Original Author: Lisa, LD Capital

1. Company Introduction

Beijing Pop Mart Culture and Creative Co., Ltd. was established in 2010 and is a leading trend culture and entertainment company in China. Over the past decade, POP MART has built a comprehensive operation platform covering the entire trend toy industry chain, focusing on global artist exploration, IP incubation and operation, consumer reach, trend culture promotion, and innovative business incubation and investment. On December 11, 2020, Pop Mart International Group Limited was listed on the main board of the Hong Kong Stock Exchange.

On August 22nd this year, Pop Mart (09992.HK) released its 2023 interim performance, with significant recovery in core business indicators, net profit of 477 million yuan exceeding the total for the entire previous year, and overseas business maintaining a high-speed growth momentum, with a 140% year-on-year revenue increase. According to historical performance data, Pop Mart's performance in 2022 ended the previous trend of continuous growth, with revenue increasing by only 2.67% and net profit experiencing a negative growth of 44.32%. Pop Mart's stock price also plummeted by 70% from its peak of over 100 Hong Kong dollars. As the pandemic recedes and the economy returns to normal, the financial report data provided by Pop Mart seems to reveal that it has emerged from its "darkest moment." Pop Mart's Chairman and CEO, Wang Ning, stated at the performance meeting, "We are confident that our overseas business will reach 1 billion yuan this year; we are confident that next year's overseas revenue will exceed the total revenue of the entire group before the 2019 IPO, equivalent to creating another Pop Mart overseas," bringing strong expectations to investors.

