Original Author: stella@footprint.network

In August, the cryptocurrency market experienced significant volatility, with a large fluctuation in the price of Bitcoin. Meanwhile, the NFT market saw a substantial decline, raising concerns about the future development trend of this emerging industry.

Have we reached the bottom of the bear market? Despite the industry's positive news not stopping, with 5 Ethereum ETFs submitted this month and the first cryptocurrency exchange license issued in Hong Kong, the bearish sentiment in the NFT market still prevails, with a noticeable decrease in user activity and participation.

In this report, we will delve into the highlights of the NFT industry in August, exploring the blockchain, trading market, and investment dynamics of the NFT field. Despite the recent market downturn, we have still found a glimmer of hope: innovative NFT projects continue to emerge, prioritizing the genuine interests of creators and users, attracting attention and support.

The data in this report is sourced from Footprint Analytics' NFT research page. The page provides an easy-to-use dashboard containing the most crucial statistical data and indicators to understand the latest developments in the NFT industry and is updated in real-time. You can find the latest information on transactions, projects, and financing by clicking here.

Key Points Overview

Cryptocurrency Market Overview

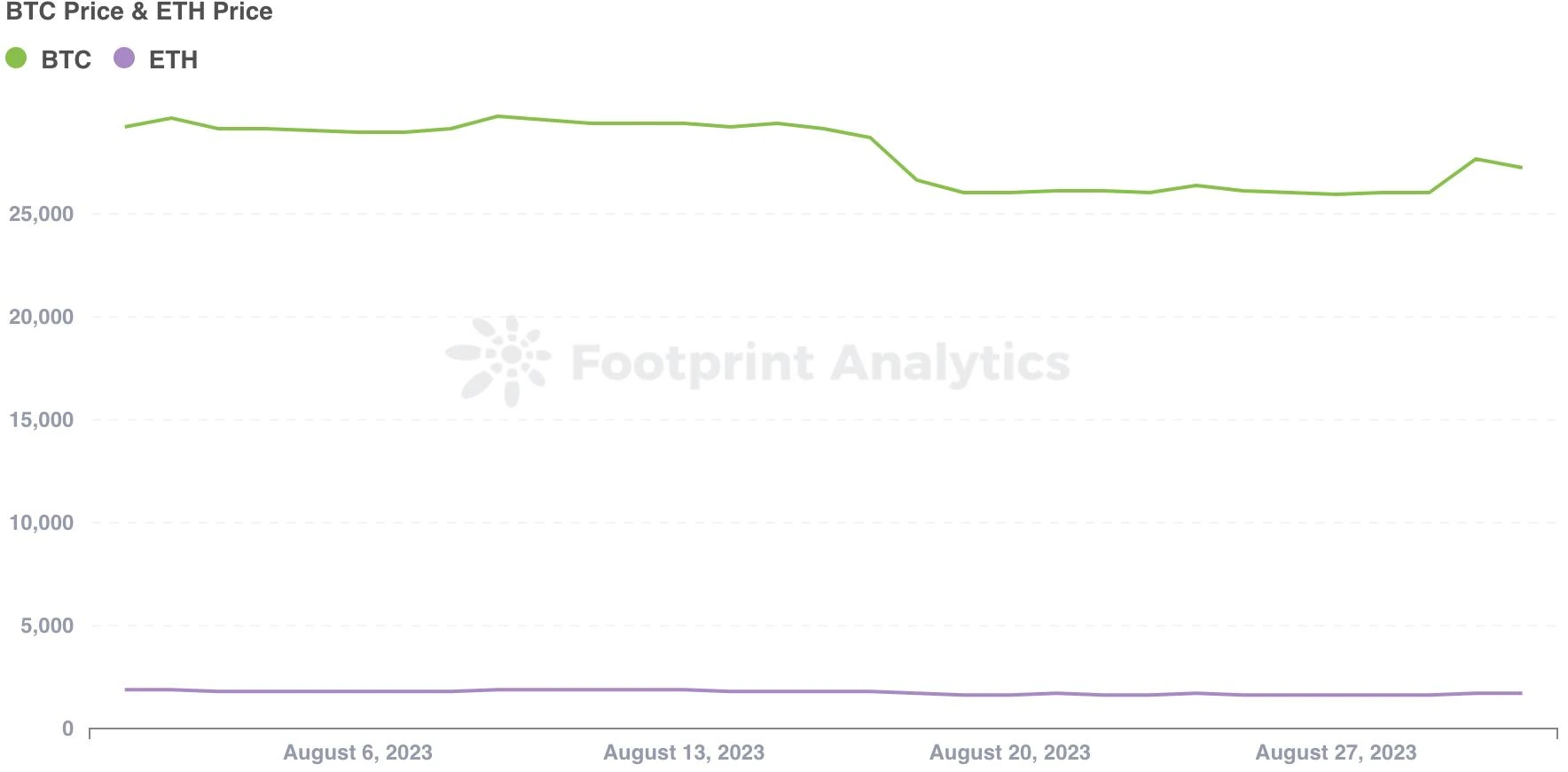

- In August, the value of Bitcoin fluctuated significantly, ranging between a low of $23,664 and a high of $30,057 within the month.

NFT Market Overview

In August, the NFT market saw a significant decline; compared to July, the trading volume decreased by 21.7%; the volume decrease was 20.6%; and the number of independent users decreased by 27.4%.

