Original Author: Aiko (Twitter: @0xAikoDai)

Source: Folius Ventures

Summary

Against the backdrop of rising global gaming industry standards and overcapacity, Web3 has become one of the ways for game developers to recover costs due to its high profit margins throughout the entire lifecycle, attracting many web2 teams. However, with overcapacity on the supply side and liquidity depletion on the demand side, the drawbacks of Web3 have gradually become apparent after two years of development. Therefore, this research report outlines the competitive landscape of the Web3 gaming industry and the existing viable entrepreneurial opportunities.

For teams still in the stage of developing Web3 products, it is necessary to recognize that as an industry with incomplete infrastructure but extremely high profit margins, teams must have versatile capabilities. The cognitive gap between most mid-level teams and top teams is huge, and they need to quickly see this gap and accelerate their learning and iteration speed. At the same time, new business models continue to emerge, and teams can fully leverage Web3 commercialization opportunities and seize the market initiative. They can also take advantage of changes in the distribution landscape to capture traffic-based super apps and traffic entry points, or independently open up the market to become a super app themselves.

In addition, for teams still exploring and observing, they can first seize the parallel opportunities between Web2 and Web3 at a time when customer acquisition costs in Web2 remain high and business models are reaching bottlenecks, especially with a large player base driven by casual games and AI. Secondly, summarizing and digesting past successful/hot projects can also provide a lot of methodology to be used in operations. Thirdly, they can develop products that satisfy more user entertainment needs and have long-term business models on top of high traffic entry points. Fourthly, based on new asset forms, there are still opportunities for gamification and commercial innovation of assets. Lastly, for fully on-chain games, it is more advisable for teams to create excellent open-source racetracks rather than reinventing the wheel, which may open up the next wave of trends. Finally, the future of the Crypto agent (crypto+AI) field is likely to still be dominated by traffic, and teams should adhere to a path led by traffic. In the near future, on-chain AI agents will definitely tend to cooperate with high-quality traffic entry points.

In response to our previous two reports, this attempt summarizes the cyclical changes in the industry and provides some more universal, macro, and feasible advice for entrepreneurs at different stages. In the process of writing, we deeply realize that the industry has entered deep waters, with slow progress in infrastructure and a lack of market liquidity, making entrepreneurship extremely difficult. However, we hope that developers can find some methodologies and breakthrough inspirations for coping with the market downturn in this article, and we sincerely pay tribute to the seekers who are constantly moving forward.

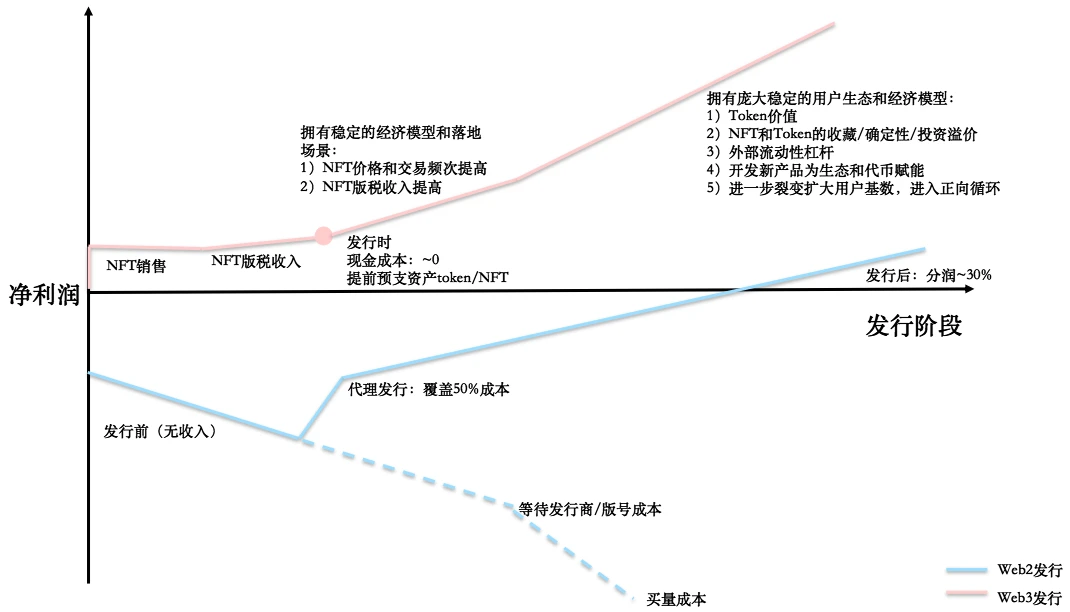

For many game developers limited by game licenses and user acquisition costs, Web3 is indeed a good choice…

