Original Author: Packy McCormick

Original Compilation: Luffy, Foresight News

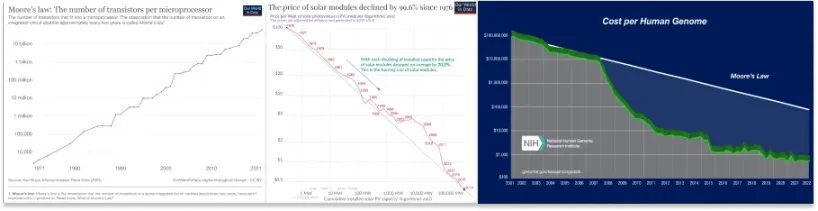

Any technology that has enough value in an ideal state will eventually reach that state.

The ideal state referred to here is the ultimate goal or highest potential that technology can achieve, under the premise that all problems are solved and the technology is widely adopted.

Understanding the ideal state may be the most important thing for technology to do in its early life, because if the ideal state represents enough value for enough people, then problems will be solved and technology will be popularized.

The prosperity and downturn of these technologies are useful noise. Prosperity can attract resources, and downturns are useful for restructuring, problem-solving, and charting the course for the next phase.

In any market cycle, the expectation of the ideal state is like a magnet, attracting new researchers, entrepreneurs, and investors to improve the work of those who have not achieved this goal. If you believe that the ideal state is achievable, then you will attribute previous failures to timing or improper schemes and continue to try new methods.

Artificial intelligence, autonomous driving, and augmented reality/virtual reality have stagnated for decades, consuming billions of dollars, and now they seem to be experiencing a breakthrough. This is capitalism: if the opportunity is large enough and feasible, ambitious people will continue to try to find ways to make it work. Even if thousands of dreamers die on the way, these dreams will not die.

Recently, there have been new voices claiming that cryptocurrency is dead. Prices are falling, activity is decreasing, and people are leaving the industry. I know, it's cruel and boring. But I am convinced that cryptocurrency is one of those dreams that will not die.

Half a month ago, I wrote an article "I, Exponential," which is a paean to capitalism. The ideal state of cryptocurrency is to make capitalism more efficient.

This is a grand claim, but it may also be too grand. Cryptocurrency is not lacking in grand claims, and I will describe my thoughts as specifically as possible in two parts:

Capitalism is good and it will continue to evolve.

Cryptocurrency makes capitalism more efficient.

Capitalism is good and it is constantly evolving

The way capitalism works is to incentivize people to act in their own interests and make it as easy as possible for people to do so. The way capitalism works is to allow anyone to propose the best solution for any problem they see in the market. Many will fail, but some will succeed.

This is the core principle of capitalism: incentivizing entrepreneurship and increasing the variance of inputs will lead to better results.

To believe my argument that making capitalism more efficient will make cryptocurrency valuable enough, we need to agree on two premises: capitalism is good, and capitalism is constantly evolving.

Capitalism is good.

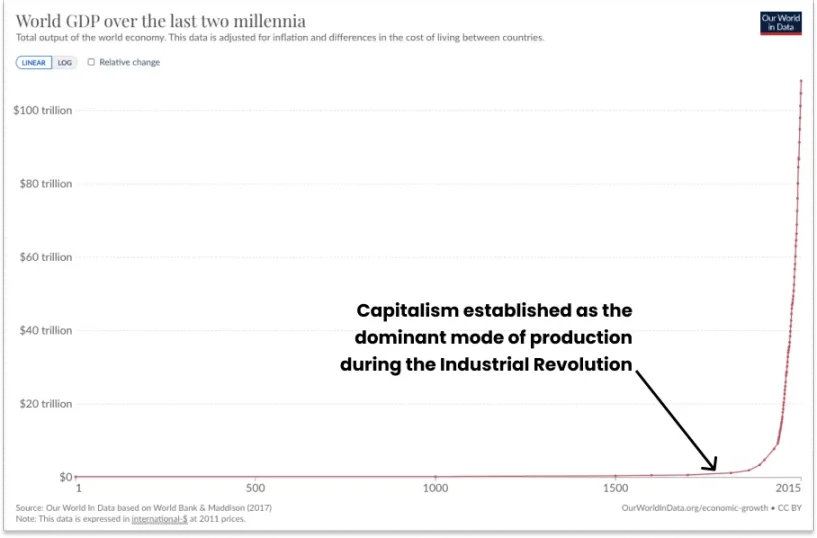

The invisible hand has created modern miracles by coordinating the actions of billions of "selfish" people. From the world's GDP over the past two centuries, it can be seen that the living standards and quality of life of billions of people around the world have improved (capitalism truly began in the 18th century).