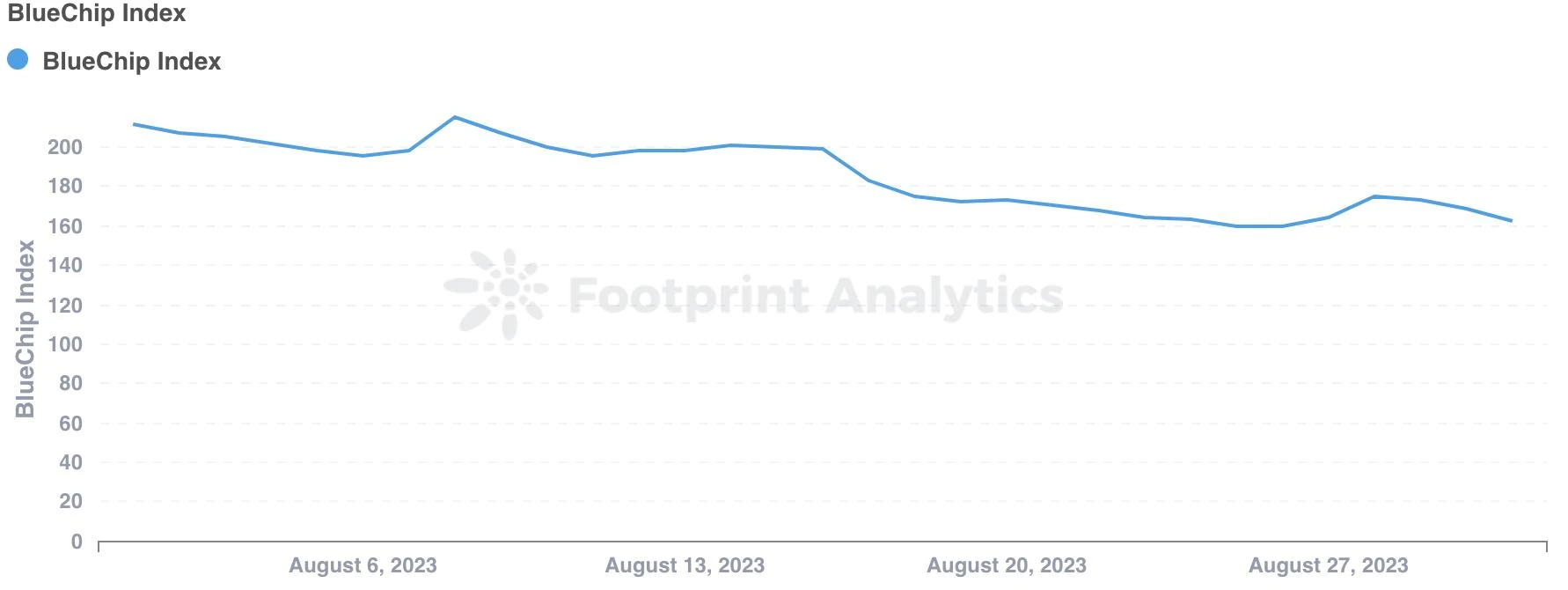

The blue-chip index trended downward, indicating a stronger bearish sentiment in the market.

Public Chains and NFT Trading Market

After trailing behind Polygon for three consecutive months, Ethereum regained its leading position in the number of independent users.

Blur's leading advantage in trading volume continued to shrink, decreasing from 52.5% to 48.3%.

NFT Financing Situation

In August, the NFT market maintained a sluggish trend, with a total of 5 rounds of financing amounting to $14.45 million.

Despite the recent inactivity in NFT financing, projects that demonstrate innovation and prioritize the genuine interests of creators and users continue to attract attention and support.

This Month's Hot Topic: Royalties

- OpenSea announced that it will stop mandatory royalty fees starting from March 2024, making them optional.

Key Developments This Month

MasterExchange secured a $2.7 million financing and completed its first music release (IMO).

NFT startup FirstMate raised $3.75 million, with Dragonfly Capital leading the investment.

OpenSea released redeemable NFT industry standards.

FingerprintsDAO collaborated with CryptoPunks creator Larva Labs to launch a membership-based NFT series "Voxelglyph."

Magic Eden launched a $1 million fund to cultivate blue-chip NFT series on the Polygon chain.

Sotheby's faces a lawsuit for alleged misleading and manipulating BAYC NFT sales.

Cryptocurrency Market Overview

In August, the value of Bitcoin fluctuated significantly, ranging between a low of $23,664 and a high of $30,057 within the month. On August 1st, the submission of 5 Ethereum ETH applications triggered a brief surge in the value of Bitcoin, reaching $30,000. However, the excitement was short-lived, and following the market's weakness after the downgrade of the U.S. government's credit rating, the prices of BTC and ETH quickly fell back.

On August 8th, Bitcoin once again broke through the $30,000 mark, possibly stimulated by the launch of the new stablecoin PayPal USD (PYUSD) by PayPal. However, Bitcoin quickly plummeted to nearly $25,000 shortly after. This decline was driven by a series of negative events, including reports of SpaceX selling a large amount of BTC, the crisis of China Evergrande, and a massive $1 billion liquidation in the cryptocurrency derivatives market in a single day.

At the end of August, a U.S. appellate court made a ruling favorable to Grayscale in its lawsuit against the U.S. Securities and Exchange Commission, causing the price of Bitcoin to soar from $26,000 to $28,000, and eventually stabilizing around $26,000.

