Original Author: Benson Sun, former FTX Taiwan Community Partner (Twitter: @BensonTWN)

Lately, when helping everyone submit claims, I have been frequently asked one question: Will FTX actually lose money? And if they do, how much will they lose?

The most objective way is to look at the price of secondary market claims.

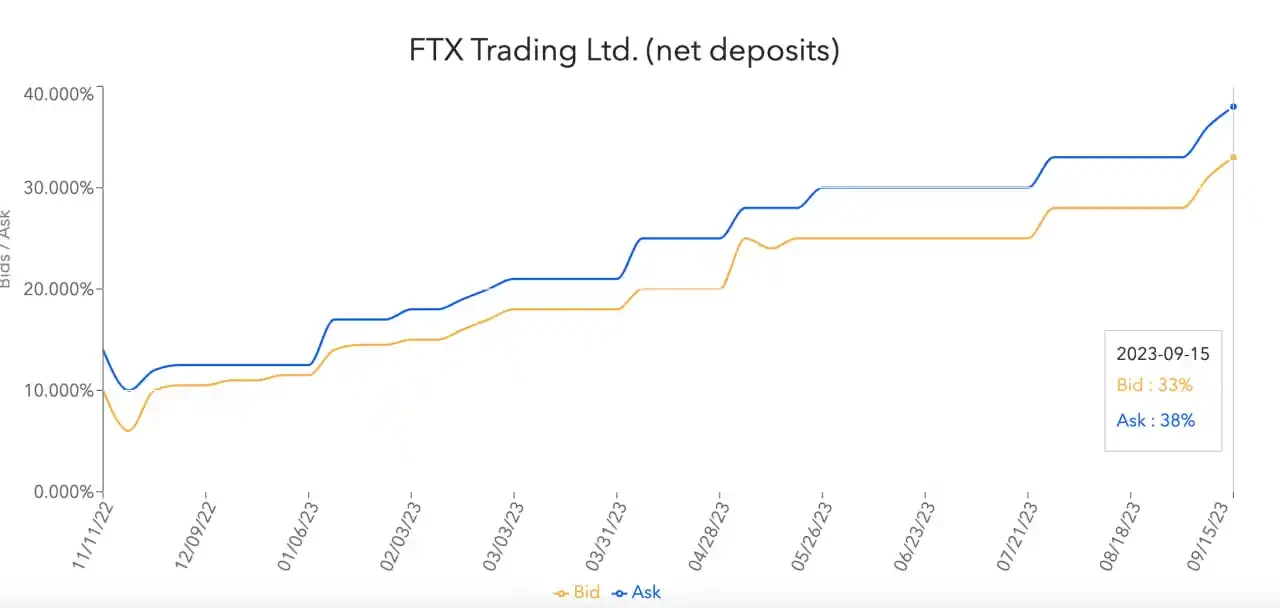

On the claim market, the acquisition price of FTX claims (net deposit) has risen to around 35%, and it shows a trend of gradually increasing each month.

I asked a claim buyer how they priced the claims, and they indicated that for FTX cases, they expect to double their return within 5 years. In other words, the current consensus among claim buyers is that the recovery rate within 5 years will exceed 70%, and that's why they are willing to buy claims at 35% of the price.

PS: Note that this refers to the net deposit account, and prices for other accounts will be different, which will be detailed later.

FTX has now recovered assets worth a total of $7 billion, compared to the $12 billion claim size, resulting in a recovery ratio of around 60%-70%, which is consistent with this figure. Of course, the buyers in the secondary market for claims also base their bids on market conditions, and these conditions will change over time.

The changing factors include:

- Whether FTX can recover more clawback from executives, donors, and politicians

- Whether the claim size has changed (for example, if there are blacklisted accounts unable to submit claims due to identity issues, thereby reducing the claim size, or if suddenly a government fine increases the claim size)

- How long John Ray's proposed restructuring plan will take

- How high the bids from FTX bidders are

- The price of asset liquidation

It is also important to note that the status of the claim itself will also affect the final amount/sequence of the claim, which is also reflected in the secondary market price of the claim.

The changing factors include:

- Whether there are locked tokens (such as locked FTT, locked SRM, etc.)

- Whether the account was net deposited (net deposit) or net withdrawn (net withdraw) in the 90 days before 11/11/2022

- Whether there are funds in FTX earn (the account with 5-8% interest)

- Whether there are lent assets

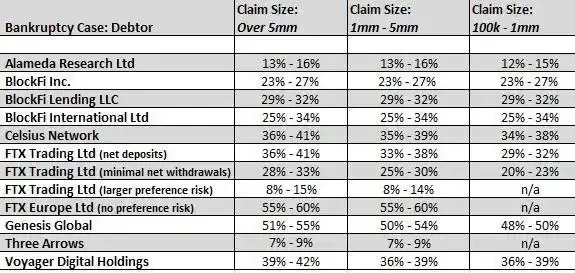

So we can see that in the FTX trading claims in the following figure, they are divided into three categories:

The acquisition prices from high to low are:

Net deposit: Net deposit within 90 days, with no clawback risk Minimum net withdraw: Net withdrawal within 90 days, with clawback risk Larger preference risk: Other factors that may affect the claim sequence

You can log in to FTX to check the deposit and withdrawal records. Confirm whether the total cash flow in the 90 days before 11/11/2022 was net deposited or net withdrawn. If it is the former, then the clawback risk will be relatively low, and the subsequent claims may be more complete. Because John Ray has not yet mentioned how to clawback accounts with net withdrawals, he has only proposed an idea.

Due to the large number of FTX users, it will be very difficult to clawback from retail users, so in the end, it may have no impact on retail users at all, but the acquisition price in the claim market will reflect this information first. I hope this answers everyone's questions.

A side note

I know that many of you are betting that John Ray's team has been sucking blood, and some big claimants are also very unhappy. Currently, I am working with these big claimants to prepare some things to accelerate the progress of the restructuring plan. (The good news is that the buyers of FTX are real and not a smokescreen.)

If there is more news, I will announce it to everyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。