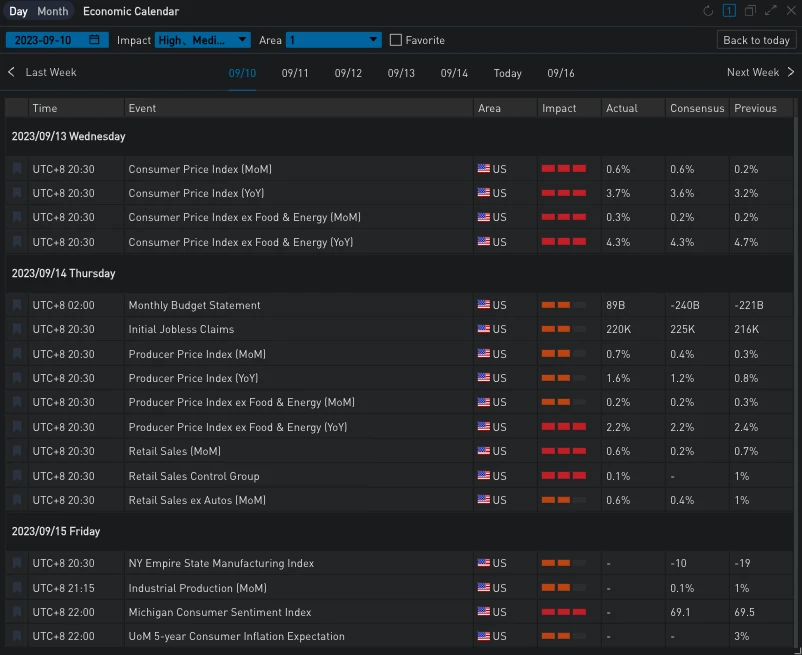

On Thursday at 8:30 PM (UTC+8), the United States released a series of heavyweight data, including a 0.6% monthly retail sales rate for August, exceeding the expected 0.2%; the PPI monthly rate recorded 0.7%, marking the largest increase in over a year, surpassing the expected 0.4%. Further data analysis shows that the surge in oil prices is the main reason for the rise in the PPI index. Influenced by the strong U.S. data, the U.S. dollar index surged significantly in the pre-U.S. session, breaking through the 105 level; U.S. bond yields rose across the board, with the two-year yield returning above 5%.

Source: SignalPlus, Economic Calendar

Yesterday, the three major U.S. stock indexes collectively closed higher, rising by about 0.8% to 0.9%, and cryptocurrencies closely followed suit, helping BTC achieve a 4-day consecutive rise and smoothly surpass the 26,500 level, closing up by 0.97%; ETH also stabilized above 1600, closing at 1628.67 (+0.62%).