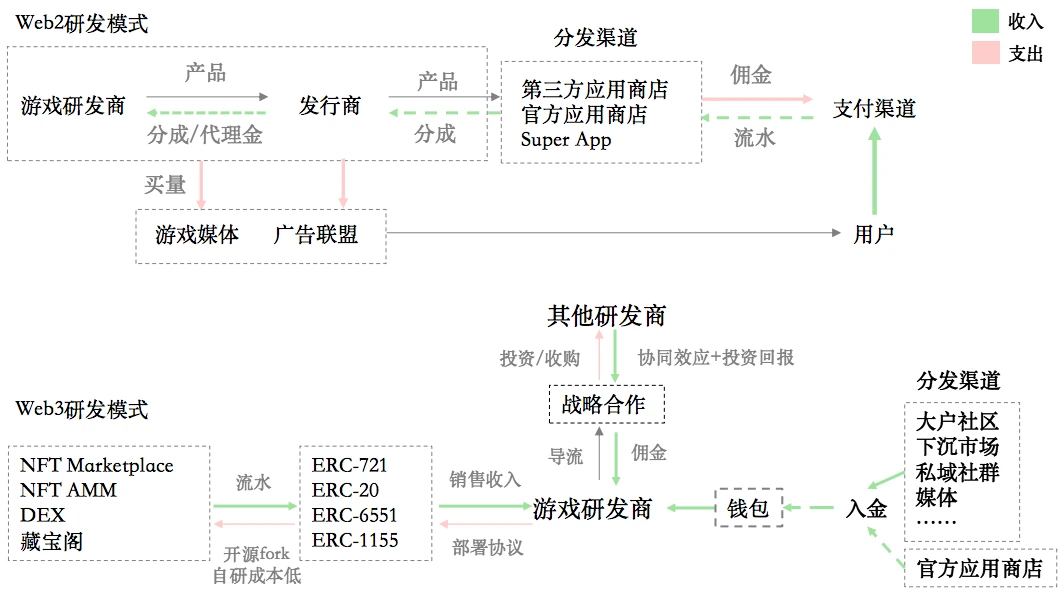

Web3 provides commercial opportunities throughout the entire lifecycle of the game: NFT/FT/taxation. Compared to traditional development methods, Web3 is indeed an effective way to increase game profit margins and achieve globalization.

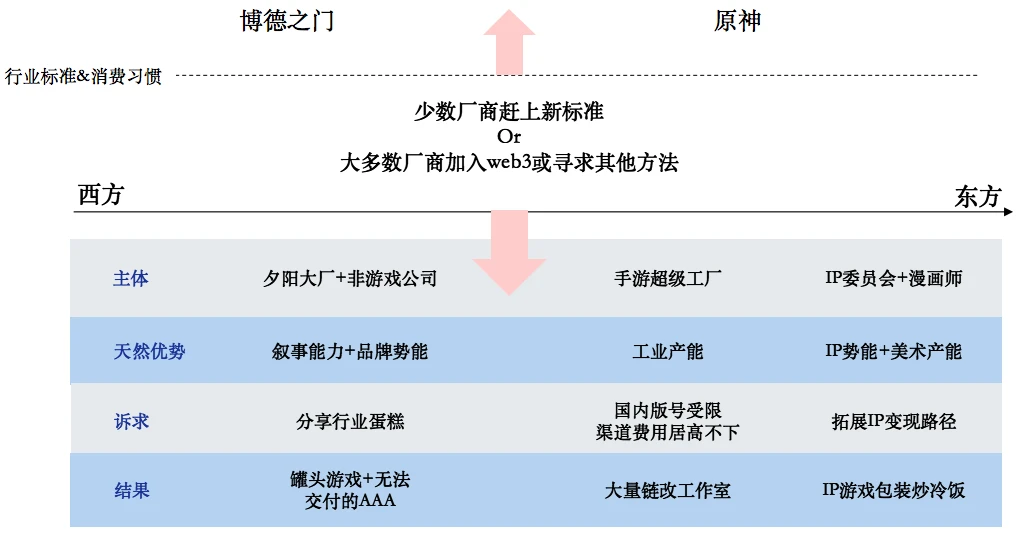

Supply side: However, against the backdrop of elevated gaming industry standards in both the East and the West, Web3, as the only outlet, has absorbed a lot of excess productivity, and after two years of development, problems have gradually emerged.

Demand side: We have entered an era of liquidity depletion, with limited existing markets, scarce attention, and extremely fast shifts. Therefore, at this stage, teams should focus on refining products and incentive models, striving to break through customer acquisition barriers in order to catch the express train of abundant liquidity.

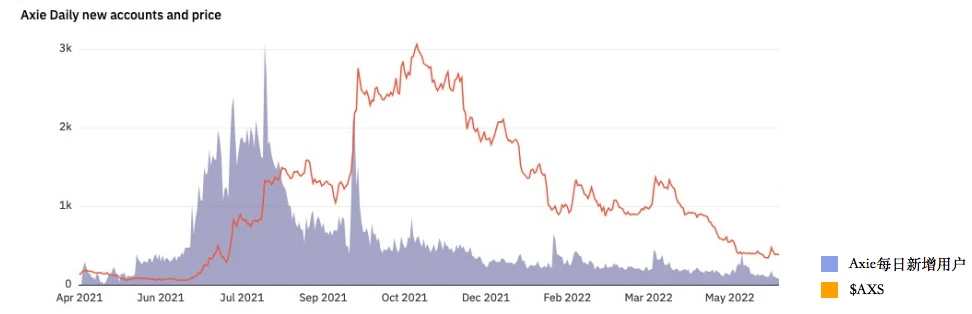

The success of Axie in the market is irreplicable due to its liquidity.