2. Business Data

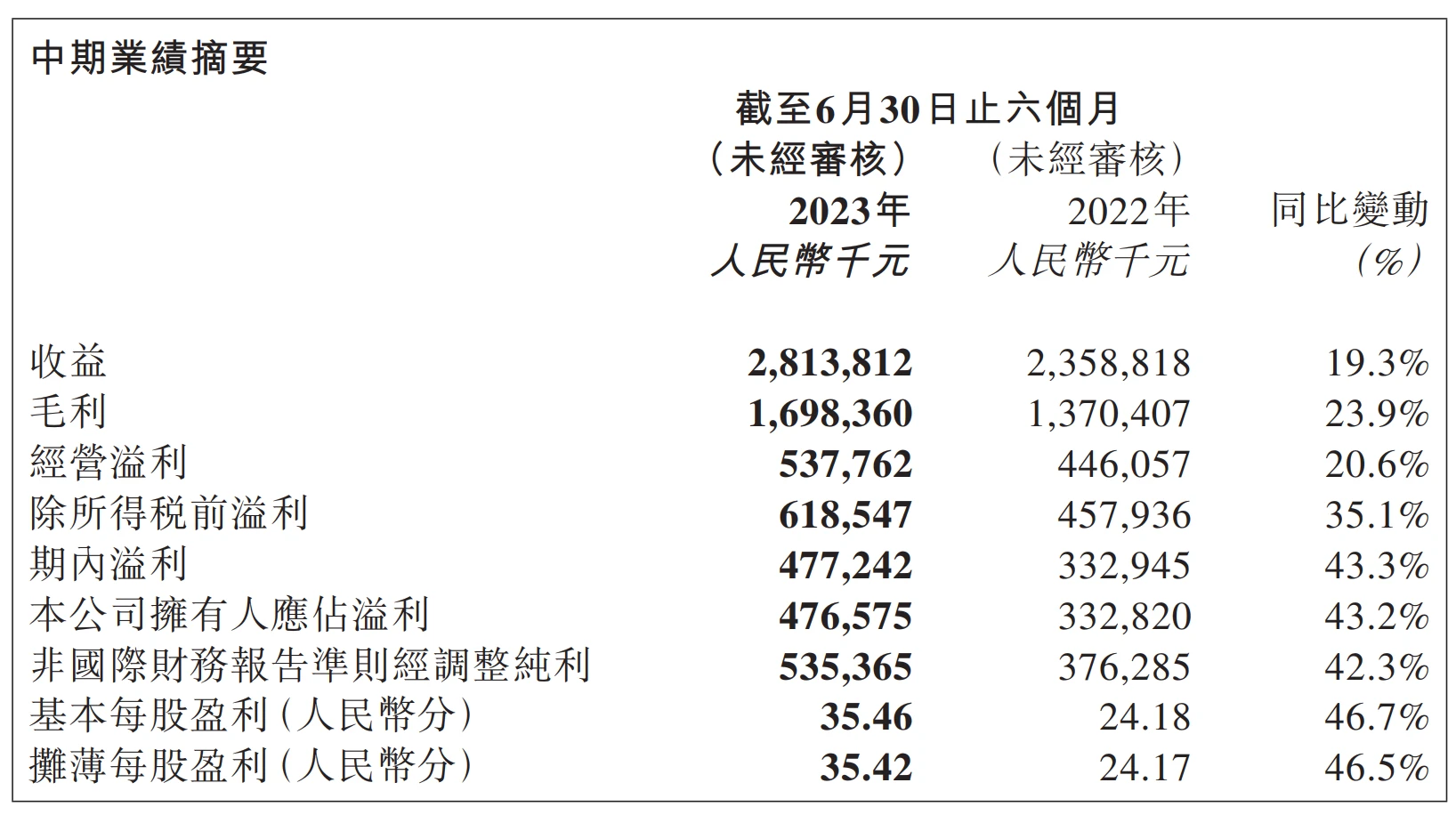

In 23H1, Pop Mart achieved a revenue of 2.814 billion yuan, a year-on-year increase of 19.3%, and an adjusted net profit of 535 million yuan, a year-on-year increase of 42.3%. The net profit attributable to the parent company was 477 million yuan, a year-on-year increase of 43.2%.

Significant recovery in domestic offline market, surge in sales through Douyin online channel