NFT Market Overview

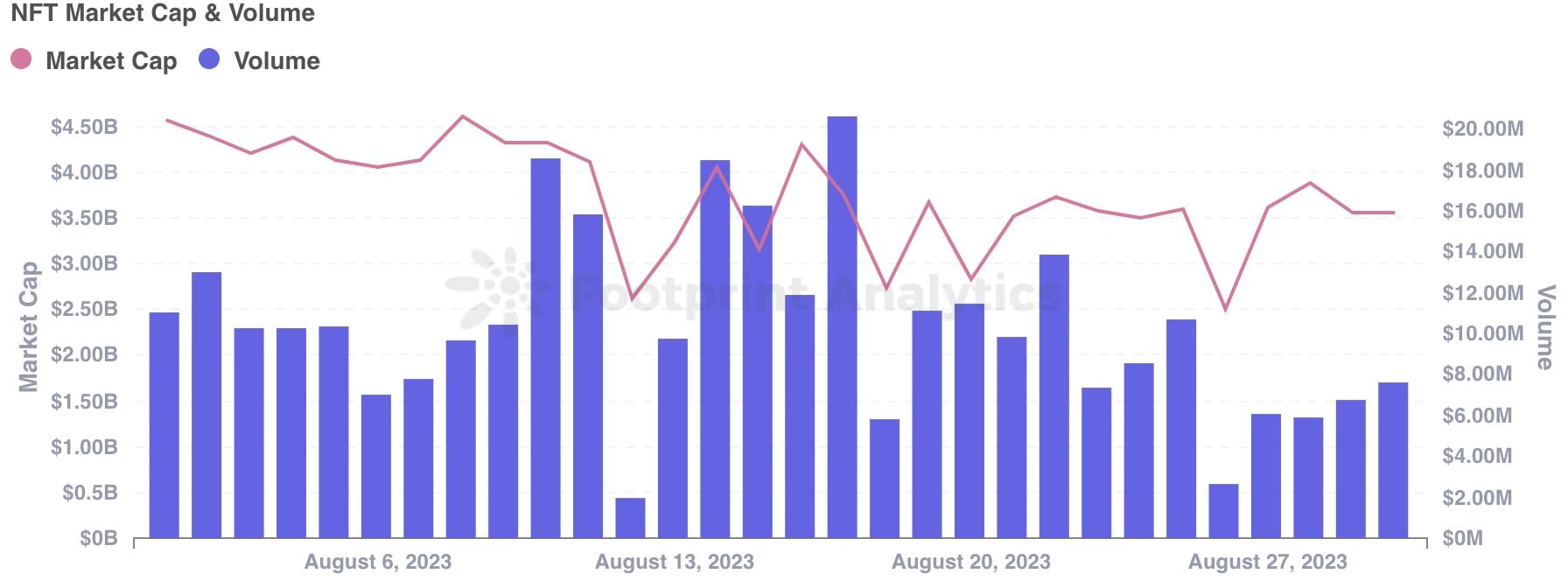

In August, the trading volume in the NFT market saw a significant decline, with a total trading volume of $527 million, a decrease of 21.7% compared to July; the volume was 1,119,066 transactions, with a decrease of 20.6%; and the number of independent users was 313,610, a decrease of 27.4%.

Source: NFT Market Overview

Recent market fluctuations have had a significant impact on market capitalization and trading volume. The blue-chip index trended downward, indicating a stronger bearish sentiment in the market.

The floor price of the second-ranked blue-chip NFT BAYC has been continuously declining since January 2023. In August, it fell below 23 ETH, indicating that the bear market is still ongoing and more time is needed for recovery.

Source: NFT Market Cap & Volume

Source: BlueChip Index

These data indicate a continued deceleration in the NFT market, with significant changes in user participation and investment activities. Similar to the macro cryptocurrency market, the current characteristics of the NFT market are lack of confidence and a risk-averse mentality.