As Robert Zubrin pointed out, not only has per capita GDP increased, but it has also "grown proportionally with the cube of the population size." Malthus was wrong in that, under capitalism, more people are not consumers of resources. More people who can contribute their best efforts or ideas are resources.

Capitalism is good, but it is not perfect. Fortunately, capitalism is evolving.

Capitalism is constantly evolving.

People tend to see capitalism as a static system that not only drives the development of goods and services enjoyed by humanity, but also evolves itself.

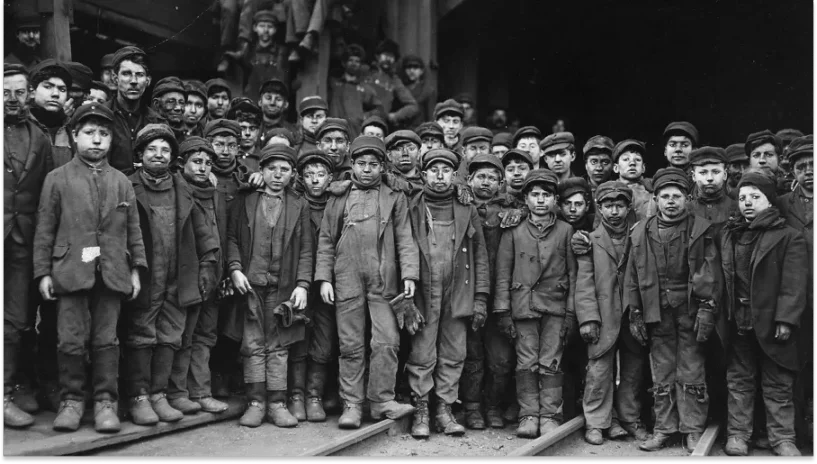

Think about the Industrial Revolution, the increase in productivity brought about wonderful results, just look at the GDP chart! But there was also a cruel side, with children as young as five or six working twelve to sixteen hours a day, usually seven days a week, in unsafe working conditions.

Child labor during the Industrial Revolution

Today, owning the means of production is still better than working them, but with the joint efforts of unions, journalists, regulatory agencies, and even progressive companies, working conditions for laborers have improved significantly. For example, Henry Ford implemented a 5-day, 40-hour work week in 1926, not out of kindness, but to test his theory that reducing working hours could improve worker morale and productivity.

Consider also the ambitious financing methods of technology companies. Before the 1950s, to develop and expand a new technology, you either needed to be wealthy enough to provide funding yourself, persuade a bank to lend to you, or build it within an existing company. Technology entrepreneurship was a barrier for ordinary people. When Sherman Fairchild wrote a $1.4 million check to form the "Traitorous Eight" and create Fairchild Semiconductor, a new financing model was born.

Venture capital, now known as venture capital, ignited the tech industry as we know it today. As Sebastian Mallaby wrote in his book "The Power Law," "This unique financial form, which transforms talent into products and combines unconventional experiments with commercial objectives, has nurtured a business culture that has made Silicon Valley so rich."

I don't believe we have reached the end of history or the end of capitalism. I believe cryptocurrency can make capitalism more efficient.

How cryptocurrency makes capitalism more efficient

What makes capitalism more efficient?

As shown by the two examples above, capitalism does not develop along a single trajectory. Improving working conditions and new financing models make capitalism more efficient.

Cryptocurrency may improve capitalism in many different ways. I asked Claude, an AI at Anthropic, what an ideal capitalism would look like, and he told me that while economists have not reached a consensus on the answer, there are some basic principles:

Strong property rights and contract enforcement.

Free markets, with prices determined by supply and demand.

Low barriers to entrepreneurship.

Benign competition among companies with low concentration of power.

Open trade and capital flows between countries.

Democratic processes that reflect the opinions and interests of the people.

Equal opportunities regardless of identity or background.

The combination of business interests and long-term social welfare.