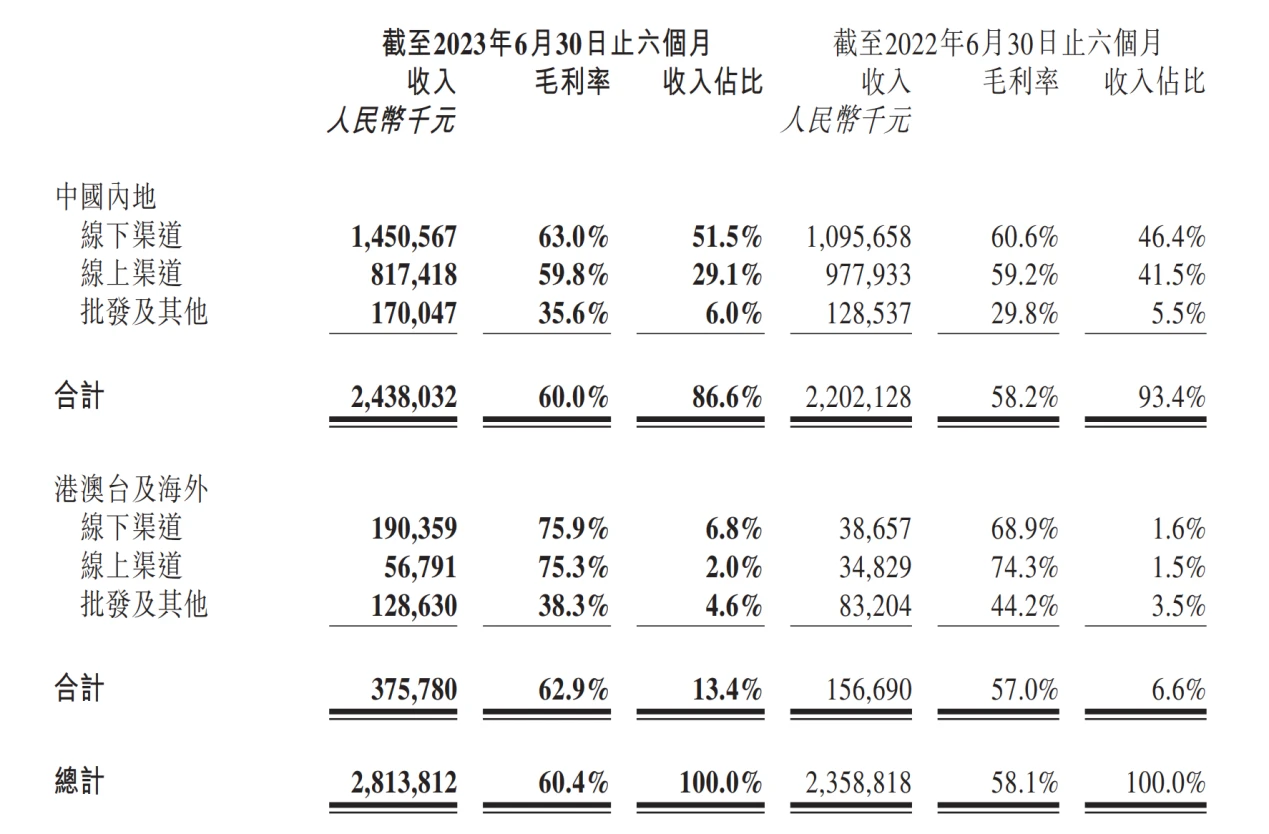

Mainland China's revenue in 23H1 was 2.438 billion yuan, a year-on-year increase of 10.71%. The domestic user base steadily grew, with 4.384 million new members added in 23H1, bringing the total membership to over 30.38 million, accounting for 92.2% of sales and a repeat purchase rate of 44.5%.

By sales channel:

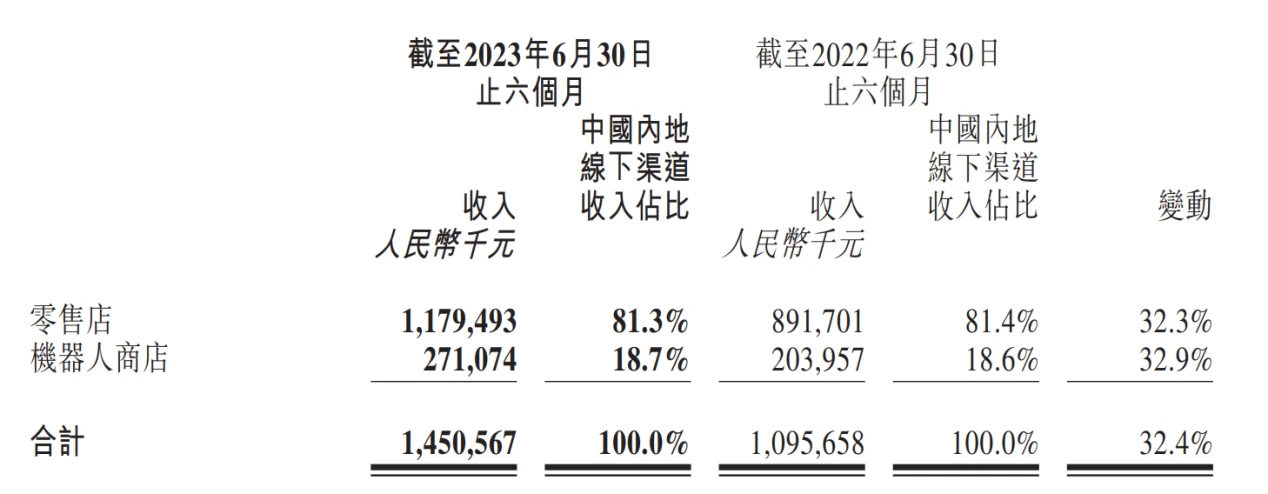

(1) Offline revenue was 1.451 billion yuan, accounting for 51.5% of total revenue, with retail stores and robot stores achieving revenues of 1.179 billion yuan and 271 million yuan, respectively, representing year-on-year growth of 32.3% and 32.9%. The increase was mainly due to the recovery of offline consumption after the pandemic and improvements in store display effects, as well as rapid growth in robot sales in scenarios such as high-speed rail, airports, and cinemas.