Source: Binance & TradingView

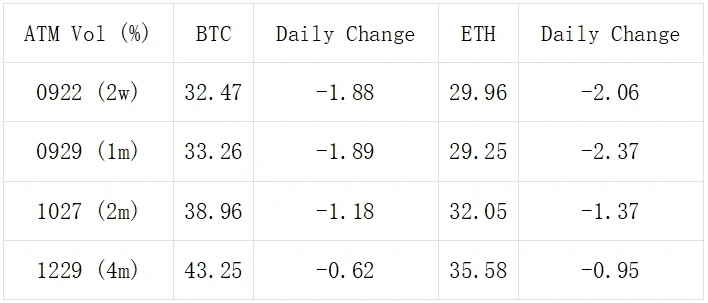

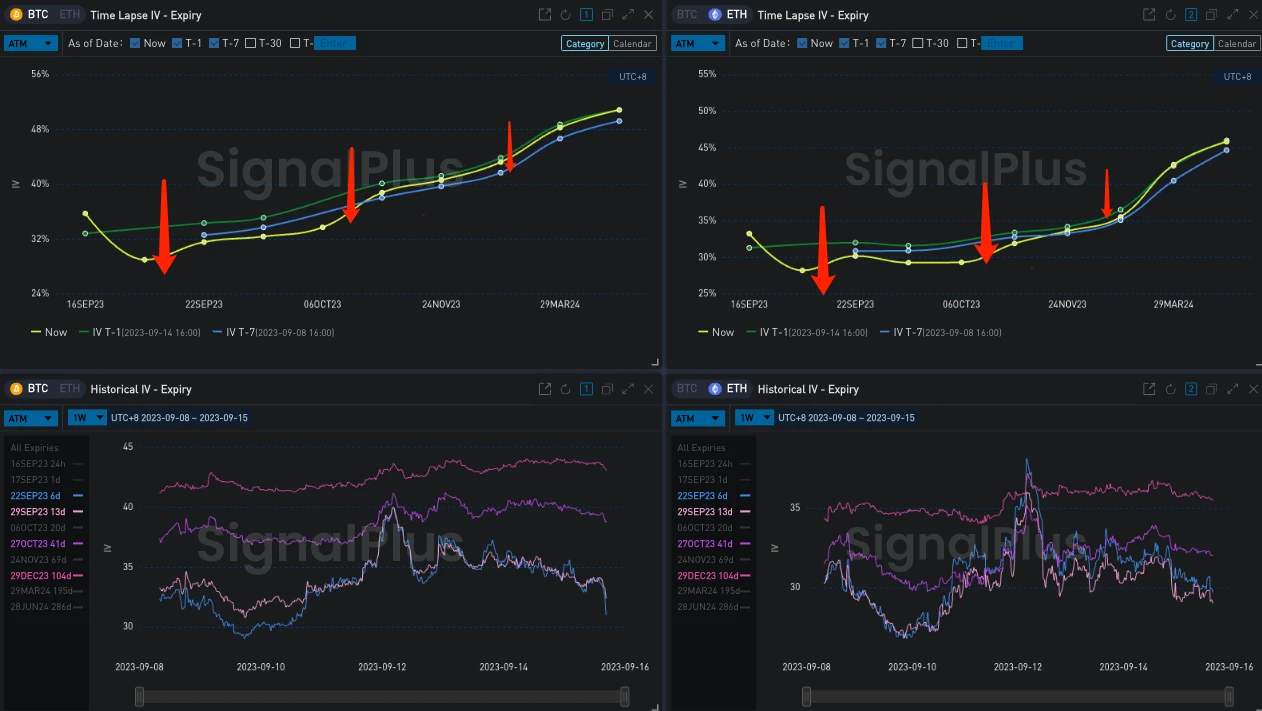

After the release of yesterday's data, the market almost locked in the expectation that the FOMC meeting next week would not raise interest rates (98% probability). Implied volatility has continued to decline, with September IV for BTC/ETH falling by about 2% as of today's settlement, and medium- to long-term IVs have also shown declines of around 0.5% to 1.2%.

Source: Deribit (as of 15 Sep 16:00 UTC+8)

Source: SignalPlus

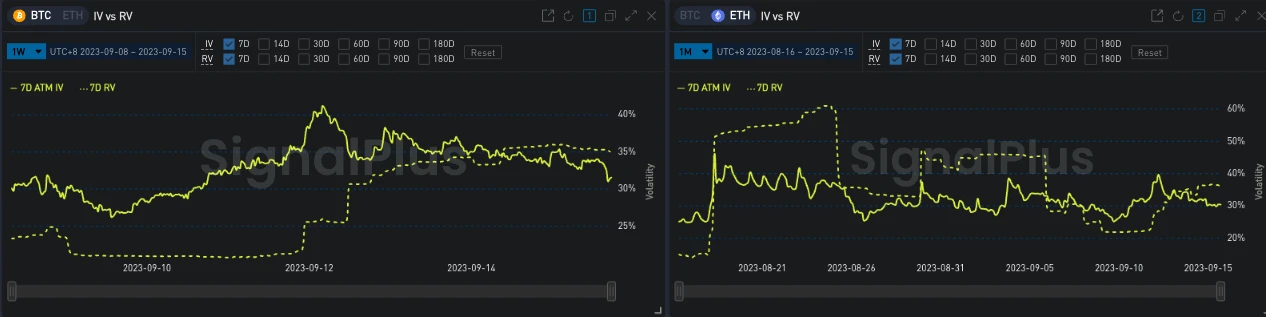

It is worth mentioning that this week, the volatility of cryptocurrencies has rescued the actual volatility (7d) of BTC/ETH from the bottom of nearly 20% back to around 30%, and short-term IV has fallen below RV after yesterday's decline.

Source: SignalPlus

In terms of trading, due to the market almost pricing in the expectation of no interest rate hike by the FOMC, there has been a large amount of selling of BTC next-period options at the 25,500-P and 27,500-C positions, almost flattening the IV premium for this term.

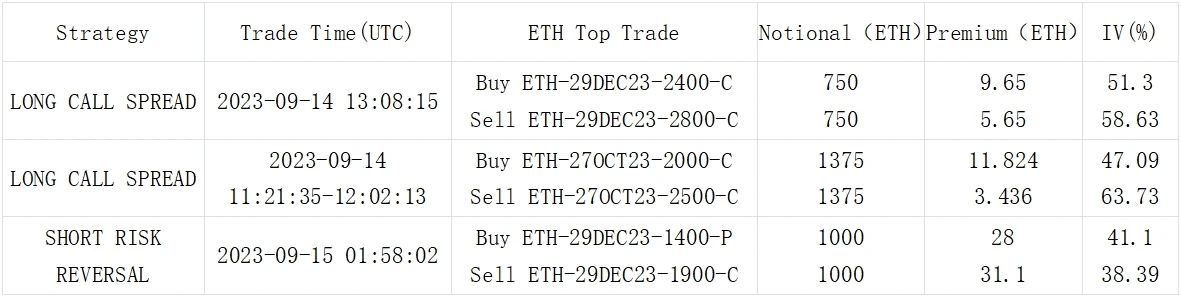

On the other hand, the recent stable price increase has strengthened traders' confidence in long-term investment, and the bulk market has seen many far-term Call Spread trades represented by BTC-28Jun24 50000 vs55000 and ETH-29Dec23 2400vs2800.

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the PluginStore of ChatGPT 4.0 to get real-time crypto information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and exchange ideas with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。