From the perspective of DAU: In April 2021, new users entered, broke through the barriers for the first time in June, and growth slowed in August, revealing the flaws in its economic model; but due to its large user base and smooth gaming experience, a new peak appeared in October as the market surged.

From the perspective of $AXS: Its growth curve closely matches the rise of BTC, and due to the leverage of DAU on a huge scale, its increase is more significant than that of BTC; when the era of abundant liquidity arrives, the price of $AXS is elevated to the next level.

Conclusion: A product with large external traffic and a smooth user experience, even if it has reached the end of its product lifecycle, its value will be exponentially reflected in the market during the era of abundant liquidity, forming a second growth curve. Therefore, in the context of liquidity depletion, game teams should lower their short-term market expectations and focus long-term attention on 1) refining products; 2) innovating incentive mechanisms; and 3) breaking through customer acquisition barriers to better embrace the arrival of abundant liquidity.

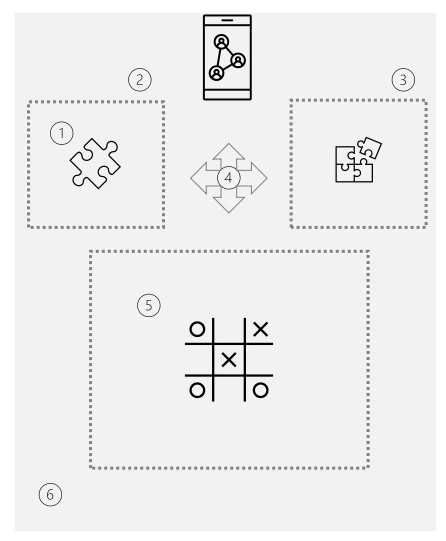

What is the current competitive landscape for Web3 game entrepreneurship?

An analysis from the perspectives of industry profit margins, team cognition, business models, and the market:

1. As an industry with incomplete infrastructure but extremely high profit margins, versatile teams can reap the greatest rewards, while teams lacking versatile capabilities will face even greater challenges and higher error rates.

As an industry with incomplete infrastructure but extremely high profit margins, versatile teams can reap the greatest rewards, while teams lacking versatile capabilities will face even greater challenges and higher error rates.

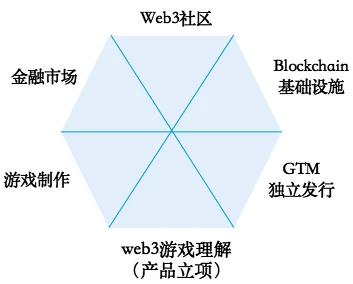

Web3 game team skill set:

Due to the inadequate industry infrastructure and high profitability, Web3 game companies are driven to self-develop as much as possible, rather than passively siphoning. Therefore, Web3 teams need to have the ability to build a versatile ecosystem, and cannot rely on mature industry infrastructure or distribution pipelines of large companies in the past.

Furthermore, the strong financial nature and community nature of Web3 are the soil for user growth and increased profitability. If the team also has financial capabilities, independent distribution capabilities, and community operation capabilities, and makes good use of Web3's native means, its final customer acquisition cash cost should be extremely low, while the income ceiling is extremely high.

Therefore, if a team is still composed of personnel from Web2 game companies, they can only serve as content providers and cannot self-develop or integrate production and sales. They also cannot fully utilize Web3 financial tools for growth and increased income. In the era of liquidity depletion, their Web3 learning and practice process will be even more challenging.

In summary, the entrepreneurial environment of Web3 requires teams to originally have talents who truly understand global game distribution and financial markets, as well as strong technical capabilities for development and implementation. Only a very small number of versatile teams can reap the industry's greatest premium. On the other hand, if a Web2 game company with strong game production capabilities enters Web3 without assembling the aforementioned versatile capabilities, its financing, asset issuance, community operation, and major milestone error rates will be higher, and the fluctuating financial market will add to its pressure and fear.