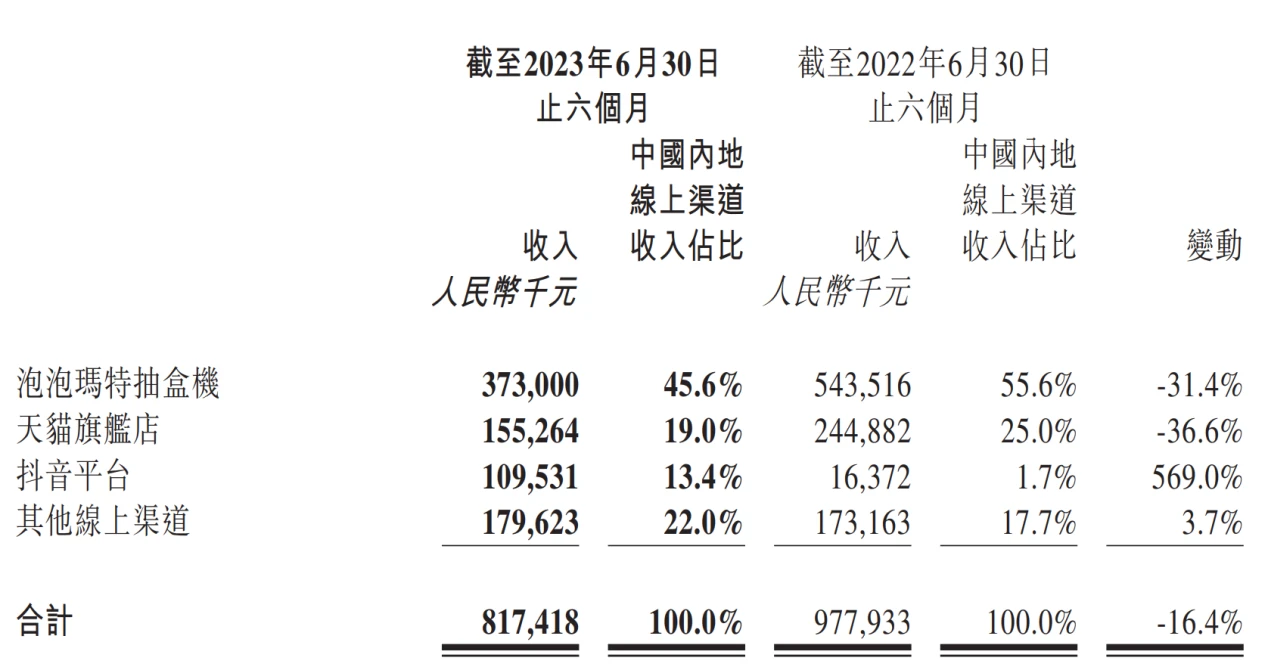

(2) Online revenue was 817 million yuan, with a less significant growth compared to offline, accounting for 29.1% of total revenue, a decrease of 12.4%. Pop Mart achieved revenues of 373 million yuan, 155 million yuan, 110 million yuan, and 180 million yuan from its capsule machines/Tmall flagship store/Douyin platform/other channels, with year-on-year changes of -31.4%, -36.6%, +569%, and +3.7% respectively. Traditional e-commerce platforms such as Tmall were affected by the recovery of offline channels, while Douyin channel revenue surged, being the channel with the highest Average Revenue Per User (ARPU), and the high-end MEGA series sold well on Douyin.

(3) Wholesale revenue was 170 million yuan, accounting for 6.0% of revenue, with a year-on-year increase of 32.3%, mainly benefiting from the sales growth of Pop Mart stores in Nanjing.