Limited regulation focused on correcting market failures and protecting rights.

Sufficient funding from the government for public goods such as infrastructure, education, basic research, and social safety nets to mitigate the structural challenges of capitalism.

We may have objections to specific details, but this result is close enough to the ideal state. What surprised me is that the first seven read like a list of characteristics of an ideal world for cryptocurrency.

Cryptocurrency strengthens digital property and has self-executing smart contracts.

Now, I can obtain the current price of HarryPotterObamaSonic10Inu or a monkey jpeg purely based on supply and demand.

Composability, open-source code, and shared infrastructure make it relatively easy to launch new applications.

Competition forces protocols to have minimal value extraction.

Cryptocurrency is a 24/7 global market, with users and developers around the world.

Decentralized protocols rely on the governance of their holders.

The most popular new applications in the cryptocurrency space are built by anonymous developers.

If you read carefully, you will find that not all of these have reached the ideal state.

HarryPotterObamaSonic10Inu is a junk coin; who cares if you can find its price and trade immediately?

Governance also has issues: low voter turnout and easy manipulation by whales.

We can argue whether friend.tech is good or bad, but it is the most popular new application demonstrated by all the funds and efforts invested in the field so far, which is not worth celebrating.

Amidst all the chaos, there are signs that we are moving towards the ideal state. I found some particularly striking paths.

First, if you value the internet, giving digital assets physical properties (such as property rights) is a big deal.

For example, I wrote about the necessity of cryptocurrency, which allows people to control their personal AI models, a concept that now seems strange but will soon not be. It's one thing to lose your @x handle, and another to lose your girlfriend.

If you are starting a company, having computers that can make commitments is even more important. Just as entrepreneurial activity in society is determined by property structures, digital entrepreneurs need commitments that cannot revoke their access or restrict their allocations.

Companies built on-chain (based on L1 such as Ethereum and Solana, L2 such as Base, Optimism, and zkSync Era, and protocols such as Farcaster), must improve performance in multiple aspects (cost, speed, security, UX). In fact, protocols can incentivize developers to build on them and adjust incentives in the long term through protocol token ownership, an idea I wrote about in "Small Apps, Growing Protocols," which should accelerate this transition when performance trade-offs disappear.

The digital property guaranteed by blockchain has the potential to increase online entrepreneurial activity just like physical property does offline. Incentivizing entrepreneurship and increasing the variance of inputs will lead to better results. Or as Chamath said, "Some will work, some won't, but you always have to learn."

Second, compared to any other technology or platform to date, cryptocurrency can more easily create a global free market based on supply and demand, even for non-existent things.

Cryptocurrency provides the opportunity to apply free markets to almost everything. Decentralized exchanges like Uniswap are the first products that allow anyone to list any digital asset, provide initial liquidity, and create intermediary-free markets.

It is certain that the vast majority of things traded in today's cryptocurrency market are garbage—99% of all tokens and NFTs created in history are actually worthless. But noise is a feature, not a bug. 99% of websites on the internet are garbage. 99% of people's ideas about starting a company, explaining natural phenomena, or designing the next big technology are garbage. Capitalism is effective because it allows less than 1% of truly great people to emerge.

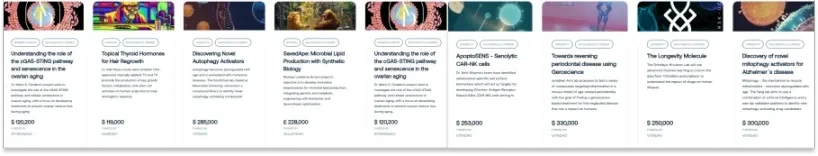

Molecule is one of my favorite examples of a new on-chain free market. It uses so-called IP-NFTs to fund scientific research by bringing "the rights of intellectual property and research data onto the chain, unifying the legitimate rights, data access, and economics of research projects into cryptocurrency on Ethereum." It has funded research on longevity, hair regeneration, autophagy, and Alzheimer's disease.

Projects funded by Molecule

Importantly, Molecule's potential is to reduce the influence of the free market to the research level, so that scientists can research what the market deems important.