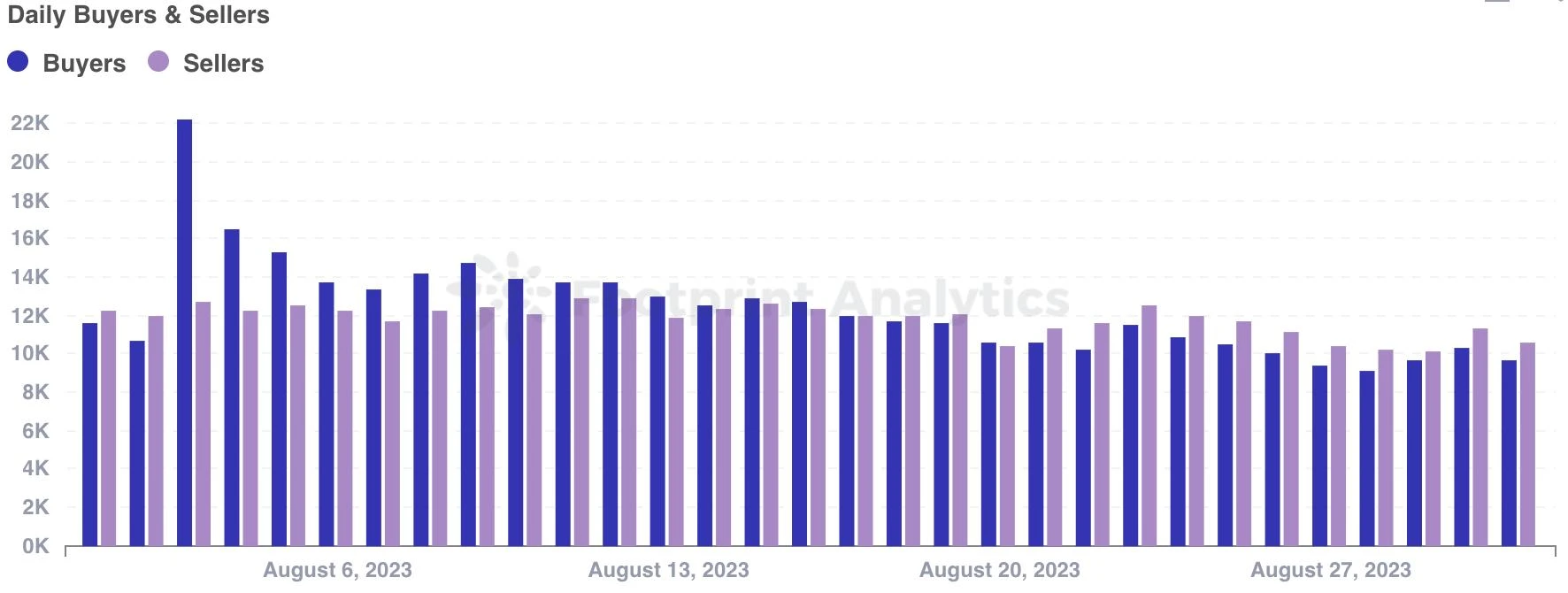

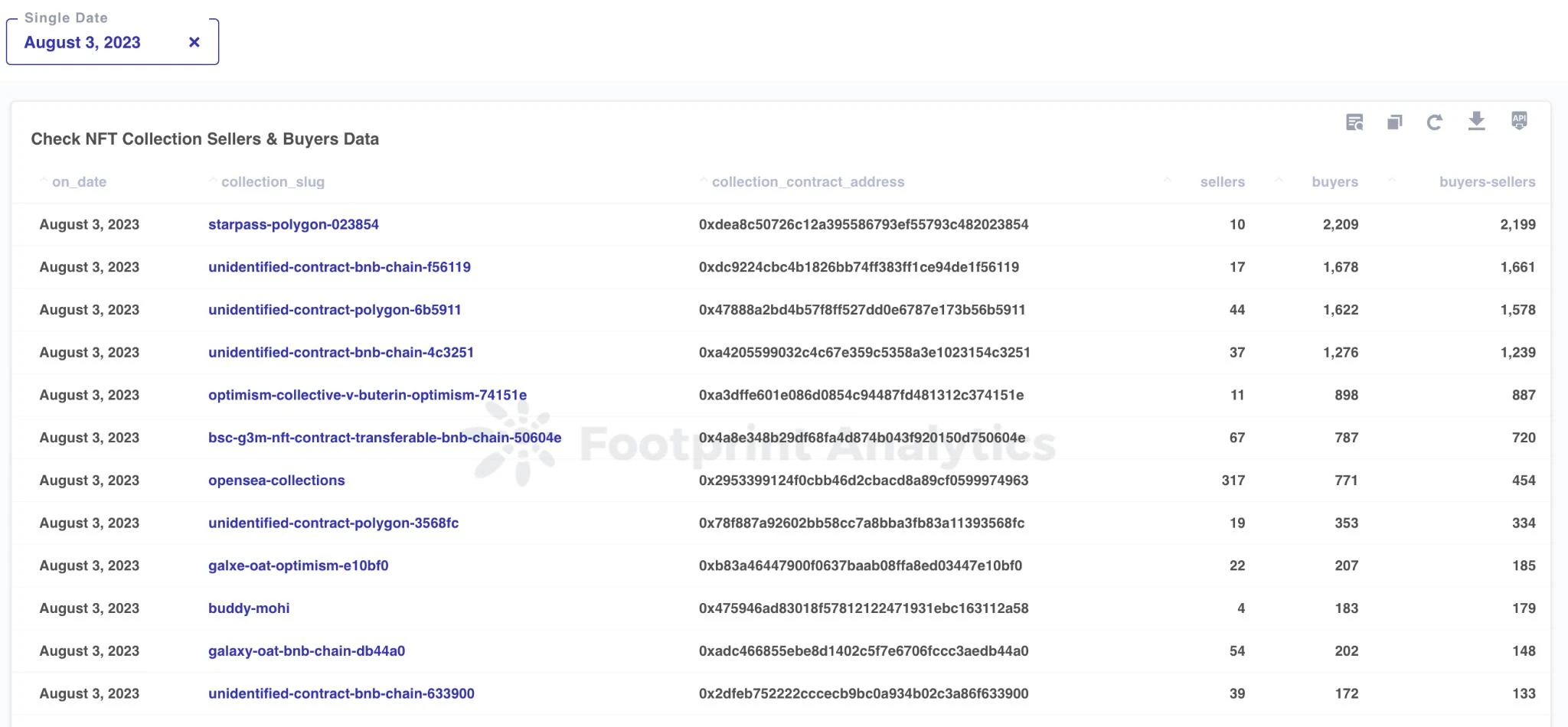

In August, the buyer/seller ratio in the NFT market was 131.63%, a decrease of 17.5% compared to July. There were a total of 211,696 buyers and 160,822 sellers in the month. It is worth noting that compared to the previous month, the number of buyers decreased by 29.4% and the number of sellers decreased by 20.1%. Throughout the month, except for a significant increase in the number of buyers on August 3rd, the daily number of buyers and sellers remained relatively stable.

Source: Daily Buyers & Sellers

On this day, the StarPass project on the Polygon chain had the largest proportion of buyers. According to PolygoScan, the largest holder of 62.7% of NFTs conducted frequent trades at low or near-zero prices and royalties on August 3rd. However, the project's disclosure of details is very limited in terms of transparency.

Source: NFT Buyer & Seller

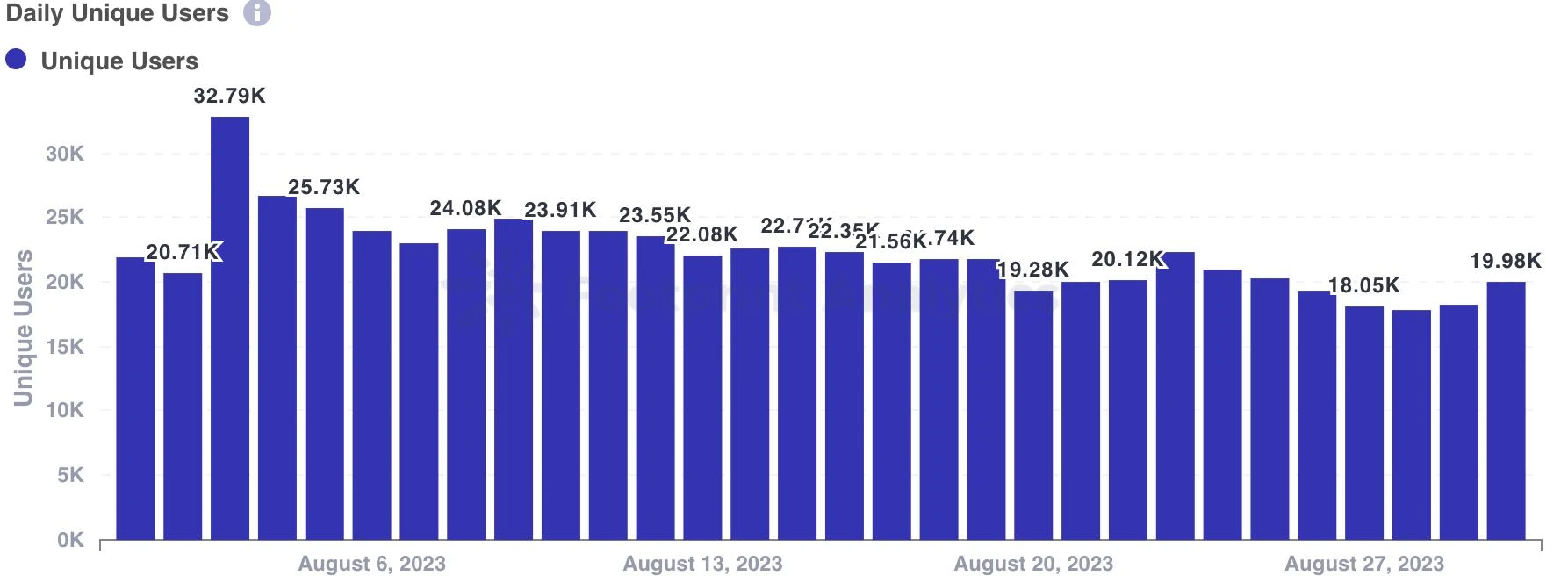

The trend of daily independent users shows a similar trend to the daily number of buyers and sellers, indicating a positive correlation between the two.