Continued high growth in overseas markets with promising future

Revenue from China, Hong Kong, Macau, Taiwan, and overseas in 23H1 was 376 million yuan, with a year-on-year growth rate of 139.8%, increasing its revenue share from 6.6% in the same period last year to 13.4%. Offline/online/wholesale revenues were 190 million yuan, 57 million yuan, and 129 million yuan, with year-on-year growth rates of 392.4%, 63.1%, and 54.6% respectively. Pop Mart CEO Wang Ning stated that all overseas stores are currently profitable, and he is confident that the overseas business will reach 1 billion yuan this year.

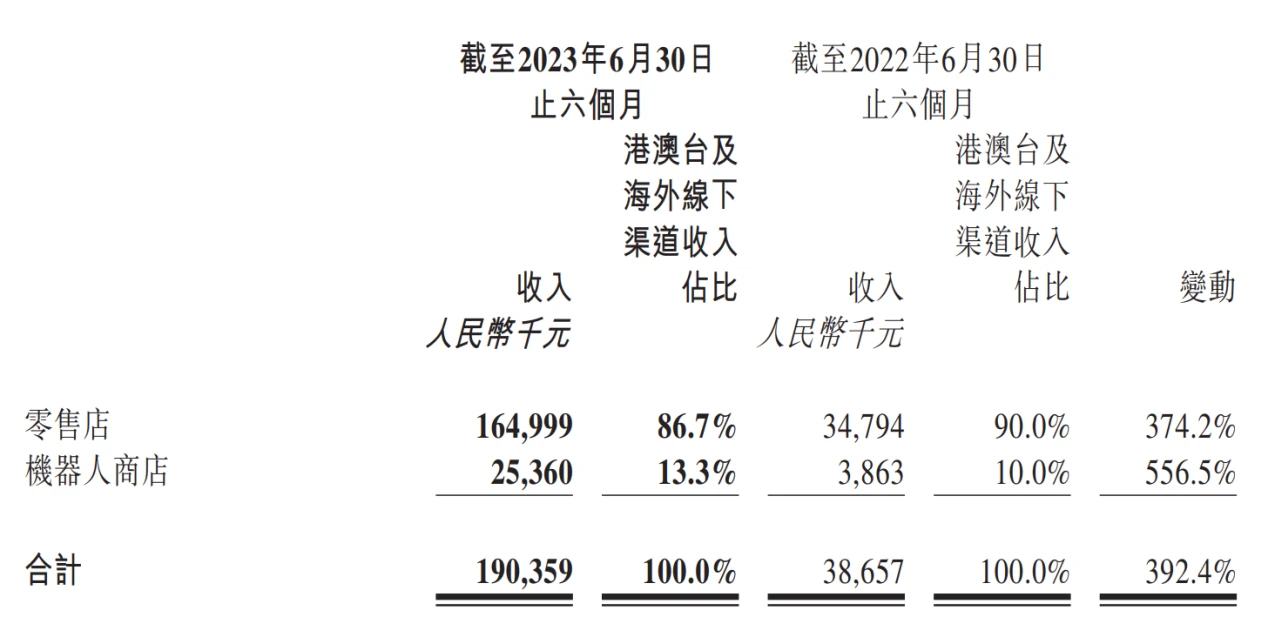

(1) Offline channels

Retail store/robot store revenues were 165 million yuan and 25 million yuan, with increases of 374.2% and 556.5% respectively; the number of retail stores and robot stores increased by 27 and 81 respectively compared to the same period last year. In the first half of 2023, Pop Mart continued to implement its DTC (Direct To Customer) strategy, opening its first offline stores in France and Malaysia, and announced the establishment of a joint venture with Minor International, one of the world's largest hotel, restaurant, and retail industry groups, to jointly develop the Thai market. It also actively participated in overseas exhibitions such as the UK MCM Comic Con, Melbourne OZ Comic Con, Jakarta Comic Con, and the IOICITY Mall Battle in Malaysia, continuously promoting brand globalization and increasing overseas brand recognition.

