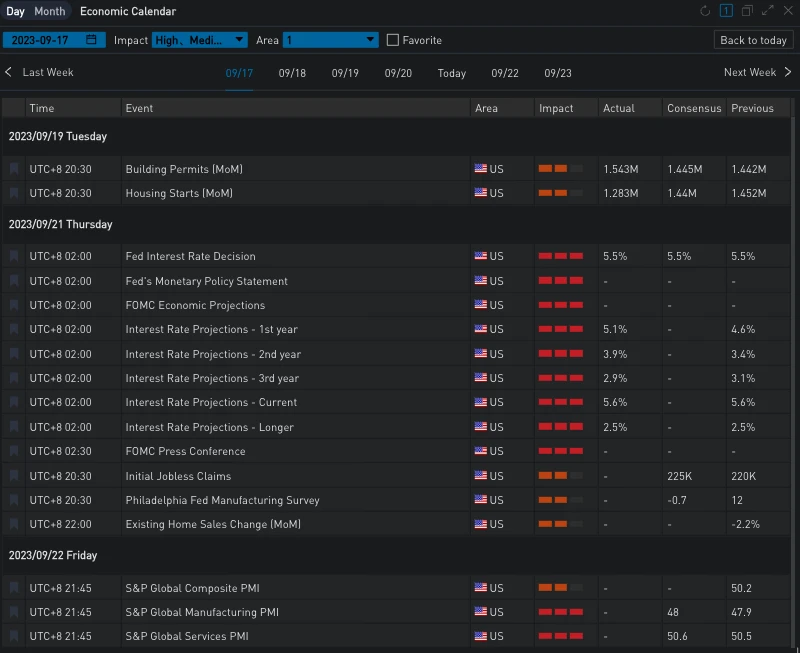

The Federal Reserve's September meeting, as expected, maintained the interest rate in the range of 5.25% to 5.50%, staging a "hawkish pause" worth noting:

First, while it is expected to raise interest rates again this year, the forecast for a rate cut in 2024 has been reduced from 100 basis points to 50 basis points. As Powell mentioned in the subsequent Q&A session, "The Fed will maintain restrictive rates until there is confidence that inflation will fall to 2%."

Second, the Fed significantly raised its forecast for the U.S. economic growth rate for this year (from 1% to 2.1%), and accordingly changed the description of the pace of economic expansion in the Summary of Economic Projections (SEP) from "moderate" to "solid." After this meeting, the core contradiction in the market is no longer "whether there will be another rate hike in 2023," but when the interest rate will break the "Higher for Longer" pattern and shift from raising rates to cutting rates.

Source: SignalPlus, Economic Calendar

In the cryptocurrency market, BTC ended its consecutive days of volatile upward trend and experienced a short-term decline yesterday during the FOMC Q&A session, along with a downturn in U.S. stock market risk assets, with a drop of around 2%. Although the price quickly rebounded thereafter and regained most of the lost ground, the intraday BTC price trend is still in a slow downward channel, closing at 27003 (-0.41%) today.

Source: Binance & TradingView

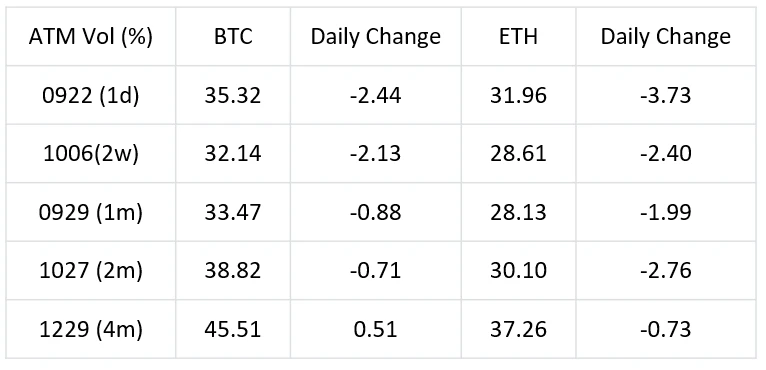

After the FOMC, the front-end IV (implied volatility) significantly fell, with the September ATM IV for BTC/ETH dropping to 33.47% (-0.88%)/28.13% (-1.99%). Looking at the mid-to-long term, ETH IV has decreased, while BTC has slightly increased. This change has intensified the difference in IV between BTC and ETH. In the more liquid end of October/December, the ATM IV difference for both has exceeded 8% Vol, providing an opportunity for cross-asset volatility arbitrage strategies.

