Hello everyone, I am a cryptocurrency market strategy analyst (Crypto Big Orange), focusing on sharing the trends of mainstream currencies, not talking big, just seriously writing my own insights!

Big Orange Auntie Short-term Long Orders Executed for Profit

——Orange Talks Hot Topics——

First, let's talk about the general decline in the US stock and cryptocurrency markets last night. The main reason for this decline is the new high in US bond yields. US bond yields have always been known as the anchor for global asset pricing. I have mentioned in previous articles that the main reason for the current market weakness, especially the blood-sucking in the crypto market, is that US bond yields are too high. Even the crypto market is investing in US bonds through the RWA concept to generate returns. In this situation, it is very difficult for the cryptocurrency market to keep capital from flowing out, unless the crypto market also presents a super strong innovative concept race like the US stock market AI.

But in reality, in the bear market background, many so-called landing applications from the previous cycle are now almost non-existent, let alone new concepts. Capital no longer believes in these stories. Last night, the 30-year US bond yield reached its highest level since 2011, the 10-year yield reached its highest level since 2007, and the more interest rate-sensitive 2-year yield reached its highest level since 2006. The sharp rise in US bond yields was the most important reason for the general decline on Black Thursday last night, which led to a decline of over 1.5% in the three major US stock indexes, Bitcoin falling below 27,000, and Ethereum falling below 1,600.

Next, let's talk about the macro situation. Last night, central banks in many countries chose to follow the Federal Reserve and paused interest rate hikes, especially in the UK. There was a strong expectation of a 25 basis point rate hike before last night, so this pause in rate hikes was unexpected. In addition to the UK, both Switzerland and Japan chose to keep interest rates unchanged last night, while the central banks of Sweden and Norway each raised interest rates by 25 basis points on the same day.

Although some central banks raised interest rates while others did not, the statements made at the interest rate meetings were basically the same, that is, to leave open the possibility of future rate hikes. This can be seen as paying homage to the Federal Reserve. However, whether or not to raise interest rates does not have a particularly large impact on the market in this day and age, far less than the guidance and rhetoric about future expectations.

In addition, the US Department of Labor announced that the number of initial jobless claims unexpectedly decreased by 20,000 to 201,000 last week, reaching a new low since January, indicating a healthy labor market. This data continues to support the Federal Reserve's decision to raise interest rates.

Moving on to the savior of the cryptocurrency market, BlackRock. Although this news is not related to BlackRock's ETF, it is still relevant to the cryptocurrency market. According to the latest equity disclosure data from Futu, US asset management companies led by BlackRock have recently increased their holdings of BitDeer, a US-listed company under Bitmain. According to statistics, BlackRock, First Trust, and Credit Suisse Asset Management together hold over 160,000 shares of BitDeer, valued at over $2 million at the current BTD price. Moreover, these companies are continuing to increase their holdings, indicating that major US asset management companies are preparing to enter the cryptocurrency market.

——Orange Talks Market——

BTC: Bitcoin is still very fragile in the current market and has not yet emerged from this deep bearish period. It is difficult to keep moving forward confidently at this time. There will definitely be repeated fluctuations, adjustments, and psychological blows to retail investors. Even the old hands will eventually be defeated before turning upwards.

The 26,500 level is very important on the 4-hour chart at the moment. We need to see if it can hold this week. If not, we will continue to explore lower levels. Therefore, the current market is unpredictable. Without hotspots in the industry, and without the premise of incremental funds and users, we need to pay close attention to risks, especially for short-term players. For long-term value investors, however, this may present an opportunity.

Perpetual short-term recommendation: Short at 26,800-27,000, long at 26,200-26,000.

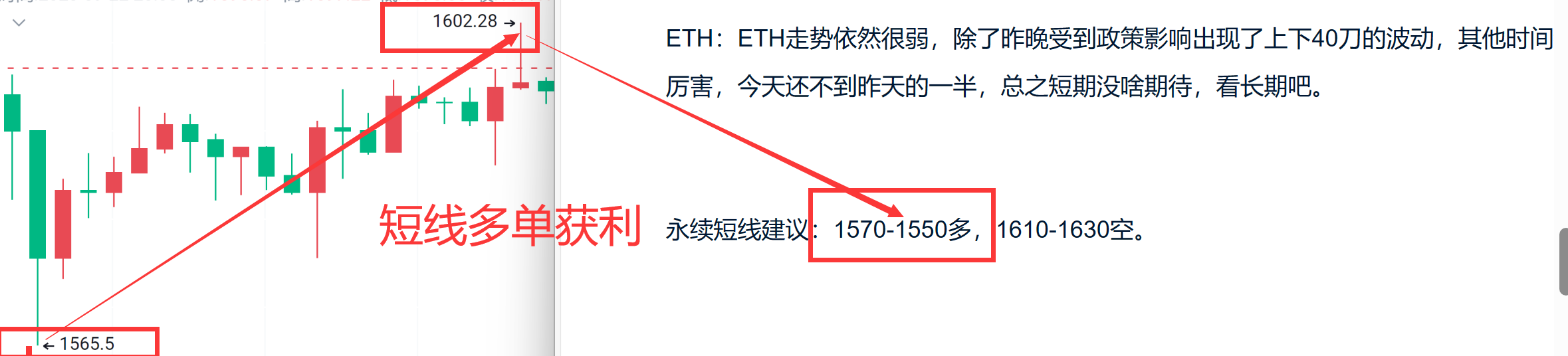

ETH: The recent trend of ETH is very weak, it can't even hold 1,600, and the trading volume has also increased. This situation is not particularly good because the volume decreased during the rise, but increased during the fall. This means that the decline is more about triggering stop-loss orders, while the rise is more about placing orders. The urgency is different. In addition, in recent days, there have been reports of ICO tokens being transferred to exchanges for sale, and even Vitalik Buterin has been selling coins, which has had a certain impact on investor confidence. In the short term, I am not optimistic about the trend of ETH, but in the long term, ETH has built a strong moat, coupled with the increasing staking rate, so the long-term trend is still positive.

Perpetual short-term recommendation: Short at 1,615-1,625, long at 1,570-1,550.

Risk warning and disclaimer: The market is risky, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account the specific investment goals, financial situation, or needs of individual readers. Readers should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investing based on this information is at your own risk.

————I am Crypto Big Orange. Friends who have questions about trading can learn and discuss together! Scan the QR code to follow the public account for inquiries about market trends and operations!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。