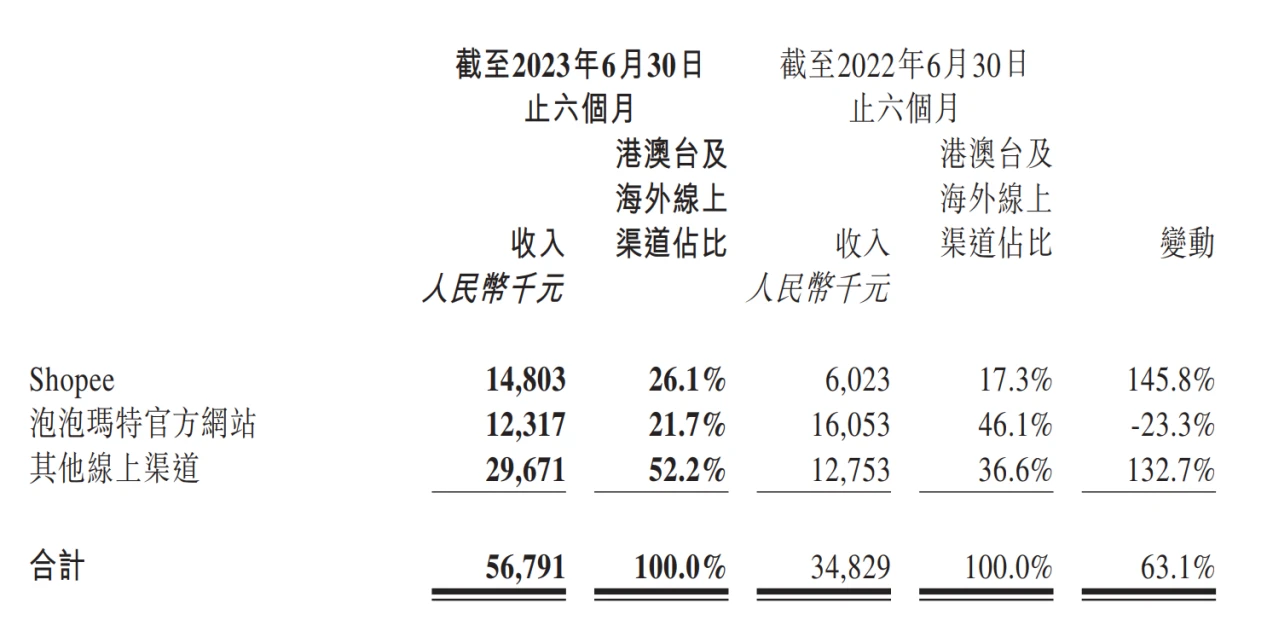

(2) Online channels

Shopee/Pop Mart official website/other revenues were 15 million yuan, 12 million yuan, and 30 million yuan, with year-on-year changes of 145.8%, -23.3%, and 132.7% respectively. The decrease in revenue from the Pop Mart official website was due to the company reducing advertising on the official website and increasing promotion on platforms with higher sales conversion rates.