Source: Monthly Unique Users by Chain

Public Chains and NFT Trading Market

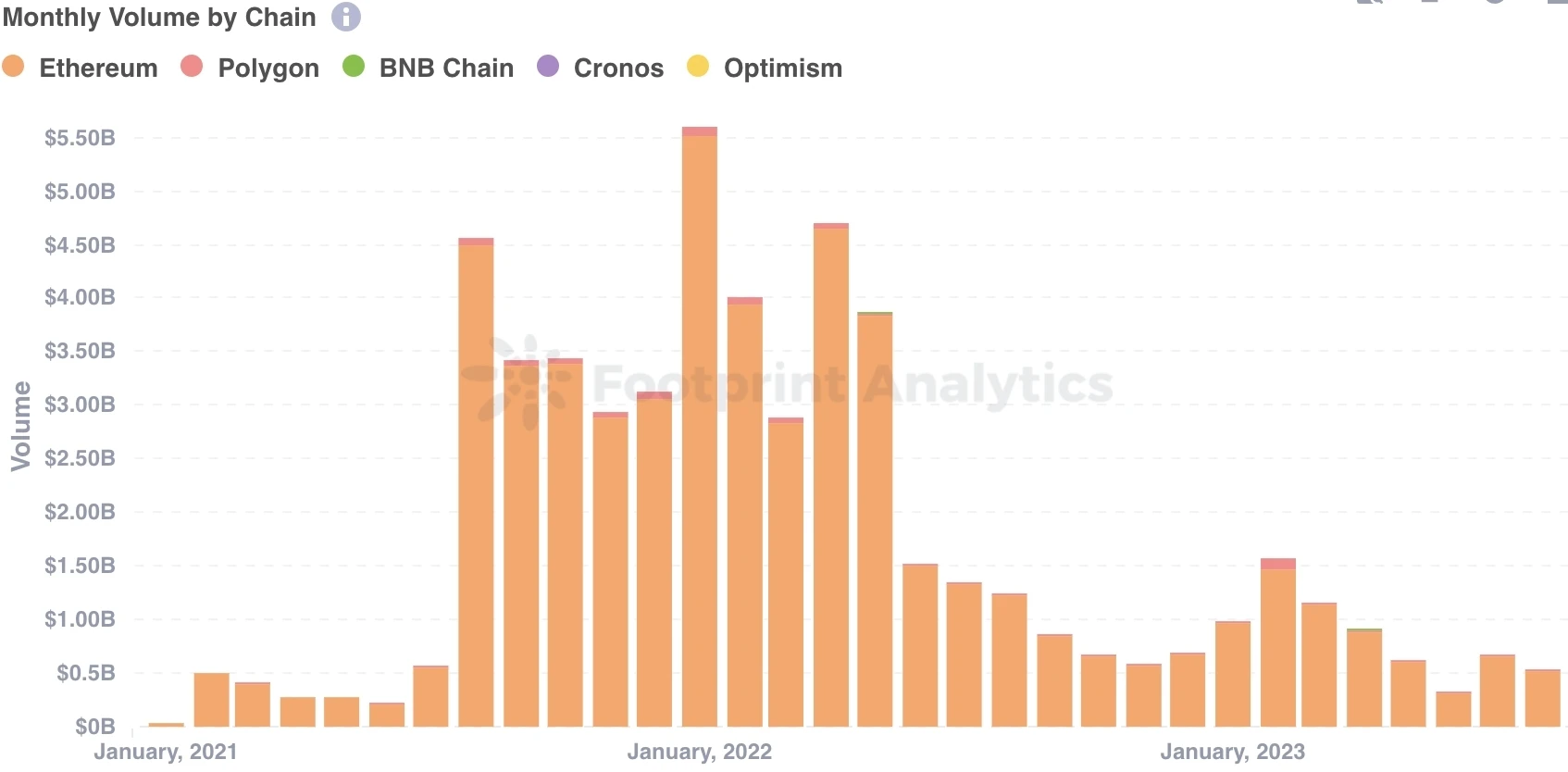

In August, Ethereum continued to maintain its dominance in the NFT market, accounting for 97.8% of the total trading volume. However, Ethereum's overall trading volume decreased by 21.9% compared to July, totaling $5.152 billion, reflecting a downward trend in the entire NFT market.

