Original | Odaily Planet Daily

Author | Qin Xiaofeng

Recently, the bankrupt FTX has had many latest developments, and combined with Binance frequently facing "liquidity crises" questioning, it has further sparked market panic. With multiple factors stacking up, users' attention to CEX platform Proof of Reserves (PoR) has once again increased.

It has been 10 months since the collapse of FTX. Have CEX platforms that once claimed to enhance industry transparency and regularly release PoR reports truly fulfilled their promises?

Odaily Planet Daily conducted investigations on several platforms including Binance, OKX, Bitget, Kucoin, Bybit, HTX (renamed from Huobi), Gate, and Crypto.com, and found some interesting situations.

I. Binance and Other Platforms Regularly Release PoR Reports

Binance, OKX, Bitget, and Kucoin have been releasing PoR reports on time every month since November last year, following FTX's collapse, and providing users with Merkle Trees for open-source verification. Among them, Binance upgraded its system in January this year—using zk-SNARK technology to upgrade its reserve proof system, and "missed" one issue; Bitget also missed one report in February due to a platform-wide upgrade.

Among the other platforms, Bybit releases reports every two months, with a total of five PoR reports updated. HTX (renamed from Huobi) claims to update data at the beginning of each month, but the official website does not display past PoR reports. Currently, only data from September 1st can be viewed—some of the data involved in the subsequent statistics was captured from official announcements, which may not be complete.

(Gate report)

Gate currently only has "reserve proof" issued by a third-party auditing agency, with release times in May 2020 and October 2022. There has been no related data presentation since then, and no verification tool provided. Crypto.com has only released an asset proof in December last year, and the promised Merkle Tree asset proof has yet to be launched.

II. Binance Leads by a Wide Margin in Total Reserves, Multiple CEX BTC Reserves Rise

From the data collected by various platforms, Binance's total asset reserves lead by a wide margin, ranking first every month, even exceeding the sum of reserves of other platforms; OKX ranks second, consistently holding the second position after Binance; Bybit surpassed HTX (renamed from Huobi) to rank third starting from May this year. The changes in reserves for each platform are shown in the video below:

(CEX Reserve Ranking, click to play video)

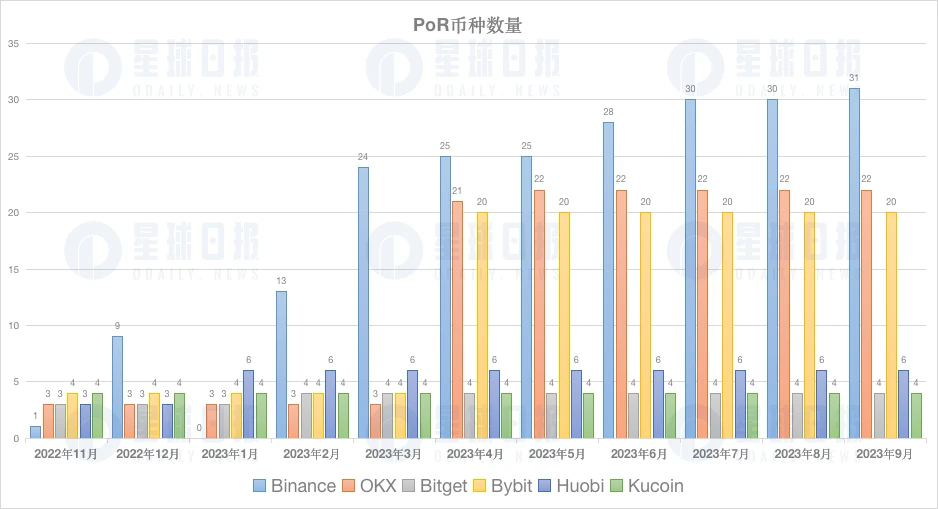

Overall, the asset reserves of various platforms have shown significant growth compared to when they were first disclosed. An important reason is that the number of currencies involved in reserve announcements is increasing. For example, in the case of Binance, the November 2022 report only disclosed BTC reserves, with the December report increasing to 9 types, and continuously increasing thereafter. The latest September report includes a total of 31 tokens, the most among all CEX PoR reports.

OKX is the second platform in terms of the number of currencies disclosed, increasing from the initial 3 types to 21 in April this year—currently 22; Bybit is next to Binance and OKX, increasing from 4 types in the early stage to the current 20. Bitget and Kucoin have remained at four—BTC, ETH, and two stablecoins (USDT, USDC).