On-chain, even less obvious assets like creativity can be created in a free market. I like Jacob Horne's prediction market concept and have tried my own entrepreneurial prediction ideas. You can imagine people staking their ETH on the outcomes they want to see, providing price signals before entrepreneurs take action. John Palmer of PartyDAO is building this toy model with Idea Guy Summer: buying NFTs to join the DAO, proposing ideas, holders voting on them, execution with enough votes, and all ETH must be spent by the end of Summer's last day (September 23). Currently, people are proposing to buy NFTs and convert ETH to USDC, but as more economic activity moves on-chain, these ideas may become more substantial.

Allowing any digital asset to find a free market based on supply and demand may have unpredictable effects, but it is foreseeable that putting existing assets on-chain is useful and has already begun.

Third, real-world assets are being put on-chain, which can lower the capital costs of businesses and projects, increase liquidity by entering a 24/7 global market, and lower the barriers to entrepreneurship.

The potential is enormous, and I believe this is the most obvious way cryptocurrency makes capitalism more efficient. When capital can more easily find suitable opportunities, with low friction and low transaction costs, capitalism becomes more efficient. When funds freely flow to the most promising businesses, products, or ideas, productivity and progress are maximized. Frictionless flow of capital allows for rapid redeployment when new opportunities arise, meaning less pointless loss when capital is soft. Lower transaction costs mean more capital is available for value-creating activities, rather than being extracted by intermediaries.

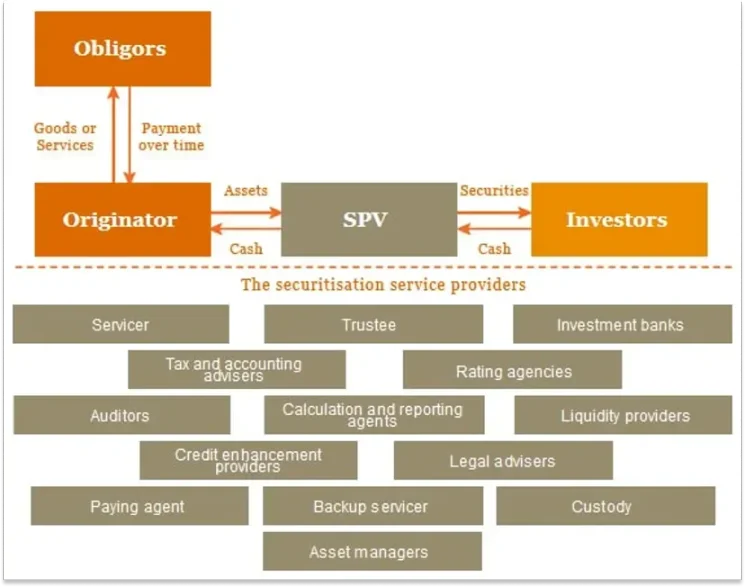

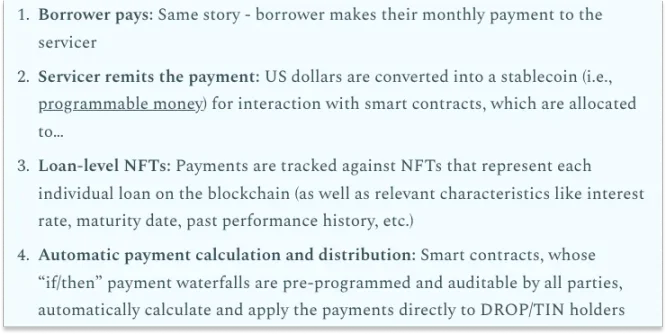

In the guest article "Everything is Broken" on "Not Boring," Kevin Miao of Blocktower explains his expectations for moving securitization onto the chain. Real-world asset (RWA) DeFi protocol Centrifuge streamlines the traditional funding process for securitization into four steps through code, down from nine steps and 14 participants in our $14 trillion securitization market. This process involves 14 participants…

Parties involved in securitization transactions, source: PwC

Source: Kevin Miao, Everything is Broken

Kevin Miao points out that streamlining the process not only lowers the basis points of capital costs—"with our $14 trillion securitization market, even a 25 basis point efficiency improvement would save borrowers $35 billion annually"—but a trusted, neutral, public, and open blockchain means developers can provide value-added services on Centrifuge.