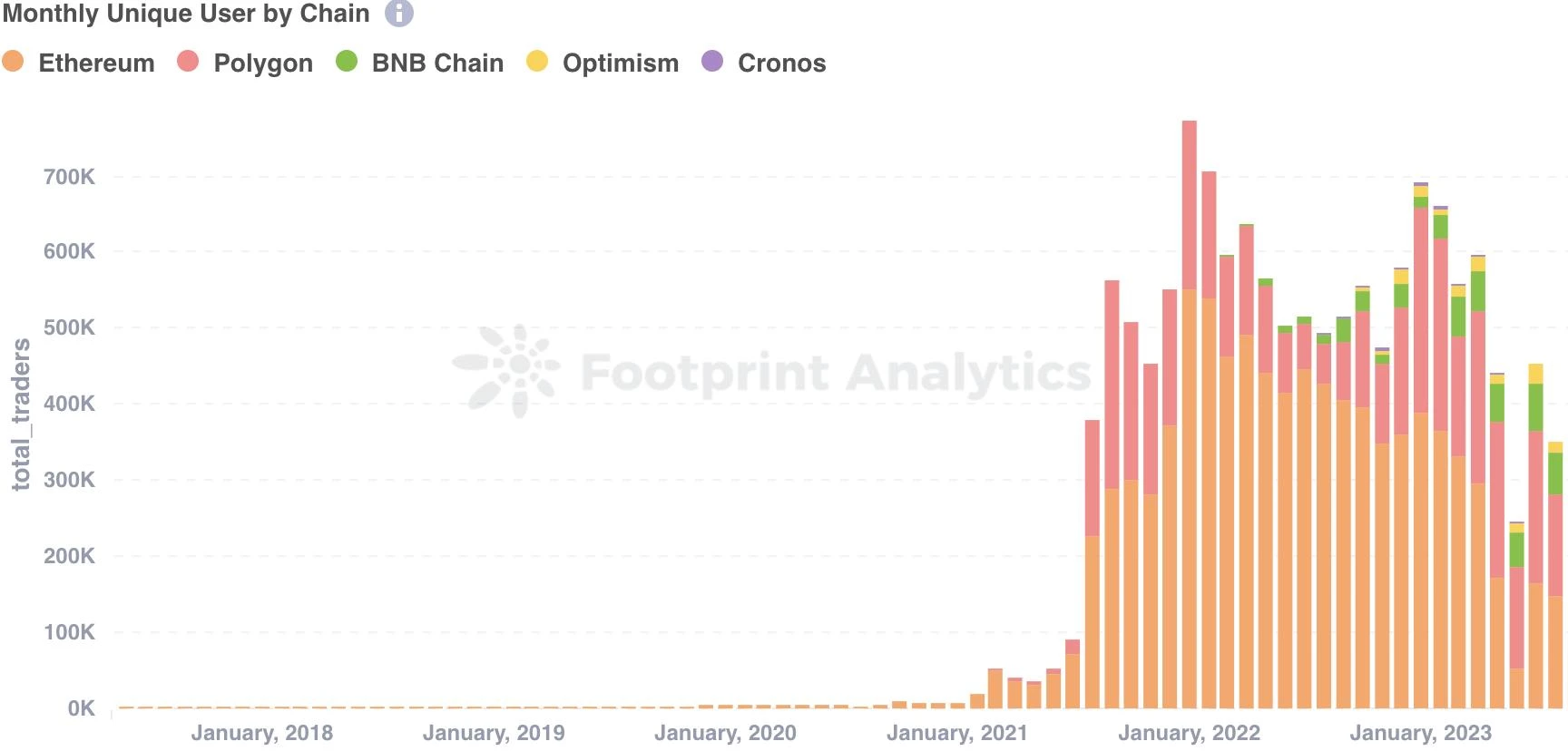

The number of independent users on Ethereum was 147,140, a decrease of 10.7% compared to July. It is noteworthy that after trailing behind Polygon for three consecutive months, Ethereum regained its leading position in the number of independent users.

Source: Monthly Unique Users by Chain

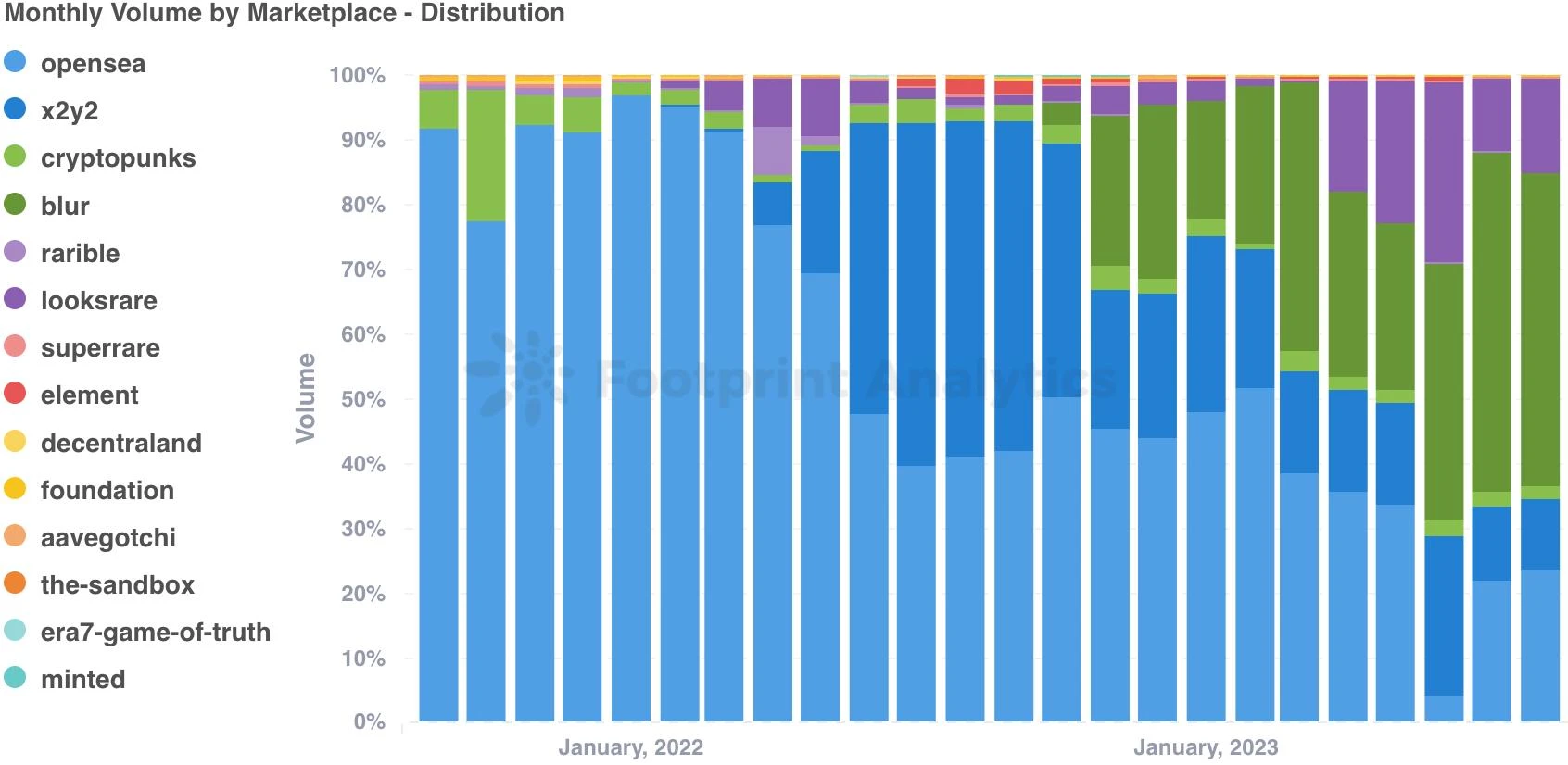

In the NFT trading market, Blur's leading advantage in trading volume continued to shrink, decreasing from 52.5% to 48.3%. In contrast, LooksRare showed an upward trend during the same period, with its market share increasing from 11.3% to 14.7%.