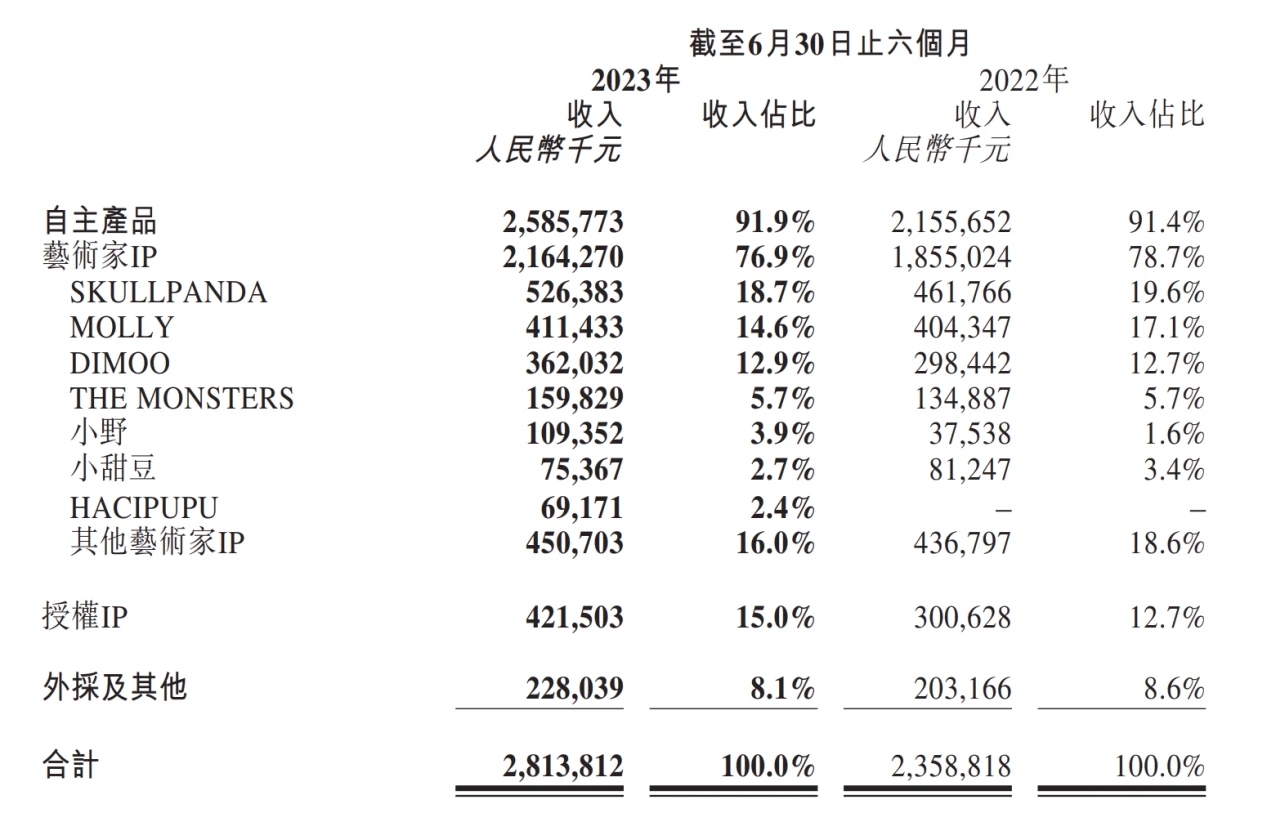

Steady growth of classic IPs, continuous efforts in new product series

Top IPs maintained strong vitality, with the three major self-owned IPs SKULLPANDA, MOLLY, and DIMOO achieving revenues of 526 million yuan, 411 million yuan, and 362 million yuan, with year-on-year growth rates of 14.0%, 1.8%, and 21.3% respectively. The eighth series of SKULLPANDA, "Temperature," launched in November 2022, was well-received by fans for its warm colors and ceramic-like texture, achieving a single series sales revenue of 254 million yuan in 23H1; the high-end product line MEGA COLLECTION, launched 3 years ago, gradually entered a mature stage of operation, divided into five series: Grand, Art, Lifestyle, Joy, and Original, with a focus on MOLLY and DIMOO, achieving a revenue of 242 million yuan in the first half of the year.

New IPs launched by Pop Mart were also well-received, with HACIPUPU, positioned as a "socially anxious little boy," achieving a revenue of 69.20 million yuan in the first half of the year, and the internally designed PDC (Pop Design Center) team's Xiao Ye series achieving a revenue of 109 million yuan, a year-on-year increase of 191.3%.

Licensed IPs achieved a revenue of 422 million yuan, with a year-on-year growth of 40.2%. In the first half of the year, Pop Mart continued to collaborate with more external copyright holders in diverse styles and ways, contributing to sales with new products.

IP operation and creative design are the core driving forces of Pop Mart's development, and are expected to further drive revenue and profit growth in the future.

Profitability indicators rebound, inventory issues improve

Pop Mart's gross profit margin in 23H1 was 60.4%, a year-on-year increase of 2.3%; adjusted profit margin was 19%, a year-on-year increase of 3%; and net profit margin attributable to the parent company was 16.9%, a year-on-year increase of 2.8%.