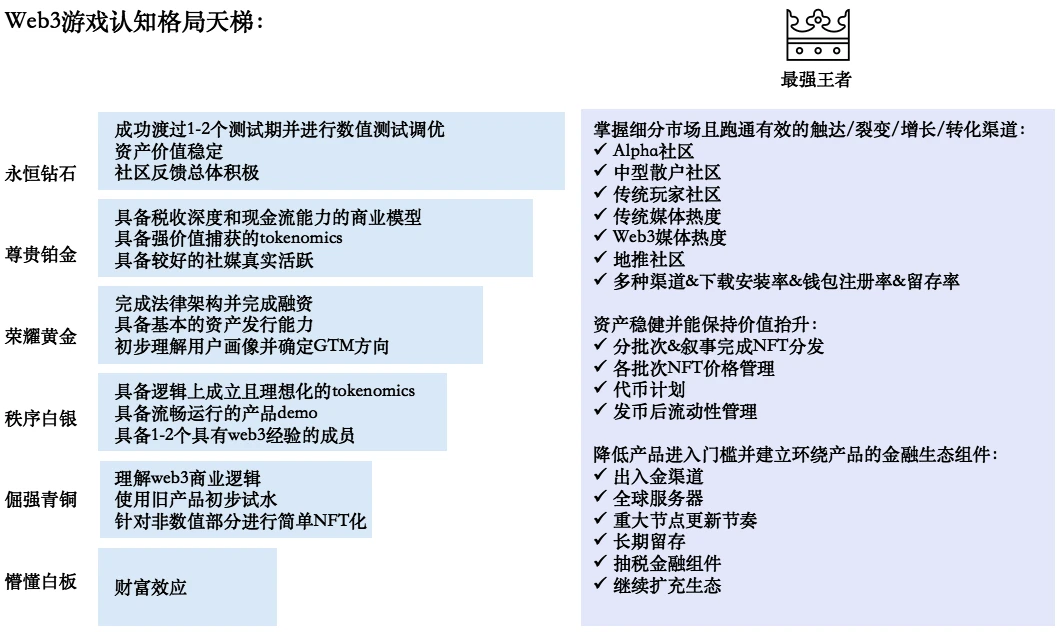

2. There is a huge gap between mid-level and top-tier companies, and most companies may not yet meet the threshold, requiring teams to have extremely strong evolutionary capabilities and iteration speed.

Web3 game cognition ladder:

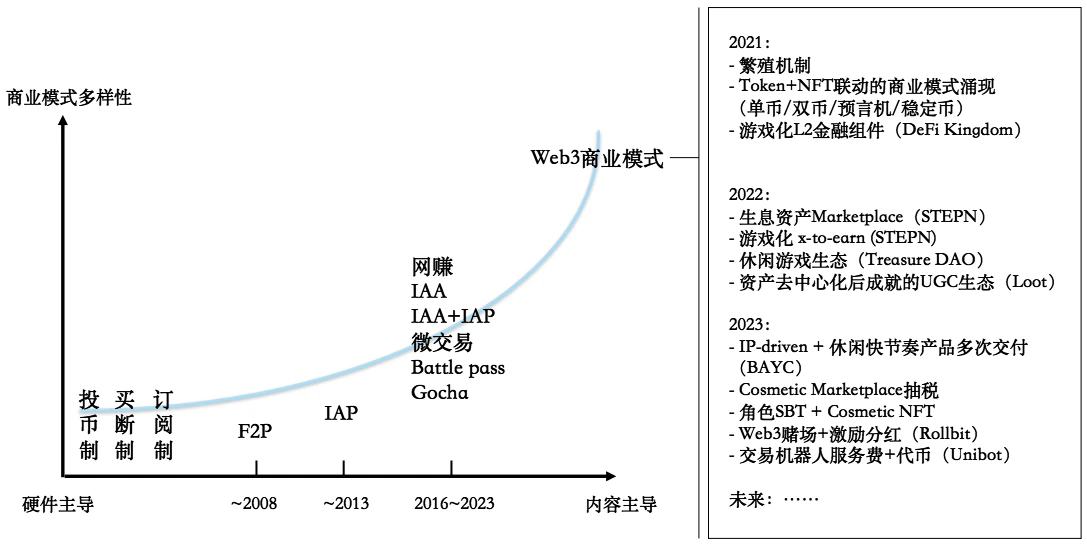

3. Business model innovation is constantly emerging. The more liquidity is depleted, the more it requires new changes. Web3 business models are evolving with market trends/new asset forms, and teams need to innovate with a full understanding of the market and economic models.

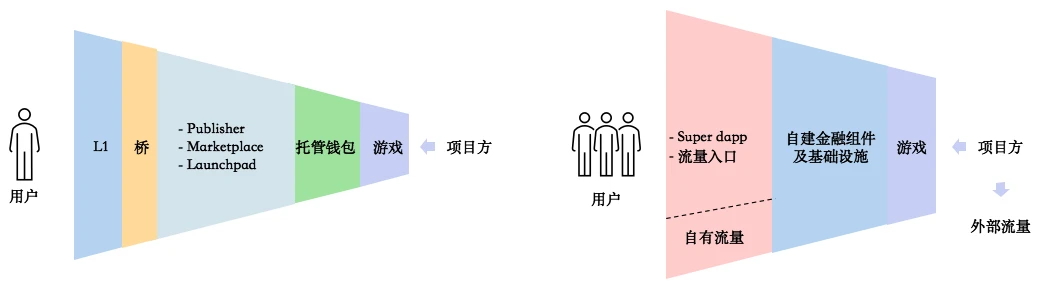

4. The drainage potential of L1/2 and platforms is gradually declining, and the rise of super ecosystems and traffic entry points on single L1/2 is expected to compete in the next cycle. Project teams need to quickly choose a good platform to settle in or actively open up new paths for user acquisition.

