Tracking real-time hotspots in the currency circle, seizing the best trading opportunities. Today is Saturday, September 23, 2023. Welcome to follow Yibo's coin talk. I am Yibo! We do not predict trades. In fact, we observe market fluctuations (narrowing, diffusion), structure (market batch structure), emotions (external market stocks, the US dollar, etc.). As a trader, you (through trading) affect prices, and prices also affect your emotions and behavior.

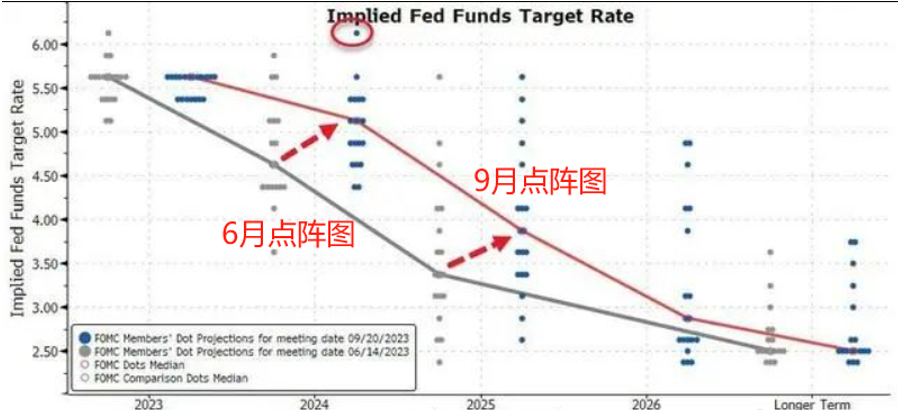

The dot matrix chart shows that there were originally four interest rate cuts in 2024, which has been reduced to two. The Fed will indeed cherish the temporary relief brought by high interest rates. From the perspective of knowing that future interest rate cuts will put the US dollar in a passive position, it is highly probable that Chairman Powell will not dare to paint such a vague and elusive picture for the market before achieving the goal of fighting inflation. This interest rate decision is very hawkish. There is still one more interest rate hike opportunity this year. Before the end of the interest rate hike cycle, more data will be based on the existence of "good for the good" which leads to the end of the rebound and the start of the retracement. From a technical perspective, the daily trend is bearish. Plan your trades, trade your plans. It is still a volatile trend now, and the rebound pressure position is blocked, making it difficult to push higher. There is no real trend appearing, so operations should be based on pressure support positions and reverse operations.

September 23rd ETH morning trading plan:

Review: Yesterday's price basically remained around 1590 for the whole day. The rebound on the 4-hour chart is still under pressure at the middle track. The previous rebound was also pressured twice by the middle track before falling back. However, the lack of continuity in the fall has temporarily led to a shakeout. The weekend is likely to maintain a range-bound shakeout. The lack of breakthrough momentum in the shakeout trend and insufficient one-way volume will lead to repeated plate washing. Continue to focus on the gains and losses of the middle track to determine the short-term direction. The one-hour trend structure can also be seen. The Bollinger Bands are still in a contracted state, without a clear pattern. The K-line is oscillating around the middle track. After a wave of decline, the overall trend has entered a state of repair. There will be no significant fluctuations in the short-term shakeout trend, but opportunities can be found in small shakeouts.

Trading suggestion: Short at 1595-1615, target 1550-1530, risk control at 1650!

September 23rd BTC morning trading plan:

Review: The market trend yesterday remained weak, always in a range-bound shakeout trend. The highest reached 26740, and the lowest came to around 26470. Currently, the price is running around 26500. From the overall market trend, after the downward trend, the shakeout continues. The impact of the interest rate hike on the market should not be so weak, so the current shakeout is a new accumulation of downward momentum, and the decline will continue. The hourly chart has contracted to the extreme, indicating that the market is not far from breaking. The expected cyclical structure of the daily trend is very strong, with pressure at the high level, and the market is gradually falling back. From a technical indicator perspective, the Bollinger Bands are running in a parallel state, the K-line is forming consecutive declines, the short positions are gradually increasing in volume, and the moving average shows signs of turning with the price. In summary, there is still room for a decline in the market, and the downside space is relatively large. Therefore, the downward momentum will definitely be greater than the rebound. Looking at the 4-hour trend, the downward trend has formed, and the market has not provided an effective rebound in the short term. Therefore, the future operation will continue to maintain the same bearish mindset.

Trading suggestion: Short at 26600-26800, target 26200-25800, risk control at 27200!

If you are still in a state of confusion, don't understand the technology, can't read the market, don't know when to enter, don't know how to stop loss, don't know when to take profit, randomly add positions, get trapped at the bottom, can't hold onto profits, and can't catch the market when it comes. These are common problems for retail investors. However, it doesn't matter. Come to me, and I will guide you in the correct way of trading. A single profitable trade is worth more than a thousand words. Instead of frequent operations, it's better to be precise. Let every trade be valuable. What you need to do is find me, and what we need to do is prove that our words are not empty. 24-hour real-time guidance. The market fluctuates quickly. Due to the impact of timeliness on review, for the subsequent market trends, real-time layout based on actual trading is the main focus. Coin friends who need contract guidance can scan the QR code at the bottom of the article to add my public account

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。