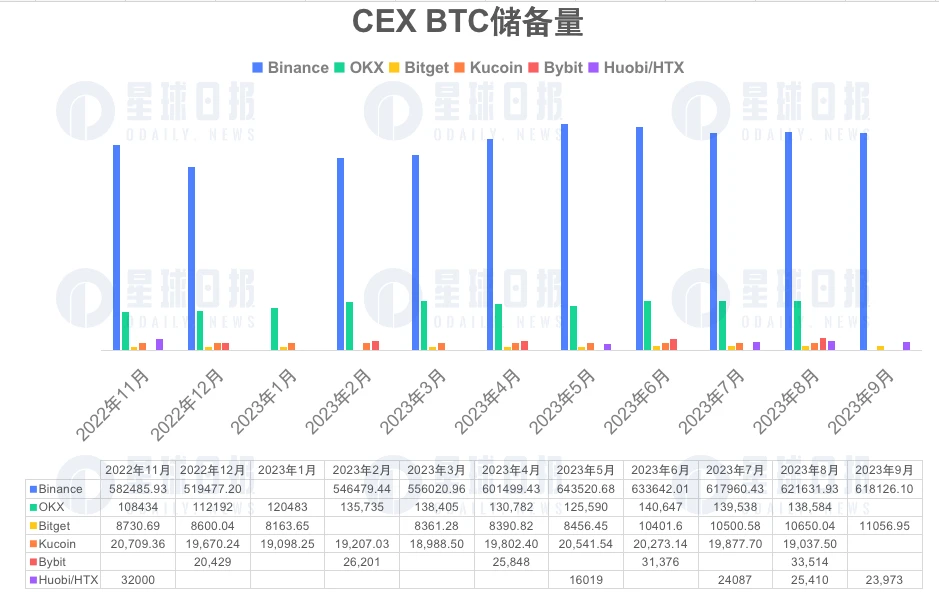

Another dimension to consider is the BTC reserve amount. Data from Odaily Planet Daily shows that Binance has the highest BTC reserve amount, currently around 618,000, followed by OKX (138,500). The BTC reserve situation for each platform is shown below:

Compared to 10 months ago, the BTC reserve amounts of Binance, OKX, Bitget, and Bybit have all shown significant growth, with increases generally exceeding 10%. Bybit has the highest increase at 64%, followed by OKX at 27.7% and Bitget at 26.6%; HTX (renamed from Huobi) has experienced the largest decline, with the BTC reserve amount once halved, and currently rebounding to 23,973.

The last indicator is the cleanliness of the reserves, i.e., the proportion of non-platform token assets in the total assets. Bitget and Kucoin's PoR reports did not involve the platform, so they were excluded. Among the other four, Bybit has the highest reserve cleanliness, with over 95% in the reports for April, June, and August; Binance follows closely, with reserve cleanliness consistently above 85%, reaching a high of 87.69%; OKX and HTX (renamed from Huobi) have reserve cleanliness between 50% and 60%, meaning close to 40% of the reserves are platform tokens—HTX includes HT and TRX in its platform token statistics.

III. Specific Reserve Analysis for Each Platform

Binance's total reserves have fluctuated from $9.451 billion when first disclosed in November 2022, reaching a peak of $69.905 billion in May this year; however, due to panic caused by the SEC lawsuit in June, there was a significant outflow of funds, resulting in a final figure of $65.343 billion for that month.

In the past 10 months, OKX has had several obvious changes: first, the BTC reserve amount has continued to rise; second, the stablecoin reserve amount has also grown, from an initial $3.06 billion to $5.43 billion, an increase of over 70%. However, the platform token reserve value of OKX has always been above $10 billion, accounting for over 40%.

Both the BTC reserve amount and the total asset reserves of Bitget have continued to rise, showing a positive trend, possibly benefiting from its strategy this year—being the first to obtain various new tokens and gaining high market attention. Bybit, like Bitget, has steadily increased both its BTC reserve amount and total asset reserves.

Overall, Kucoin has not had major changes. Additionally, according to Nansen data, the proportion of the platform token KCS in Kucoin's address is 12.7%, and its reserve asset cleanliness exceeds 85%.

Odaily Planet Daily will continue to track the asset reserve situation of various CEX platforms.

Recommended Reading:

"Traditional Auditors Exit, Where Will CEX Reserve Proof Go?"

"Analysis of Asset Reserve Details of Seven Major Exchanges, Who Has Exposed Potential Risks?"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。