Reasons for games being attached to L1/2 or distribution platforms:

1) Well-known ecosystems have more brand potential, making games easier to gain attention due to the "head mining effect."

2) Limited by team capabilities and infrastructure, games cannot independently have a complete set of user deposit and account systems, requiring platforms to provide them.

Issues and risks:

1) The conversion chain for users entering the game is too long, and the user churn rate is high due to the multiple asset transfers.

2) Being tied to a platform may attract more market attention during the mainnet launch period, but the total traffic pool/liquidity is small, making it easy to rise and fall together.

3) The existing market has a limited ceiling, and some L1/2 and platforms also need representative works to break through customer acquisition barriers.

New participants in distribution:

1) Super dapp: With a long-tail traffic and increasingly sophisticated financial components, and expanding influence, it is gradually evolving into a super ecosystem (e.g., STEPN, Axie), providing assistance to other games on external social media and internal infrastructure.

2) Traffic entry points: Wallets and social apps are gradually improving their financial/technical components (e.g., Metamask and Telegram), demonstrating the ability to handle more complex dapp financial interactions, using natural traffic pools while shortening the user conversion path.

For project teams:

1) The options for single-game distribution are increasing, and it is necessary to choose an ecosystem that best matches the user profile and has strong traffic support.

2) Attention in the existing market shifts with liquidity/wealth effects, and independent exploration of external customer acquisition channels is still necessary.

So, in the era of liquidity depletion, what are some directions worth exploring for Web3 game teams?

1. Seize parallel opportunities between Web2 and Web3 games, catching up with new user consumption habits and AI experiences at a time when Web2 customer acquisition costs are high and commercialization is reaching bottlenecks.

- Phenomenon 1: Faced with the same user base, Web2's customer acquisition costs are rising again

The growth of the global market for web2 games in 23 years is largely due to match-three, simulation management, and casual casino games, but the cost of acquiring users for these games is high. After the success of "Traveling the World," the acquisition cost for traditional H5 mini-games has tripled. Web3 faces the same user habits and cheaper customer acquisition costs, as well as higher profit margins.

Recommendation: Teams making casual games can focus on continuously releasing products and using mutual advertising and token implantation in their own DEX to channel traffic and liquidity into new games, taking advantage of the large traffic and rapid attention shift characteristic of casual games.

- Phenomenon 2: Gacha business models are reaching bottlenecks and lack innovation opportunities

The Gacha (pay-to-win) business model introduced from Japan to China has been around for ten years, but in the past six months, especially after the opening of domestic game licenses, it has been found that player spending power is weakening, and overall user payment scale is decreasing. On the other hand, games like "Justice" have achieved success with light payments and high DAU.

Recommendation: Web3 offers many commercialization opportunities, suitable for commercial innovation. It is recommended to read our previous two research reports to maximize the profit space of NFT+token+taxation.

- Phenomenon 3: Simplified experience, high frequency of stimulation

Finding a game that can be quickly picked up and addictive and making it mobile-friendly, from "Vampire Survivors" to "Shell Team," and from the prototype of "Crazy Knights" has given birth to several games ranking in the top ten on WeChat mini-programs. It is evident that from the AAA realistic art production pipeline to the competition for second-generation industrial capacity of 3D rendering, as users become aesthetically fatigued, they are increasingly choosing to spend fragmented time in high-frequency stimulating mini-games.

Recommendation: Simplify and design incentives based on the gameplay prototype to better match the capabilities of Web3 teams. The closer it is to the original stimulation of opening boxes, the more similar it is to the economic incentives of Web3 itself, indicating that more templates can be referenced, and the user profile is more aligned.

Web3 teams making games can also consider adding an idle experience to the game, giving the game itself an "electronic disc" effect, rather than unlimited gold farming 24/7. Therefore, the previously mentioned "energy value system" design is also very important.

- Phenomenon 4: Developing in parallel with AI and the gaming industry

There are indeed parallel opportunities led by AI in the gaming industry, but it is advisable not to add entities unnecessarily.

For teams that have come to Web3 due to the collapse of the middle ground or intense traditional competition, it is advisable to reconsider this industry transformation opportunity, especially in the context of censorship in China and the inability to use large foreign models. It is best to use AI to create innovative experiences and next-generation products on one hand, and use Web3 for global distribution and higher leverage commercialization on the other.

Recommendation: Design from economic/diplomatic/agency perspectives. For example, the agent based on SLG games that I mentioned in the article. This also means more trading and profit space for AI.

