"Weekly Editor's Picks" is a "functional" section of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, the Planet Daily also publishes many high-quality in-depth analysis content, which may be hidden in the information flow and hot news, passing by you.

Therefore, our editorial department will select some high-quality articles worth reading and collecting from the content published in the past 7 days every Saturday, bringing new inspiration to you in the encrypted world from the perspectives of data analysis, industry judgment, and opinion output.

Now, let's read together:

Investment and Entrepreneurship

Adjusting assumptions and risk models; interpreting is better than speed; detailed documentation is crucial; balance between long and short; hiring people passionate about the industry; everyone wears multiple hats; trading operations are the most important department; the situation for sellers is getting better; the investor community is becoming smarter.

DeFi

RWA in the Eyes of the Federal Reserve: Tokenization and Financial Stability

As of May 2023, the size of the tokenized market on permissionless blockchains is $2.15 billion.

Tokenization can bring many benefits, including allowing investors to enter markets that were previously inaccessible due to high investment thresholds. The programmability of tokens and the ability to embed additional functionality through smart contracts may also be beneficial to the underlying asset market. Tokenization may also promote lending by using tokens as collateral and improve the liquidity of the underlying asset market.

The size of the tokenized market below one billion dollars is relatively small compared to the overall size of the cryptocurrency market or traditional financial markets, and does not pose a systemic financial stability issue. However, if the tokenized market continues to grow in terms of quantity and scale, it may pose financial stability risks to the cryptocurrency market and the traditional financial system. In the long run, the redemption mechanism established in tokenization between the cryptocurrency asset ecosystem and the traditional financial system may have potential implications for financial stability. In addition, due to the lack of liquidity in the underlying assets, tokenized assets may face problems. Another financial stability risk is the issuer of tokenized assets themselves. Tokenization may package high-risk or illiquid underlying assets into safe and easily tradable assets, which may bring higher leverage and risk. Once the risk is exposed, these assets will trigger systemic events.

In-depth Research Report on Frax Finance: A New Chapter in the Stablecoin Race

Frax Finance is a DeFi protocol that provides three stablecoins and collateral derivatives (FRAX, FPI, frxETH) for earning yield, providing liquidity, and collateralizing in DeFi. The protocol uses innovative sub-protocols and native governance tokens (FXS, FPIS) to ensure price stability and user governance. It is a major participant in the global cryptocurrency market, with over $800 million in locked value.

Fraxswap is the first constant product automated market maker with a built-in time-weighted average market maker (TWAMM); Fraxlend is a lending platform that allows anyone to create a market between a pair of ERC-20 tokens; Fraxferry is a permissionless, non-custodial, and secure cross-chain bridge. In June of this year, Frax Finance announced plans to launch its second-layer scaling solution, Fraxchain, by the end of the year.

Frax Finance has built a significant user base and business presence. It is no longer just a single currency protocol. Instead, it is forming a DeFi ecosystem centered around the stablecoin FRAX, with support for key features such as LSD (frxETH), expanding its coverage to elements such as DEX (FRAXSwap) and lending (FRAXLend). The core advantage of Frax Finance lies in its comprehensive narrative of LSD and stablecoins. Frax Finance is collaborating with Curve to tap into liquidity release opportunities in the tens of billions of dollars LSD market, which has broad prospects. In addition to leveraging increased LSD profits, it is also possible to shape a new stablecoin landscape by utilizing crvUSD and the native stablecoin FRAX.

Detailed Explanation of Uniswap v4 "Truncated Oracle": Concept, Operation Mechanism, and Role

The truncated oracle is an on-chain price oracle that uses a geometric mean formula to record the price of assets in the Uniswap liquidity pool, and then truncates the feed price of the oracle—meaning that within a single block, the recorded price can only move up or down to a maximum value.

This truncation helps eliminate the long-term impact of large trades on prices—whether these large trades are legitimate or malicious—because if a malicious actor tries to manipulate the price, they must continue to manipulate it over multiple blocks, making the cost of manipulating the truncated oracle very high. By measuring the degree of extreme price fluctuations that can be recorded through truncation, the oracle can ignore outliers and eliminate the impact of large trades on prices, making it more secure.

Currently, Uniswap v4 and the truncated oracle Hook are still under development, and the final specifications may change.

GameFi

Folius Ventures: The Journey to Find the North Star of Web3 Games

For many game developers limited by edition numbers and user acquisition costs, Web3 is a good choice.

