Market News

The listing application for Bitcoin spot ETF has attracted widespread attention in the market. Franklin Templeton, a globally renowned asset management company with nearly $1.5 trillion in assets under management, has joined the competition, signaling the entry of traditional asset management companies into the Bitcoin market, intensifying the competition for Bitcoin ETFs.

According to court documents, Franklin Templeton plans to launch a Bitcoin spot ETF named "Franklin Bitcoin ETF," which will be listed on the Cboe BZX Exchange, a securities exchange under the Chicago Board Options Exchange (CBOE). Coinbase Custody Trust Company will be responsible for custody, New York Mellon Bank will serve as the cash custodian and manager, and Delaware Trust Company will act as the trustee. This arrangement demonstrates Franklin Templeton's serious attitude towards building a Bitcoin ETF.

Meanwhile, the chairman of the U.S. Securities and Exchange Commission (SEC) stated at a Senate hearing that they are reviewing the decision on Bitcoin spot ETFs. In addition to Grayscale, multiple spot ETPs are also awaiting SEC review. This indicates a changing attitude of the SEC towards Bitcoin spot ETFs, which is undoubtedly positive news for institutional investors.

Stimulated by the news, the price of Bitcoin briefly surged to $26,500, but has since slightly retreated to $25,960. Data shows that the open interest of Bitcoin perpetual contracts on the Binance platform has reached a new low in 8 months at $2.384 billion, resulting in $256 million in liquidation losses. In the absence of liquidity, manipulating contracts has become an important method for institutional profit. In addition, the CPI data released in the evening also received significant attention. The price of Bitcoin experienced significant fluctuations, briefly dropping below $25,300 before quickly rebounding and oscillating in the $25,300-$26,500 range. $25,000 is considered a strong support level, reminding everyone to pay attention to two cost prices: the market cost price is in the $25,000-$26,000 range, and the mining cost is in the $15,000-$16,000 range, indicating that the market bottom may form between these two cost prices.

Is There Still Opportunity for ARB?

The recent sharp decline in ARB prices, reaching a drop of 32.61%, far exceeding other Layer2 solutions, has raised concerns among investors. We believe that the main reasons for the decline in ARB prices are as follows.

First, the governance proposal of the Arbitrum decentralized autonomous organization (DAO) may have an impact on the price. One proposal suggests allocating up to $75 million worth of ARB from the treasury to support the short-term needs of DApps, but even if approved, this allocation would be less than 2% of the DAO treasury, thus having limited impact on the ARB price.

Secondly, a governance proposal proposed by PlutusDAO on September 9 suggests returning tokens to ARB holders through a collateral mechanism, involving 2% of the total supply. Some investors believe that this inflationary method is inappropriate and will put pressure on the price.

In addition, the liquidation risk of leveraged trading has also affected the price. Generally, when the price falls, leveraged long positions will be forced to close, highlighting the need for holders to closely monitor Arbitrum's recent activities and deposit trends to understand the reasons for price changes.

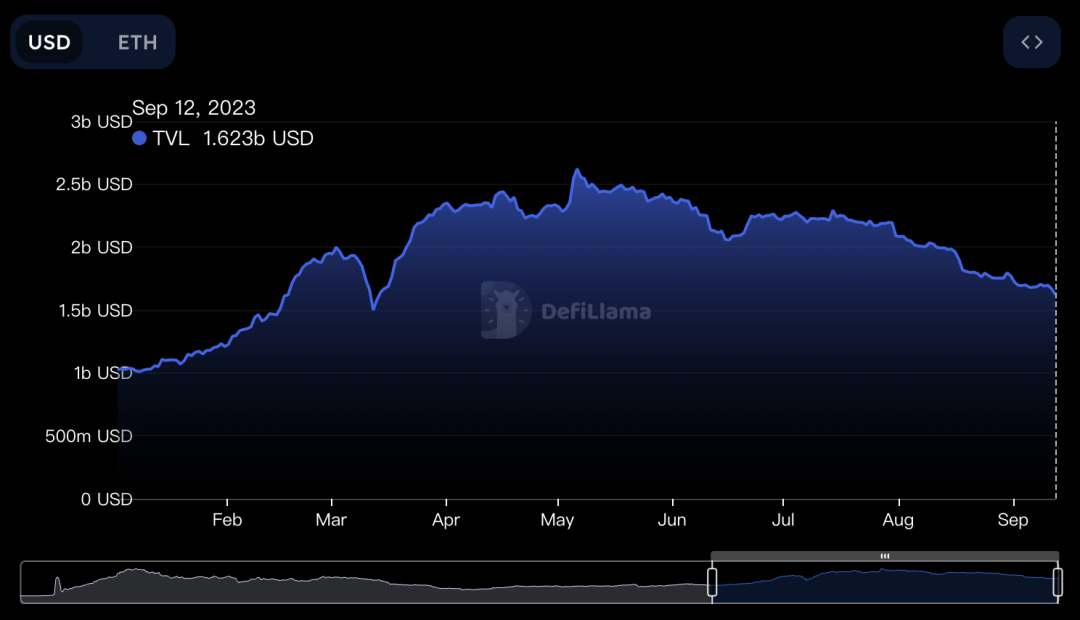

Arbitrum's TVL has dropped to $1.62 billion, a new low since mid-March, decreasing by 25% in the past two months, reflecting a decline in holder confidence. This not only affects liquidity and disrupts the project's health, but also hinders the entry of new users, further impeding the network's expansion.

In addition, the number of active addresses of some well-known DApps has significantly decreased in the past 30 days. The decrease in TVL and user activity indicates a reduced demand for the network. This may be due to the impact of the rise of competing chains such as zkSync Era and Base.

The decline in ARB prices is attributed to dissatisfaction with the governance mechanism and a decrease in network activity. If it cannot increase trading volume and user base, ARB's price may be left in an awkward position compared to its competitors.

It is not a good time to enter ARB at the moment. Its key support level is gradually declining, and there is no clear bottom. Consider establishing a spot position when the following two conditions are met:

When BTC retraces and volume increases after bottoming out and consolidating.

When ARB's price volume reclaims the key support/resistance level.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。