2. Seize the window period to digest the proven routines of Web3 in the early and mid-stages of operations.

Early stage:

- Find the right data pool: (Refer to Friend.tech)

When X (formerly Twitter) incentivized creators and this incentive sparked social media effects, it accessed this open (API interface or crawlable data) data source and quickly completed the financialization of KOLs (Share). Perhaps entrepreneurs in this direction can explore other data pools that meet the conditions. After all, the core of its business model is to select important off-chain PoW and traffic and package them on-chain, and on-chain is for valuable data, information, and people to rent.

- Batch invitation system: (Refer to STEPN, Friend.tech)

Use an invitation mechanism in batches to slowly release people, while completing product testing at various stages. Let the fomo social split as an economic incentive lay the groundwork, and slowing down the user entry speed in the early stage actually extends the overall project's operational life.

- NFT operation experience: (Refer to Memeland, Matr1x)

Given that the NFT market has left enough cases and gameplay, this game operated in an NFT-driven manner has many playbooks to refer to, and even has a more complete industry chain (core of NFT operator-whitelist intermediary-KOL). (1) Early-stage Twitter and alpha community marketing, stimulating user liver production in the community; (2) The plate has low liquidity, good control of the plate, and creates wealth effects; (3) The expectations of several NFT series can continuously help the price be good; (4) Whether it is issuance or speculation, it can help the team make some money without spending a penny; (5) Finally, it is based on product+FT Airdrop + cash flow.

- User acquisition/region arbitrage: (Refer to Axie, Hooked)

Do more UA investment testing channels, seize the opportunity to convert users on-chain at low acquisition costs in low-cost regions; at the same time, establish local promotion and distribution systems (guilds) and add a token incentive layer, which is more obvious in terms of token wealth effect compared to the local per capita income level, bringing opportunities for dissemination and breaking barriers.

Mid-term:

- Rolling logic: (Refer to STEPN)

Many people are now telling the story of "web3 distribution" to web2 manufacturers, but what many traditional manufacturers fail to realize is that not only can web3 be seen as a global distribution method, you can even reissue it on every chain. Given the significant differences in liquidity/user profiles/traffic support on each chain (especially in the era of large TVL), launching new assets across chains is like building a new head mine for users, who will continue to enter new chains to make money early. Or similar to the rolling logic in traditional games, starting from a new starting line to practice new characters, verify assumptions about strategies, and gain positive feedback.

- Casualization/fragmentation operation: (Refer to BAYC)

For mature IPs, games can be seen as a means of enhancing community cohesion and attention during the operation phase, so the key lies in high frequency and asset FOMO, without the need to produce AAA and lengthy games.

3. Relying on large traffic entry points to create products that satisfy more users' entertainment needs and have long-term business models, in other words, spreading existing entertainment needs and web2-tested business models through new traffic channels and adding a web3 incentive layer.

Telegram bot:

After the rapid rise of Unibot, many entrepreneurs have entered the TG bot race to create imitations, but currently, adjustments in strategy/performance are only seen in trading bots and GPT-type bots. Although trading bots have risen rapidly by meeting the trading needs of crypto users, their business model is single, and the UI/UX and trading strategy optimization ceiling is low, and the user base has not yet surpassed the tens of thousands, making it difficult to break through customer acquisition barriers.

Therefore, new TG bot entrepreneurs need to open up their thinking and try products that are more in line with the habits of the general consumer, and establish a long-term stable business model. One low-cost method to try is to directly spread the business model already running in web2 (gambling) through new traffic channels (Telegram) and add a web3 incentive layer (token+NFT), as exemplified by Rollbit. In addition, the following ideas are for reference only:

Examples:

Game category: Based on the development history of WeChat mini-programs, consider the gaming performance that TG bots can provide and the education of users from deep to shallow. It is recommended to conduct more testing and combine the main user distribution areas (India, Russia, the Middle East, etc.) and game preferences to identify the user profile.

It is speculated that TG users can accept elemental games, and breaking barriers and growth will rely on social and viral games, while crypto users are more likely to accept cultivation+pvp and card gameplay.

【Simple elemental category】- Connect and Tetris.

【Social gathering category】- Pictionary, Werewolf.

【Comparison and viral category】- Jump, Sheep.

【Placement card category】- Currently leading in WeChat mini-programs, such as "Traveling the World," "King of Salted Fish," etc.

Lottery category: With more and more valuable assets, not only consensus blue-chip NFT assets (BAYC/punk) but also IP joint assets and real-world collateral on-chain (such as Pokémon cards on-chain), combined with a variety of lottery gameplay and dividend incentive mechanisms, there are many gameplay options.

【One-yuan treasure】- Each person has the opportunity to participate in a blind box NFT draw for valuable items with just 1 yuan.

【Game blind box】- Similar to participating in a tree planting game to receive a fruit blind box, or participating in an NFT game to receive an NFT blind box draw.

