Centralized sequencers are by no means the biggest problem facing L2 platforms in fulfilling their promise to "borrow" Ethereum security.

Source: CoinDesk

Translation: BitpushNews Mary Liu

In the crypto industry, some rollup operators have faced criticism for using "centralized sequencers" to package transactions and relay them to Ethereum, but the real risk may lie elsewhere.

Low-cost and fast rollup networks such as Arbitrum, Optimism, and Coinbase's Base are rapidly becoming attractive alternatives for conducting transactions on the Ethereum network. Transactions are completed on these "L2" networks and then recorded on Ethereum for subsequent transactions.

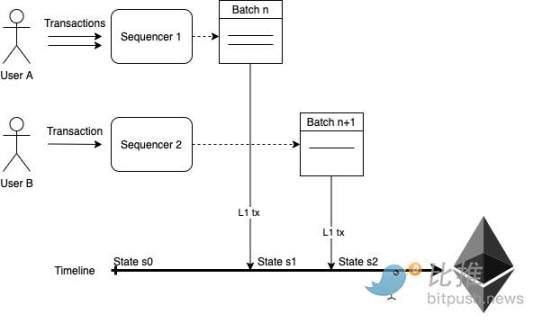

Recently, there has been much discussion about how these Layer 2 networks rely on a "sequencer," which is responsible for bundling user transactions and guiding them to Ethereum.

Sandy Peng, co-founder of Scroll rollup, explained in an interview this week that the sequencer is like an "air traffic controller for the specific L2 ecosystem it serves." "So, when A and B both try to make a transaction at the same time, who goes first? This is determined by the sequencer."

When users transact on L2 rollup networks, the sequencer is responsible for verifying, ordering, and compressing these transactions into batches that can be sent to the layer 1 chain (such as Ethereum). In return, the sequencer collects a small portion of the fees charged to users.

Criticism of this setup is that current rollup sequencers are often operated by "centralized" entities, representing potential single points of failure, transaction censorship issues, or potential blockages if the entity chooses to shut them down altogether.

For example, Coinbase operates the sequencer for its new Base blockchain, which, according to the analysis firm FundStrat, could generate approximately $30 million in net income annually.

It's not just Base. Today's leading rollups all rely on "centralized" sequencers, meaning a single party (usually the company building the rollup) is responsible for sequencing.

The option for a "decentralized" system is brewing, but Ethereum's largest L2 has yet to embrace it—or has not made time to embrace it at all.

In the blockchain world, trust should be minimized, and people often feel uneasy about the idea of a single company controlling critical elements of chain operation.

However, after speaking with experts, people may come away with the impression that the greater risks facing L2 decentralization and security lie elsewhere.

What is a sequencer?

The operation of Coinbase's new Base network is similar to other rollup networks: it promises fast and cheap transactions to users, ultimately "settling" on the Ethereum main chain.

In addition to convenience, the main selling point of rollups like Base is that they run directly on top of the Ethereum main network—meaning they are designed to borrow its primary security features.

When users submit transactions on Base, sequencer nodes intervene promptly and compress them into a "batch" with transactions from other users. Then, the sequencer submits these transactions to Ethereum, where they are formally recorded in its ledger.

Similar to other major rollups, Coinbase is currently the sole sequencer on Base, meaning the company is fully responsible for sequencing and batch processing transactions for Base users.

During a quarterly earnings call with Wall Street analysts last month, Coinbase CEO Brian Armstrong acknowledged the role this setup plays in Base's business model: "Base will earn revenue through sequencer fees, and you can earn sequencer fees for any transaction executed on Base, essentially, over time, Coinbase can run one of these sequencers like any other sequencer."

Decentralized L2 sequencing technology exists: distributing the role of sequencer to multiple parties.

Coinbase has indicated that it ultimately plans to adopt this technology, and other rollup platforms have also expressed plans to adopt it. However, decentralized sequencers have proven difficult to deploy on a large scale without slowing down or triggering security risks.

The lucrative income from operating sequencers seems to inhibit decentralization. This also applies to the potential maximum extractable value (MEV) opportunities brought by centralized sequencing—extracting additional profits from users by strategically arranging transaction execution.

Meanwhile, the current centralized sequencer setup poses risks to users.

Binance pointed out these issues in a recent research report: "Since the sequencer controls the order of transactions, it has the power to censor user transactions (although complete censorship is unlikely, as users can submit transactions directly to L1), and the sequencer can also extract maximum extractable value (MEV), which may cause economic harm to the user base. In addition, flexibility may be a major issue, meaning that if the sole centralized sequencer fails, the entire Rollup will be affected."

In the foreseeable future, the sequencer system may remain centralized—meaning these risks may persist for some time. But when it comes to L2 security issues, the sequencer issue is misleading.

There are even greater risks

The most important concern for blockchain users is whether their transactions are processed as expected and whether their wallets are secure and protected from unauthorized transactions that could result in fund loss.

If centralized sequencers engage in malicious behavior, they theoretically could slow down or reorder transactions to extract MEV, but they typically do not have the ability to fully censor, enhance, or deceive new transactions.

Peng stated: "When it comes to making L2 a great L2, decentralized sequencers are 'low on our priority list.'"

It is worth noting that the popular Optimism rollup (used by Coinbase as a template to build its own Base chain) currently lacks fraud proofs, i.e., algorithms on the L1 chain that can "prove" L2 transactions have been accurately recorded.

Anurag Arjun, founder of Avail blockchain focusing on data availability, stated: "Apart from decentralized sequencers, an important part is the actual implementation of fraud proofs or validity proofs and having an escape hatch mechanism."

Fraud proofs are the primary means by which networks like Optimism and Base "borrow" Ethereum security—allowing validators on the Ethereum main chain to check if the L2 network is working as advertised.

"The whole point of Rollup is to build this mechanism so that Rollup itself does not have to introduce cryptographic economic security," Arjun said. "From a broader perspective, this is the point of inheriting the base layer."

Arjun stated that without fraud proofs, Optimism, Base, and other networks with similar missing features essentially require users to trust their own security practices rather than Ethereum's security practices.

Optimism and Base also lack an "escape hatch" mechanism for users to withdraw funds back to Ethereum in the event of sequencer failure.

Arjun explained, "If there is an escape hatch mechanism, and the sequencer fails or goes offline, you can actually bridge your assets and safely exit." Without an escape hatch, Rollup users could potentially lose funds if issues arise.

Three stages of Rollup development

Ethereum co-founder Vitalik Buterin proposed a set of stages numbered 0 to 2 for classifying the decentralization of different Rollup networks. The staging criteria aim to recognize that new Rollup networks often rely on "training wheels" to safely test and deploy to the public before achieving full decentralization.

According to Buterin's model, the L2 network data aggregation platform L2Beat tracks the overlay status of different platforms. According to L2Beat, every leading Rollup network currently relies on some form of "training wheels."

Until valid fraud proofs are obtained, Optimism and Base will be considered "stage 0" in Buterin's classification scheme. As a direct competitor to Optimism and Base, Arbitrum scores higher because, despite having a centralized sequencer, it has fraud proofs.

Arbitrum also has drawbacks that hinder it from entering the "stage 2" status—currently, it is still widely considered a "stage 1" Rollup.

The training wheels documented by L2Beat extend from the lack of fraud proofs (or validity proofs, in the case of ZK Rollup) to centralized upgrade control.

Through L2Beat's data, it may be discovered that centralized sequencers are by no means the biggest problem facing L2 platforms in fulfilling their promise to "borrow" Ethereum security.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。