Source: Monthly Volume by Marketplace - Distribution

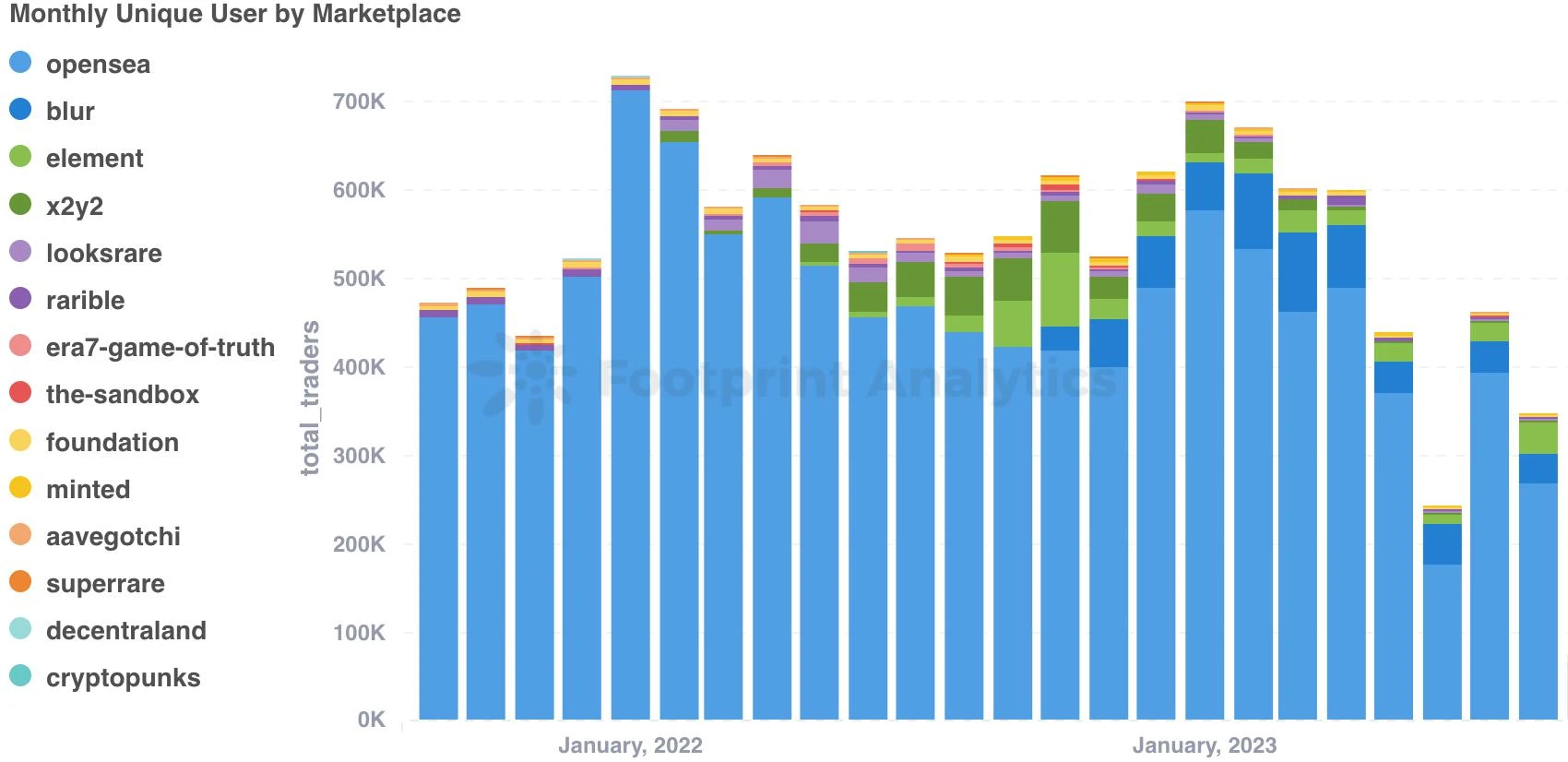

OpenSea still maintains its leading position in the number of independent users, with a large user base reaching 268,300. However, overall user activity in the industry has declined, leading to a decrease in the number of users using the platform.

Source: Monthly Unique Users by Marketplace

The NFT market is entering a period of adjustment, providing a valuable opportunity for the industry to explore innovation and upgrade its products.

OpenSea is actively working to establish industry standards for redeemable NFTs. On August 28th, OpenSea released its standards and roadmap for redeemable NFTs through a blog post. Redeemable NFTs have intrinsic value or utility and can be "redeemed" for another NFT, whether it exists on-chain or off-chain. These initiatives enable creators to build closer connections with their communities, promote more immersive membership experiences, and unlock new applications of Web3 technology. Notable examples of redeemable NFTs include GutterMelo by PUMA x Gutter Cat Gang, Invisible FriendsPhysical Collectibles, and Crowd Phase 3 by Creature World. Generally, the process of acquiring a new NFT through redemption involves the destruction of the original NFT. However, OpenSea's groundbreaking standards and user experience go beyond this traditional approach, introducing the concept of feature exchange.

Source: Invisible Friends - OpenSea

Redeemable NFTs are one of the most exciting applications of NFT technology, but they lack a standard. OpenSea has already released four improvement proposals (ERC-7496, ERC-7498, SIP-14, and SIP-15) and is actively seeking community feedback and partnerships to drive the development of future projects.

NFT Financing Situation

Similar to the previous month, the NFT market maintained a sluggish trend in August, with a total of 5 rounds of financing amounting to $14.45 million.

MasterExchange, a music investment trading platform, has raised $2.7 million in seed financing from investors, including Vectr Fintech, a Hong Kong-based venture capital firm, and Claes-Henrik Julander, CEO of Pan Capital.

MasterExchange provides an Initial Music Offering (IMO) system similar to an Initial Public Offering (IPO) to notify potential song investment opportunities to investors. Any rights holder, including artists and music labels, can initiate an IMO on the MasterExchange platform. Investors who purchase shares of song rights can receive income generated from song usage (such as streaming or commercial releases). MasterExchange provides comprehensive investment prospect information for each song, prioritizing transparency to enable users to make informed decisions.

Source: MasterExchange Website

This innovation allows music enthusiasts to interact with their favorite music in a novel and engaging way through NFTs. It provides artists with the opportunity to sell a portion of their future income, driving the development of artistic creation.

DRiP, an NFT issuance platform on the Solana chain, successfully raised $3 million in seed financing to accelerate the development of collectible content and Web3 social platforms. DRiP enables creators to send digital gifts to supporters every week. DRiP's flagship event is Showcase, a free art release curated by the DRiP team, showcasing the works of artists, animators, musicians, and other creators on Solana. Previous works include Solana Spaceman by bunjil, RIVALS by Flag Monkez, The UP Only Cet by Peblo, and Metropolis by Daramola.

