Original | Odaily Planet Daily

Author | Nan Zhi

Since the concept of Telegram Bot became popular, various types of Bots other than "trading Bots" have also started to appear on Telegram. However, before launching on Telegram, similar applications were already available on the web or desktop, and for certain categories of Bots, launching on Telegram does not provide any additional benefits, and may not even be necessary—Telegram is not the holy grail for Bots.

Odaily Planet Daily will take "coin issuance Bots" as the research basis to explore their additional features and to determine which categories of Bots are suitable for Telegram.

Coin Issuance Bots

The main promotional feature of coin issuance Bots is "one-click coin issuance." However, this feature had already been implemented by multiple web-based products, or in the era before web-based tools, there were already various modes of Meme fixed versions in the market, which only required simple parameter modifications in the development application (such as Remix, Hardhat, etc.) to complete coin issuance.

The differences of coin issuance Bots on Telegram are:

Low learning curve: The process and content are template-based, further reducing the learning curve, and allowing completion without understanding the principles;

Portability: Not limited by device and location, while web-based platforms need to be mobile-adapted to be used through wallet software;

Security brought by fixed templates: The mainstream coin issuance Bots can only deploy fixed token forms and cannot customize backdoors.

The above are the main settings of coin issuance Bots, which typically have natural limitations on their security. The income of the protocol comes from two sources: one is the transaction tax after the protocol issues coins, and the other is the protocol deploying tokens through coin issuance Bots, which will take a cut of the initial liquidity and subsequent transactions.

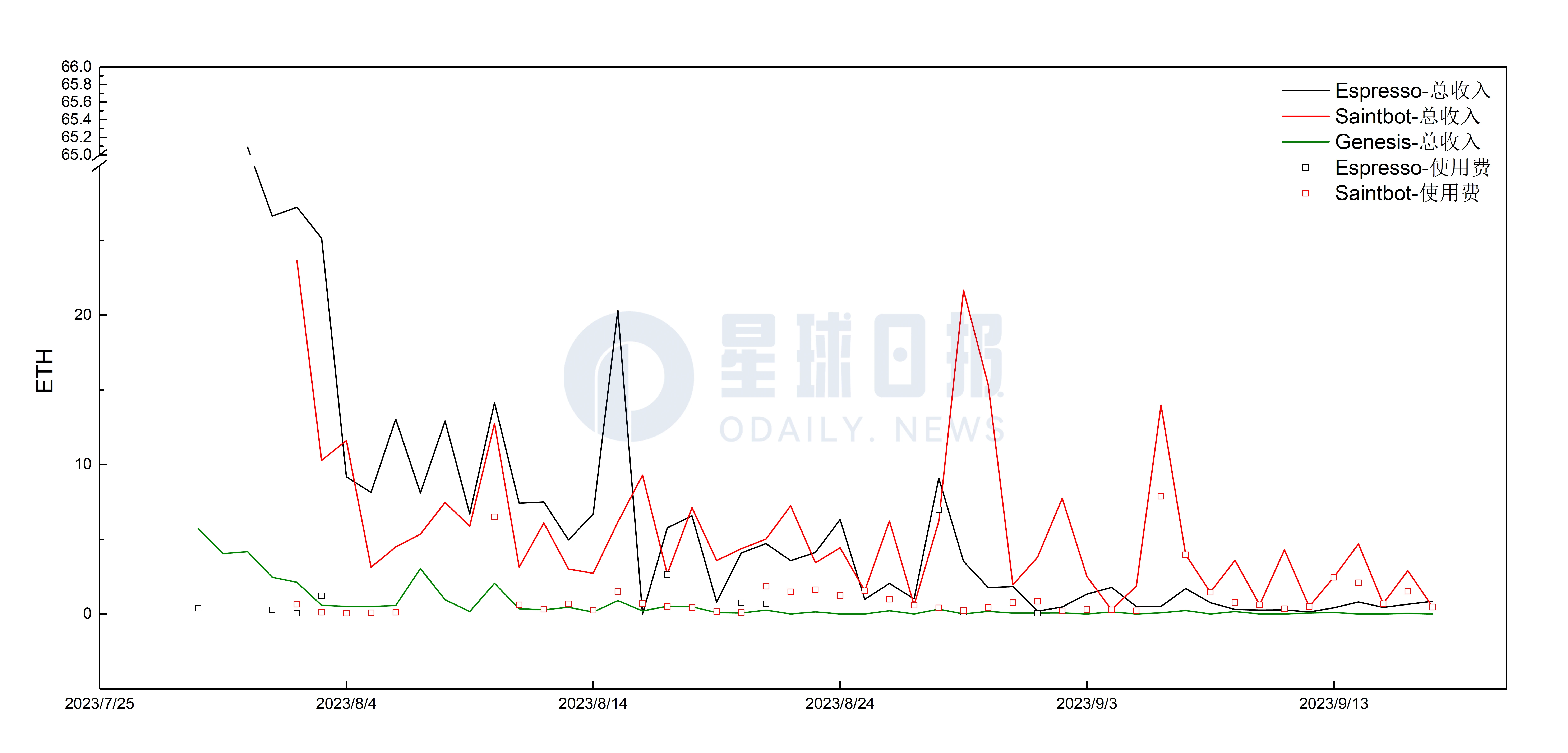

The following is an overview of their income:

The main source of income for each Bot is token transaction taxes, with Saintbot showing several large peaks. However, Genesis Bot, which significantly reduces usage fees, has not been able to capture market share.

It can be seen that the mechanism of taxing 1% of the transaction volume has also not brought sustained income to major Bots. Under the one-time income from the short lifespan of Meme coins, the market capacity is extremely limited, and various Bots still need to find sources of income in new markets.

In summary, the advantages of coin issuance Bots combined with Telegram are:

Meme players are no longer concerned with token models (such as concepts of dividends, burning, adding LP, etc.), and are more focused on the storytelling of the tokens. Those who can respond to the stories in the market in a timely manner have a significant advantage, so their portability has certain value.

However, their disadvantages are:

Ineffective features:

- End users still only see the contract address and cannot directly perceive the security (cannot know if the token comes from a coin issuance Bot with security restrictions), and still need to rely on third-party platforms for detection.

Market mismatch:

In a stock market, there is no need to further reduce the threshold, and it cannot attract more Bot users.

The market capacity is extremely limited, and current Meme players no longer accept high-tax projects, while the current fees for several Bot services are too expensive, hindering user entry.

The various additional features attached to Bots by major projects have no effect, and users still only care about the most basic function of "coin issuance" itself. Only when the usage fees further decrease due to internal competition, coin issuance Bots can gain a certain market share in specific scenarios, but they do not have long-term investment value.

Conclusion

Apart from coin issuance Bots, there are many other races for Telegram+Bots, such as game Bots (e.g., HiPvP for guessing the size), sports betting Bots (e.g., bookiebot), and US stock trading Bots (e.g., AXE CAP), among others.

Among these, game Bots can only display a simple result on Telegram, and what users are most concerned about is the gaming experience, rather than making a profit from such games. Therefore, these types of Bots have already disappeared.

On the other hand, sports betting Bots are completely opposite to game Bots. Many users only need a simple entry for placing bets and getting results, and do not care about the progress of the betting project itself (and can also watch and obtain results through official channels). Therefore, these types of Bots, which retain only the most fundamental function, have continued to develop after the tide recedes.

Telegram is not the holy grail for Bots, but rather Occam's razor. Riding on the concept can only make a Bot a temporary favorite, and Bots on Telegram do not need multiple additional features, but should focus only on their most fundamental function.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。