sports, automotive, celebrities, and more.

This business approach can also be applied to its Polygon 2.0 solution. By adapting its superchain network to enterprises and inviting traditional business institutions to deploy, it can bridge the gap between blockchain and the business world. These partnerships can bring more high-quality projects to Polygon 2.0, drive its ecosystem development, and create a positive feedback loop.

Overall, the collaboration between Polygon and traditional Web2 industry giants is likely to become the preferred blockchain network for Web2 users and global enterprises in the next 10 years. If these resources can be effectively utilized, it is likely to be a potential project for the future Polygon 2.0 superchain network.

3. Token Empowerment

When launching the Stack solution, how should the economic model be designed to enhance the value empowerment of the native token? Compared to L2 Stacks, CP's token empowerment does not have as many obstacles.

For example, in Cosmos, although in the initial version, each chain has its own ecosystem and token, $ATOM is difficult to utilize. However, at the Cosmos 2.0 conference, the team decided to use $ATOM as the gas fee standard for the Hub, allowing custom chains to share security with the Hub. In Polkadot, the current $DOT supports network governance, the treasury, and slot auctions. In the upcoming 2.0 version, the original auction will be transformed into the Coretime market.

This is also the biggest difference with CP, because ZK and OP are both Ethereum's L2, and their inherent value is to solve the scalability problem of L1. All transactions need to be verified by smart contracts deployed on L1, and confirmed assets are considered real money, which is why users trust L2, and therefore Gas is ETH.

In other words, L2 is an accessory to L1, not only helping L1 achieve scalability, but also enhancing the credit and value of L1 tokens with each transaction processed, and L2 can never truly detach from L1. This is why, under the vision of superchains, how to achieve token distribution in L2 is particularly important.

Although there is currently no detailed solution, the aforementioned EVM L2 also does not specify how the native token of the chain will gain empowerment from the superchain network. However, the following points can be considered in designing the economic model:

Governance of the L2 network (reference to Polkadot):

Although using ETH as the underlying token base for the ecosystem is inevitable, the acceptance of the native token at the network governance level is relatively high for L2.

To participate in the Stack ecosystem, the superchain must hold a certain amount of native tokens.

Token holders can participate in network governance, voting, parameter adjustments, and other governance activities to empower the token.

Establishment of a governance center/treasury: As the governance body of the ecosystem, it maintains L2 autonomy while conducting unified value management.

In this way, both developers and users can fully participate in the ecosystem, enhancing their sense of belonging and participation. For L2, it also increases the token's use cases and more efficiently mobilizes network participants.

Fee allocation for superchains (reference to Cosmos):

When building a cross-chain network in Layer 2, it can learn from Cosmos' practice of using native tokens to participate in cross-chain fee allocation. Although running smart contracts on Layer 2 still requires using ETH to pay gas fees, for the fees generated by cross-chain interoperability between superchains, it can consider using the native token of L2 for payment.

For example, in Cosmos, $ATOM is used to pay IBC cross-chain fees, and it also rewards cross-chain validators participating in verification. Extending this to L2 Stacks, when assets are transferred across superchains, a certain cross-chain fee can be set, which must be paid using the native token. Additionally, a portion of the cross-chain revenue can be allocated to token stakers. Furthermore, the development and verification of cross-chain functional modules can also be incentivized using the native token.

This approach maintains the core role of ETH in the Ethereum ecosystem while allowing the $OP token to fulfill governance and value transfer functions in the cross-chain network. If designed properly, it can create a positive incentive mechanism to promote the development of the Optimism cross-chain network.

Rent collection model (reference to Ethereum):

On August 25th, Base introduced an economic cooperation agreement with OP: Base will provide OP with two revenue models, 2.5% of sequencer revenue or 15% of profits (whichever is higher); in return, OP will provide Base with 2.75% of $OP.

The release of this plan immediately sparked widespread discussion. Based on the issuance and price of $OP, it is estimated that the total value of OP given to Base is approximately $177 million, and based on the valuation of the Base chain, the inferred 15% profit is approximately $1.1 billion, equivalent to OP holding a 15% stake in Base. Furthermore, even if the 2.5% sequencer fee is used, it can essentially be understood as OP collecting rent.