As an industry with incomplete infrastructure but extremely high profitability, multi-talented teams can reap the greatest benefits, but teams without multi-talented capabilities will face even greater challenges and higher error rates. There is a huge gap between mid-tier and top-tier developers, and most developers may not even meet the threshold for rolling, requiring teams to have strong evolutionary capabilities and iteration speed. There is constant innovation in business models. The more liquidity is depleted, the more it requires innovation. Web3 business models change with market hotspots/new asset forms, and teams need to innovate with a full understanding of the market and economic models. The drainage potential of L1/2 and platforms is gradually declining, and super ecosystems and traffic entry points that surpass a single L1/2 are rising and expecting to compete in the next cycle. Project teams need to quickly choose a good path or actively open up new paths for UA.

Web3 game teams also have the following directions worth exploring:

Ethereum and Scalability

One Year After the Ethereum Merge, What Changes Have Occurred in the MEV Supply Chain?

As the MEV supply chain evolves into a complex supply network, tracking the entire stack of order flow lifecycles becomes challenging. Although MEV-Boost's open relay data API helps understand the final steps of on-chain settlement, tracking the initial entry point of orders remains elusive.

Flashbots is still committed to providing transparency in the MEV ecosystem and providing research data for contributors and collaborators. The transition of Ethereum to proof of stake, coupled with the rise of MEV-Boost, fundamentally reshapes the dynamics of the transaction supply chain. While this achievement is significant and worth celebrating, the centralized power of MEV will continue to pose inherent challenges to the neutrality and decentralization of blockchain.

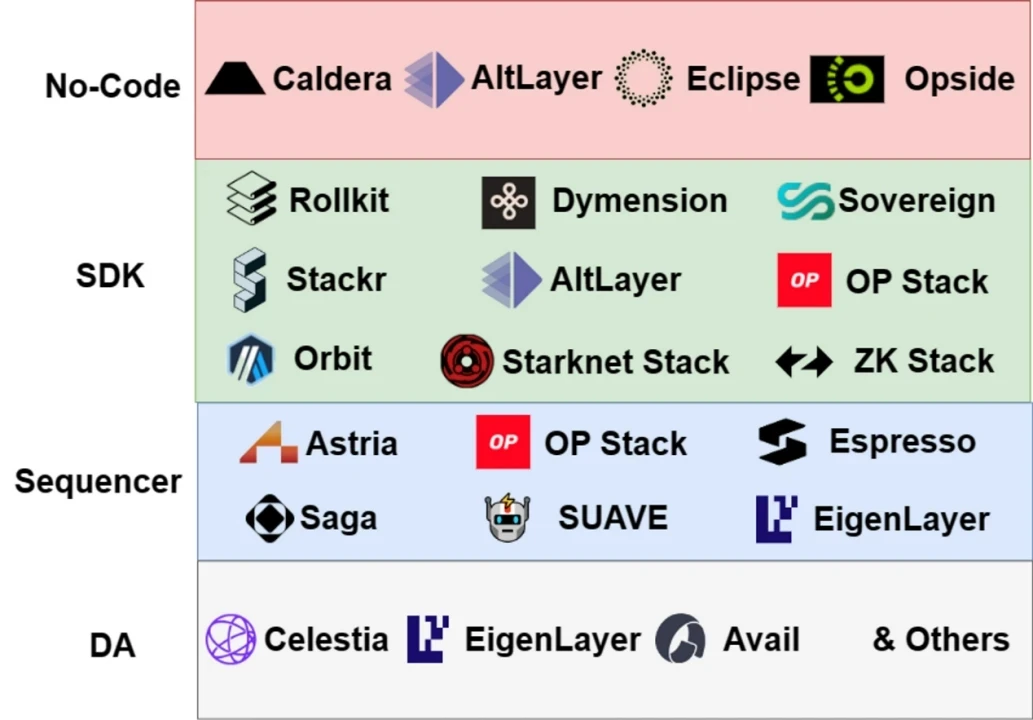

Rollup Summer Coming? A Detailed Discussion on the Overview, Ecosystem, and Future Prospects of RaaS

RaaS brings cheaper, more efficient, and equally secure application chains and higher interoperability, and is also an experimental ground for innovative ideas.

The future of RaaS will involve more zk, non-Ethereum, modularity, customization, interoperability, and multiple staking.

Detailed Explanation of Draft ERC-7521: Adding User Intent to Account Abstract Wallets

The key to enabling general intent is to use smart contract-based abstract accounts. Similar to ERC-4337, the intent is signed as a message and then verified on-chain through a separate transaction. These signed messages are then propagated in their own memory pool.

The goal of this specification is not the technical details of how intent is precisely handled, constructed, or managed off-chain, but to create a framework for smart contract wallets to integrate and automatically support the broad possibilities defined by signed intent itself.