【Bargain group】- Group purchase of fragmented blue-chip NFTs or directly create a TG launchpad bot, which can be obtained at a low price through forwarding and group purchases, bringing the same whitelist system from Discord.

Private domain category: Both of the above involve dissemination and viral growth in TG groups, and TG is still in the early stages of content ecology, so before the content matrix is built, it is possible to first combine DAO+creator ecology to build a private domain and commercialize it.

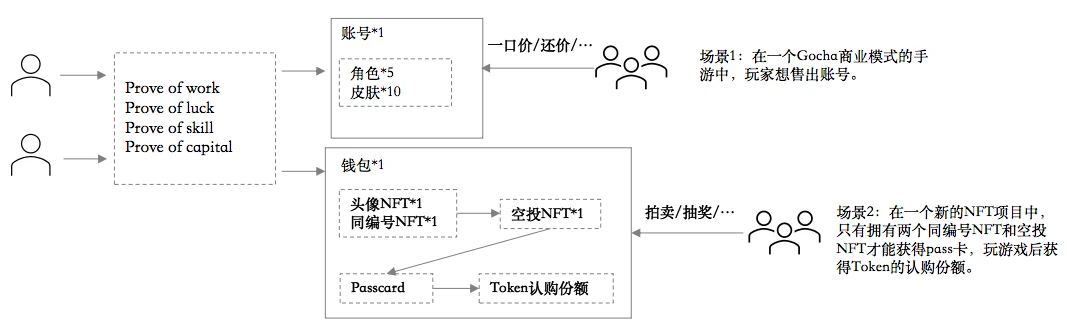

4. There are still opportunities for game-asset gamification and commercial innovation: Treasure House

Background 1: The overall liquidity of the NFT market is depleted, and the NFT market needs new narratives and trading hotspots.

Background 2: At the application layer, the complexity of NFT-driven game assets has already increased, with multiple asset types and large quantities under the same IP, all interlinked, and the ultimate value is reflected in the product and token. However, players still need to conduct off-chain transactions in the community or manually collect NFTs that meet the requirements one by one, making the trading method very primitive.

Background 3: At the protocol layer, with the emergence of ERC-6551 and ERC-4337, although the underlying technical issues of account abstract wallets have not been resolved (e.g., stability issues with supporting and private key generation wallets), with the improvement of infrastructure, the granularity of accounts and assets in the future will be significantly different from now. Just as ERC-721 and ERC-20 have completely different interaction forms/financial attribute logics, the new form of assets in the future will be: multi-subject+multi-granularity nested, more difficult to unify pricing, so the financial interaction forms and scenarios based on future assets will become more interesting.

Recommendation:

For a Marketplace like the Treasure House, it first requires the game itself to be able to operate for a long time, have a large DAU, and have valuable assets and abundant liquidity; secondly, it requires the game project team to be able to design and operate activities, so that each sales operation activity promotes game activity and market trading volume. This can refer to the routine operation activities of web2 games, such as launching festival gift packs/blind boxes, etc., but without affecting the value of valuable assets (such as characters).

Some mechanisms worth learning from and making web3: bidding lottery, appraisal mechanism, public bidding auction, etc…

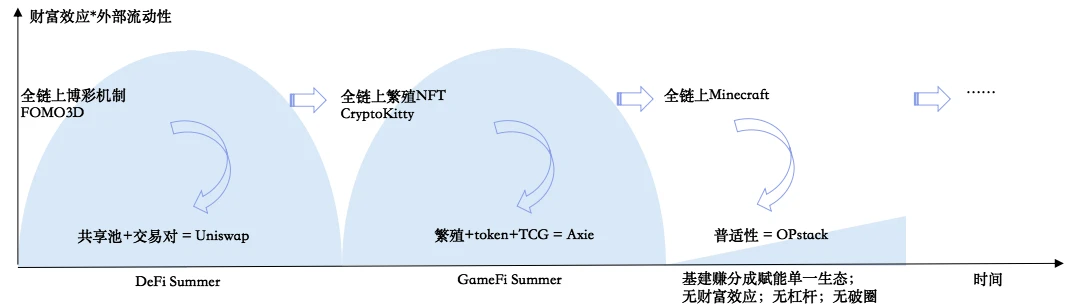

5. Full-chain games: Create an excellent open-source racecourse, rather than reinventing the wheel, find innovative mechanisms with enough wealth effect and productize+gamify them, ultimately breaking barriers and driving new liquidity.

Background 1: Full-chain narratives have inherited liquidity from NFT and GameFi. Loot appeared alongside NFTs like BAYC, Punk, and its market price peaked when the Dark Forest community, the pioneer of full-chain games, had the most participants. Full-chain strategic games (such as Wolf Game, Sunflower, etc.) also appeared after Axie and GameFi summer, but the FDV is all below $5M, which is one-fourth of Axie and one-fifth of STEPN.

It can be seen that in the case of depleted liquidity in both NFT and GameFi, the possibility of the sudden rise of social strategic full-chain games is small, and even if it does, it is probably difficult to break through customer acquisition barriers.