In the past Ethereum network, as a foundational chain for business-to-business interactions, outsourced interactions to L2, and a portion of the fees generated on L2 were allocated to L2 as execution fees, with the remaining portion going to L1 for secure settlement, serving as a source of income for Ethereum. Therefore, the actions of OP and Base can be seen as pioneering an alternative rent collection model for L2.

While the possibility of using L2 native tokens as the gas unit for superchains is unlikely, as ETH is ultimately the consensus token, if L2 is viewed as a contractor for Stack, responsible for network construction, introducing investment, and helping to build the ecosystem, and the superchain's role is to deliver a portion of the profits, this profit model is indeed very attractive, especially for a super L2 like OP backed by resources.

Mutual empowerment with project parties:

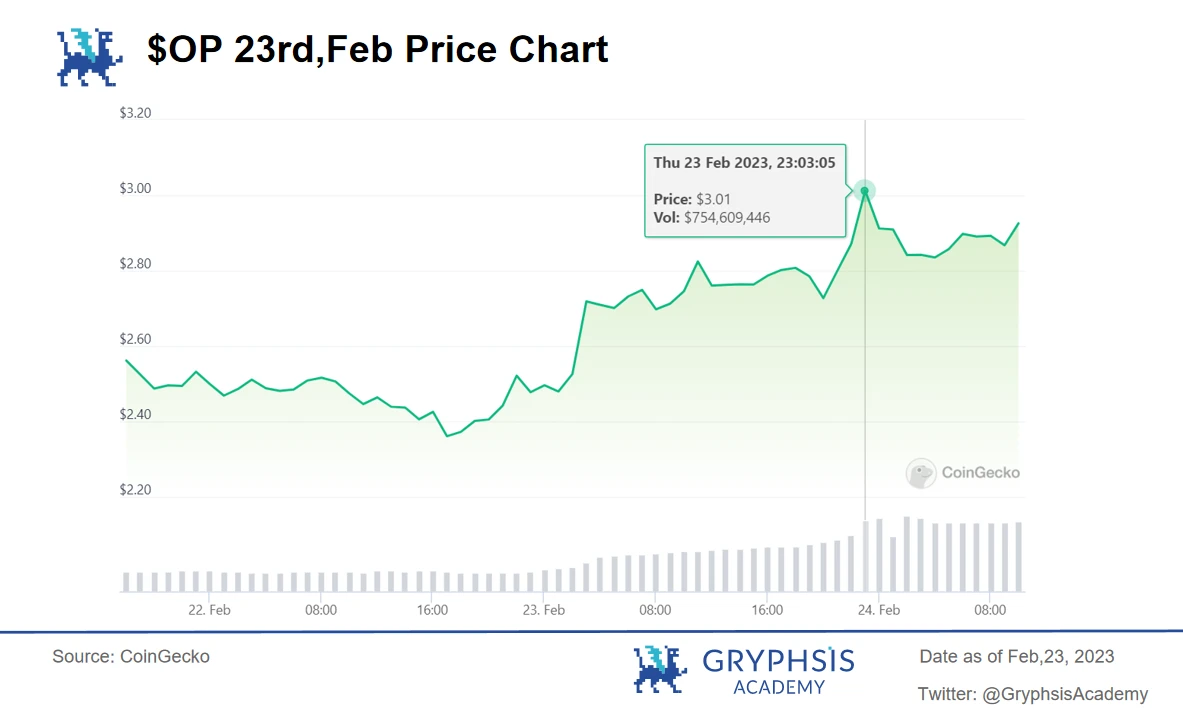

Taking OP Stack as an example, currently opBNB, ZORA, Base, Mantle, Worldcoin, and Debank have successively joined OP Stack, and their impact on the price of OP is significant. However, due to time constraints, it is not possible to visually observe the daily growth trend. Therefore, we temporarily select the price change of $OP announced on the deployment day by Base:

It can be seen that on February 23rd, the price of $OP briefly rose to $3.01. This was likely due to Base announcing a collaboration NFT on the OP mainnet around 10:30 PM, followed by a rapid price surge to the highest value around 11 PM, and then a subsequent decline.

