This weekend's news is relatively calm, but there are still two exchange-related news worth paying attention to. First, the ftx claims website has reopened, bringing a glimmer of hope to users who have suffered losses. Second, the Jpex incident has affected the confidence of Hong Kong people, leading to doubts about the security of exchanges. This once again highlights that the risk of exchanges themselves is the biggest and most direct risk.

For traders, staying away from small exchanges should be their conscious choice. Although small exchanges may offer more investment opportunities, traders should choose exchanges with scale and reputation for trading due to issues such as imperfect regulation and high security risks. In a market full of risks and uncertainties, protecting one's funds is crucial.

In addition, there are many highlights in the market this week, which can be described as a "super central bank week." The Federal Reserve, the Bank of England, the Swiss National Bank, and the Bank of Japan will hold meetings successively, and these globally important economies will determine the next direction of interest rates. The most important of these is the Federal Open Market Committee (FOMC). According to recent macroeconomic data, US inflation is falling across the board, there are signs of cooling in the labor market, and the risk of a recession in the US economy is not high, and corporate profitability is improving. The current economic situation in the US is relatively good, which is favorable for risk assets.

Currently, the market generally believes that the Federal Reserve will not raise interest rates in September, so the market's focus has shifted from "how much more to raise" to "how long to continue." Therefore, we focus on Powell's remarks at the press conference and the new dot plot, which will have a significant impact on the market.

Bitcoin (BTC) has been fluctuating within the range of $25,300 to $26,800 for the past month. What we need to pay attention to is whether it can hold above $26,800 and whether it will fall below $25,300. Otherwise, this narrow range-bound pattern may continue for some time.

In addition, let's share three possible scenarios for the price of XRP

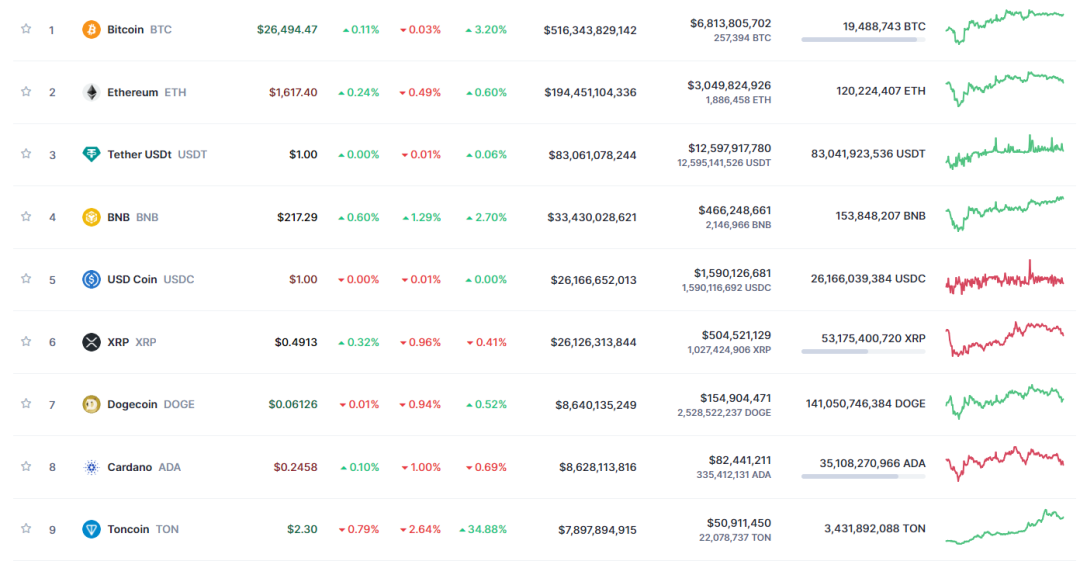

According to the latest data, the trading price of XRP is about $0.491. The cryptocurrency market is constantly changing, and XRP is no exception. We will delve into three possible scenarios for the recent price trend of XRP:

Scenario one: Bullish reversal. Despite the decreasing trading volume and EMA convergence (which is usually a signal that volatility is about to rise), XRP still has the potential to overcome difficulties. If the number of active addresses starts to climb and trading volume increases, we may see a bullish divergence. This would be a typical case of a shift in market sentiment towards the positive, potentially pushing the price higher above the moving average and avoiding the impending death cross.

Scenario two: Bearish continuation. The second scenario is not so optimistic. With the sharp decline in the number of active addresses and the convergence of EMA, the bearish trend may continue. If a death cross occurs, where the 21-day EMA is below the 200-day EMA, it could trigger selling. Decreasing trading volume will further push the price down.

Scenario three: Sideways drift. The third scenario is more uncertain, that is, sideways consolidation. Sometimes, when indicators give mixed signals, the market will choose the path of least resistance, often sideways consolidation. If the number of active addresses remains stable and trading volume remains low but stable, XRP may enter a consolidation phase. This means the price will hover around the current level, allowing both bulls and bears to catch their breath temporarily.

In summary, the future of XRP seems to be at a crossroads. The decrease in the number of active addresses and the convergence of EMA indicate that volatility is about to rise. However, whether this volatility will be upward or downward remains to be seen. But one thing is certain: as the death cross approaches, investors may be waiting for the right time to reduce their assets in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。