Due to the expected possibility of a soft landing for the US economy, coupled with the surge of newly listed technology stocks, all three major US stock indexes rose across the board. In this context, Bitcoin has rarely shown a three-day consecutive uptrend. However, Bitcoin faces an important resistance level at $26,800-$27,200, and this price range is crucial. If Bitcoin can break through and stabilize within this range, it is likely to usher in a trend of upward movement. Conversely, if it fails to break through this resistance level, Bitcoin will continue to fluctuate mainly between $25,300 and $26,800.

Due to the expected possibility of a soft landing for the US economy, coupled with the surge of newly listed technology stocks, all three major US stock indexes rose across the board. In this context, Bitcoin has rarely shown a three-day consecutive uptrend. However, Bitcoin faces an important resistance level at $26,800-$27,200, and this price range is crucial. If Bitcoin can break through and stabilize within this range, it is likely to usher in a trend of upward movement. Conversely, if it fails to break through this resistance level, Bitcoin will continue to fluctuate mainly between $25,300 and $26,800.

In addition, considering the impact of the FTX liquidation process, some traders may adopt over-the-counter trading methods, and the market seems to have a sense that the bearish factors have been exhausted. Please pay attention to the changes and dynamics of the market.

As Bitcoin and other cryptocurrency markets continue to experience sideways fluctuations, whales are filling their "pockets" with more Bitcoin. According to data from on-chain tracking institution Santiment, the supply share held by whales holding over 10,000 BTC increased from 10.6% in October 2021 to 11.7% in August 2023.

At the same time, the number of Bitcoin holders is also increasing. Since the end of 2021, the number of Bitcoin holders has increased from 38 million to nearly 49 million. Despite facing a bear market and increased regulatory scrutiny, the number of holders continues to grow. The latest report from Glassnode shows that as of August, the supply of Bitcoin held by long-term holders reached a historical high of 14.74 million coins, while the supply held by short-term holders dropped to the lowest level since 2011.  Whales are not only focusing on Bitcoin but also accumulating other cryptocurrencies such as Ethereum and Litecoin.

Whales are not only focusing on Bitcoin but also accumulating other cryptocurrencies such as Ethereum and Litecoin.

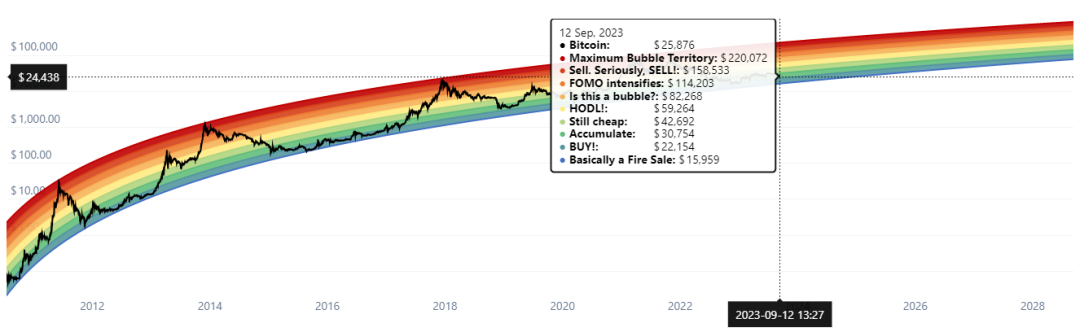

By analyzing the historical price data of Bitcoin, it can be observed that Bitcoin may currently be in an oversold state, identified as an accumulation zone by the rainbow chart. This means that accumulating more Bitcoin at the current price level (approximately $26,000) may be a good choice.

Although it is not guaranteed that Bitcoin will follow past price patterns, most investors seem to be focusing on the next Bitcoin halving event, expected to take place in April 2024. According to historical trends, each halving event has triggered a new market cycle, leading to new highs for Bitcoin. For example, in 2013, the price of Bitcoin reached $1,170, in 2017 it reached $19,400, and in 2021 it soared to $68,770.

Although it is not guaranteed that Bitcoin will follow past price patterns, most investors seem to be focusing on the next Bitcoin halving event, expected to take place in April 2024. According to historical trends, each halving event has triggered a new market cycle, leading to new highs for Bitcoin. For example, in 2013, the price of Bitcoin reached $1,170, in 2017 it reached $19,400, and in 2021 it soared to $68,770.

Although it is difficult to predict what kind of price activity the next halving will bring, there are some signs that we can anticipate based on historical trends. By examining the price performance of Bitcoin before and after the past three halving events, it can be seen that Bitcoin experienced impressive price uptrends after the first and third halvings, while it suffered minor losses in 2016.

Returning to the current market situation, I will share my general expectations for the Bitcoin market in the coming months

First, from late September to late October, Bitcoin will gradually start to rise and experience an upward trend. Then, from late October to the end of December, Bitcoin may undergo a slow decline and eventually reach the second bottom of this bear market, expected to be around $20,000. However, it is unlikely that Bitcoin will drop below $15,000 and return to previous lows, as there are too many people waiting to buy the dip. If I were a market maker, the best strategy would be to initiate a sharp drop to lure short positions, but not to drop too low. I expect Bitcoin to possibly break through $20,000 and trigger a large number of people to short the market when there is a lot of talk about breaking the previous low, while also causing those waiting to buy the dip to miss out.

Starting from January next year, Bitcoin will gradually resume its upward trend and continue until BlackRock launches a spot ETF. It is important to note that this is just a general framework expectation for the future market, and more adjustments will be made based on real-time conditions. This is also a long-term forecast for reference only!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。