Since Binance announced the concept of opBNB, and with the addition of high-quality projects such as Base Protocol, ZORA, Mantle, and Debank to OP Stack, it is undeniable that these projects have brought OP a significant level of visibility and prestige, attracting more project parties to take an interest in OP Stack.

Therefore, it is a very reasonable choice for project parties to purchase and hold $OP tokens when deciding to deploy on OP Stack, not only to participate in the ecosystem but also as a form of value investment.

$OP will definitely have a role in the future superchain ecosystem, and holding $OP can give project parties more rights in the future. In addition, because project parties and OP are essentially a community of shared interests, as more projects are deployed on OP Stack, the increase in the value of $OP tokens will directly benefit project parties. Furthermore, OP Stack will actively support/promote project parties for ecosystem development, bringing positive exposure and growth to project parties. This win-win situation will encourage more projects to join, creating a positive cycle. In this regard, OP seems to have set a good example.

III. Conclusion

With this, the CP V.S. Layer 2 Stacks series of articles comes to an end, and the entire series will be summarized next.

The competition between CP and Layer 2 superchain networks is fundamentally about improving the infrastructure of blockchain. For a blockchain team, implementing all network and consensus code, including security, cryptography, etc., requires a lot of effort, not to mention optimizing their own business logic.

If a completely open-source code framework appears at this time, preparing the network, consensus, communication, and other elements for you, and you only need to deploy your business logic, it greatly realizes the division of labor in the network and supports interoperability, paving the way for the prosperity of the entire ecosystem.

However, at present, CP's technology is more mature compared to Layer 2, but the ecosystem community of L2 is more prosperous. However, if L2s are to further develop superchain networks, they should focus on addressing the technical risks of the chain.

In addition, there is an interesting phenomenon, which is that the Ethereum Foundation's definition of L2 is very vague. The Ethereum official website also states that there is currently no officially certified L2. We can anticipate the impact of Ethereum's attitude towards L2. From the perspective of L1, it is certainly hoped that only the "execution" will be outsourced to L2, while it enjoys the "rent". The definition of L2 must certainly align with its own interests.

If one day, L2 superchain networks abandon ETH and use their own tokens to build gateways, what action will Ethereum take?

However, whether it is a multi-chain ecosystem like CP, which spans L0-L1, or Layer 2 Stacks, which brings L2-L3 multi-chain ecosystems, each has its own unique advantages and use cases. Apart from the possibility of gradually fading due to operational issues, these different multi-chain solutions are more likely to survive and ultimately achieve a fully connected ecosystem for different public chains and multi-chain ecosystems through different connection methods. As for who can capture more market share in this fully connected future, it depends on how each project operates.

References:

https://medium.com/@eternal1997L

https://tokeneconomy.co/the-state-of-crypto-interoperability-explained-in-pictures-654cfe4cc167

https://research.web3.foundation/Polkadot/overview

https://foresightnews.pro/article/detail/16271

https://messari.io/report/ibc-outside-of-cosmos-the-transport-layer?referrer=all-research

https://stack.optimism.io/docs/understand/explainer/#glossary

https://www.techflowpost.com/article/detail_12231.html

https://gov.optimism.io/t/retroactive-delegate-rewards-season-3/5871

https://wiki.polygon.technology/docs/supernets/get-started/what-are-supernets/

https://polygon.technology/blog/introducing-polygon-2-0-the-value-layer-of-the-internet

https://era.zksync.io/docs/reference/concepts/hyperscaling.html#what-are-hyperchains

https://medium.com/offchainlabs

Disclaimer: This report is an original work completed by @sldhdhs3, a student at @GryphsisAcademy, under the guidance of @Zou_Block and @artoriatech. The author is solely responsible for all content, which may not necessarily reflect the views of Gryphsis Academy or the organization commissioning the report. Editorial content and decisions are not influenced by readers. Please be aware that the author may own the cryptocurrencies mentioned in this report. This document is for informational purposes only and should not be considered as a basis for investment decisions. It is strongly recommended that you conduct your own research and consult with an independent financial, tax, or legal advisor before making investment decisions. Please remember that past performance of any asset is not indicative of future returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。