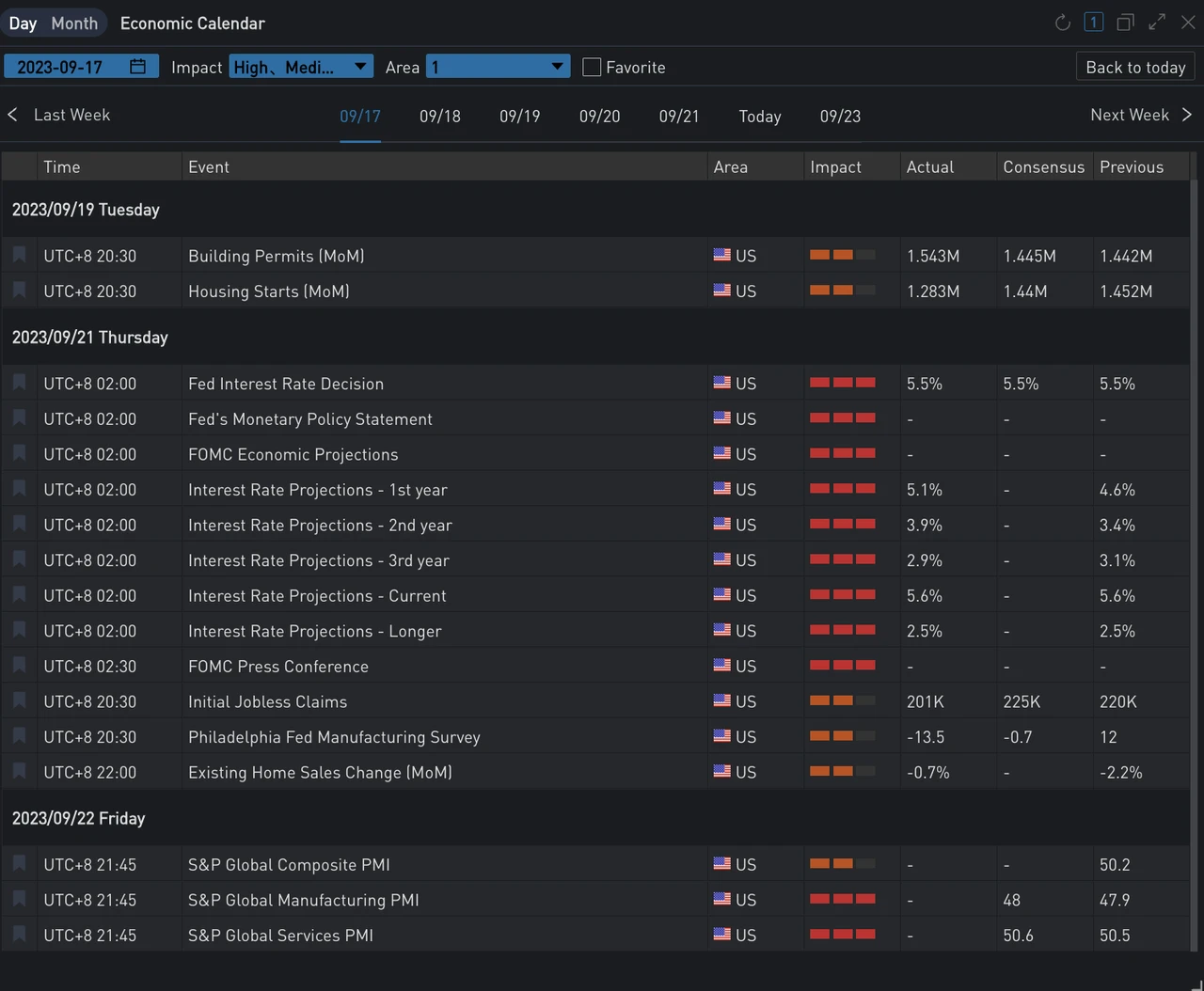

The U.S. interest rate market is still experiencing aftershocks from the "hawkish pause," and the lower-than-expected initial jobless claims data (201,000 people, expected 225,000 people) has made matters worse. The two-year U.S. bond yield has climbed to its highest level since 2006 at 5.18%, and the ten-year yield has also reached the 4.50% mark. As a result, all three major U.S. stock indexes opened and closed lower under pressure, with sectors such as consumer goods and real estate experiencing significant declines, leading to the third largest single-day drop of the year for the SPX (-1.6%).