Background 2: To prevent full-chain games from eventually becoming primitive and brutal pos/pow competition and to optimize UI/UX, the team needs to delve into technical issues and gradually develop the trend of full-chain game technology-driven self-built Appchains/L2, layer by layer. The game and test network environment are closed, with only double-digit test users, making it easy to reinvent the wheel and lacking universality, and there is currently no sign of open source, making it a long way from being permissionless and interoperable.

Analyzing the innovation of past full-chain games, the following commonalities can be summarized:

1) The innovation of full-chain games may not appear in the main tasks, but in the side tasks. If valuable side tasks can be identified in this process and productized, it may be possible to create infrastructure with universality, and if it can be financialized+gamified on top of the product, it can greatly reduce user barriers and drive new liquidity influx.

2) It is easier to drive innovation by focusing on simple and FOMO asset gameplay with wealth effects, such as the dividend mechanism in Fomo3D and the asset appreciation mechanism through breeding deflation in CryptoKitty, in order to become an excellent racecourse.

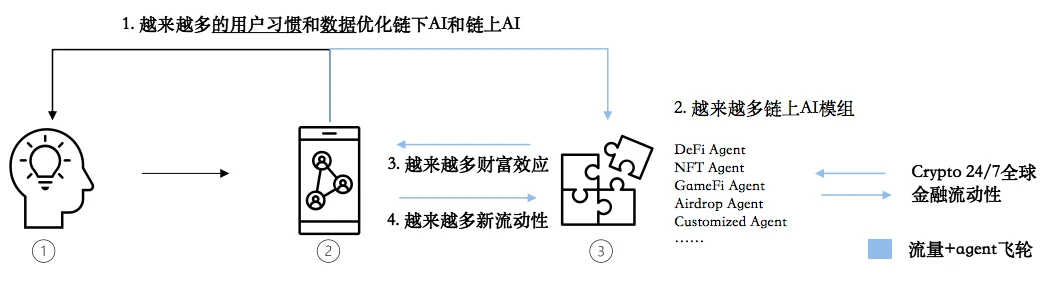

6. The era of AI agents is still dominated by traffic. Traffic dominance + crypto agents are more likely to drive volume and find good commercialization paths, while backend AI can continue to optimize + modularize and seek cooperation with high-quality traffic entry points.

1) - LLM (optional): Transforming user intent from traditional keyboard/click input to natural language input to reduce user entry barriers.

2) - Front-end Dapp: Collecting user habits and data.

Most likely an open social app, chatbot, and game, or transforming existing web2 traffic entry points into a more convenient and user-friendly AI+web3 entry.

3) - On-chain AI agents and their modules: In order to obtain more user habits and data, AI modules will be willing to open interfaces, and the core spirit of web3 is open source, permissionless, and composable. Therefore, high-quality on-chain AI modules will definitely join forces with traffic entry points.

Comprehensive business map surrounding on-chain Agent modules

1) - Agent: Commercialization of AI agents themselves: free trial + subscription, service fee commission, etc.

2) - Asset layer surrounding a single Agent: Various asset types, diverse commercialization and monetization: Advanced Passcard (ERC-721), Agent token (ERC-20), cash flow dividends to stakeholders, etc.

3) - Multi-agent asset game: One AI Agent airdrops tokens to other Agent users, conducting vampire attacks; while old agents can choose to increase stakeholder dividends to regain users.

4) - Agent coordinator: Possibly led by a high-traffic super app, bundling multiple AI agents through user customization, each AI has different payment methods (subscription/NFT/token, etc.), and an app with coordination logic can redirect traffic and help users settle in one go, earning fees from it.

5) - Agent game environment: More likely to be the first to achieve complex AI games and commercialize them. In basic behaviors such as airdrops, AI interaction is limited, and user profit margins are limited; but the game is like a scenario where rules are artificially set and interaction frequency, profit margins, and complexity can be infinitely increased. Note that the game can be conducted off-chain, and users can store a portion of funds in the app-hosted wallet, only needing to put the economic interaction part on-chain.

Several game models that come to mind:

In SLG games, users allocate funds, and AI manages the country and diplomatic relations, involving negotiations, betrayal/cooperation, bribery, and other complex economic interactions, from which the game project can collect taxes.

In auction board games (such as modern art/monopoly), users allocate funds, and AI conducts auctions and bidding (AI also solves the problem of asynchronous games requiring players to be present for a long time).

6) - 24/7 global financial liquidity for AI agent pricing: A certain AI agent module announces new features on a social platform, causing token demand/consumption expectations and speculative expectations, which may prompt people to buy the token of that AI agent.

Acknowledgments

Alen@qiqileyuan

Ben

Blanker@0xblanker

Chris@ChrisYicheng

Chris Lu@chrislulu816

Frost@frost_lam

Jason@MapleLeafCap

Luozhu@LuozhuZhang

Saku@poemran

Yige Min@Alpacacheeze

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。