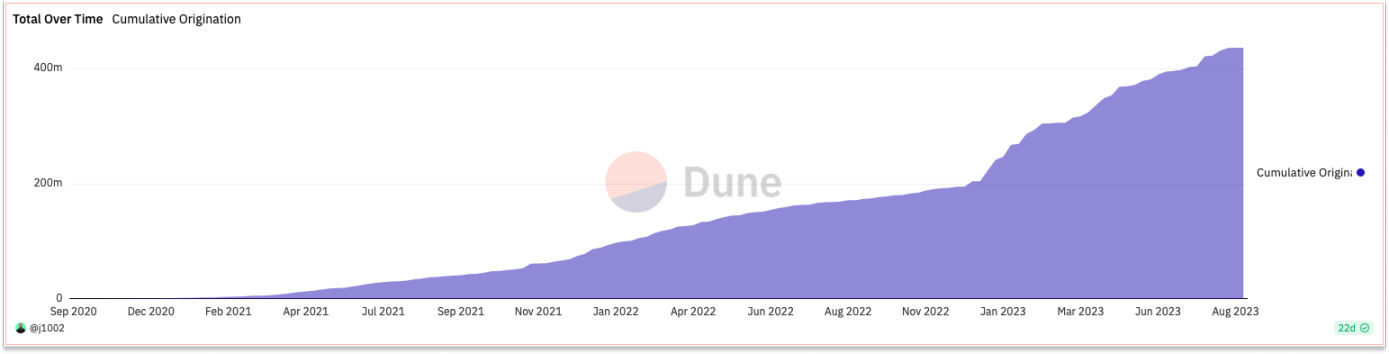

Despite being in a bear market, Centrifuge's total funds have more than doubled in 2023, reaching $436 million. This is insignificant in terms of the total securitization market, but the rapid growth is encouraging.

RWA DeFi may have a greater impact on markets traditionally lacking liquidity and accessibility.

Goldfinch and Jia provide loans to small businesses around the world. My sister works in small business lending in Africa, so I've heard horror stories of businesses having to pay high interest rates to access capital—sometimes as high as 12% per month. Both Goldfinch and Jia allow these small businesses to access global liquidity and cheaper capital on-chain, using off-chain assets and income as collateral. As they repay on time, small businesses build on-chain credit scores and access lower rates.

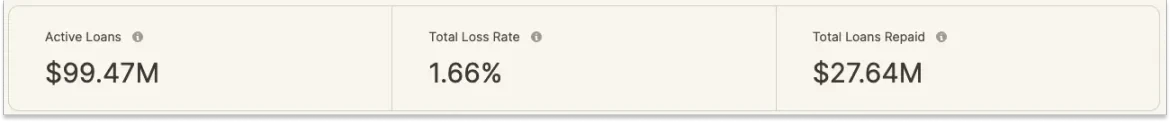

Jia just launched the first lending pool in Kenya and the Philippines this summer and has already seen strong early results. Goldfinch started lending in December 2020, with outstanding loans of $100 million, and after experiencing its first loss this summer, the loss rate is 1.66%, having recovered $27.6 million in loans.

Another project that caught my attention is Plural Energy, which allows people to invest in solar, wind, and battery storage projects for as little as $10, when the typical minimum investment is $50,000. Plural focuses on small to medium-sized projects lacking liquidity (too small for traditional infrastructure investors) and lengthy and complex underwriting processes.

By filing with the SEC (under Reg A+), Plural can tokenize equity in projects and use that equity as a wedge for DeFi. Over time, as developers hold their project's equity on-chain in token form, they will be able to borrow against that equity on-chain at lower capital costs than off-chain.

These are just a few examples of RWA DeFi, projects being built on-chain to eliminate friction, increase liquidity, and lower capital costs. They are early signs of helping global capital find suitable opportunities and driving the development of capitalism.

As time goes on, we will see more types of projects and assets going on-chain. In the ideal state, capital can flow at internet speed, making capitalism more efficient.

However, regulation remains a major bottleneck. Bringing assets like company stocks onto the chain is complex, especially in the United States. Ultimately, opportunities will force regulators to establish reasonable regulations. Large companies like Visa and JPMorgan have announced on-chain settlement products in the past week, and firms like BlackRock have applied for Bitcoin and Ethereum ETFs. As large institutions continue to see opportunities to lower costs and increase liquidity, I expect them to lobby the government.