Source: SignalPlus, Economic Calendar

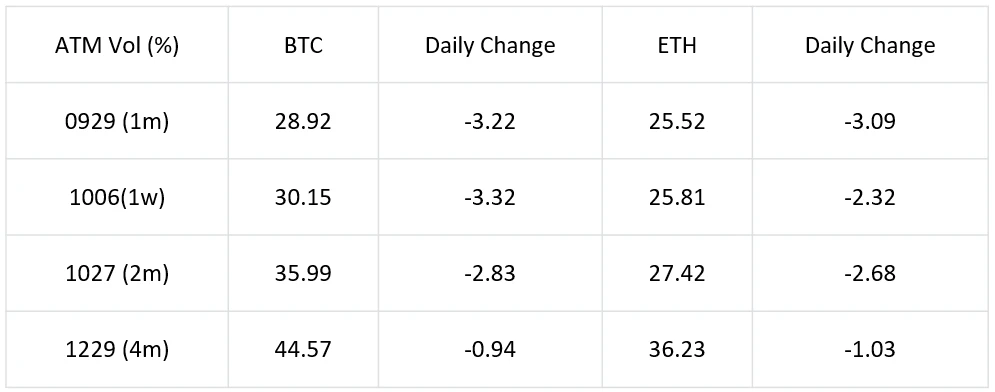

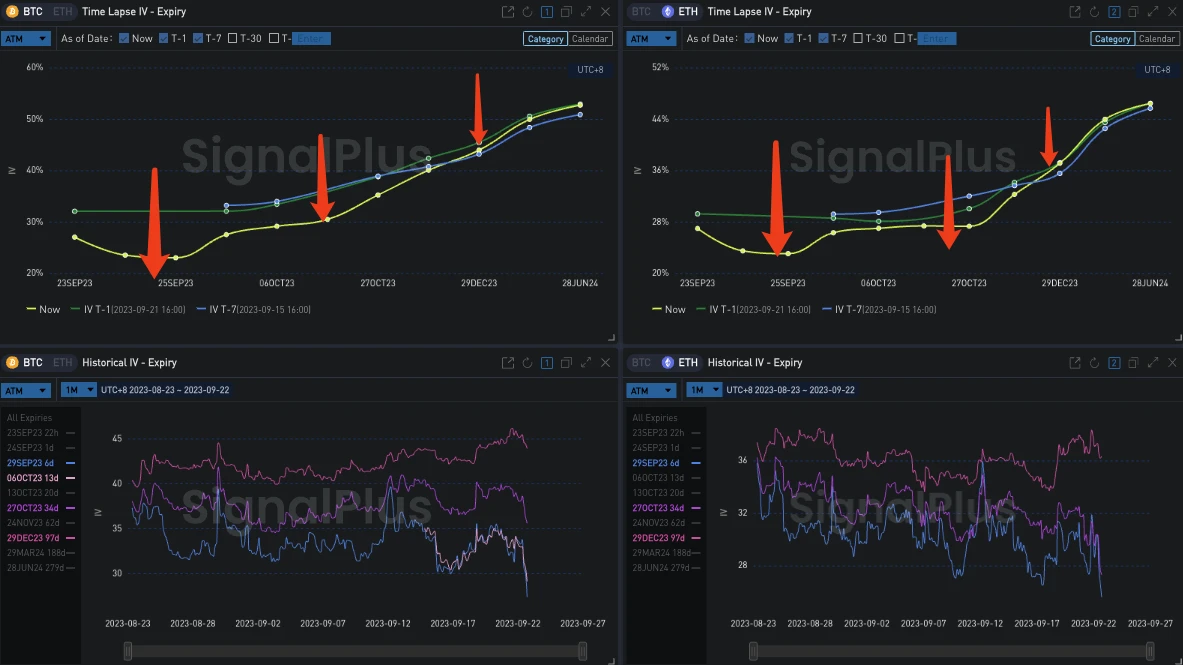

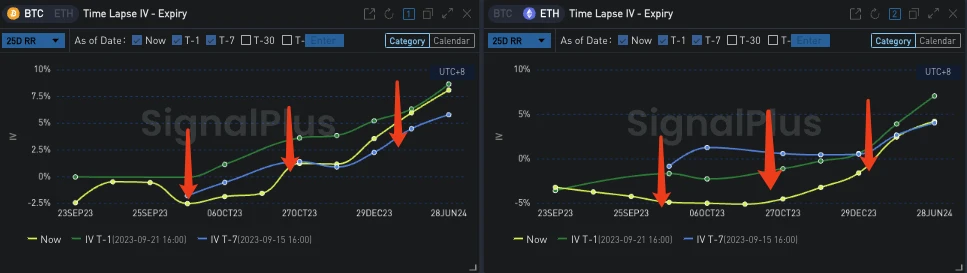

In the cryptocurrency market, after a wave of declines, BTC has slowly rebounded to above 26,500, and the overall implied volatility level has once again decreased by 2-3%Vol, with a steep slope in term IV. On the other hand, following the price drop, the BTC/ETH Skew has significantly fallen, and the medium-term 25dRR has once again entered the negative range.

Source: Binance & TradingView

Source: Deribit (as of 22 Sep 16:00 UTC+8)

Source: SignalPlus

Source: SignalPlus

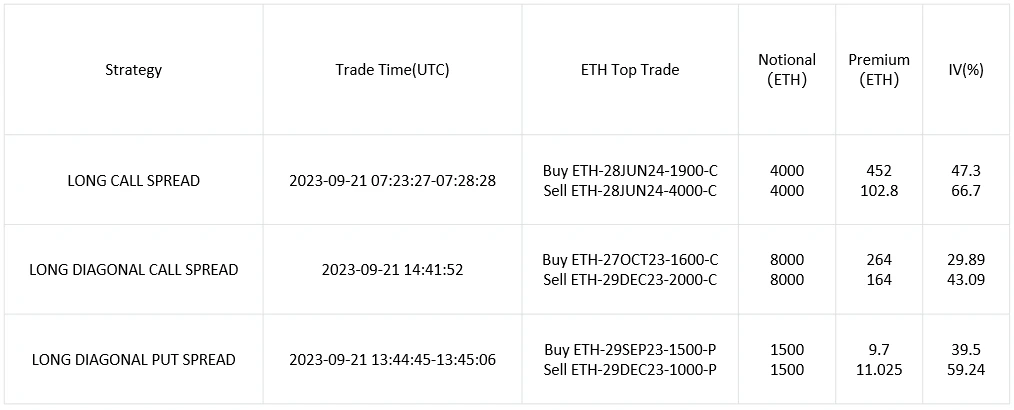

In the past 24 hours, bulk strategy trades have mainly focused on calendar spread strategies. In the case of BTC, recent Put/Call options have been sold, providing premium support for medium- to long-term bullish positions. As for ETH, the bullish spread 27OCT 1600C vs 29DEC 2000C, with a large quantity of 8000ETH per leg, has become the focus. In addition, the triangle spread strategy represented by 29SEP 1500P vs 29DEC 1000P has also received favor from traders, providing protection for the downward pressure on Ether prices under high interest rates.

Source: Deribit Block Trade

Source: Deribit Block Trade

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。