The increase in gross profit margin was mainly due to two reasons. First, on the revenue side, the company controlled the intensity and frequency of discounts in the first half of the year; second, on the cost side, the company continued to optimize its supply chain, including reducing procurement costs, controlling the number of molds, and strengthening negotiation capabilities with factories. The company achieved its goal of a gross profit margin of over 60%.

As of June 30, 2023, the inventory was approximately 760 million yuan, a decrease of 20.8% compared to the same period last year and a decrease of 12.5% compared to December 31, 2022; the days of inventory turnover decreased from 156 days on December 31, 2022 to 132 days on June 30, 2023. This was mainly due to the continuous flexible adjustment of the supply chain, improved accuracy of forecasts, and optimization of order quantity control, reflecting the steady improvement of Pop Mart's refined operational capabilities.

Theme park and game landing, continuous expansion of new businesses

After more than 2 years of polishing, Pop Mart City Park will officially open in September. This immersive IP-themed park is located in Chaoyang Park, Beijing, covering an area of approximately 40,000 square meters, divided into four major areas: Bubble Street, Forest Area, Lakeside Area, and the main park building, MOLLY Castle. At the same time, the first game "Dream Home" will start exclusive testing in Q4 2023, and the game business is expected to be combined with the city park in the future, playing a supporting role. While the park is a long-term strategic layout that may not bring significant benefits to the company in the short term, the lack of content extension for the image IP itself, providing consumers with online and offline IP interactive scenes, can further enhance the IP's influence and deepen member stickiness, maximizing the value of the IP and to some extent reducing the willingness of players to "quit." Benchmarking against Disney's IP empire, the continuous expansion of Pop Mart's business territory has brought greater imagination to the capital market.

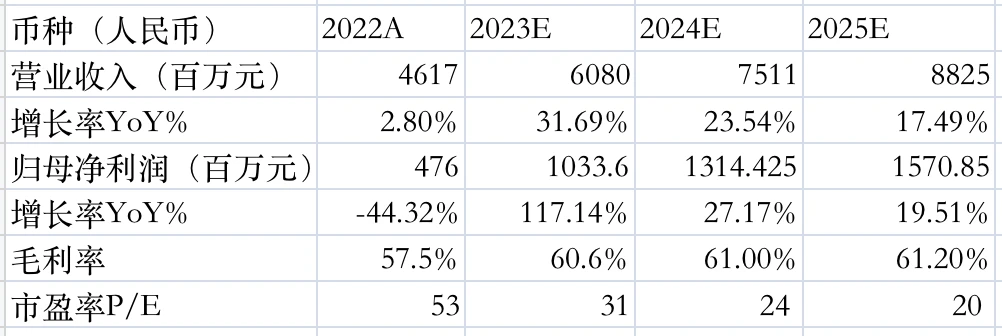

### 3. Profit Forecast and Investment Advice

After the brutal growth of the "blind box craze," the entire industry has gradually transitioned from early disorderly competition to a stage of diversified competition and long-term development. As a leader in the trend toy industry, Pop Mart, with high-quality IP as its core, has formed certain barriers through years of deep cultivation. After the pandemic, both revenue and profit have improved, with the domestic offline scene recovering and broad overseas expansion opportunities. At the same time, it has enriched its comprehensive operational layout by building a complete ecosystem including games and theme parks. We expect the company's revenue for FY2023E to FY2025E to be 6.08/7.51/8.825 billion yuan, with year-on-year growth of 31.69%/23.54%/17.49%, and net profit attributable to the parent company to be 1.033/1.314/1.571 billion yuan, with year-on-year growth of 117%/27.17%/19.51%. Based on the closing price on September 7, 2023, the corresponding PEs are 31/24/20X, and we give it a "buy" rating.

Risk Warning: Consumer recovery falls short of expectations; new product promotion falls short of expectations; overseas expansion falls short of expectations; intensified market competition.

This report does not constitute investment advice for any individual.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。