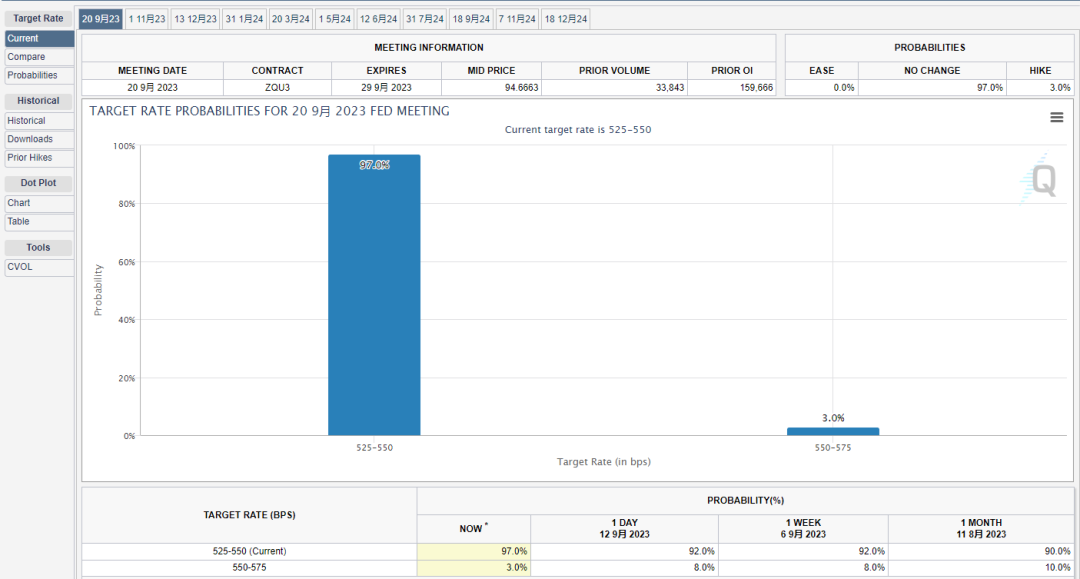

Last night's CPI data showed that the year-on-year increase in the US CPI in August rose to 3.7%, while the year-on-year increase in core CPI fell to 4.3%. This data basically meets market expectations, so the probability of the Fed not raising interest rates in September has reached 97%, while the expectation of a 25 basis point rate hike in November has dropped to 40.8%.

At the same time, FTX has been approved by the court to liquidate its over $3.4 billion in crypto assets. As we enter September, the market faces many challenges, with mixed news and extreme market volatility. This intense washing behavior is likely intentional by major funds, aimed at washing out those with unstable chips. Looking at the trend, BTC has formed a strong support at $25,300, returning to oscillate within the range of $25,300 to $26,500. The key resistance level is at $26,800, and once broken, a trend of upward movement may occur. The key support level is at $25,300, and once broken, a probable downtrend may occur. Otherwise, the market will mainly oscillate sideways.

Regarding the issue of FTX asset auctions, according to official information, FTX holds approximately $3.4 billion in crypto assets, including SOL, BTC, ETH, APT, USDT, XRP, BIT, STG, WBTC, and WETH, among many other currencies. These currencies account for 72% of FTX's total crypto asset holdings, while the remaining 28% is made up of over 400 other tokens. In addition, FTX also owns 38 properties in the Bahamas worth approximately $222 million.

As for whether these assets will trigger a sell-off and lead to a market collapse, according to the official explanation, FTX only allows the sale of tokens equivalent to $1 billion per week (certain specific tokens can be increased to $2 billion). In addition, FTX has hired Mike Novogratz, CEO of Galaxy Digital, as an advisor, and Galaxy Digital is handling the over-the-counter (OTC) sales of FTX assets. Therefore, it can be considered that FTX's assets will not enter the public market, thus avoiding the risk of triggering a sell-off and causing a market collapse.

Although the cryptocurrency market is highly volatile, it also presents significant opportunities. To succeed in this field, we need to remain flexible and seize the timing of the end of the bear market and the beginning of the bull market. Characteristics of a bull market include rising prices, optimistic investors, increased trading and media coverage, and low interest rates. It is expected that 2024 may usher in a bull market, as the value of cryptocurrencies is expected to increase significantly with industry development and technological innovation.

To prepare for the next bull market, investors should strive to learn as much as possible about cryptocurrencies and blockchain technology, and use technical analysis to aid decision-making. At the same time, risk management and staying informed are also crucial. Joining the cryptocurrency community, attending conferences, and collaborating with other enthusiasts can also enhance one's investment capabilities. Predicting the future of the market is difficult, but through preparation and learning, we can better seize opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。