Early signs of the ideal state of cryptocurrency—making capitalism more efficient—already exist. Cryptocurrency can provide property rights for developers, encourage more entrepreneurship, and increase the variance of inputs, which is the lifeblood of capitalism. It can create a free market for anything. It is starting to bring real-world assets onto the chain, allowing capital to flow more freely to the right places and lowering the barriers to entrepreneurship.

Even though these signs are overshadowed by the bear market, they are real,

We are still in the early days

To be honest: real-world cryptocurrency has not yet lived up to its written promises. There are highlights, but they are often overshadowed by bad actors, scams, and wild price swings.

I've spent a lot of time trying to explain what cryptocurrency has built so far, but the more I think about it, the less I understand it. For now, that's important.

In the gaming world, the lack of widespread practicality for cryptocurrency is to be expected. "We're too early!" is a phrase often quoted, but I think it's true.

Ethereum has been around for less than ten years, and it is the newest major technological platform we have. Artificial intelligence has been around for almost 70 years, and the origins of VR can be traced back to the 1960s with Headsight and Sensorama. Something like Bitcoin first appeared as electronic cash in Bruce Sterling's 1994 "Heavy Weather." Smart contracts didn't truly appear until Charles Stross's "Accelerando" in 2005 and Daniel Suarez's "Daemon" in 2006.

Cryptocurrency hasn't had much time to prove itself, and the time it has had has been spent in the whirlwind of the internet, which is both very good and very bad with money pouring in.

Very few science fiction works mention cryptocurrency, which may mean:

The value of this technology is not yet enough to warrant science fiction writers to imagine it.

This is a truly rare new idea.

I think it's the latter. If so, then we are still in the science fiction conceptualization stage of cryptocurrency. At this stage, people dream of potential use cases and ideal states when the technology runs perfectly, and people just happen to build through it.

HG Wells conceived the "world brain" in 1899, a very early idea of the internet. It took us a century to think about the impact of the internet before it flourished, and we finally came to this conclusion:

Bad websites of the 90s like Amazon, Apple, Disney, Coca-Cola, and Webvan

Although the start of the internet was awkward, and any company with a ".com" name made billions of dollars, the ideal state of the internet—connecting everyone in the world for communication and transactions—is clearly very valuable, so much so that researchers, entrepreneurs, and investors persevered through the crisis and built the internet we know and love today.

At this stage, it is most important to grasp the ideal state. With a valuable enough ideal state, everything else is implementation.

The ideal state of cryptocurrency is that it will make capitalism more efficient and accelerate progress in various industries. This has enough value for civilization, and people will pursue it in prosperity and adversity.

This is indeed happening. Talking about infrastructure investment at this stage of the cycle has become a cliché, but on-chain infrastructure has made huge progress in the past year.

L2 solutions like Optimism, Base, Arbitrum, zkSync, and Starknet are making block space cheaper. Innovations such as account abstraction, supersends, embedded wallets, and multi-party computation provide developers with tools to create smoother user experiences while retaining the advantages of cryptocurrency. Stablecoins are becoming infrastructure, as emphasized by Visa's announcement of using USDC on Solana to speed up merchant settlements. Researchers at Stanford University have even proposed the ERC-xR standard, which will make certain transactions reversible. I have spoken with numerous teams dedicated to correcting the flaws of cryptocurrency.

Despite price declines and lack of activity, the progress of infrastructure indicates that smart people still have confidence in the ideal state of cryptocurrency and are dedicating their careers to it. This also acknowledges that ordinary users will not want to make trade-offs: they will want the benefits of Web3 and the convenience of Web2. While I believe mass adoption is not important yet, it will be crucial at some point if cryptocurrency is to reach its ideal state. Entrepreneurs need to derive unique value from on-chain construction. Businesses will need to turn to cryptocurrency for their project financing, and lenders will need to seek funding opportunities there.

I believe the next decade will see faster progress and more economic opportunities than any previous decade. The wheels are turning, and this will happen with or without cryptocurrency. However, my hope is that by bringing more capitalist engines onto the chain, we will accelerate this process and allow crazier ideas to flourish.

As everything becomes decentralized, cryptocurrency can further push capitalism to the edge, reducing the costs of market transactions and benefiting individuals and entrepreneurs.

Capitalism is good, and capitalism evolves. I believe cryptocurrency can play a role in this evolution. With a valuable enough ideal state, this is inevitable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。