Source: Deribit (as of 21 Sep 16:00 UTC+8)

Source: SignalPlus, Rapid decline in front-end IV after FOMC

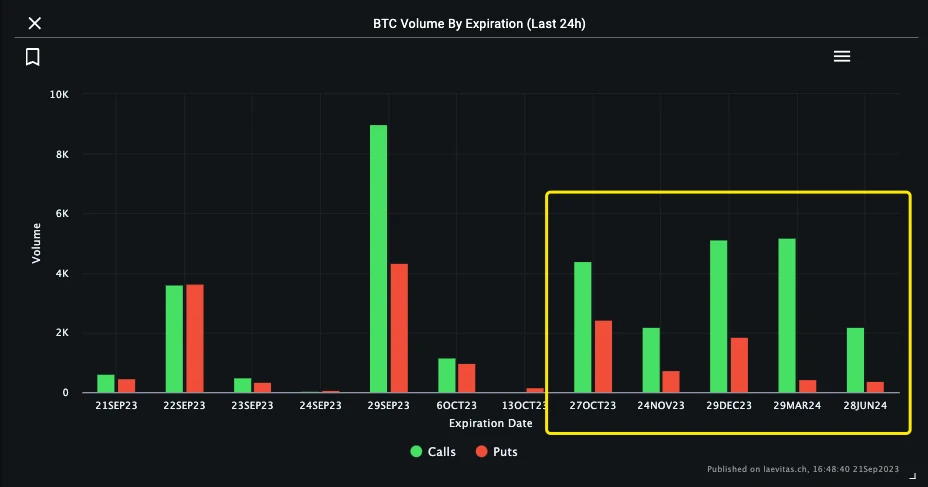

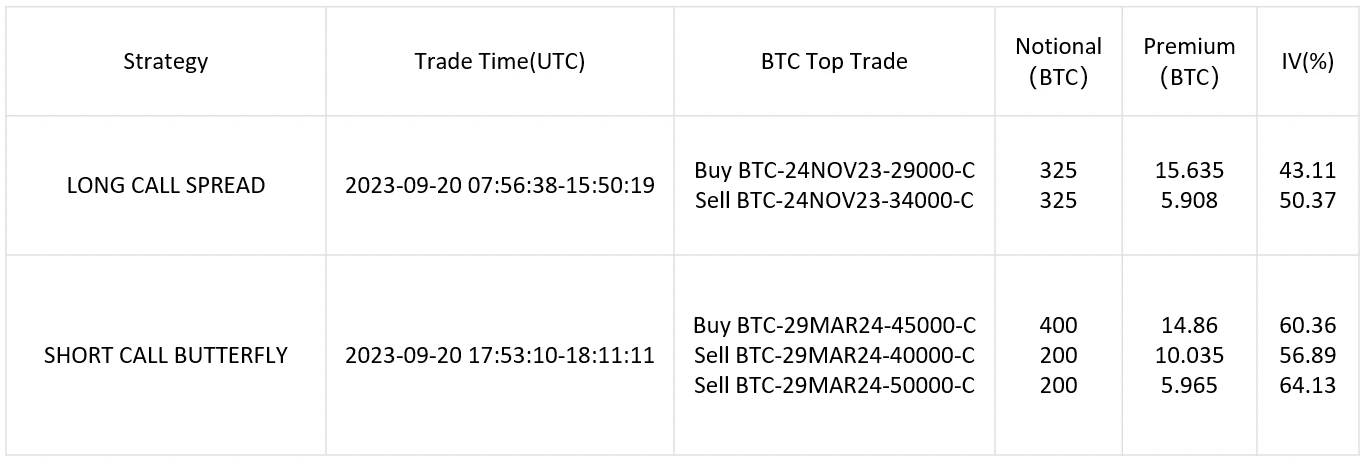

In terms of trading, the distribution of market trading volume over the past 24 hours has gradually shifted towards the medium to long term, with investors paying more attention to long-term investment strategies. Among them, buying Call Spreads for the end of October and beyond has become a focus of attention, with a cumulative turnover of 1700 BTC/16800 ETH.

Source: Laevitas

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the PluginStore of ChatGPT 4.0 to get real-time crypto information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and engage with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。