The EntryPoint contract in ERC-4337 is mimicked but also split into two separate parts. The first part, called the entry point, is the primary entry point for submitting intent solutions, responsible for verifying intent signatures and running advanced intent processing logic. The specific content of the intent processing logic is defined in a separate contract called the intent standard, specified by the signed intent itself. The entry point calls these contracts to process an intent. It is the intent standard that defines how to handle additional intent data and execution, as well as the basic off-chain rules related to inherent denial-of-service attack vectors associated with the intent.

The focus of the specification is to define a basic framework for smart contract wallets to connect and unlock powerful intent expressions for users, even as the landscape continues to evolve. Defining intent as a collection of smaller intent segments provides a good user experience, reducing the number of times users need to sign. Intent segmentation and shared background data also help unlock powerful features without using a lot of gas. Intent can trust that all its segments will be processed in order without the need for manual checks.

OKX Ventures: Systematic Analysis of the Past, Present, and Future of Account Abstraction Track

EIP 4337 can be considered as the final draft solution for Ethereum AA without the need to modify the consensus layer.

Two routes for multi-chain account abstraction: 4337 compatible method and native account abstraction.

The combination of AA and MEV: AA, Sequencer, and intent essentially extend the chain of on-chain operations, making the chain that MEV needs to bribe longer. The Bundler and intent solve of AA may cooperate with roles in the MEV chain such as Searcher to form an MEV share.

Essentially, intent is not necessarily bound to AA. Intent is essentially an innovation at the user experience layer, a better and faster understanding and decomposition of user needs into one or more UserOperations; AA is backend optimization for better execution of user instructions. Telegram bot is a typical intent innovation, but the backend still uses EOA wallets, which does not affect the user experience.

Biconomy, Stackup, and Pimlico are currently more mature 4337 solutions. Continuing to improve SDKs and modular solutions will help capture the early market and achieve high market coverage of technical solutions. Stackup has implemented two types of Paymaster and Bundler modes, and in the future, a full-process solution plus multiple component libraries will be the way for such leading projects to further expand their advantages.

Future development of AA: In the short term, the focus is on expanding the market, while working with layer 2 to jointly promote the mode; in the medium term, the focus is on the landing of modular Bundler and Paymaster and the deployment of SDK, while optimizing the user experience in detail (such as reducing gas costs, adding optional EOA-to-ERC-4337 conversion, etc.); in the long term, mandatory conversion of EOA wallets should be considered.

Multi-Ecosystem

Solana DeFi Revival: Review of Q3 Progress and Q4 Outlook of Ecosystem Projects

In Q3, some notable events catalyzed the Solana ecosystem: MakerDAO hopes to use Solana's virtual machine (SVM), Maple Finance returns to Solana, EUROe stablecoin launches on Solana, and CNBC's evaluation of Solana surpasses BCH and LTC.

In Q4, there is a lot of activity in the derivatives and synthetic asset space (Zeta Markets, Drift, Cypher); some key innovations can further expand the use cases of LST (Marinade, JitoSOL, SolBlaze, Sanctum); lending is laying the foundation for further growth of Solana's DeFi ecosystem (MarginFi, Solend, Kamino Finance, Lifinity).

Weekly Hot Topics Recap

Over the past week, the JPEX case of unlicensed exchanges in Hong Kong continued to develop (special topic);

In addition, in terms of policy and macro markets, the U.S. House Financial Services Committee will approve an amendment to ban the application and testing of unauthorized CBDCs, the SEC requests court approval to inspect Binance.US, Gary Gensler will attend a House Financial Services Committee hearing on "Oversight of the SEC" next week, and the Japanese government will allow startups to raise funds in cryptocurrency;

In terms of opinions and voices, Coinbase report: Selling cryptocurrency holdings by FTX is unlikely to have a significant impact on the market, Matrixport: Bitcoin price may reach $37,000 by the end of the year, WSJ: Tether lends stablecoins again, less than a year after promising to reduce secured loans to zero, CZ responds to executive departures: Binance has added over 600 new employees during the same period.

Institutions, large companies, and major projects: Citi launches token service, allowing customer deposits to be converted into digital tokens for transfers, Aave community has voted to approve the proposal to "increase GHO borrowing rate to 2.5%", PolkaWorld: Suspended operations for half a month, Polkadot's new governance framework OpenGov is forcing ecosystem projects to leave, Tip Coin opens token TIP for application, friend.tech has launched the web version;

In the NFT and GameFi fields, Huang Licheng proposed to purchase Yuga assets such as BAYC with 11 million APE tokens and issue governance token DAM, and the proposal has been approved…… Well, it's been another eventful week.

Attached is the "Weekly Editor's Picks" series link.

Until next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。