Source: DRiP Website

FirstMate, a startup dedicated to providing digital storefronts for NFT creators, recently completed a $3.75 million financing round. The round was led by Dragonfly Capital, with participation from Coinbase Ventures and NextView. Unlike traditional trading markets, FirstMate prioritizes meeting the needs of creators by providing a unified platform. On this platform, artists can showcase all of their works, regardless of their source. Additionally, FirstMate grants artists complete control over royalties, ensuring that they have full control over their creative activities.

Source: FirstMate Website

Despite the recent inactivity in NFT financing, projects that demonstrate innovation and prioritize the genuine interests of creators and users continue to attract attention and support. While the overall market may have experienced a slowdown, there are still noteworthy attempts within the challenges. These projects not only bring novel concepts but also steadfastly commit to empowering creators and creating value for users. As the market adjusts and evolves, these innovative efforts serve as inspiring examples, demonstrating that there are still opportunities for growth and success in the NFT space.

Hot Topic of the Month: Royalties

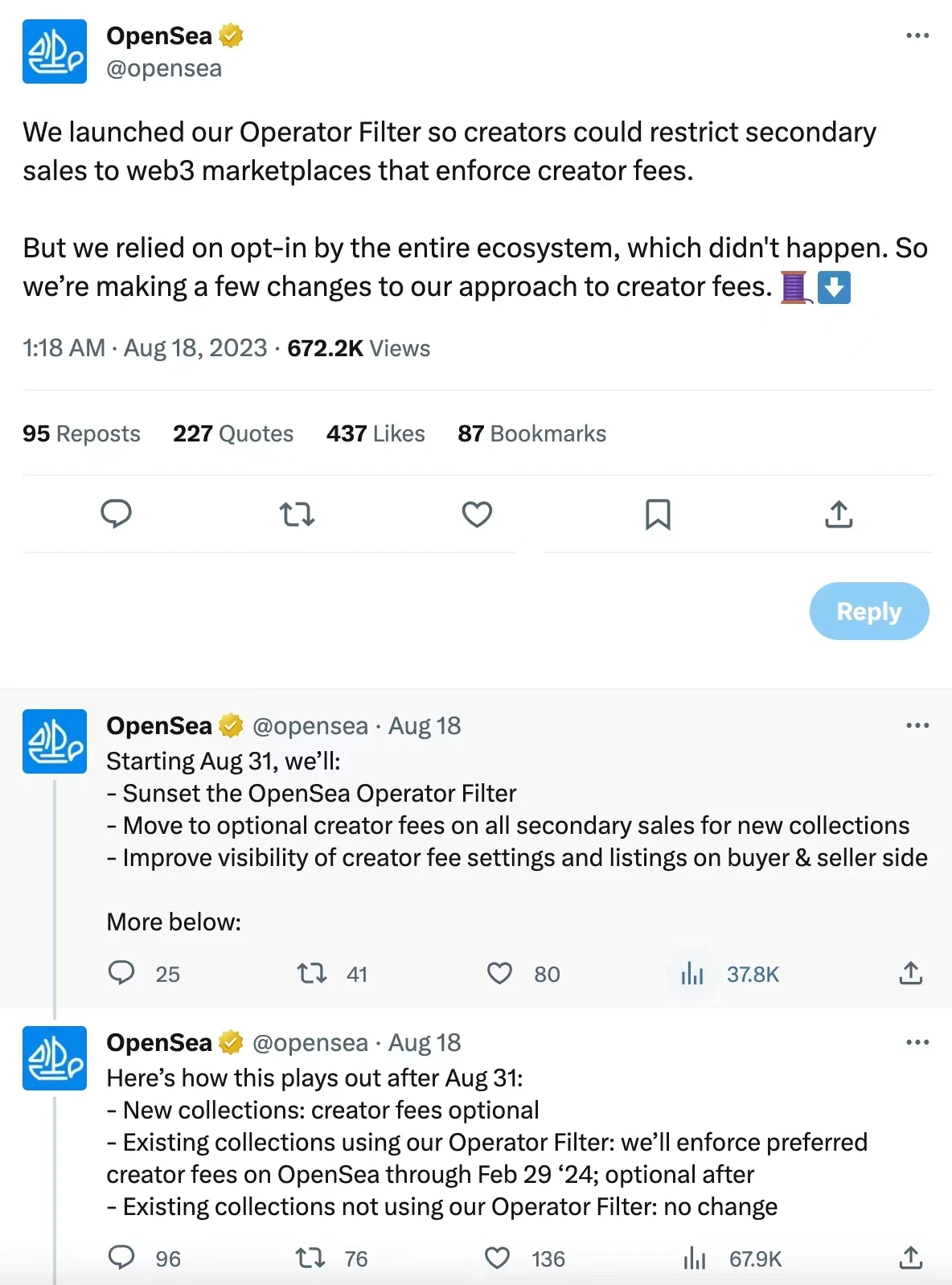

On August 18th, OpenSea announced that it will stop mandatory royalty fees starting from March 2024, making them optional. This decision highlights a shift in the market, as major trading platforms will no longer require mandatory royalties. For example, platforms like Blur and LooksRare have already adopted optional royalty models, while SudoSwap has implemented a zero royalty policy.

Source: OpenSea Twitter

OpenSea's decision has sparked various reactions. Supporters of the move see it as an important step towards finding a balanced approach that benefits both creators and buyers, while meeting the diverse needs and preferences of participants in the NFT ecosystem. However, Yuga Labs (BAYC creators) responded to OpenSea's decision by announcing that they will block the trading of their new NFTs on the platform.

OpenSea's announcement has caused a stir in the NFT community, sparking discussions about its potential impact on creators and the entire NFT ecosystem. As the NFT market continues to evolve, finding the right balance between attracting sellers, ensuring fair compensation for creators, and maintaining a competitive edge will be a delicate task.

The research report includes:

- Chains: Ethereum, Polygon, BNB Chain, Cronos, Optimism

- Trading Markets: OpenSea, LooksRare, Blur, X2Y2, Cryptopunks, Rarible, SuperRare, Foundation, Decentraland, Aavegotchi, Element, Era7, the Sandbox, Minted

This article is contributed by the Footprint Analytics community.

The Footprint Community is a global collaborative data community where members use visualized data to create impactful insights. In the Footprint community, you can get help, build connections, and exchange knowledge about blockchain-related topics such as Web 3, Metaverse, GameFi, and DeFi. Many active, diverse, and highly engaged members encourage and support each other in the community, contributing data, sharing insights, and driving the community's development.

Footprint Official Website: https://www.footprint.network

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。